2017 RANKING & REVIEWS

TOP RANKING BEST ETFS AND BEST PERFORMING ETFS

What Are the Features of the Top ETFs?

Many financial and investment professionals look to Exchange Traded Funds, also called ETFs, as an incredibly valuable product for investors at all levels to add to their portfolio.

ETFs are a collection of securities that can be bought or sold through a brokerage firm. When searching for the best performing ETFs and the top-rated ETFs, investors will see they can find them from nearly every possible asset class.

Award Emblem: Top 10 Best ETFs to Invest in

Some of the benefits of top ETFs as part of an investment strategy include:

- The best ETFs offer tax efficiency and tax-related benefits

- The top ETFs include flexibility in how they’re traded. They’re bought and sold during the day, as markets are open, and prices are continuous. This means investors know instantaneously how much they pay when they buy shares of an ETF, or how much they will receive if they sell shares of an ETF. This simplifies overall portfolio management.

- As with mutual funds, the top ETFs also offer the benefit of simplified portfolio diversification and built-in risk management.

- The best ETFs tend to have relatively low operational costs, particularly when compared with similar mutual funds.

The following list of the best-performing ETFs and the best ETFs to buy also covers details of what to look for in top ETFs, and there is a brief section below highlighting the differences between the best ETFs and mutual funds since these investment products are similar to one another.

Something should be noted before exploring this ranking of the top ETFs and the best-performing ETF options.

Some of the best ETFs included in this ranking may have YTD returns that are in the negative, but they were included on this list of the top 10 ETFs because they’re expected to do well in 2017, based on current projected economic and governmental trends.

See Also: Top Credit Cards for College Students| Ranking | Best College Student Credit Cards

AdvisoryHQ’s List of the Top 10 Best ETFs

List is sorted alphabetically (click any of the ETF names below to go directly to the detailed review section for the top ETF):

- Fidelity Total Bond (FBND)

- iShares US Healthcare Providers ETF (IHF)

- JPMorgan Diversified Return International Equity (JPIN)

- Principal Edge Active Income (YLD)

- Schwab U.S. Broad Market Index Fund (SCHB)

- SPDR® S&P® Biotech ETF (XBI)

- SPDR® S&P 500® ETF (SPY)

- SPDR® S&P® Metals and Mining ETF (XME)

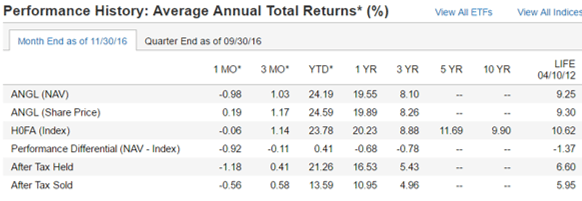

- VanEck Vectors Fallen Angel High Yield Bond (ANGL)

- Vanguard Total Stock Market Fund (VTI)

FYI: Please note that the data and figures in this article are as current as of December 2016. Please visit the respective sites for the most updated information.

Image Source: Pixabay

Top 10 Best ETFs| Brief Comparison

Top ETFs | Ticker | 1-Year Return | Expense Ratio |

| Fidelity Total Bond | FBND | ||

| iShares US Healthcare Providers ETF | IHF | ||

| JPMorgan Diversified Return International Equity | JPIN | ||

| Principal Edge Active Income | YLD | ||

| Schwab U.S. Broad Market Index Fund | SCHB | ||

| SPDR® S&P® Biotech ETF | XBI | ||

| SPDR® S&P 500® ETF | SPY | ||

| SPDR® S&P® Metals and Mining ETF | XME | ||

| VanEck Vectors™ Fallen Angel High Yield Bond ETF | ANGL | ||

| Vanguard Total Stock Market Fund | VTI |

Table: Top 10 Best ETFs | Above list is sorted alphabetically

FYI: Please note that the data and figures in this article are as current as of December 2016. Please visit the respective sites for the most updated information.

Detailed Overview of the Differences Between Top ETFs and Mutual Funds

A key question many investors have when they’re choosing between a top-performing ETF or a mutual fund as they build their portfolio is how the two compare. There are similarities as well as differences between the best-performing ETFs and mutual funds.

- Legal Structure: Whether an investor is choosing a top ETF or a mutual fund, there are two primary types of legal structures, which include open and closed-ended funds. These two options are available with both ETFs and mutual funds.

- Buying and Selling: With ETFs, pricing is continuous throughout the trading day, and they’re then sold in the stock market. With mutual funds, there are transactions directly between the investor and the fund that don’t require a brokerage account, and there isn’t the option to set price limit orders or to buy on margin.

- Pricing: A significant difference between an ETF and a mutual fund is the fact that prices change based on a stock exchange, and prices may vary from the NAV. With a mutual fund, on the other hand, all shareholders receive the NAV each day, which is a single daily price.

- Costs and Fees: With ETFs, there can be a brokerage fee and difference charged on every buy and sell, but in general, fees tend to be lower than with mutual funds, although no-load mutual funds have no fees when they’re purchased straight from the company.

- Taxes: As mentioned above, the best ETFs can represent a good investment opportunity regarding tax efficiency; however, with a mutual fund, redeeming a mutual fund may have tax implications.

The following ranking of the best-performing ETFs and the best ETFs to buy covers not just the top funds that are available; it also provides details about each of their features that make them a sound investment opportunity.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best ETFs

Below, please find the detailed review of each of the best ETFs on our list of the best-performing ETFs. We have highlighted some of the factors that allowed these top 10 ETFs to score so well in our selection ranking.

Don’t Miss: Top Frequent Flyer Credit Card Offers | Ranking | Best Credit Cards for Travel Rewards

Fidelity Total Bond (FBND) Review

The Fidelity Total Bond (FBND) is one of the top ETFs available from Fidelity and in general. The goal of investing in this best ETF portfolio is to have a high level of current income, and according to U.S. News and World Report, this fund typically invests at least 80% of all assets in debt securities based on repurchase agreements.

The Fidelity Total Bond utilizes the Barclays U.S. Universal Bond Index to guide how assets are allocated across three primary asset classes. These asset classes are investment-grade, high-yield, and emerging markets.

Key Factors That Led to Our Ranking of This as One of the Top ETFs

Portfolio details and other characteristics of the Fidelity Total Bond that led to its ranking on this list of the best performing ETF options and the best ETF funds are highlighted below.

Portfolio

As mentioned above, the portfolio breakdown of this selection for one of the best ETFs to buy and one of the top ETFs overall includes investments of at least 80% of repurchase agreements and debt securities of all types, based on the Barclays U.S. Universal Bond Index.

The assets are allocated across emerging markets, high-yield, and investment-grade asset classes.

Then, up to 20% of assets are invested in lower-quality debt securities. The goal of the portfolio management with this best ETF is to have interest rate risk that mirrors the index.

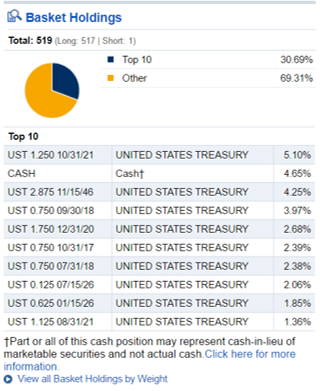

The most significant holdings of this top ETF, as of this writing, include:

- US Treasury Note 1.25%

- US Treasury Note 0.75%

- US Treasury Bond 2.875%

- US Treasury Note 1.75%

- US Treasury Note 0.75%

The asset classification is Fixed Income, and the debt type objective is a blend.

Image Source: Fidelity

Performance, Cost, and Risk

The Fidelity Total Bond is an actively managed top ETF with current net assets of $206.39 million. The expense ratio is 0.45%; the YTD return is more than 6%, while the one-year return is 4.54%.

Since this ETF and its investment strategy includes investment across different sectors and credit qualities, this is considered not only a top-performing ETF but also a best ETF for risk-adjusted returns and diversification.

According to some analysts, this ETF will fare well even in the face of potential rises in the interest rate that are likely to occur in 2017 since it is actively managed.

Since this portfolio is classified as being less affected by interest rate changes, there is less volatility overall.

Despite the cushion against interest rate changes, this is a relatively high-risk ETF because of the potential to earn high yields.

This best ETF can be purchased directly through Fidelity for no commission fee.

iShares US Healthcare Providers ETF (IHF) Review

The primary objective of the iShares US Healthcare Providers ETF is to provide exposure to companies based in the U.S. that provide specialized healthcare and treatment, health insurance services, and diagnostics.

This is a sector-based ETF, and it’s ranked as a best ETF to buy because of the increased focus on healthcare in the U.S., as well as the aging population.

IHF, one of the best-performing ETFs, also provides access to a variety of healthcare services stocks, and it tracks the results of an index made up of equities based in the healthcare providers sector.

Key Factors That Led to Our Ranking of This as One of the Top ETFs

The iShares US Healthcare Providers ETF was included on this list of the best-performing ETFs and the best ETFs to buy for reasons cited below.

Portfolio

The current key holdings of this top-performing ETF include:

- UnitedHealth Group Inc

- Aetna Inc

- Anthem Inc

- Express Scripts Holding Co

- Cigna Corp

- Humana Inc

- Laboratory Corporation of America

- Quest Diagnostics Inc

- Davita Inc

The current exposure breakdown of this pick for one of the best ETFs includes:

- Managed Healthcare: 47.44%

- Health Care Services: 27.10%

- Health Care Facilities: 19.65%

- Health Care Technology: 2.09%

In general, at least 90% of assets of this top ETF are invested in index securities.

Performance, Cost, and Risk

The current assets under management with this top-performing ETF as of December 21, 2016, are $510,070,855, and the Benchmark Index is the Dow Jones U.S. Select Healthcare Providers Index.

The current number of holdings is 47, and the mid-point price as of December 2016 is 125.97.

The year-to-date total returns are currently up 1.52%, and the expense ratio is 0.44%.

This is often ranked as a best ETF for long-term investors searching for passively managed funds. It’s ranked particularly well in terms of tracking error and the bid/ask ratio.

Some of the key areas of risk with this pick for one of the best ETFs to buy include asset class risk and concentration risk.

Investors interested in buying this top-performing ETF can share the information with their financial planner, or they can buy shares through online brokerage firms, including commission-free through Fidelity.

Image Source: iShares

Related: Top First Credit Card for Young Adults, Teenagers, First-Timers & Beginners | Ranking and Comparison

JPMorgan Diversified Return International Equity ETF (JPIN) Review

While many of the names on this ranking of the top ETFs and the best-performing ETFs focus on domestic equities, the JPMorgan Diversified Return International Equity ETF is different because it provides foreign exposure.

This best ETF to buy is based on a concept of delivering international exposure, as well as the potential for higher risk-adjusted returns as compared to what an investor would see with a market cap-weighted index.

This best ETF portfolio tracks the FTSE Developed ex North America Diversified Factor Index.

Key Factors That Led to Our Ranking of This as One of the Top Mutual Funds

The DFA Emerging Markets Portfolio contains the following features and benefits that led to its ranking on this list of the top 10 mutual funds and the best mutual funds to invest in.

Portfolio

The investment approach taken with this best ETF to buy and best index ETF focuses on the creation of a portfolio that’s risk-based and integrated with multi-factor security selection, according to JPMorgan. The security selection factors include low volatility, momentum, size, and value.

The objective is also to look at places where traditional market-cap-weighted indexes are lacking, such as risk concentration or the favoring of securities that are overvalued.

Current sector exposure breakdown of this best-performing ETF includes:

- Consumer discretionary: 11.3%

- Consumer staples: 12.0%

- Energy: 8.6%

- Financials: 9.2%

- Health Care: 10.6%

- Industrials: 11.0%

- Information Technology: 8.7%

- Materials: 9.0%

- Telecommunication Services: 8.4%

- Utilities: 10.4%

Country exposure focuses on areas in Asia and Europe, primarily Japan and the UK.

Performance, Costs, and Risk

Underlying index characteristics that define this best ETF include valuation with this fund targeting equity securities with appealing prices as compared to their fundamentals. This ETF also targets equity securities with risk-adjusted returns that have been high recently, and there is a focus on identifying stocks with low levels of volatility that provide opportunities for higher risk-adjusted returns, as compared to the market.

Market capitalization is also a key component of this best ETF portfolio, with a focus on small companies that outperform the market over the long-term.

Current one-year fund NAV performance is 10.09% and is 3.50% since inception.

The expense cap expiration date is 02/28/2019, the total operating expenses are 1.33%, the fee waivers and available expense reimbursements are 0.90%, and the net expense ratio is 0.43%.

According to the prospectus for this top ETF, the primary investment risk centers around equity market risk. There is also some element of general market risk investors should consider as they look at this best index ETF.

Principal Edge Active Income (IHF) Review

The primary objective of the Principal Edge Active Income (IHF) is to provide investors with a current source of income. This is an actively managed best ETF that achieves investment goals by allocating assets to investment-grade and non-investment grade fixed income securities. These are frequently referred to as junk bonds. Assets are also allocated in equity securities.

According to Principal Funds, the Sub-Advisors of this best ETF portfolio actively manage the fund and work to allocate assets among the fixed income securities and equity securities that are going to allow them to take advantage of fluctuations in economic conditions.

The investment managers of this pick for one of the best-performing ETF options include Edge Asset Management, Inc. and Principal Global Investors, LLC.

Key Factors That Led to Our Ranking of This as One of the Top ETFs

Features of the Principal Edge Active Income Fund that led to its inclusion on this list of the best ETFs to buy and the top-rated ETFs are detailed below.

Portfolio

As of the end of November 2016, the portfolio composition of this pick for one of the best ETF funds included the following composition of asset types:

The top holdings of this best ETF portfolio as of 12/22/2016 include:

- Covanta Holding Corp SR Unsecured

- T Mobile USA Inc Company Guar

- Spring Corp Company Guar

- CSC Holdings LLC SR Unsecured

- First Data Corporation Company Guar

- Bank of America Corp JR Subordinate

The stock sector breakdown includes cyclicals, such as basic materials and financial services; defensive, including consumer defensive; and sensitive, including energy and industrials.

Performance, Cost, and Risk

One of the primary reasons this was included on this list of the best-performing ETFs and the best ETFs to buy was because of its returns.

The YTD returns for this particular best-performing ETF are up 14.36%, while the one-year return is up 11.85%, making it one of the most competitive options on this list of the best ETFs in terms of returns.

The expense ratio is slightly higher than many of the other best-performing ETFs on this ranking at 0.75%, and the net assets for this top ETF are currently $275.74 million with 6,775,000 outstanding shares.

As of 12/22/2016, the number of holdings was 151 and the distribution yield was 5.19.

In general, benefits of this top-performing ETF include an agile, flexible approach designed to improve income. In addition to generating income, this best ETF also seeks to mitigate volatility through diversified risk and provide consistency in portfolio returns over market cycles.

The management of this best-performing ETF is hands-on, and the managers have long-term and proven expertise in the areas of tactical asset allocation as well as the selection of securities.

Other features of this best ETF to buy include a cost-effective structure and liquidity.

Image Source: Principal Funds

Popular Article: Top Airline Credit Cards | Ranking | Best Airlines Miles Credit Cards (Reviews)

Schwab US Broad Market Index Fund (SCHB) Review

The ultimate investment objective of the Schwab US Broad Market Index Fund (SCHB) is to track the total return of the Dow Jones U.S. Broad Stock Market Index, with at least 90% of net assets invested in stocks that are part of the index.

This index includes the biggest 2,500 publicly traded domestic companies. This means pricing information is highly accessible.

According to managers of this top-performing ETF, the fund may sell securities in the index if there is a belief that they might be removed from the index. The fund may also include up to 10% of assets in securities that aren’t part of the index.

The asset classification of the best index ETF is equity, with a geographic objective based in the U.S. It’s passively managed, and this pick for a best ETF to buy is based on broad/multi-cap/core or blend capitalization.

Key Factors That Led to Our Ranking of This as One of the Top ETFs

Among the best-performing ETFs, the following are some key reasons this is a best ETF to buy.

Portfolio

The basket holdings of this best ETF portfolio include the following companies, which as stated above, are some of the largest publicly traded companies in the U.S.:

- Apple Inc

- Microsoft Corp

- Exxon Mobil Corp

- Berkshire Hathaway Inc

- Johnson & Johson

- JPMorgan Chase & Co

- Amazon.com Inc

- General Electric Co

- Facebook Inc

Sector exposure is broken down into the following percentages with this top-performing ETF:

- Information Technology: 19.90%

- Financials: 15.17%

- Health Care: 12.53%

- Consumer Discretionary: 12.29%

- Industrials: 10.64%

Other sector exposure categories include consumer staples, energy, real estate, materials, utilities, and telecommunication services.

Industry exposure includes banks, oil, gas and consumable fuels, software, pharmaceuticals, equity real estate investment trusts, and internet software and services.

Regional exposure with this top ETF is focused primarily in the U.S.

Performance, Cost, and Risk

The Schwab US Broad Market Index Fund is well-rated among top-performing ETF options for many reasons. It’s popular among investors, and most people consider it simple in terms of trading. It also offers balanced, diversified exposure to the U.S. market.

This pick for one of the best ETFs is considered an inexpensive choice. And because of its liquidity, if traders use the Schwab platform, they can trade shares of this best ETF with no commission charges.

Regarding ratings, this top ETF scores best in its holdings diversification, a well as costs and tracking error.

The gross expense ratio is 0.03% with this best-performing ETF.

As of 12/21/2016, the YTD NAV return is up 13.82%, and the 52-week NAV return is up 15.16%.

With any ETF, there is some level of risk, but with this pick for a best ETF to buy and a best index ETF, the risks are minimized because of the diversification of this best ETF portfolio.

Some of the principal risks named in the prospectus include market and investment style risk, equity risk, liquidity risk, and large- and mid-cap risk.

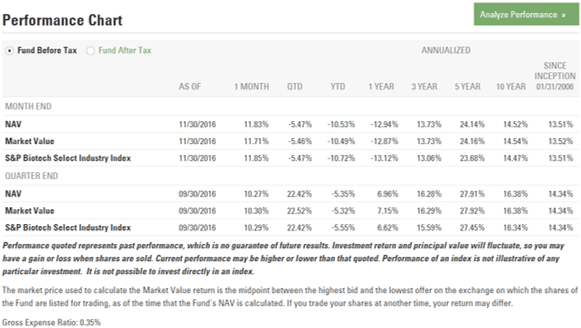

SPDR® S&P® Biotech ETF Review

The objective of the SPDR® S&P® Biotech ETF is to provide returns that correspond to the performance of the S&P® Biotechnology Select IndustryTM, before fees and expenses. This benchmark is based on the sub-industry of biotechnology on the S&P Total Markets Index. The Biotech Index is a modified equal weight index.

Typically, this pick for one of the best-performing ETFs will include up to 80% of total assets invested in securities that make up the index. The fund is not diversified, and it’s well-rated for factors such as its tracking error.

Fund characteristics of this, one of the top ETFs, include an estimated 3-5 year EPS growth of 14.02%, 88 current holdings, and a price/earnings ratio of 16.68. The inception date was 1/31/2006.

Key Factors That Led to Our Ranking of This as One of the Top ETFs

Among the best-performing ETFs, the following are specific features of the SPDR® S&P® Biotech ETF that led to its ranking on this list of the top 10 ETFs.

Portfolio

The full allocation of assets with this best-performing ETF is dedicated to biotechnology.

Fund top holdings include:

- Clovis Oncology Inc.

- Ionis Pharmaceuticals Inc.

- Kite Pharma Inc.

- United Therapeutics Corporation

- ACADIA Pharmaceuticals Inc.

- Tesaro Inc.

- Celgene Corporation

- BioMarin Pharmaceutical Inc.

- Intercept Pharmaceuticals Inc.

- Amgen Inc.

One of the benefits of this best-performing ETF is the fact that it’s an equal-weighted fund, which means that there is regular rebalancing to make sure the holdings remain equal in weight.

This provides the opportunity to earn better returns from smaller companies in the biotech sector.

Performance, Cost, and Risk

In general, biotech stocks have been volatile over recent months and even the past year or so, because the fear of potential regulatory issues and lawmaking with the possibility of stopping what’s been called price gouging.

That’s why even though this top ETF has the potential to perform well, it’s currently down, although most analysts expect that this best ETF portfolio and other investments in the biotech industry will do well next year.

While the YTD returns are down 10.53%, the one-month returns are up 11.83% with this top ETF.

It’s that prediction that ultimately led to the inclusion of the SPDR® S&P® Biotech on this list of the best ETFs to buy. The entire biotechnology industry has been the source of a lot of campaign rhetoric in 2016, but most analysts believe now is the time for investors to buy into this area, and this particular ETF provides an excellent option.

The industry is also being led by innovation right now, which is another reason it is a good time to consider biotech.

The biggest source of risk with this top ETF is the industry focus on biotechnology, which can be heavily influenced by regulatory and government decisions.

Image Source: SPDRS

Read More: Top Credit Cards for Low Credit Scores | Reviews | Best, Fastest Ways to Build Credit

SPDR® S&P 500® ETF (SPY) Review

Among the best-performing ETFs and the top-rated ETFs, the SPDR® S&P 500® ETF is possibly one of the most popular. This top-performing ETF tracks the prominent S&P 500 Index, making it a best index ETF, and it’s managed by State Street Global Advisors. State Street is one of the biggest ETF management firms in the world.

The goal of the SPY ETF is to mirror as nearly as possible the total return of the S&P 500 Index. This market capitalization index is ranked as large-cap, and it has an inception date of 1/22/1993, making it one of the most established on this ranking of the best ETF funds.

The estimated 3-5 year EPS growth is currently around 10.24%, and the number of holdings right now is at 506.

Key Factors That Led to Our Ranking of This as One of the Top ETFs

Among the top-rated ETFs, the following are specific features of the SPY ETF, one of the top 10 ETFs available.

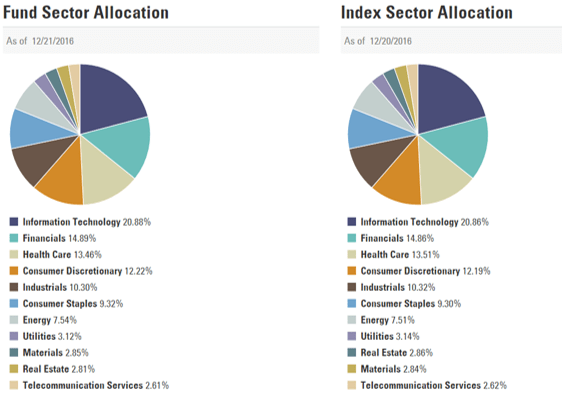

Portfolio

Diversification in holdings and asset allocation is one of the primary benefits of the SPY ETF, ranked as one of the best ETFs available to investors. This best index ETF features, as of 12/21/2016, fund sector allocation that breaks down in the following way:

- Information Technology: 20.88%

- Financials: 14.89%

- Health Care: 13.46%

- Consumer Discretionary: 12.22%

- Industrials: 10.30%

- Consumer Staples: 9.32%

Other sectors included with this best-performing ETF and best ETF portfolio are energy, utilities, materials, real estate, and telecommunication services. This very closely matches current index sector allocation for the S&P 500.

Companies that represent top holdings with this best index ETF include:

- Apple Inc.

- Microsoft Corporation

- Exxon Mobil Corporation

- Berkshire Hathaway Inc. Class B

- Johnson & Johnson

- JPMorgan Chase & Co.

- Amazon.com Inc.

- General Electric Company

- Facebook Inc. Class A

- AT&T Inc.

Image Source: SPDRS

Performance, Costs, and Risk

This large-cap equity best ETF is the oldest ETF, and it has one of the largest amounts of assets under management, as well as one of the biggest trading volumes compared to all other ETFs. It provides excellent exposure to U.S. large caps, and it’s considered very cheap to hold.

The expense ratio of this pick for one of the best ETF funds is just 0.11%, and it’s a favorite among everyone from novice investors to experienced tactical traders. The current assets under management are $222.38 billion, and the average daily volume is currently $18.72 billion.

As of 11/30/2016, the YTD NAV was 9.64%, and the one-year NAV was 7.95%, while the three-year NAV was 8.96%.

The prospectus for this top-performing ETF and this best ETF to buy cite some of the following as potential risks:

- Passive strategy/index risk: The trust isn’t actively managed, so rather than striving to outperform a benchmarking index, the goal is to track the performance of an index of securities.

- Equity investing risk: The risk of investing in this top ETF is similar to investing in any other equity securities and is based on fluctuations in the market and changes in interest rate.

- Index tracking rate: The prospectus for the SPY ETF, one of the top ETFs, cites the fact that the return of the Trust may not match or correlate with the return of the Index due to expenses and costs required to adjust the portfolio.

SPDR® S&P® Metals and Mining ETF (XME) Review

The objective of the SPDR® S&P® Metals and Mining ETF, ranked as one of the best ETFs and a top-performing ETF, is to provide investment results that correspond to the S&P Metals and Mining Select Industry Index.

In general, holdings of this pick for one of the top 10 ETFs includes firms that are in the Metals and Mining sector as dictated by GICS. This can include coal firms.

This is the only fund tracking U.S. metals and mining, and it features equal-weight holdings. There are some downsides to this ETF, such as the fact that it doesn’t necessarily provide a complete industry representation, but it does have liquidity and significant trading volumes. Other places it ranks well include costs and tracking error.

Key Factors That Led to Our Ranking of This as One of the Top ETFs

Below are details regarding holdings and performance of this pick for one of the best ETF funds.

Portfolio

Among the fund sub-industry allocations as of 12/21/2016 with this best ETF are the following:

Other sub-industry allocations include precious metals and minerals, coal and consumable fuels, and copper. This very closely matches the sub-industry allocations of the Index.

Some of the top companies included in this best ETF portfolio include:

- AK Steel Holding Corporation

- Compass Minerals International Inc.

- United States Steel Corporation

- Steel Dynamics Inc.

- Reliance Steel & Aluminum Co.

- Newmont Mining Corporation

- Commercial Metals Company

- Nucor Corporation

- Alcoa Corp.

- Royal Gold Inc.

Performance, Risks, and Cost

As of 11/30/2016, the one-month NAV for this best ETF to buy was 22.39%, the QTD was 17.38%, and the year-to-date was 110.55%, making this the top-performing ETF on this ranking of the best ETFs to buy. The one-year NAV for this top ETF is 97.62%.

The gross expense ratio is currently 0.35%.

According to the prospectus for this best ETF to buy, the following are some potential areas of risk that come with this best-performing ETF:

- Concentration risk: Since this top ETF is concentrated in one sector, there is the potential for risks based on changes or trends in that industry that will have a greater impact on this ETF than on one without an industry focus.

- Equity investing risk: The value of a security can go down unpredictably based on market cycles.

- Index Tracking Risk: The Fund incurs operating expenses which can lead to results that don’t necessarily match the Index returns.

Related: Top Credit Cards for People with No Credit History | Ranking and Reviews

VanEck Vectors™ Fallen Angel High Yield Bond ETF (ANGL®) Review

The VanEck Vectors™ Fallen Angel High Yield Bond ETF is one of the best ETFs to buy, and the objective is to replicate the price and yield performance of the BofA Merrill Lynch US Fallen Angel High Yield Index (HOFA).

This Index is made up of corporate bonds that are below investment-grade and denoted in U.S. dollars. When these corporate bonds were initially issued, they were rated investment grade.

The commencement date of this pick for one of the best ETFs was 4/10/2015, and the administrator is Van Eck Associates, while the custodian is the Bank of New York Mellon. This selection for a best-performing ETF has current assets of more than $477 million, and it features a monthly distribution frequency.

Portfolio

Sector weightings currently with this pick for one of the top-rated ETFs include:

- Energy: 27.3%

- Basic Materials: 23.9%

- Communications: 13.6%

- Financial: 12.6%

- Consumer, Cyclical: 5.1%

Other sector weightings include technology, non-cyclical consumer, industrial, utilities, and diversified. Currency exposure is almost entirely U.S. dollar-based, and the majority of assets are made up of BB-rated corporate bonds and B-rated bonds.

Key company holdings with this best-performing ETF include:

- Freeport-Mcmoran Inc

- Tech Resources LTD

- Spring Capital Corp

- Softbank Group Corp

- EMC Corp

- Southwestern Energy Co

- FirstEnergy Corp

- Cenovus Energy Inc

The average portfolio maturity is 9.64 years.

Image Source: VanEck

Performance, Cost, and Risk

Key features of this best ETF include the fact that it provides the potential for high, competitive yields. Typically, high yield bonds that were originally issued as investment-grade corporate bonds have a better credit quality than other broad high yield bonds.

Fallen angels have tended to outperform the broad high yield bond market in 9 out of the past 12 years, and fallen angels also tend to offer one of the best risk/reward trade-off situations, as compared to the overall high yield bond market.

The current YTD return is 23.26%, and the one-year return is currently 19.57%. This best-performing ETF has an expense ratio of 0.35%, and a trading volume of 156,018.

The primary risk cited in the prospectus of this pick for one of the top-rated ETFs is high yield securities risk. There are risks associated with junk bonds, and they are considered speculative in nature.

Junk bond pricing is sensitive to changes in the economy, as well as changes on the part of the issuer. Junk bonds can also suffer during times when the economy is on the decline, or when interest rates are rising for a period of time.

Also, bonds are subject to credit risks if the issuer cannot make interest payments or repay the debt.

Don’t Miss: Top UNSECURED Credit Cards to Rebuild Credit | Ranking | Unsecured Cards to Build Credit for Bad, Poor, & No Credit Individuals

Free Wealth & Finance Software - Get Yours Now ►

Vanguard Total Stock Market ETF (VTI) Review

The Vanguard Total Stock Market ETF is designed to track the performance of the CRSP US Total Market Index, and it includes large-, mid-, and small-cap equity diversification in terms of both value and growth. This best index ETF features a passive management style, full investment, and low expenses.

The key benefit of the Vanguard Total Stock Market ETF and a big reason it’s included on this list of the best ETFs and the best ETFs to buy is the fact that it is an inexpensive way for investors to gain complete market equity exposure.

It’s neutral in its coverage, minimizing sector and industry-based risk, and it can be beneficial for both traders as well as investors with a long-term approach and outlook.

Key Factors That Led to Our Ranking of This as One of the Top ETFs

Among top-rated ETFs, the following are specific features of the Vanguard Total Stock Market ETF leading to its inclusion on this ranking of the best-performing ETFs.

Portfolio

As of 11/30/2016, The Vanguard Total Stock Market ETF contained 3,619 stocks and a median market cap of $53.2 billion. The turnover rate as of the fiscal year-end in December is 3.5%, and the fund’s total net assets are $488.1 billion.

The portfolio is designed in a way that tracks the performance of an index that measures the returns of the entire stock market.

The highly-diversified sectors making up this pick for one of the best-performing ETFs include:

- Basic Materials: 2.60%

- Consumer Goods: 9.50%

- Consumer Services: 13.20%

- Financials: 20.20%

- Health Care: 12.50%

- Industrials: 13.30%

- Oil & Gas: 6.90%

- Technology: 16.40%

- Telecommunications: 2.30%

- Utilities: 3.10%

As of 11/30/2016, the biggest company holdings that were part of this best ETF included:

- Apple Inc.

- Alphabet Inc.

- Microsoft Corp.

- Exxon Mobil Corp.

- Johnson & Johnson

- Berkshire Hathaway Inc.

- Amazon.com Inc.

- JPMorgan Chase & Co.

- General Electric Co.

- Facebook Inc.

Performance, Cost, and Risk

U.S. News and Report ranks the Vanguard Total Stock Market ETF as number one in the large-blend category, giving it an overall score of 9.3 out of 10. It receives excellent marks from U.S. News in terms of costs, tracking error, bid/ask ratio, and holdings diversity.

Regarding average annual returns, at one-year, the Total Stock Market ETF Nav is 8.28%, and at three years, it’s 8.63%.

Returns before taxes for the Total Stock Market ETF is 15.01% at one year and 10.39% at three years.

As mentioned, a top reason this is considered not only one of the best-performing ETFs but also one of the best ETFs overall is the fact that it’s incredibly low cost with an expense ratio of 0.05%, as compared to the average expense ratio of similar funds, which is 1.01%.

The primary risk cited with this pick for one of the best ETF funds is simple stock market risk, and the potential for one sector of the stocks included in this best ETF portfolio to suffer in terms of performance.

Popular Article: Top Credit Cards With No Foreign Transaction Fees | Ranking | Credit Cards Without Foreign Transaction Fees

Conclusion — Top 10 Best ETFs

An ETF is an investment opportunity that’s similar in many ways to a mutual fund in the fact that it offers easy, inexpensive means of diversification and generally strong returns.

There are some differences between top ETFs and mutual funds, however, particularly when it comes to tax and expense issues.

When looking for the best-performing ETFs and the best ETFs to buy, the following are some considerations to keep in mind:

- Expense ratio

- Level of exposure across sectors and industries

- Past performance

- Potential for increased future returns based on economic and governmental factors

- Reputation

- Level of risk

Each of the names on this ranking of the top 10 ETFs and the best-performing ETFs takes into consideration the above criteria and represents some of the best opportunities for investors across a diverse set of the top ETFs.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.