About AdvisoryHQ

AdvisoryHQ News was launched in 2015 and has since become one of the fastest-growing review and ranking media for the financial advisory, investment, mortgage, banking, wealth management, and accounting sectors. Read more: Overview of AdvisoryHQ News.

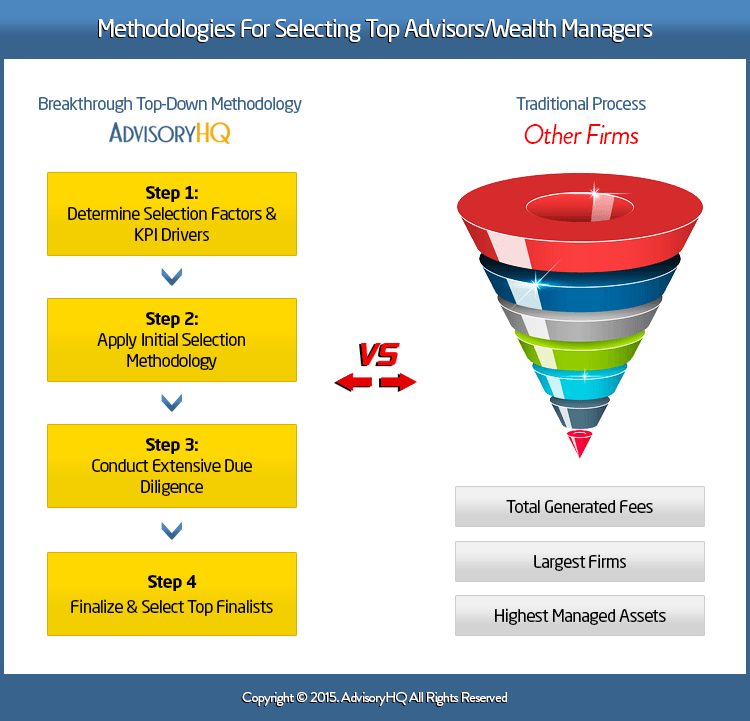

AdvisoryHQ’s Top-Down Selection Methodology

The decades-old “financial advisor ranking methodologies” used by established financial news organizations like Barron’s (U.S.) and Citywire (U.K.) are highly focused on three major categories: total assets under management (AUM), firm size/quality of practice, and the amount of revenue generated by an advisory firm.

While Barron’s methodology is based on “proprietary” and undisclosed “multiple subcalculations” based on the three high-level categories mentioned above, AdvisoryHQ presents below a detailed public overview of its own selection methodology.

To generate a more reflective ranking of the best rated financial advisory and wealth management firms, AdvisoryHQ went beyond just analyzing AUM, revenue, and the size of an advisory firm.

AdvisoryHQ developed a breakthrough “Top-Down Advisor Selection Methodology” (explained below) that is based on a wide range of filters including fiduciary duty, independence, transparency, level of customized service, history of innovation, fee structure, quality of services provided, team excellence, and wealth of experience.

Note: AdvisoryHQ reviews and ranks advisory and investment companies only. We do not review or rank people (financial professionals, investment individuals, etc.)

Objectivity

Our review and ranking articles are always 100% independently researched and written. Firms do not even realize that they are being reviewed by AdvisoryHQ until after our reviews have been completed and published to the public. Read more: AdvisoryHQ’s Objective Approach.

Consumers and financial professionals alike appreciate the objective structure and approach that AdvisoryHQ utilizes. Here is a media release from Sunrise Advisors regarding AdvisoryHQ:

“We feel privileged to be a part of this elite group of firms ranked by AdvisoryHQ,” said David Walsh, JD, CFP®, Director of Family Office Services. It makes it even more meaningful that advisory firms were not able to influence AdvisoryHQ’s rankings in any way. We weren’t even aware of our consideration by AdvisoryHQ until we were notified of our selection. With too many rankings or reviews based on a single metric (like firm size) or coming as a result of ‘pay-to-play’ advertising swaps, AdvisoryHQ’s process is importantly unbiased, objective, and consumer-centric.”

Read more comments here: AdvisoryHQ’s Objective Approach.

Building Our Ranking Methodology

Based on keyword searches that users enter into the search box on our website, combined with an extensive U.S. and U.K. keywords search analysis that was performed using Google, Bing, Yahoo!, Ask.com, AOL, and other search mediums, AdvisoryHQ determined that the average consumer mostly searches for financial advisors that fit some or all of the following dimensions:

- Independent financial planners, advisors, and asset management firms

- Advisors that act as fiduciaries

- Firms that provide customized services

- Firms that have a high level of transparency

- Fee-only advisors and wealth managers

- Fee-based advisors that are also fiduciaries (more on this later)

- Firms that have a well-established and experienced advisory team

When constructing the logic for AdvisoryHQ’s selection methodology, the review team integrated the above requirements as part of our selection criteria. The following sections provide a detailed review of our methodology criteria, factors, and ranking process.

Don’t Miss:

- Ranked By AdvisoryHQ? Permission to Use Your FREE Award Emblem

- SEC Award Criteria Disclosure

- How Other Advisors are Promoting Their Award/Recognition

- About AdvisoryHQ

- Meet the AdvisoryHQ Team

- Do Advisors Have a Say in Their Review & Ranking?

- How Long Does an Advisor Remain on the Top Ranking List?

- Can Advisors Request Corrections/Additions to Their Reviews?

- Can Anyone Request a Review of an Advisory Firm?

- Do Firms Pay for Their Ranking?

- Permissions for Reprints

AdvisoryHQ’s Four-Step Selection Methodology Structure

Below is a step-by-step breakdown of our methodology process.

Step 1: Develop a Comprehensive List

Using publicly available sources, AdvisoryHQ identifies a wide range of financial advisors, registered investment managers, wealth managers, and financial planners that provide services in a designated area.

Step 2: Apply Initial Threshold Filters

After developing a comprehensive list of firms, our review team then applies the initial methodology filters to narrow down the list of identified firms.

Initial Filters:

- Fee structure (fee-only vs. fee-based vs. commission-based structures)

- Fiduciary duty

- Independence (a situation that minimizes conflict of interest issues)

- Scale of innovation

Fee Structure (Fee-Only vs. Fee-Based vs. Commission)

Based on what a lot of consumers are searching for, AdvisoryHQ’s methodology logic is “fee-only” centric. However, there are times when the review team will identify and rank one or more advisory firms that have a fee-based/commission-based structure based on the reasons explained below.

Fee-Only:

Fee-only financial advisors, financial planners, and wealth managers do not accept commissions or third-party referral payments. Their only source of advisory payments comes from their clients.

A fee-only structure minimizes the inherent conflicts of interest that come with selling and recommending financial products. While a client’s objectives, not the advisor’s method of compensation, should drive the advisor’s recommendations, this is not always the case.

Across the financial industry, a lot of firms and individuals that call themselves “financial advisors” are actually commission-based financial product salespeople. Their compensation is determined solely by the quantity of financial products they sell rather than the quality of their advice.

A TD Waterhouse survey showed that most consumers were unaware of the regulatory distinctions between fee-only vs. fee-based (fee + commissions) vs. commission structures.

The survey found that 88% of consumers would not seek advice from fee-based/commission-based investment firms if they knew the firms were not legally required (non-fiduciaries) to act in the investor’s best interest in all aspects of the relationship.

For example, about 90% indicated they would not seek financial advice from a stockbroker if they realized the stockbroker was not legally required to disclose conflicts of interest prior to providing financial advice. Eighty-five percent indicated they would not seek advice from a commission-based firm if they realized that such advisors provided fewer protections than Registered Investment Advisors (RIAs), which are required to act as fiduciaries.

Fiduciaries are legally required to act in their clients’ best interest, 100% of the time.

As such, AdvisoryHQ’s selection factors and logic have been designed toward identifying, selecting, and ranking the top fee-only advisory firms across the U.S. and the U.K.

Fee-Based and Fiduciaries:

Our methodology also favors fee-based advisory firms that are also fiduciaries. Many consumers confuse fee-based advisors with fee-only advisors, and that is unfortunate because there are some critical differences between these two types of compensation models. Fee-based advisors receive some of their compensation directly from their clients, but they are also free to accept commissions from the companies whose financial products they sell.

Oftentimes, the fact that the advisor earns commissions is not readily provided to the client or apparent in the client’s statement.

Like the commission-based model, a fee-based compensation model creates potential conflicts of interest because the investment manager’s income is affected by the number of transactions conducted and by which products are selected.

Our goal when presenting our rankings is to provide a wide range of top-rated advisors to a wide range of client types. In some cities we have observed fee-based advisory firms that provide an amazing level of service to clients and have fees that are sometimes less than those charged by fee-only advisory firms that operate in that same geographical location.

Here at AdvisoryHQ, our methodology is focused on identifying, ranking, and presenting the top-rated, fee-only wealth advisors and investment managers. We do acknowledge that there are good-intentioned wealth advisors who choose to work under different compensation structures; however, too often their clients are unaware of the conflicts of interest that exist in some of these models.

Our methodology sometimes favors fee-based advisory firms that are also fiduciaries because such advisors are required to fully disclose any conflicts of interest and are also required to always place their clients’ interests ahead of their own.

For example, we rated Investors Advisory Group (IAG) as one of this year’s top ranking best wealth management firms in Wisconsin.

IAG operates under a fee-based structure. But it is also a fiduciary, which is a common thread that connects the firm and the fiduciary duty under which they operate. Fiduciary duty requires them by law, in addition to their practice principles, to put their clients’ interests ahead of their own.

The firm also provides customized services to each of its clients, and its advisors commit themselves to staying current with financial trends, products, and practices, which helps them to make responsible decisions about their clients’ investments.

Here is a statement that encompasses the foundation upon which the firm is built:

“Doing things that are in the best interest of our clients is at the heart of how we provide objective investment advice. We don’t make ‘cookie cutter’ recommendations. We truly believe in the importance of seeing things from each client’s perspective and customizing a plan to help each client meet their long- and short-term goals.”

Commission-Based Structure:

Although AdvisoryHQ’s selection methodology favors fee-only (and fee-based + fiduciary) wealth managers and financial advisory firms, in extremely rare cases we might include one commission-based firm in the list of top-ranking advisors.

Here is why…

Our goal is to identify and provide broad ranging lists of advisory firms who can meet the needs of different consumer types, including high and ultra high-net-worth investors. Ultra high-net-worth investors are those with investable assets of at least $30 million. High-net-worth investors are those with an excess of $1 million in investable assets.

Some ultra/high-net-worth individuals and families seek out some unique, “velvet-glove” services that may be provided best by a particular advisory firm in a particular city or state that is fee-based or commission-based.

Fiduciary Duty

AdvisoryHQ’s methodology strongly favors financial advisors, planners, and wealth managers that assume fiduciary duties and responsibilities. As explained above, this means that they have a fiduciary responsibility to act in their clients’ best interest.

Fiduciaries are required by law to disclose all fees, maintain an open architecture, and “sit on the same side of the table” as you.

With a fiduciary, products and services will not be pushed onto you just to line the advisor’s pocket. When a fiduciary makes a recommendation, you can be sure that it’s done with the aim of further growing your investments and improving your financial portrait.

As a fiduciary, your advisor’s only thought when providing advice or selecting investment products for your portfolio is how the advice/investments will help you reach your financial objectives.

Independence (A Situation that Minimized Conflict of Interest Issue)

AdvisoryHQ’s selection logic is designed to favor independent financial advisors and wealth management firms. These are firms that provide services and recommend financial products that are not based on any affiliation with a major bank or financial institution. An independent structure leads to a reduced conflict of interest situation.

Unlike an in-house advisor or broker, who is limited to the menu of products approved by his/her employer, independent financial advisors can help clients make informed and objective investment choices from a wide selection of financial products.

Scale of Innovation

The relationship with a financial advisor, planner, or wealth manager is normally a very long-term relationship. As such, it is essential to seek advisors who are constantly improving their services and business practices.

You will benefit from the most accurate and timely advice because such advisors invest in their team continually, including continual education that is far beyond minimum industry requirements. AdvisoryHQ’s selection logic is designed to favor firms that emphasize innovation and consistent improvement as part of their overall policy, mission, goal, and strategy.

Step 3: Apply Integrated Selection Filters

After trimming down the initial list using AdvisoryHQ’s initial methodology filters, AdvisoryHQ’s review team then conducts a deep-dive review assessment of the remaining advisors to select the final list of top-ranking advisors, planners, and wealth managers.

When performing their deep-dive assessment and due diligence, the team applies the following selection filters.

| Selection Criteria | Why Is This Important? |

| Resource Availability | An advisory firm’s greatest strength is its dedicated team of advisors, RIAs, CFPs, wealth managers, financial planners, client service professionals, and other supporting staff members. One of the key dimensions that AdvisoryHQ reviews as part of its final methodology selection logic is the number of “available” advisory professionals and supporting staff. Firms with a broad listing of advisors, planners, asset managers, and other supporting staff will have the necessary bandwidth to provide the right level of support to a broad base of individuals, families, and institutions. However, our biggest focus is the number of advisors relative to the number of clients. As an example, a firm with a small number of advisors can still rank high if it only caters to a select number of clients or if it provides niche services. |

| Experience Level | In addition to the number of available resources, AdvisoryHQ also considers the combined experience level of the advisory team, including years of experience, certification, and leading roles within their fields of expertise. A team with a broad level of expertise and extensive years of experience will have the appropriate skillset to deal with a wide range of client financial issues. |

| Transparency | Our selection methodology favors advisory firms whose fees are completely transparent. (Don’t miss: Average Financial Advisor Fees–Wealth Managers, Planners, and Fee-Only Advisors) Before beginning any work, your advisor should disclose their fees to you. This way, there are no surprises or hidden fees. |

| Customized Services | The level of flexibility in providing customized services is another factor used in our analytical logic. AdvisoryHQ’s selection logic favors firms that provide services that are tailored toward their clients’ unique situations. |

| Quality of Advisor’s Website | Consumers like to review an advisor’s website in detail before contacting that advisor. As such, AdvisoryHQ considers the ease of use, graphical design, and functionality of an advisor’s website as part of our methodology. |

| Open Door Policy | AdvisoryHQ also favors firms that emphasize an open door policy. An open door policy encourages you to ask questions, get to know their staff, and feel at home in their office. Such firms will actively encourage you to contact them throughout the year before you make major financial decisions or whenever you have financial questions. |

| Audience | Advisors cater to various audience types. Some advisors mainly focus on providing services to individual investors, while others cater solely or mainly to institutional clients. Our focus is to identify and rank those advisors and wealth managers who cater to and work with individuals and families. |

Step 4: Generate the Final List

Based on the results of our assessment, AdvisoryHQ then selects the individuals and entities that make it into our various lists of top financial advisors, planners, and asset managers.

Scale of AdvisoryHQ’s Methodology Selection Factors

Please note that there are hundreds, if not thousands of possible factors, filters, and selection criteria that can be applied to any ranking and rating selection across any industry.

It is nearly impossible for any ranking or review company to accommodate all possible selection filters when developing a selection methodology.

The selection filters outlined above are the only selection filters that we currently accommodate.

Perform Additional Due Diligence Before Using an Advisory or Wealth Management Firm

Before hiring an investment manager or financial advisor, it is strongly recommended that consumers perform additional due diligence. Such due diligence may include performing background checks. Consumers can use BrokerCheck, an online tool that enables consumer to scrutinize a potential financial adviser.

It is free to use and manage by the Financial Industry Regulatory Authority (FINRA). FINRA oversees the people and firms that sell stocks, bonds, mutual funds and other securities. Simply type in your current or prospective broker’s name to see employment history, certifications, and licenses—as well as regulatory actions, violations or complaints you might want to know about. You also can get information about your broker’s firm. There’s no reason not to check.

Detailed due diligence information on wealth managers and RIAs that are registered with the Securities and Exchange Commission (SEC) and not with FINRA can be found here: Investment Adviser Public Disclosure (IAPD).

The IAPD Program provides information about both SEC and state-registered investment adviser firms. The SEC typically regulates investment advisers that manage more than $100 million in assets. Advisors, wealth managers, and investment managers that do not meet this threshold generally are regulated by the states.

You can also visit the link below to use the CFP Board’s verification function to verify an individual’s certification status. The search results will identify individuals who currently hold CFP® certification as well as individuals who are not currently certified but who held CFP® certification at one time.

CFP BOARD: VERIFY AN INDIVIDUAL’S CFP® CERTIFICATION AND BACKGROUND

Searching using the CFP Board’s verification function should also turn up any securities or insurance-related infractions that were committed by the advisor as well as any violations of the CFP rules or code of ethics, which holds designees to a higher standard of conduct than FINRA or the SEC.

For additional due diligence, consumers can also call their state insurance commissioner to request disciplinary histories (if any) of insurance licensees committed by licensed personnel.

Note: AdvisoryHQ is NOT a financial advisory firm

The content provided on AdvisoryHQ.com is provided for news and information purposes only and is not to be regarded as financial advice. AdvisoryHQ is not a financial advisor, registered investment advisor, broker/dealer, wealth manager, financial consultant, financial analyst, securities broker, or any type of financial advisory firm.

The information we provide is for information purposes only. The content on AdvisoryHQ.com is general in nature and has been prepared without considering your specific objectives, financial situation, or needs. AdvisoryHQ is not responsible for any investment or financial decision made by you.

You and you alone are responsible for your own financial/investment research and investment decisions. Before acting on any information on our website, we strongly encourage you to first seek the advice of a qualified financial advisor, planner, and/or wealth manager. Please review our Terms carefully as by accessing or otherwise using this site, you are agreeing to be bound contractually by the Terms stipulated here.