Guide: How to Get the Most from Acorns Investing

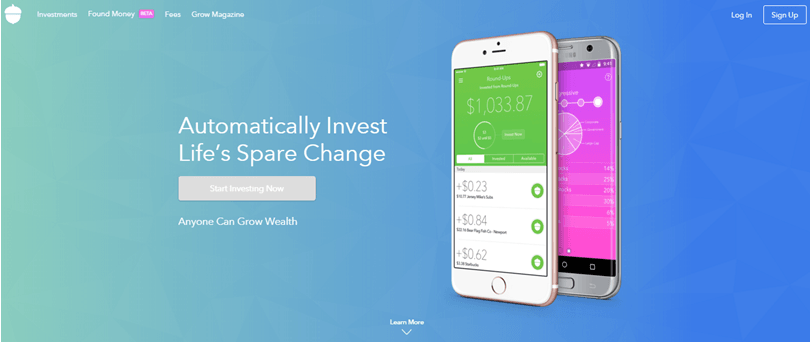

When you think of acorns, you probably think of squirrels packing them away for the winter. The Acorns investing app is similar: it is designed to help you squirrel away bits of money, particularly those that are so small that you’re not likely to miss them.

The Acorn financial app has been receiving widespread praise from users and experts alike, making it a top contender among the best investment apps.

Acorn Investing Review

Is an Acorns investment safe? Acorns investment reviews, though not agreeing on every point, all seem to say so.

In this article, we will discuss Acorns app safety, touch on Acorn investing reviews, and offer you six tips to get the most out of Acorns investing this year.

Acorns Investing Review

With more than 1 million users and counting, the Acorns app is one of the newest and best investment apps to consider using. To help users make the most of their Acorns account, our Acorns investing app review has outlined six tips for getting started.

1. Acorns Investment Review: Start Early

When saving for retirement or any other long-term goal, there is one universal truth: the sooner you start, the better. That’s the beauty of compound interest, after all. And it goes double for the Acorns app because it offers some terrific incentives for students and young people.

Acorns offers up to four years without fees when you sign up with a valid “.edu” address. An Acorns investment review from PR Newswire quoted Acorns founder and CEO Jeff Cruttenden on the importance of removing savings barriers for students:

“We understand that students carry great financial burdens, and Acorns wants to ensure there is nothing holding people back from investing. I founded Acorns because starting to save money as early as possible sets a path toward long-term financial health. We’re committed to giving young people the opportunity to grow their investments with Acorns and changing their perception of investing from complicated and inaccessible to simple and essential.”

So, there you have it: Acorns is in your corner.

See Also: Is Acorns App Safe? (Acorns Security & Safe to Use?)

2. Acorns Investment Review: Make It Automatic

Financial guru Dave Ramsey advises followers to “pay themselves first,” meaning that while you are making out your monthly plan to pay the rent or mortgage, pay the utilities, pay the groceries, and so on, you should also make savings an equally important line item (provided you have enough excess after taking care of the basics, of course).

His rationale? It’s all well and good to say that you will save “whatever is left over” at the end of the month or pay period…but life happens.

Maybe you decide that you need a new pair of sneakers or that you really want to go out to dinner and rationalize that you can always save next month. If that money had already been put in savings, you wouldn’t even think about it.

With automatic savings deposits, out of sight is out of mind. It is hard to feel deprived when you’ve gotten used to not seeing that money in your checking account, and it feels great to see your savings account (or Acorns account!) balance increasing.

While Acorn investing reviews usually highlight the spare change round-up feature (it is, after all, Acorns’s bread and butter), you should also know that you can set up automatic, recurring deposits directly from your bank account.

Let’s say that you eat breakfast on the go every day. Coffee, a bagel, whatever—it only adds up to $5. But then your schedule changes, and on Tuesdays, you have an early meeting where they offer coffee and doughnuts to make up for the early hour.

You could easily put that $5 you aren’t spending on breakfast to work by setting up an automatic deposit into your Acorns account.

When free doughnuts add up to $20 extra in your investment portfolio each month, it’s hard to believe that there’s no such thing as a free lunch!

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

3. Acorns Investment Review: Round-Ups

We discussed the automatic round-up briefly in the previous section. Acorns isn’t the first to come up with this idea, as many Acorns investment reviews will point out, but when something works, there’s no need to reinvent the wheel.

When you sign up for an Acorns account, it will ask you to link your debit or credit card.

Acorns Investment Reviews

Every time you make a purchase, Acorns will round your purchase up to the next dollar and earmark the leftover spare change for your Acorns account.

For example, let’s say you spent $14.32 at Target. Acorns would round your total to $15 and “allocate” the 68 cents as Acorns funds.

Once your “allocations” hit $5, Acorns transfers it to your investment account, and the process begins again. Just like the recurring deposit scenario outlined above, Acorns’s spare change strategy does something brilliant: it allows you to save without feeling the pinch.

Our Acorns investment app review (found here) explains the process well while also offering other helpful insights.

An Acorn investing review from Huffington Post points out that it is a great tool “for young folks to start saving because they siphon a little money here and there.

The intended result is that you use one of these savings apps for a while—without actually thinking about it—and end up with sizable savings that you would not have built up on your own.”

Keep in mind that, although you can link multiple cards to the Acorns app, the “Round-Up” will always come from your linked checking account. For example, if you spent $3.50 on your credit card, the $0.50 Round-Up will be transferred from your checking account, not your credit card.

Here’s our tip: the more cards you link to the Acorns app, the faster your Acorns account balance will grow. You can link as many cards as you want, meaning that every time you swipe, you can be investing in your future.

Don’t Miss: Qapital Review—What Is Qapital? Everything You Must Know! (App Review)

4. Acorns Investment Review: Found Money

This feature is still in beta, but it is incredibly exciting. Found Money is a rewards program that “will give its users bonus investment cash when they shop at brand partners like Jet.com, 1-800-Flowers, and Hotel Tonight,” according to an Acorn investing review from Business Insider.

This truly is “found money”: instead of adding change from your account, your account receives money just from shopping at certain places!

Since Acorns is linked to your debit or credit card, it knows when you’ve shopped automatically; there’s no further effort on your part, making it one of the best investment apps for people who want a hands-off investment method.

Acorns hopes to increase its partnership roster, but for now, you can take advantage of some very generous rates:

- 1-800-Flowers: $15 for every transaction over $20

- Dollar Shave Club: 10% of each transaction

- Hotel Tonight: $10 for every booking over $100

- JackThreads: $15 for signing up as a new customer

- Jet.com: 5% of each transaction

- Airbnb: Guests receive 15% of Guest Service Fee, hosts receive $50 for their first booking

5. Acorns Investment Review: Take the Long View

Some negative Acorns investment reviews point out that investing with Acorns doesn’t get you anywhere very fast. However, financial website The Simple Dollar would argue that that’s part of the point. Its writer, Kevin Cash, writes:

“No, Acorns won’t make you rich overnight… It’s not trying to. If high-risk, high-reward is your game, you’ll want to look elsewhere. But, if you’re a new investor trying to get your feet wet in the world of ETFs without putting too much effort into it, Acorns probably isn’t a bad way to start.”

Recurring contributions will definitely make your account grow faster, but even those small amounts of change add up to something that, before, simply would have been spent if left sitting in your checking account.

And as Cash stated, the Acorns app is a great way to get your feet wet in the world of investing. Take some time to read up on Harry Markowitz’s work (which Acorns is built upon), Modern Portfolio Theory, and the five different portfolios you can choose from with Acorns.

Education can make all the difference in the world of investing. Why not start with Acorn finance, where the risks and barriers to entry are low, and you can learn your way around the field?

Related: YNAB vs. Mint | Ranking and Comparison: YNAB or Mint?

6. Acorns Investment Review: Go Big, Make It Count

Our last piece of advice? Spare change doesn’t always add up quickly, so put yourself in the best situation possible to let it grow. When it comes to Acorns, there is a $1 monthly fee assigned if your balance is below $5,000.

If you aren’t adding to your account rapidly, this could be a significant fee, even when using the best investment apps. For instance, if you took it at its $5 minimum and your investment didn’t grow rapidly, you would be out of capital in less than a year.

An Acorns investing review from Policy Genius explained it this way:

“If you have 50 transactions every month with an average of $.25 rounded up per transaction, you’re only investing $12.50 every month. At that point, Acorns’ monthly fee is taking away 8% of your monthly contributions to your investment portfolio.

The more transactions you have (the more you’re spending, perhaps multiple small purchases like coffee or fast food) and this percentage will go down.

At 100 transactions per month with an average of $.25 per transaction, you’re investing $25 per month and giving 4% to Acorns. At 150 transactions, you’re investing $37.50 and giving almost 2.7% to Acorns.”

So, the Acorns app makes the most sense if you make a lot of transactions—or if you are able to combine the power of round-ups with additional contributions.

How much could you send away to savings each month before you feel the pinch? Do you have $5,000 that you could invest to get yourself over that $1 per month fee hump?

If you are able to do these things, we think you will get the most out of an Acorns account.

Final Considerations

While Acorns makes it easy to invest and withdraw funds, keep in mind that any earned funds are taxable, as pointed out in an Acorns investment review by InvestorJunkie.

Say, for example, you want to invest with the Acorns app until your portfolio reaches a net worth of $5,000. You could choose to continue investing with Acorns, or you could close your account and switch to another brokerage.

If you choose to close the account and use another brokerage, you will have to withdraw your $5,000 return and include it as taxable income when you prepare your tax statement.

Still, this is nothing new in the investing world, and should not be seen as a negative. Any portfolio that includes stocks, bonds, or mutual funds will be subject to taxation, no matter what.

Users can close an Acorns account at any time through filling out a form, deleting the Acorns app, and withdrawing funds. There does not appear to be any penalty for these processes.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Acorns Investment Review

Our recommendation? If you are an Acorns app user or plan to become one, enjoy the spare change round-up feature, but also push yourself to contribute regularly through automatic deposits.

Start with that $5 a week, and if you don’t feel deprived, maybe try adding another dollar each week until you cry uncle.

You might drink a little less coffee or rent fewer movies, but your future will look brighter day by day.

Popular Article: QuickBooks Online Review—What Is QuickBooks Used for? (Online Features & Reviews)

Image Sources:

- https://pixabay.com/photos/office-office-desk-laptop-desk-1081807/

- https://www.acorns.com/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.