From Food to Health Care to Transportation, a Full Breakdown of the Costs for Your Bundle of Joy

Nickey and Chris just had their second baby and couldn’t be more thrilled. But, one thing they haven’t had time to think about while changing diapers is how much that little bundle of joy is going to cost them over the next 18 years.

Love, of course, has no price tag, but it does help to know what expenses are on the horizon for a new baby so they can be planned, budgeted for, and possibly reduced over the next nearly two decades.

How Much Does it Cost to Raise a Child?

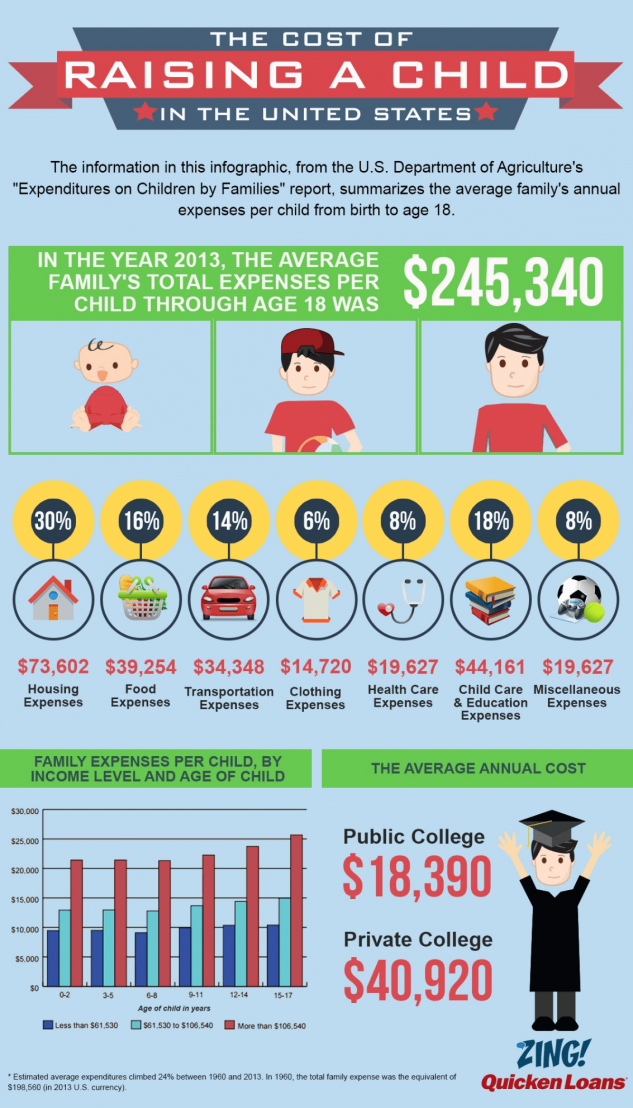

According to the U.S. Department of Agriculture’s “Expenditures on Children by Families” report for 2013, that happy family can expect to spend $245,340 from birth until the age of 18.

What does that breakdown look like? From the most to the least expensive, here are the percentages for each expense:

- Housing (30%)

- Child Care & Education (18%, doesn’t include college)

- Food (16%)

- Transportation (14%)

- Health Care (8%)

- Miscellaneous (8%)

- Clothing (6%)

While things, like picking up a Happy Meal here and there and paying for soccer camp each summer, might not seem like it would add up to almost a quarter of a million dollars, those costs do add up over time. But knowing how each category costs break down can help you to reduce them.

Let’s take a look at each of the above expense types and what goes into them. In this AdvisoryHQ report, we’ll also answer some important family planning questions like, “Is the per child cost the same if you have more than one kid?” and “Does the region or state I live in change the costs of raising a child?”

Knowledge is power, so read on to get some powerful information on the costs of raising a child and how you can keep them under control for a brighter future.

Where Does It Cost the Most to Raise a Child?

There are certain areas of the U.S. where the costs of raising a child are higher or lower than the average. The most expensive area is the urban Northeast, where the cost of raising a child is about 15% higher than the average.

The more affordable areas are out in the country. Families that live in rural areas spend about 21% less than the average American family on expenses for raising a child.

The biggest difference in cost comes from the price of housing, which is usually much more affordable in rural than in urban areas.

Here is an overview of how the cost per child from birth to 18 looks depending on where in the U.S. you reside:

- Urban Northeast: $282,480

- Urban West: $261,330

- Urban Midwest: $240,570

- Urban South: $230,610

- Rural Areas: $193,590

Costs of Raising a Child by Expense Category

How are all those dollars divided up and can you lower that cost? Just like with any type of budgeting, you can save on some of the costs of raising your child depending upon your lifestyle and how good your budgeting skills are.

If you have a grandparent that loves watching your children for nothing more than a few hugs, then your childcare expense goes down considerably. If you cook more and eat out less than the average family, that will significantly help with your food expenses.

This infographic (courtesy of Quicken Loans) provides a full cost breakdown of each expense category. We’ll talk about the typical expenses in each category next and give you tips on how you can save money on them.

Housing Expenses

Families will spend an average of $73,602 on housing expenses for their child during the first 18 years of their lives. We’ve talked about how where you live can raise or lower that cost because it’s tied to how much homes or apartments cost in any given area.

Items included in this expense category are:

- Mortgage/rent payments

- Property taxes & insurance

- Maintenance and repairs

- Utilities (electricity, water, etc…)

- Home furnishings and appliances

How to Lower Housing Costs per Child

While you may not want to pick up and move out to the country to lower the cost of housing for your child-raising expense, this category does include other areas where you can reduce costs.

A big one is the cost of electricity. By using energy efficient technologies, buying appliances that are energy efficient, and ensuring your home is insulated well, you can save quite a bit.

Just a simple advanced power strip that reduces electricity waste from idle devices can save $100 per year, according to the U.S. Energy Department. Homes using various energy efficient technologies can on average save 20% or more on energy bills.

Childcare & Education Expenses

For childcare and education, families will spend about $44,161 from birth to 18 years. This is one area where having family members as babysitters can save families a significant amount of money. However, not everyone has family members living nearby, so let’s look at where these expenses come from to see other potential areas for savings.

- Daycare tuition

- Daycare/school supplies

- Babysitting

- Elementary to Highschool tuition/books/fees

How to Lower Childcare/Education Costs per Child:

The care of your child is not something you want to skimp on, but a few saving opportunities do exist without having to sacrifice schooling.

- Buying used books or supplies (like calculators) instead of new

- Applying for any potential school scholarship programs

- Some private schools allow parents to volunteer to reduce tuition

- Swap babysitting with other parents you trust

Food Expenses

Some parents feel that food should be at the top of the expense list, especially when their kids hit those teen years, but on average it’s #3, costing about $39,254 over a child’s first 18 years of life.

Food expenses include:

- Food and non-alcoholic beverages purchased at stores

- Dining at restaurants

- School meal plans

How to Lower Food Costs per Child:

One of the most recommended ways to reduce a family’s food costs considerably is to cook more and buy pre-packaged meals and fast food less. This can not only reduce the weekly food bill, but it is also generally healthier since home-cooked food doesn’t have the same types of sugars, carbohydrates, and preservatives as the pre-packaged type.

How much can you save? According to Forbes, home cooking is 5 times less expensive than ordering restaurant delivery and 3 times less expensive than using a meal kit service. A time saver during the week is to cook ahead and freeze meals on the weekend with the whole family pitching in, then just reheat each night.

Transportation Expenses

Some moms and dads feel like they moonlight as a chauffeur because they’re driving their kids back and forth to activities like dance, basketball, school programs, tournaments, and more. All that driving adds up to about $34,348 over 18 years.

Items included in this expense category are:

- Monthly vehicle loan payments & down payments on loans

- Gasoline

- Oil, repairs & maintenance costs

- Insurance

- Public transportation

How to Lower Transportation Costs per Child:

While you can’t control the cost of gas, there are a few other ways you can work to reduce those transportation costs.

- Proactive vehicle maintenance which will help reduce costly repairs later

- Bundle auto insurance with home/renters’ insurance to lower the rate

- When you buy a car, look for either a hybrid or fuel-efficient model

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Health Care Expenses

Families spend an average of $19,627 for their child’s health care during their first 18 years. This is another category where it can be hard to control expenses and where you definitely don’t want to cut corners, but there are a few ways you can reduce costs in this area.

Health care costs include:

- Medical and dental services not covered by insurance

- Prescription drugs and medical supplies

- Health insurance premiums

How to Lower Health Care Costs per Child:

Technology advances in the health care industry have also lowered costs of certain medical visits. For example, many health care systems now offer telehealth services for less severe medical issues.

You can save money by doing a “virtual house call” with a doctor via video chat to check on things like a rash or ask if you should go in to have something checked out. A typical cost for this virtual doctor visit is about $49.

Another way to save is prescription discounts. If you don’t have an insurance plan that covers prescriptions, ask your clinic or doctor’s office if they have any prescription discount cards, often they’ll have something that will give you a discount off the price.

Miscellaneous Expenses

For items that aren’t included in the other main categories, families will spend about as much as they do for health care, which is $19,627. What does the U.S. Department of Agriculture put in this category?

- Personal care items (haircuts, toothbrushes, etc.)

- Entertainment (computers, smartphones, sports equipment, etc.)

- Reading materials (non-school books, magazines, etc.)

How to Lower Miscellaneous Expense Costs per Child:

This category can get quite expensive with the electronics-dominated world we live in. It seems that children request their own tablet or smartphone at younger and younger ages.

You can save a pretty penny on a new electronic device by using a trade-in program, which are offered by many carriers when they release a new model.

To save on books and videos, why not make a day of going to the library to check them out for free? This not only reduces costs and clutter (once those books are outgrown) but can also teach a child responsibility since they need to bring the items back by the due date.

Clothing Expenses

The last and lowest expense category in the costs of raising a child comes in at $14,720 over 18 years. And includes everything clothing related.

- Children’s clothing

- Diapers

- Footwear

- Services like dry-cleaning & alterations

How to Lower Clothing Costs per Child:

For centuries, multi-child families have lowered their clothing costs, sometimes much to a child’s dismay, by using the hand-me-down method. This is a great way to save money and get good use of clothing that is often grown out of too fast.

You can also save a lot on clothing and shoes by shopping in thrift and “gently used” consignment shops, which can offer great selections, name brand clothing, and school uniforms for much less than buying them brand new.

What Else Should You Know About the Costs of Raising a Child?

Here are a few other beneficial things to know about child-rearing costs that can help you plan and also might give you some hope on the horizon. This first one is especially good to know if you’re planning to have more than two children.

Does it Cost Less the More Children You Have?

The per child cost for a child’s first 18 years goes down a good bit once you have more than two children. Parents with three or more kids pay about 22% less than those with one or two.

Savings are due to children generally sharing bedrooms, the hand-me-down system, food being purchased in larger discount quantities, and sibling discounts at schools and daycare centers.

Do Children Cost Less or More by Age?

There isn’t a huge amount of difference in the price you pay for a baby/toddler as compared to a child just entering elementary school. However, costs do generally increase as a child gets older.

Here are the average costs according to age:

- 0-2 years: $12,940

- 3-5 years: $12,970

- 6-8 years: $12,800

- 9-11 years: $13,680

- 12-14 years: $14,420

- 15-17 years: $14,970

AdvisoryHQ’s Conclusion | Cost of Raising a Child

While it can be sobering to look over the costs of raising a child, it shouldn’t put a damper on your enthusiasm for welcoming that new bundle of joy into your family. The number may seem overwhelming, but you do have 18 years to spread it out!

By knowing what to expect in advance, it makes it much easier to put away savings for future expenses and make lifestyle changes like being more energy efficient and cooking more often than not only save you money but can also provide other wellbeing benefits.

When you’re aware of what you’re spending now and in the future on your child, you can make informed adjustments to lower those costs and come in below the average.

The costs aren’t written in stone but are more of a guideline of what to expect, so you have more control over your finances. With smart decisions, you can provide the same quality of care for your children while also being more financially comfortable.

Image sources:

- https://pixabay.com/en/kid-soap-bubbles-child-fun-1241817/

- https://www.quickenloans.com/blog/wp-content/uploads/2016/09/The_Cost_of_Raising_a_Child_in_the_United_States_3.jpg

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.