2017 RANKING & REVIEWS

TOP RANKING BEST BANKS IN CANADA

Ranking of the Top 5 Banks in Canada | Best High-Interest Savings Accounts in Canada

Across Canada, there are several Canadian banks and financial institutions to choose from.

Following up on our recent bank reviews and ranking articles (Best U.S. Banks with High-Yield Accounts and No Fees, Top Banks in Australia, and Best British Banks), we have published this list of the top banks in Canada to present a detailed review of Canadian banks that fall into one of two categories:

- The Top & Largest Banks in Canada

- The Best Canadian Banks with High Interest Savings Accounts

Depending on the scale of banking services provided, as well as the types of high-yield savings accounts it offers (if any), a top bank in Canada might be included in one or both of the ranking categories above.

For example, Royal Bank of Canada (RBC) is the largest bank in Canada. But it is not considered one of the best Canadian banks with high-interest accounts because its savings accounts do not offer particularly high-interest rates.

Award Emblem: Top 5 Best Banks in Canada

AdvisoryHQ’s List of the Top 5 Best Largest Banks in Canada

List is sorted alphabetically (click any of the bank names below to go directly to the detailed review section for that bank).

- Royal Bank of Canada (RBC)

- Toronto-Dominion Bank (TD Bank)

- Bank of Nova Scotia (Scotiabank)

- Bank of Montreal (BMO)

- Canadian Imperial Bank of Commerce (CIBC)

Click here for 2016’s Top 5 Best Banks in Canada

Top 5 Largest Banks in Canada | Brief Comparison

Below is the list of this year’s top 5 banks in Canada, based on their respective asset sizes and bank deposits.

Canadian Banks | Market Capitalization (CAD) |

| Royal Bank of Canada (RBC) | $142.86B |

| Toronto-Dominion Bank (TD Bank) | $123.38B |

| Bank of Nova Scotia (Scotiabank) | $95.19B |

| Bank of Montreal (BMO) | $64.83B |

| Canadian Imperial Bank of Commerce (CIBC) | $46.18B |

Table: Top 5 Largest Banks in Canada | Above list is sorted by market capitalization

* Market capitalization figures obtained from Yahoo Finance Canada

* See below sections for the financial statements for these large Canadian banks

AdvisoryHQ’s List of Best Canadian Banks with the Best High-Interest Savings Accounts

In addition to the above list of biggest banks in Canada, listed below are the best Canadian banks that offer some of the best high-interest savings accounts in Canada.

- Achieva Financial

- Bridgewater Bank

- MAXA Financial

- AcceleRate Financial

- Hubert Financial

- Implicity Financial

- Oaken Financial

Best Banks in Canada for Highest Yielding Accounts | Brief Comparison

Canadian Banks | Account Name | Rate | QB* |

| AcceleRate Financial | AcceleRate Savings | 1.70% | Y |

| Achieva Financial | Achieva Savings | 1.70% | Y |

| Alterna Bank | High Interest eSavings | 1.95% | Y |

| Bridgewater Bank | Smart eSavings Account | 1.75% | |

| Canadian Direct Financial | KeyRate Savings Account | 1.50% | Y |

| EQ Bank | Savings Plus | 2.00% | |

| Hubert Financial | Happy Savings Account | 1.70% | Y |

| ICICI Bank | HiSAVE Savings Account | 1.35% | Y |

| Implicity Financial | High Interest Savings Account | 1.70% | Y |

| MAXA Financial | MAXA Savings | 1.70% | Y |

| Oaken Financial | Oaken Savings Account | 1.50% | Y |

| Outlook Financial | High Interest Savings Account | 1.70% | Y |

| Peoples Trust | Peoples Choice e-Savings Account | 1.45% | Y |

*QB: “Y” means the account is available in Quebec

Table: Top Canadian Banks for High Interest Savings Account | Above list is sorted alphabetically

- Please review the respective banks’ websites for the most updated yield and account information

- The high interest rate information provided above is accurate as of 2017

- Source: Canadian High Interest Savings Bank Accounts

In the table above, we’ve presented a list of the best banks in Canada and have ranked these banks by the high-interest savings accounts they provide within Canada. We have also included the names of the respective high-yield savings accounts and the rates offered.

Some of these banks may be affiliated or have partnership agreements with the Big Five Canadian banks.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Banks in Canada

Below, please find the detailed review of each firm on our list of the best banks in Canada. We have highlighted some of the factors that allowed these Canadian banks to score so high in our selection ranking.

See Also: Top Banks and Credit Unions in Vancouver | Ranking | Vancouver Banks and Credit Unions Comparison

RBC Royal Bank Review – Largest Bank in Canada

RBC Royal Bank is the biggest bank in Canada by total asset size. As of the first quarter of 2017, RBC reported $1,161,766,000,000 in total assets, which is the highest compared to all the other top banks in Canada.

RBC earns revenue from five business segments:

- Personal & Commercial Banking

- Wealth Management

- Investor & Treasury Services

- Capital Markets

- Insurance

RBC boasts an impressive 80,000 employeess worldwide, over 16 million clients, and a presence in 38 counries, according to their 2016 Annual Report. They have outlined specific goals that underline their commitment to staying Canada’s biggest bank as well as one of Canada’s top banks.

Their vision is simple: To be among the world’s most trusted and successful financial institutions. Their goals are also area specific:

- In Canada: To be the undisputed leader in financial services

- In the U.S.: To be the preferred partner for corporate, insititutional, and high net worth clients

- In global finance centers: To be a leading institution valued for their trusted advice and expertise

Source: RBC Royal Bank

Key Highlights from RBC 2017 Q1 Performance

The 2017 Q1 results provide a comparison between the first quarter of 2017 and the first quarter of 2016.

- Net income of $3,027 million (up 24%)

- Diluted EPS of $1.97 (up $0.39)

- ROE of 18% (up 270 bps)

- CET1 ratio of 11.0% (up 110 bps)

RBC’s gains in Personal and Commercial banking were supported by the U.S. operations of Moneris. Higher net interest income on volume growth, transaction revenue, and uptick in fee-based clients led to gains in Wealth Management earnings. Capital Markets and Investory & Treasury Services also saw strong results. The Insurance segment of RBC’s business also saw positive results thanks in part to the sale of RBC’s home and auto manufacturing business.

To explore the financials of RBC Royal Bank in detail, you can review their 2016 Annual Report and 2017 First Quarter results.

Don’t Miss: Best Credit Unions in Vancouver, BC, Canada | Ranking

Toronto-Dominion Bank (TD Bank) Review – 2nd Biggest Bank in Canada

Since its founding in 1855, TD Bank Group has grown from a single-branch bank serving grain millers and merchants to becoming one of the largest financial services institutions in the world. As one of Canada’s biggest banks, TD Bank provides financial solutions to individuals and businesses around the globe.

The Toronto Dominion Bank that most consumers know today was chartered in 1955 when The Bank of Toronto merged with The Dominion Bank. Through the years, TD Bank’s growth included the creation of its wealth management division, the acquisition of Canada Trust in 2000, and its evolution into a North American bank with the acquisition of U.S. entities, including Banknorth and Commerce Bancorp in the United States.

As of the first quarter of 2017, TD reported in $1,186,900,000,000 total assets, making it the second biggest bank in Canada.

Key Highlights from TD 2017 Q1 Performance

A quick glance at the 2017 Q1 earnings report provides a comparison between this year’s first quarter and last year’s first quarter.

- Reported diluted earnings per share – $1.32 compared with $1.17

- Adjusted diluted earnings per share – $1.33 compared with $1.18

- Reported net income – $2,533 million compared with $2,223 million

- Adjusted net income – $2,558 million compared with $2,247 million

Past Year at a Glance

TD Bank provides a specific framework for how they plan to work towards institutional growth and a positive culture for their customers, colleagues, and community. This framework is the TD tree and it outlines the actions necessary to spur the bank’s continued success. These actions are:

- Innovate

- Develop

- Think Customer

- Own

- Execute

Source: TD Bank

At the end of 2016, this Canadian bank reported record earnings for the seventh consecutive year. As one of the biggest banks in Canada this positive performance was driven by growth in their U.S. Retail and Wholesale business.

TD reached an all-time high in 2016. They also managed to put more money in the pockets of their shareholders with an 8% increase in its quarterly dividend from the previous year.

To explore the financials of TD Bank in detail, you can review their 2016 Annual Report and 2017 First Quarter results.

Related: Best Second Chance Checking Accounts | Ranking | Comparison Review of Top 2nd Chance Accounts

Bank of Nova Scotia (Scotiabank) Review – 3rd Largest Bank in Canada

Bank of Nova Scotia (Scotiabank) is ranked the third largest Canadian bank based on a total asset size of $886,992,000,000. This large Canadian bank offers corporate banking as well as personal, commercial, and investment banking products, tools, and services across the globe. It currently has a global team of over 90,000.

The Bank of Nova Scotia was established in 1831, when a group of Halifax businessmen got together. The topic of the meeting was the pressing need for a public bank to serve as an alternative to the privately-owned Halifax Banking Company. Three months later, on March 30, 1832, with an authorized capital of £100,000 the Bank of Nova Scotia became the first chartered bank in Nova Scotia.

By the early 1900s, the Bank of Nova Scota established a coast-to-coast branch network. By 1930, the existing head office became too small, leading to a much-needed upgrade.

Their new office building was opened in August of 1931, designed by renowned archietect, John M. Lyle. It has become a distinctively Canadian building with motifs of Canada’s natural and economic history incorporated into the building’s design by Lyle.

Image Source: Best Canadian Banks

Key Highlights from Bank of Nova Scotia 2017 Q1 Performance

Scotiabank’s 2017 Q1 earnings provide a comparison of this year’s first quarter results to last year’s first quarter results.

- Net income – $2,009 million compared to $1,814 million

- Diluted earnings per share – $1.57 compared to $1.43

- Return on equity – 14.3% compared to 13.8%

Scotiabank, the third largest bank in Canada, also realized positive results in International Banking. They enjoyed their six consecutive instances of quarterly earnings exceeding $500 million. This success was bolstered by consistent growth in their Pacific Alliance countries.

Goals for 2017

In their 2016 Annual Report, Scotiabank says that it will focus on activities that increase long-term shareholder value in 2017. They plan on doing this by investing in businesses that are looking to scale and strengthening their presence in Canada and with the Pacific Alliance.

This third largest bank in Canada is confident in its current global footprint. This includes the countries of the Pacific Alliance, the Carribean, and Central America. Scotiabank believes there are promising growth opportunities through their relationship with the Pacific Alliance.

As Canada’s third largest bank in Canada, Scotiabank certainly has ambitions for moving up further in the rankings. It has outlined its strategic agenda for creating shareholder value and improving the customer experience. The core components of its strategic agenda are:

- Customer Focus

- Leadership & Employee Engagement

- Structural Cost Transformation

- Digital Transformation

- Business Mix Alignment

Source: Bank of Nova Scotia

To explore the financials of Bank of Nova Scotia in detail, you can review their 2016 Annual Report and 2017 First Quarter results.

Popular Article: Top Investment Banks (Ranking Based on Asset Size)

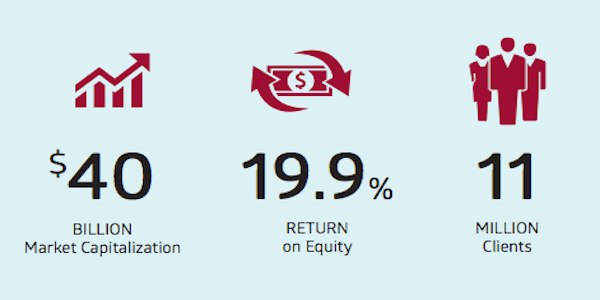

Bank of Montreal (BMO) Review – 4th Biggest Canadian Bank

The Bank of Montreal is the fourth largest bank in Canada with a total asset size of $692,384,000,000. The Bank of Montreal provides a wide range of banking products in Canada and across the globe, including bank accounts, credit cards, loans, mortgages, lines of credit, and insurance.

It also provides financial planning and wealth management services via its BMO Investments division. They also offer banking solutions for businesses including business credit cards.

BMO began conducting business on November 3, 1817 a few months after John Richardson, a prominent Montreal businessman, and eight other merchants signed the Articles of Association to establish what is now the fourth largest banks in Canada. Not only is the BMO the fourth largest Canadian bank, it is also the oldest bank in Canada.

Key Highlights from BMO 2017 Q1 Performance

BMO’s 2017 Q1 earnings provide a comparison of this year’s first quarter results to last year’s first quarter results.

- Net income – $1,488 million, up 39%

- EPS of $2.22, up 40%

- ROE of 14.9% compared with 10.9%

Bill Downe, Chief Executive Officer of BMO, said the following about the fourth largest bank in Canada:

“BMO’s performance this quarter is strong and broad-based, we delivered adjusted earnings of $1.5 billion and adjusted earnings per share of $2.28. The good momentum in the business is the consequence of a clear strategy and consistent execution, doing what we said we would do. Our roadmap is focused on providing customers with intuitive products and services that meet their evolving preferences, while improiving effiency in all of our channels.

Highlights from the 2016 Annual Report

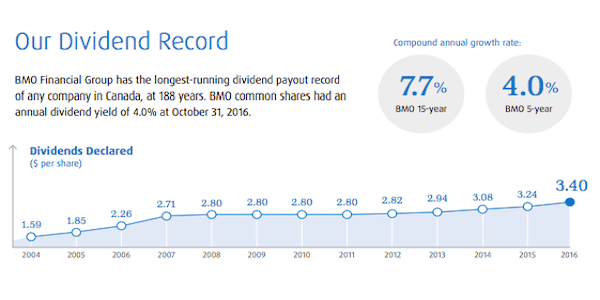

Not only is BMO the fourth largest bank in Canada, it also holds the record for longest-running dividend payouts of any company in Canada. Their record? 188 years.

Source: BMO

Despite all of the economic and political uncertainly over the past year – unexpected results of the Brexit vote, the election of Donald Trump in the United States, and the wildfires in Fort McMurray, Alberta among other things – BMO, the fourth biggest bank in Canada, managed to realize record returns. By the end of 2016 there was:

- Adjusted net revenue growth of 8%

- Adjusted net income of over $5 billion for the first time

- Earnings per share of $7.52, an increase of 7% from the previous year

In their effort to stay – and hopefully surpass! – their status as the fourth largest bank in Canada, BMO has also doubled down on its commitment to staying up to date with changes in the financial technology landscape. Their current focus is on innovation, flexibility, and cost effectiveness. All of these factors have the potential to lead to happy results for both customers and shareholders.

To explore the financials of BMO in detail, you can review their 2016 Annual Report and 2017 First Quarter results.

Read More: Top Ranked Banks in America | Lists | Best and Largest U.S. Banks

CIBC Review – Canada’s 5th Top Bank

CIBC is the fifth largest bank in Canada based on an asset size of $513,294,000,000. CIBC in its present form is the result of the largest chartered bank merger in Canadian history. On June 1, 1961, the Canadian Bank of Commerce (est. 1867) and the Imperial Bank of Canada (est. 1875) came together to form the Canadian Imperial Bank of Commerce (CIBC).

CIBC has three business units:

- Retail and Business Banking: This banking unit provides personal and business clients across Canada with financial advice, products, and services.

- Wealth Management: This unit provides integrated advice and investment solutions to meet the needs of institutional, retail, and high-net-worth clients.

- Capital Markets: This unit provides integrated credit and global markets products; investment banking advisory services; and top-ranked research to corporate, government, and institutional clients around the world.

Key Highlights from CIBC’s 2017 Q1 Performance

CIBC’s 2017 Q1 earnings provide a comparison of this year’s first quarter results to last year’s first quarter results.

- Reported net income – $1,407 million compared to $982 million

- Adjusted net income – $1,166 million compared to $1,029 million

- Reported diluted earnings per share (EPS) – $3.50 compared to $2.43

- Adjusted diluted EPS – $2.89 compared to $2.55

Highlights from 2016 Annual Report

2016 was a year of transformation for CIBC as it looks to increase its presence in Canada’s financial services landscape. They reported a record net income of $4.3 billion at the end of 2016. Their three strategic business units (retail and business banking, wealth management, and capital markets) produced strong results despite an uncertain economic climate. According to President and CEO Victor G. Dodig:

“We’re undergoing a profound transformation to build a strong, innovative, and relationship-oriented bank that will better serve our clients and enhance shareholder value.”

Source: CIBC

To explore the financials of CIBC in detail, you can review their 2016 Annual Report and 2017 First Quarter results.

Related: Best Banks for Students | Ranking | Comparison Review of Top Student Banks

Free Wealth & Finance Software - Get Yours Now ►

Conclusion – Top Banks in Canada

The big five banks dominate Canada’s financial services industry. While the biggest banks in Canada obviously have a larger presence throughout the country, there are options for individuals in search of high interest savings account where they’d like to park their money.

If you’re willing to go with a lesser known bank or an online-only bank, you have the chance to earn better returns on your savings than you would with the largest bank in Canada (RBC) or even the fifth larget bank (CIBC).

But if you prefer to go with something more well known and recognizable there is always one of the big five – RBC, TD, Scotiabank, BMO, or CIBIC – happy to help you open an account.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.