Current Mortgage Rates & Loans for NY State Borrowers with Good, Great, and Excellent Credit Scores

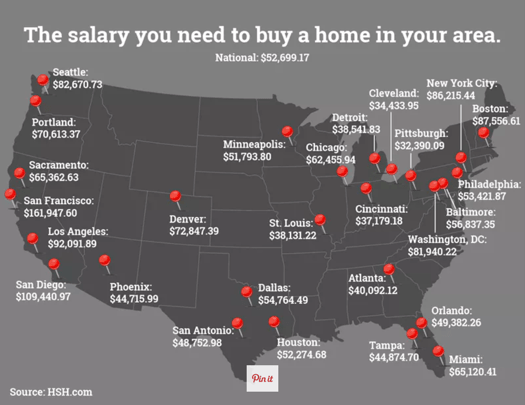

You Need to Make $86,000+ a Year to Buy a Modest Home in NYC

According to a study conducted by HSH.com, median home price in NYC is $414,000, and you’ll need to earn $86,000+ a year to buy a modest home. Luckily, it’s not the same story across the state of New York. Home prices are much lower in Buffalo, Rochester, Yonkers, Syracuse, Albany, New Rochelle, Mount Vernon, and other cities in New York state.

Are you in the market to buy a home, and are seeking today’s mortgage rates in New York City or in other cities in NY state? Or are you looking to refinance an existing NY mortgage loan? In the sections below, we’ll discuss the types of NY mortgages, required credit scores, and more to help you get the best possible rates and terms on a NY mortgage.

Current Montana Mortgage Rates | MT Refinance Rates & Mortgages for Good-Excellent Credit Borrowers

Which New York City are You Located in?

Mortgage interest rates for NY residents who have good, great, and excellent credit histories are based on a wide range of factors including the neighborhood the house is in, your down payment, and the mortgage loan amount.

Most mortgage lenders in New York, Buffalo, Albany, New Rochelle, Utica, White Plains, Rochester, Yonkers, Syracuse, Mount Vernon, Schenectady, Troy, and Niagara Falls require a down payment of around 20%.

Below is a list of some of the largest cities in New York state.

| City | County |

| New York | Bronx, Kings, New York, Queens, and Richmond |

| Buffalo | Erie |

| Rochester | Monroe |

| Yonkers | Westchester |

| Syracuse | Onondaga |

| Albany | Albany |

| New Rochelle | Westchester |

| Mount Vernon | Westchester |

| Schenectady | Schenectady |

| Utica | Oneida |

| White Plains | Westchester |

| Troy | Rensselaer |

| Niagara Falls | Niagara |

| Binghamton | Broome |

| Rome | Oneida |

| Long Beach | Nassau |

| Poughkeepsie | Dutchess |

| North Tonawanda | Niagara |

| Jamestown | Chautauqua |

| Ithaca | Tompkins |

| Elmira | Chemung |

| Newburgh | Orange |

| Middletown | Orange |

| Auburn | Cayuga |

| Watertown | Jefferson |

| Glen Cove | Nassau |

| Saratoga Springs | Saratoga |

| Kingston | Ulster |

| Peekskill | Westchester |

| Lockport | Niagara |

| Plattsburgh | Clinton |

| Cortland | Cortland |

| Amsterdam | Montgomery |

| Oswego | Oswego |

| Lackawanna | Erie |

Source: Wikipedia

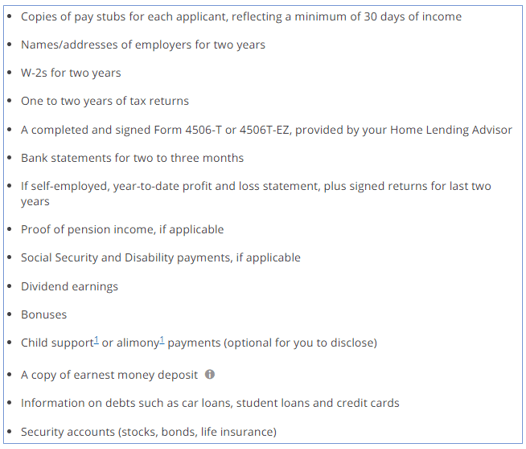

Needed Documents for a Mortgage Loan Application

According to Chase bank, below are the most common mortgage loan paperwork and documents that you’ll need to gather when applying for a mortgage loan.

Mortgage Loan Types in New York

Mortgage companies in NY provide adjustable-rate mortgages and conventional mortgage loans, including those listed below.

Adjustable-rate mortgages in New York include:

- 5/1 ARM

- 7/1 ARM

- 3/1 ARM

Conventional mortgage loans in New York:

- 10-year mortgage loans

- 15-year mortgage loans

- 20-year mortgage loans

- 30-year mortgage loans

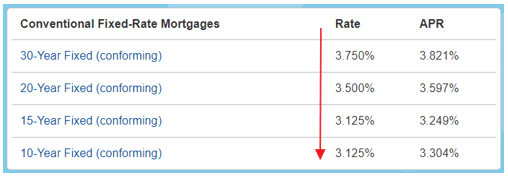

A conventional mortgage loan in New York is a home loan with a static interest rate that stays constant throughout the life of the loan.

In general, the interest rate on loans decreases in parallel to the duration of the loan. So, 30-year loans have higher rates than 20-year fixed-rate mortgages. And 20-year loans have higher rates than the 10-, and 15-year loans. The reason for this has to do with risk. The longer the loan period, the longer the lender is exposed to the possibility that you will default.

See the example below, which shows a U.S.Bank rate table with reduced rates for 20>15>10-year loans.

Most borrowers seek 30-year mortgage loans. However, if you believe you can afford to pay back a home loan within 15 years, then it is better to go with the shorter period.

Current Mortgage Rates in Maine | Home Loans in Maine for Good-Excellent Credit Borrowers

Current Mortgage Rates in West Virginia | Best WV Home Loans for Good-Excellent Credit Borrowers

Do you Have a Good or Excellent Credit Score?

Most mortgage companies in NY use your FICO score, or some other credit score, to determine the loan amount to lend you, as well as how much interest to charge you.

FICO scores range anywhere from 300 to 850:

- 300 – 629 is considered a bad credit score

- 630 – 689 is considered a fair credit score

- 690 – 719 is considered a good credit score

- 720 – 850 is considered an excellent credit score

According to CNBC, as of this year, the average FICO credit score in the U.S. is 700.

Current Mortgage Rates in Utah | Best Utah Mortgage Rates for Good-Excellent Credit

Current Mortgage Rates in Nevada | Best Nevada Mortgage Rates for Good-Excellent Credit Borrowers

Conclusion – Finding Today’s Best Loans & Mortgage Rates in New York

As you can see, there is a lot to choose from when you are looking for the best mortgage rates in New York City or across NY state.

When deciding which mortgage lender in New York state to contact, make a list of what you would like to get out of the loan: A lower rate? A faster home closing (the best mortgage lenders in NY aim for a 35-day loan processing period) or are you seeking a refinance home loan from your existing financial institution?

Once you’ve assessed your own needs, you can easily match those needs with the NY mortgage lender that best matches what you want.

Lastly, don’t be afraid to take advantage of free consultations offered by New York mortgage companies, or to pick up the phone to ask a quick, yet game-changing question.

Best of luck!

Current Mortgage Rates in Nebraska | Best Home Loans in Nebraska for Good-Excellent Credit Borrowers

Current Mortgage Rates in New Mexico | Best NM Mortgage Rates for Good-Excellent Credit Borrowers

New York Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image Sources:

- https://www.hsh.com/finance/mortgage/salary-home-buying-25-cities.html

- https://www.chase.com/personal/mortgage/home-mortgage/financing-home/application-documents

- https://www.usbank.com/home-loans/mortgage/conventional-fixed-rate-mortgages.html

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.