Review: Leveraging Acorns vs. Robinhood as the Best Investing Apps

In an automated world, investments and trading are easier than ever before.

Now, investing platforms like Acorns and Robinhood give you the ability to trade with the push of a button or automatically invest extra change every time you shop.

With a multitude of options available, you may have questions including: How do I decide between Robinhood vs. Acorns? Is Acorns safe? Is Robinhood safe?

Image Source: BigStock

This AdvisoryHQ Acorns vs. Robinhood review aims to provide an in-depth analysis of the security and fees for these best investing apps in order to answer these questions for you.

See Also: Best Budget Apps | Budgeting Software Reviews

Acorns vs. Robinhood—Smart Portfolio Management Apps

Technology has revolutionized the stocks and trades industry. In the past, you had to call your broker in order to invest or trade.

Today, however, you can simply use your cell phone or other mobile device to conduct business.

Image Source: Acorns

Acorns and Robinhood are two portfolio management apps created to make your financial planning (and life) simpler. Both of these best investing apps have gotten wide amounts of praise for their efficiency, accessibility, and affordability.

Our Acorns review and Robinhood app review will look at how each of these best investing apps works to help consumers decide between Acorns vs. Robinhood for their financial investments.

Comparison Review List

The list below is sorted alphabetically (click any of the names below to go directly to the detailed review section):

High-Level Comparison Table

Best Investing Apps | Investment Fees | Commission Fees | Minimum Account Balance |

| Acorns | 0.25% for $5,000+ | $0 | None |

| Robinhood | TBD | $0 |

Table: The above list is sorted alphabetically

Acorns vs. Robinhood—Acorns Review

Acorns is an automated portfolio management system that was created by Walter Cruttenden and his son, Jeff Cruttenden.

Walter has founded and served successful companies before, such as Cruttenden Roth (now Roth Capital Partners) and E*Offering (now a business under Schwab).

The idea for simplified investing came to Jeff while in college after witnessing several classmates unable to invest due to the lack of large sums needed to start with traditional brokerages.

Since the majority of people do business with their cell phones now, why not give them the ability to use their spare change for investments while keeping Acorns app fees low?

The Cruttendens brought on board engineers, mathematicians, marketers, designers, and financial experts (including an economist that had won the Nobel Prize) to further develop the app and its investing software.

Key Features

Our Acorns review found that the Acorns app is an award-winning portfolio management app:

- Winner of the Best Mobile App from FastCo Innovation 2015

- Winner of the Best New Economy from SXSW 2015

- Winner of the Best Design from Design Awards 2014

Don’t Miss: (BillGuard vs. Mint) BillGuard Review—Is BillGuard Safe? Most Powerful Finance App

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

The app uses modern portfolio theory to diversify your investments into asset classes, and these are represented by exchange-traded funds (ETFs), according to the Acorns site.

The investments are based on a level of risk ranging from conservative to aggressive. The software used by Acorns helps to maximize the possible return on these investments based on your circumstances.

Acorns does not charge commissions on trading for accounts that are under $5,000; accounts that are more than $5,000 are charged 0.25 percent. You can open an account with only your spare change, and you can also invest (and withdraw) money at any time with no penalties.

The company is working on a beta version of Found Money, a program that allows your favorite brands to invest in your Acorns account when you shop with them.

These companies include Jet.com, 1-800-FLOWERS, JackThreads, Hulu, AirBnB, and Dollar Shave Club.

Acorns vs. Robinhood—How Acorns Works

While you are trying to determine whether to use Acorns or Robinhood for your personal financial planning, consider how each of these best investing apps work.

Image Source: Acorns

To create an account with Acorns, you will need to complete a financial questionnaire for Acorns to review to assess risk. You will be asked to link your credit card or debit card and checking account to invest and withdraw funds.

After you create your account on Acorns, you can either add a lump sum—$5 up to $50,000—to your account, or you can use the Round Up feature. You can also set up recurring investments from your account which can occur daily, weekly, or monthly.

You may find the Round Up feature to be the easiest way to invest without thinking about your portfolio 24/7. When you shop, simply use the credit or debit card you linked to your account.

Investing with Acorns

Acorns will round the total amount you spent up to the nearest dollar and “hold” the spare change in your account. When the spare change reaches five dollars, the app will automatically invest your money into the diversified portfolio.

For example, you spend $45.57 at your local grocery store. The Acorns app will round the amount up to $46 and hold the difference of 43 cents. When the total being held reaches $5, it will then invest it into your portfolio.

Your portfolio is diversified into six ETFs, including:

- Large companies

- Small companies

- Emerging markets

- Government bonds

- Real estate

- Corporate bonds

Once the investments are made into each category of ETFs, the money is diversified further to buy individual companies’ stocks. The Acorns app uses Fractional Share Investing to accomplish this.

Since stocks and bonds can change, Acorns reviews your portfolio and rebalances the diversification on a consistent basis to make sure you are receiving the highest possible return. Our Acorns review found that this automatic feature sets Acorns apart as one of the best investing apps available.

Acorn App Fees

The affordable fees are what makes both of these best investing apps so appealing to a new generation of investors, particularly when looking at Acorns reviews.

The Acorn app fees are only one dollar per month to give you automatic investing in low-cost ETFs and anytime withdrawals. You will not be charged a commission fee for trading if your account is under $5,000.

Any accounts over the $5,000 limit are charged a 0.25 percent annual fee. There is no minimum amount required to open an account, so you can begin using the Round Up feature right away as you shop.

Additionally, our Acorns app review did find that college students can use the app free of charge for four years.

With low fees and a structure built to include all investment levels, our Acorns review found that Acorns is one of the best investing apps to consider this year.

Acorns vs. Robinhood—Is Acorns Safe? (An Acorns Review of Security)

The biggest question may be: Is Acorns safe? Can you trust an app with your personal information as well as funds?

Thankfully, our Acorns review found that Acorns uses a 256-bit encryption in both the website and app.

The data is not saved to your cell phone, computer or other mobile devices. To ease the minds of investors, Acorns has made sure that each account is insured up to $500,000 by the Securities Investor Protection Corporation (SIPC).

Acorns monitors unusual activity and will notify you of any issues. Just like the security you expect from a bank website or bank app, Acorns implements automatic logouts, identification verification, privacy, and other layers of authentication.

Popular Article: Top Day Trading Tools (Review of the Best Trading Software and Apps)

Acorns vs. Robinhood—Robinhood App Review

In a similar mission as the Acorns app, the Robinhood app seeks to democratize investing and trading using mobile devices. The idea for Robinhood was created by former Stanford roommates Vladimir Tenev and Baiju Bhatt after working in New York for large financial institutions.

The pair decided to offer a trading platform to people with no commission fees, easily accessible through cell phones and other mobile devices.

Robinhood’s mission is for millennials and other generations to trade confidently without the use of an expensive middle man. The company now employs experts, designers, and marketers and is backed by renowned investors, becoming one of the best investing apps on the market today.

Key Features

Although the company is new, Robinhood app reviews are glowing over this start-up which allows you to buy and sell stocks, stop loss orders, and stop limit orders.

The company boasts a free stock trading app, allowing you to save as much as $10 per trade transaction. For those who are trading on a budget, this is a best stock trading app to consider.

The company is also a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC).

The free stock trading app is available for iOS and Android devices. The company has plans to expand into other countries this year, including China and Australia.

Currently, Robinhood is launching programs and waitlists for these countries. Future plans also include offering customers joint, custodial, IRA, and margin accounts.

The company makes money similarly to traditional brokers as it uses the accruing interest from customers’ cash balances that are not currently invested (with no extra charges for the customer). In the future, as the margin account beta is released to the public, Robinhood will collect the interest from these accounts.

Related: Personal Capital vs. Mint—Detailed Ranking & Comparison

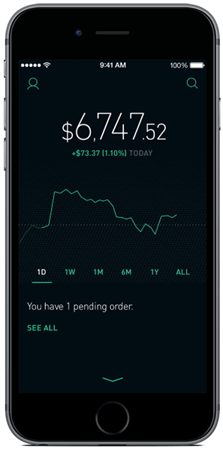

Acorns vs. Robinhood—How Robinhood Works

Robinhood is a free stock trading app that can be downloaded and set up in less than 4 minutes.

To open an account with Robinhood, you will need to complete an application to give this best stock trading app permission to check your credit history. It will also perform an “anti-money-laundering check,” according to the company’s website.

The following is a list of requirements to open a Robinhood account:

- You must be age 18 or over.

- You must have a valid social security number.

- You must have a legal U.S. residential address.

- You must be able to prove your U.S. citizenship (or have a valid U.S. visa or be a U.S. permanent resident).

There are exceptions to the requirements, like the inclusion of active U.S. military personnel stationed overseas, so make sure to review the requirements before completing an application.

Investing with Robinhood

The great news is that you can open an account with no minimum deposit, which makes Robinhood app reviews overwhelmingly positive. However, to buy stocks, you need to link an account with a financial institution.

Once you are approved and have downloaded the app, you can sign in using fingerprint identification software. The Robinhood app reviews the security and will sign you into your account.

The default account is an individualized cash account. The home page showcases a graph that provides you with a visual of how well your stocks are doing at that time. You can also check the status of individual stocks you own.

Selling and buying stocks are done simply by choosing the stock you want, confirming the amount of shares you want to sell or buy, and tapping the “okay” button to complete the transaction. If the market is closed, the stock trade will process the next day.

You can invest or withdraw funds in the same manner after linking to a bank account. In 2016, the company introduced Robinhood Instant, which gives you instant access to bank transfers up to $1,000.

If you prefer to automatically invest, you can schedule deposits to your Robinhood account on a weekly, biweekly, monthly, or quarterly basis.

Our Robinhood trading review found that users can trade more than 5,000 securities. Most of the ETFs and U.S. equities traded on the major exchanges in the country are included.

Robinhood App Fees

Robinhood app reviews show that the software does not charge any commission fees and occurs in real-time with the market, so you always have a beat on what is happening currently with your stocks.

If you are a frequent trader, saving $7 to $10 per trade is an investment within itself. The minimum amount to open a Robinhood account is zero.

With no minimum requirements and a free stock trading app, Robinhood continues to be one of the best investing apps for investors on a budget.

Acorns vs. Robinhood—Is Robinhood Safe? A Robinhood App Review of Security

A Robinhood trading review would not be complete without answering the question, “How safe is Robinhood?”

The company insures its customers’ accounts up to $500,000 through the FINRA and SIPC. Not only are members’ accounts protected up to $500,000, but cash claims up to $250,000 are also covered.

The free stock trading app uses security measures, like fingerprint scans, SSL, and 256-bit encryption, to protect your data. Just like Acorns, Robinhood also employs bank-level security.

Read More: Best Small Business Accounting Software in Australia

Conclusion: Choosing Acorns vs. Robinhood for the Best Stock Trading App

Your decision between Acorns and Robinhood is entirely dependent on the outcome you are expecting from an app.

If you are, or plan to become, a frequent trader and do not mind using only an individual taxable account, then Robinhood may be for you.

However, if you struggle to save enough money for investments, the low Acorn app fees, Round Up feature, and Found Money Program may make Acorns into one of the best investing apps for you.

In the end, mobile device technology is a new and efficient way to enter the investment arena.

These best investing apps are not only accessible, but they are also affordable and efficient, making them competitive options for those looking for the best stock trading app.

When considering Robinhood vs. Acorns, looking at Acorns reviews and Robinhood app reviews can provide valuable insight into the features, fees, and software that fit best with your financial portfolio.

Both Acorns and Robinhood have many beneficial qualities that can help you succeed in reaching your investing goals.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.