Getting the Best Mortgage Rate in South Carolina for You (10-15-30-Year Fixed, 5/1, 7/1 ARM)

Known for its miles of sandy beaches, family-friendly events, and balmy weather, purchasing a home in Myrtle Beach, Charleston, Columbia, Greenville, Hilton Head Island, Charleston, or any other South Carolina city is an attractive option.

In fact, Zillow reports that over 245,000 homes have recently been sold through their platform.

Although there seems to be plenty of supply and demand when it comes to South Carolina real estate, it’s worth mentioning that home values are on the rise. Average home values have risen 5 percent over the past year alone, with predictions of rising another 3.6 percent in 2018.

As such, taking out a new South Carolina mortgage or refinancing an existing South Carolina home loan should be paired with the best South Carolina mortgage rates to ensure that home ownership continues to be affordable in the long run.

Pennsylvania Mortgage Rates & Loans for Great Credit

Current Mortgage Rates in Illinois for Great Credit IL Borrowers

Types of South Carolina Mortgage Lenders

Today, borrowers have plenty of options when choosing between South Carolina mortgage lenders.

Rates, terms, and overall affordability can vary greatly from one lender to the next, which makes exploring multiple options key when finding the best South Carolina mortgage for you.

Banks

If you have an existing relationship with a local bank, you may want to check their South Carolina mortgage rates.

Having a positive lending relationship with a brick-and-mortar bank is great for those who prefer an in-person discussion about a mortgage rate in South Carolina.

With stricter requirements, however, new borrowers may have difficulty taking out South Carolina home loans from large banks, especially those with less than ideal credit.

Coastline Property in South Carolina

Online Lenders

Online lenders are becoming increasingly popular, and many borrowers find that online banks have the best terms and rates for South Carolina mortgages.

South Carolina mortgage lenders offering competitive mortgage rates in South Carolina online include online-only banks, lending companies, or even peer-to-peer lending platforms.

Not only are online South Carolina home loan applications easier to fill out, but they also tend to have the quickest response rates, meaning that you could potentially get an answer on mortgage rates in South Carolina within hours.

Credit Unions

If you are a member of a credit union—or are eligible to become one—this can be a great resource for an affordable South Carolina mortgage.

Because credit unions tend to have lower operating costs, their mortgage rates in South Carolina often have competitive rates and flexible terms, making credit unions into a great source for South Carolina home loans.

Key Requirements for Buying a House in South Carolina

Before you apply for a South Carolina mortgage loan, you’ll want to ensure that you complete the below list of requirements.

- Get your down payment ready (~20% of the loan amount)

- Maintain good to excellent credit

- Save some extra funds for your closing cost (there might be additional expenses that you’ll need to pay)

- Maintain a low debt balance

- Demonstrate sufficient income

- Gather your financial documents

- Get a home appraisal on the home

You’ll also need to examine your options for different types of South Carolina mortgages before choosing the best mortgage rate in South Carolina for you.

Today’s New York Mortgage Rates & Loans for Great Credit

Florida Mortgage Rates for Good, Great, Best Credit Borrowers

Good, Great, or Excellent Credit Score for a South Carolina Home Loan

Most South Carolina mortgage lenders that provide competitive mortgage rates in South Carolina use a FICO score to determine if a borrower is creditworthy or not.

FICO scores range anywhere from 300 to 850, with higher numbers seen as the most creditworthy and lower numbers seen as the biggest financial risk.

When applying for South Carolina mortgages, a borrower’s FICO score generally falls into one of these categories:

- 300 – 629 is considered “Bad”

- 630 – 689 is considered “Fair”

- 690 – 719 is considered “Good”

- 720 – 850 is considered “Excellent”

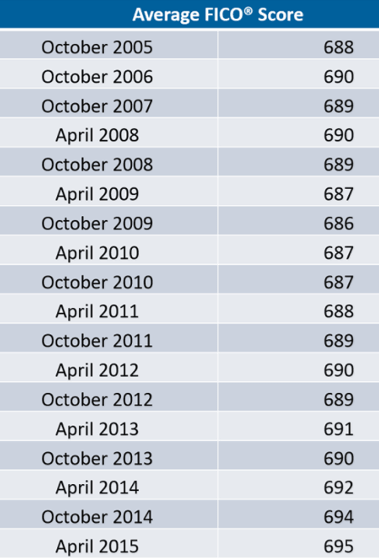

For an overview of the average FICO score from 2005-2015, see the table below. According to CNBC, the average score for 2017 is 700.

Current Texas Mortgage Rates & Loans for Great Credit

Mortgage Rates for Houston Borrowers with Good Credit

Conclusion – Finding a Top Mortgage Loan for a Home in South Carolina

When it comes to purchasing a home in South Carolina, browsing through floor plans and amenities is only one part of the equation—the real work comes from evaluating South Carolina mortgage rates and terms from the top South Carolina mortgage lenders.

It might be tempting to sign up for the first affordable South Carolina mortgage rate that you find, but it’s important to look at multiple mortgage rates in South Carolina to ensure that you are getting the best deal.

Having an affordable, manageable South Carolina mortgage rate is determined not just by your monthly payments, but also by interest rates and terms, so don’t be afraid to shop around until you find the best South Carolina mortgage for your financial needs.

Best CD Rates in NY for Good & Great Credit | 2017 Rates

Current Mortgage Rates in Mississippi | MS Mortgage Rates for Good-Excellent Credit Borrowers

Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image sources:

- https://pixabay.com/en/beach-summer-south-carolina-2405600/

- http://www.fico.com/en/blogs/wp-content/uploads/2015/08/April-2015-Average-FICO-Score.png

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.