Finding Mortgage Rates Today for Refinance & Purchase

Finding Great Mortgage Rates for Good, Best and Excellent Credit Borrowers

With mortgage rates climbing to an all-time high, buying a new home or refinancing an existing one is on the mind of many homeowners looking to save some money on their mortgage loans.

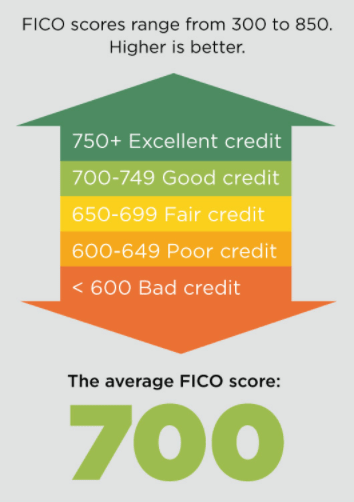

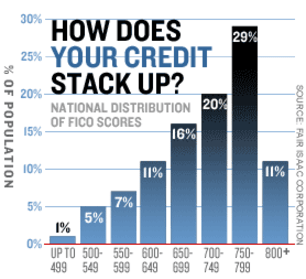

Potential home loan borrowers with great (good, best and excellent) credit scores tend to get lower interest rates on their mortgage loans, than those borrowers who have lower credit scores (low, poor, bad credit histories). According to a Bankrate survey, “a credit score of 740 or higher qualifies for the best mortgage rates from most mortgage lenders. It is difficult, but possible, to get a mortgage with a credit score that is under 620.”

Click one of the two links below to learn more about refinancing a home loan or purchasing a new home.

Mortgage Loans for Purchasing a Home

You’re ready to buy a home, and you now have your finances and documentation in order. However, at this stage you find yourself faced with the sheer number of hundreds of mortgage lenders, loans and rates that you must go through.

So how do you determine which lender to pick?

Taking the time to find the best home mortgage rates for you before you commit to a long-term mortgage loan is key to saving money in the long-term. Part of this process involves conducting a mortgage comparison between the mortgage rate providers and lenders in your area.

Comparing mortgage rates should be a top priority because today’s mortgage rates are constantly changing.

Refinancing an Existing Mortgage Loan

Why Should You Consider a Mortgage Refinance?

To help you determine whether you should consider mortgage refinancing, we pulled out the best financial tips from Investopedia and Forbes, listed below.

To Get a Lower Interest Rate

If interest rates for mortgages are on the decline, it may be a good time to consider refinancing your mortgage.

Traditionally, a rate difference of 2 percent has been considered worth refinancing, but with rates climbing higher, many lenders suggest that a change of 1 percent is well worth it.

As with any loan refinance, your previous mortgage is paid off by a new one—and in this case, the new one should have better interest rates to help you save money over the life of the loan.

Of course, it’s important to remember that saving money through a refinanced mortgage depends on more than just the rate. Homeowners should also consider factors like the new terms of the loan and the tax implications of refinancing.

As Forbes contributor Rob Berger says,

It’s important to factor in the tax consequences of a refinance. Lowering your interest rate saves money, but perhaps not as much as you may think once you adjust the lower interest payments for the smaller tax deduction.

If Your Credit Score Improves

Getting the best purchase or refinance rates often depends on credit score, so if you find that your score has jumped up, you might want to explore your refinancing options.

According to myFICO, refinancing with a credit range of 760-850 can make borrowers eligible for rates of 3.5 percent. Compare that to 5.1 percent rates for credit scores between 620-639, and borrowers could potentially be looking at savings of 1.5 percent or more.

To Change Mortgage Terms

Even if you can’t improve your overall rate, you can still lower your monthly payments by refinancing under different (longer) terms.

Of course, this isn’t always the best long-term plan. Even though you can get lower monthly payments, you’re increasing the life of the loan and thus paying more in interest.

Still, if your monthly mortgage payments are too high to fit in your budget, refinancing underneath different terms is an option that can effectively lower your payments.

You can also approach mortgage refinancing from the opposite side of the spectrum—rather than lengthening your term to create lower monthly payments, you could shorten your term to pay less interest overall.

Switch from Adjustable to Fixed

If you’re worried that mortgage rates are on the rise, you can use mortgage refinancing to switch from an adjustable rate mortgage (ARM) to a fixed rate mortgage.

Approaching a mortgage refinance from this angle does come with its own sort of risk—how do you know that mortgage rates won’t start dropping down again?

With interest rates steadily increasing over the past few years, Berger suggests that refinancing from an ARM to a fixed makes the most financial sense.

As he puts it, “For me, I wouldn’t bet on rates staying low. If I financed a property with an ARM, I’d be looking to refinance fast.”

Consolidating Debt

Some homeowners will use a low-interest, refinanced mortgage to pay off their high-interest debt. While this sounds like a smart financial decision, it does come with its own complications.

The biggest concern with using refinancing to pay off debt is that the available credit from mortgage refinancing can be a huge temptation for those who are prone to accumulating credit card debt.

As Investopedia points out,

Unfortunately, refinancing does not bring with it an automatic dose of financial prudence. Take this step only if you are convinced you’ll be able to resist the temptation to spend once the refinancing gets you out from under debt.

Additional Considerations (Refinancing Your Mortgage Loan)

Although all the reasons above are common motivations for homeowners to begin the refinancing process, it’s important to examine every option before making a commitment, so you can get the best mortgage rates from what is offered by different lenders.

This means exploring different rates and terms from multiple lenders, as well as looking at the impact that a refinanced mortgage can have on your financial future.

How long are you planning on living in your house? How can you benefit from different terms and better interest rates? Will the money saved over time make the refinancing process worth it?

Ultimately, you want to make sure that refinancing provides the best value for your personal financial health.

Image Sources:

- https://pixabay.com/en/house-home-property-residential-2483336/

- https://pixabay.com/en/new-home-house-construction-2416183/

- https://www.cnbc.com/2017/07/10/average-fico-score-hits-an-all-time-high.html

- http://www.insidervlv.com/RealEstate/images/FicoScores.gif

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.