RANKING & REVIEWS

BEST FINANCIAL ADVISORS IN CINCINNATI

Ranking the Top Financial Advisors in Cincinnati, Ohio

Cincinnati is one of Ohio’s largest metropolitan centers and the government seat of Hamilton County. It’s also home to 12 of the best financial advisors that can help you set realistic financial goals and build a prosperous financial future.

Regardless of whether you’re just starting out and saving to buy your first home or planning for retirement age and want to ensure you can retire comfortably, one of these top Cincinnati wealth management firms can help you design and execute a plan to get there.

Choosing a financial planner that best suits your needs can be challenging. You want to ensure that the financial planner you’re working with is someone you completely trust and who will take the time to understand your specific needs.

On top of that, there are so many firms to choose from that it can be very confusing and time-consuming to research everything on your own, especially if you’ve never worked with a financial advisor before.

AdvisoryHQ has made this process easier for you by selecting and rating the best wealth management firms in Cincinnati, Ohio. When preparing our list of top firms, we do a deep dive and choose only those with good reputations that are at the top of their field in specific areas of wealth management.

In the reviews below, you’ll find out more about each of the top Cincinnati wealth management firms on our list. We’ll also go over the main factors to look for in the best financial advisors in Cincinnati so you can identify the top firms that you may want to consider working with in 2021-2022.

Award Emblem: 12 Best Financial Advisors in Cincinnati, Ohio

12 Best Financial Advisors in Cincinnati, Ohio | Brief Comparison & Ranking

| Best Financial Advisors in Cincinnati, OH | 2021-2022 Ratings |

| Bartlett Wealth Management | 5 |

| Berno Financial Management, Inc. | 5 |

| Foster & Motley Corporation | 5 |

| HCM Wealth Advisors | 5 |

| Johnson Investment Counsel, Inc. | 5 |

| Madison Wealth Management | 5 |

| OJM Group, LLC | 5 |

| Osborn Williams & Donohoe, LLC | 5 |

| The Asset Advisory Group | 5 |

| Total Wealth Planning | 5 |

| Truepoint Wealth Counsel | 5 |

| Ritter Daniher Financial Advisory, LLC | 3 |

Table: 12 Best Financial Advisors in Cincinnati | Above list is sorted by rating

See Also: Ranking of Best Financial Advisors in Iowa

Tips for Selecting the Top Cincinnati Financial Advisors and Wealth Management Firms

When you first start looking into financial advisors, it may seem like all Cincinnati wealth management firms are the same. However, once you know what questions to ask and what details to drill down into, you can begin to separate the ones you want to consider from those that may not be a good match for your needs.

Below you will find some questions to consider that can help you narrow down your options as you’re reading each top Cincinnati financial advisory firm’s profile.

What Type of Clients Do Cincinnati Advisors Work With?

Some financial planning firms in Cincinnati, OH will work with people of all investment levels. Others have set a minimum investable asset or net worth level for clients to meet in order to qualify for their services. Taking a look at this factor can help you quickly identify advisors that would or wouldn’t be a good match.

What is Their Fee Structure?

Fee-only financial advisors in Cincinnati are the “gold standard” if you’re looking for completely unbiased advice. These advisors don’t accept any 3rd party commissions or incentives from sales of financial products, so you can rest assured their only incentive is to protect and grow your wealth.

On the other hand, fee-based Cincinnati wealth management firms may receive part of their compensation in the form of a commission or kickback for recommending certain 3rd party financial products. This can cause an inherent conflict of interest. So if you work with a fee-based firm, you’ll want to make sure they are also a fiduciary, which means they’re legally obligated to be transparent and put their clients’ needs first.

What Services Do Cincinnati Financial Planners Offer and Specialize In?

You’ll want to look for a financial planner that offers the types of services you need.

For example, if you’re a small business owner that needs help with an employee retirement plan, you will need a Cincinnati financial planner that specializes in that service.

Financial Advisors in Cincinnati, Ohio

And if you’d like to ensure your investments are planned with tax efficiency in mind, then you should look for tax integration services from a top Cincinnati investment management firm.

When you’re looking for the best, you’ll want to consider whether or not a firm specializes in the area you need. While most firms may offer similar services, they may not specialize in them all. If you research a company and see which services are most prevalent on their website, their specialties will start to come into focus.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

2021-2022 AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, wealth management firms, services, and products that are ranked on its various top-rated lists?

Please visit “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Best Financial Advisors in Cincinnati

Below, you will find detailed reviews and information for each firm on our list of 2021-2022 best financial advisors in Cincinnati, Ohio. In each section, we have highlighted some of the factors that allowed these wealth management firms in Cincinnati to score so high in our selection ranking.

Click on any of the names below to go directly to the review section for that firm.

- Bartlett Wealth Management

- Berno Financial Management, Inc.

- Foster & Motley Corporation

- HCM Wealth Advisors

- Johnson Investment Counsel, Inc.

- Madison Wealth Management

- OJM Group, LLC

- Osborn Williams & Donohoe, LLC

- The Asset Advisory Group

- Total Wealth Planning

- Truepoint Wealth Counsel

- Ritter Daniher Financial Advisory, LLC

Click below for previous years’ rankings:

- 2019 Review: 11 Best Financial Advisors in Cincinnati, OH

- 2018 Review: Top 11 Best Financial Advisors in Cincinnati, OH

- 2017 Review: Top 10 Best Wealth Management Firms in Cincinnati

- 2016 Review: Top 10 Best Financial Advisors in Cincinnati

Don’t Miss: Top Financial Advisors in Oklahoma City & Tulsa, OK

Bartlett Wealth Management

Bartlett Wealth Management helps its clients turn their life transitions into new beginnings and possibilities through expert wealth management.

Bartlett Wealth Management is a fee-based firm. However, as a Cincinnati Registered Investment Advisor (RIA) the firm also complies with a fiduciary standard and always operates in the best interest of its clients.

Founded in 1898, Bartlett Wealth Management is one of the oldest firms on our 2021-2022 Cincinnati ranking list. As a well-established financial advisor, they have managed the investments of generations of clients—through world wars, economic recessions, a stock market crash, and even the Great Depression.

Key Factors That Enabled Bartlett Wealth Management to Rank as One of the Top Wealth Management Firms in Cincinnati

The Financial Planning Process

As part of the financial planning process, Bartlett Wealth Management works to gain a comprehensive understanding of each client’s situation and unique needs.

While financial planning is generally paired with investment management services, it is also provided as an independent service. Bartlett Wealth Management works to discover each client’s objectives, risk tolerance, retirement timetable, and financial priorities.

Financial planning services with this Cincinnati wealth management firm may include:

- Planning for retirement

- Navigating the financial impact of divorce

- Managing an inheritance

- Executing stock option exercise

- Planning for the birth of a child or grandchild

- Managing a large stock position

- Coping financially with an elderly parent

- Coping financially with the death of a spouse or life partner

- Planning and funding charitable contributions

- Taking advantage of an early retirement package

Best Financial Advisors in Cincinnati

Investment Management Services

With the goal of protecting and preserving your hard-earned wealth, Bartlett Wealth Management’s team will act as your fiduciary guide.

While staying focused on your financial goals, this team of top Cincinnati financial advisors will design a customized, diversified, and balanced portfolio that will minimize risk and deliver consistent high-yielding returns.

The following are some of the main components of Bartlett Wealth Management’s services in Cincinnati:

- Equity Management: The firm focuses on proven financial performance in order to pinpoint higher-quality companies with above-average earnings – a great choice for investors who are seeking lower volatility.

- Bartlett Fund Advantage: Bartlett’s 5-person strategies team screens and identifies a roster of superior funds with below-average expenses.

- Fixed Income: When applicable, the firm’s dedicated investment team will work solely on the fixed income components of their clients’ portfolios.

- Environmental, Social, Governance Investing: By identifying superior funds, Bartlett provides their clients with socially responsible portfolios without sacrificing investment performance.

- Alternative Investments: In order to reduce portfolio volatility, the team at Bartlett also offers opportunities outside of the traditional asset classes of stocks, bonds, and cash.

Rating Summary

Bartlett Wealth Management adopts a strong commitment to its clients by always putting their interests above all else. Even though the company is fee-based, it is completely transparent, and clients can trust they are receiving the best services.

With a team-based approach, in-house research analysts, and a full suite of financial services, Bartlett Wealth Management easily solidifies its 5-star rating. We can confidently recommend Bartlett as one of the best Cincinnati financial advisors to consider partnering with in 2021-2022.

Related: Best Wealth Management Firms in Kansas City, Leawood & Overland Park

Berno Financial Management, Inc. Review

With a goal to help its clients make the most of their money and achieve financial peace of mind, Berno Financial Management is an independent, fiduciary, fee-only financial advisor in Cincinnati that was founded in 1993. The BFM team offers unbiased advice that focuses on their clients’ overall financial situation, not just their investments.

These Cincinnati financial planners serve a wide range of clients including young professionals, those nearing retirement, self-employed professionals, and Proctor & Gamble employees (both past and present).

Key Factors That Enabled Berno Financial Management, Inc. to Rank as One of the Top Cincinnati Wealth Management Firms

Ongoing Personal Wealth Management Services

Customized for each client’s individual needs, Berno Financial offers financial advisory services for every stage of life, from entry-level professionals to retirees. Their clients typically have an investable portfolio of $1,000,000 or more, but they do serve those under $500,000 as well.

Berno Financial Management’s Process

The wide range of services offered by this Cincinnati financial advisor is fine-tuned to consider all your personal financial needs, including:

- Retirement

- Investments

- Cash Flow

- Income Taxes

- Education Funding

- Insurance

- Estate Planning

Investment Management Services

These top-rated Cincinnati investment managers use the research of Nobel Prize-winning economist Eugene Fama as a foundation for their investment strategy. They plan for the long-term rather than trying to time the markets.

Berno Financial adopts a “total portfolio approach” to help clients achieve their goals. This includes asset allocation and asset location strategies to ensure all accounts are working together towards the client’s unique goals.

These Cincinnati financial advisors believe that the best investment strategy to achieve returns has to be:

- Passive

- Broadly-Diversified

- Low-Cost

- Tax-Efficient

Rating Summary

Berno Financial offers clients a personal touch that’s not always possible from larger Cincinnati financial advisors. They maintain a strong commitment to helping clients achieve their financial goals while providing targeted and unbiased guidance.

With a wide range of comprehensive services as well as a nationally recognized and credentialed team, Berno Financial neatly scores a 5-star rating as one of the best Cincinnati financial advisors to consider partnering with this year.

Foster & Motley Corporation Review

Founded in 1997, Foster & Motley Corporation is a Cincinnati wealth management firm that offers clients three tiers of services ranging from investments below $1,000,000 to over $5,000,000.

Approaching each client with conviction and compassion, this fee-only Cincinnati financial advisory and investment management firm provides expert financial services while constantly seeking new ways to help their clients live life with confidence.

Key Factors That Enabled Foster & Motley Corporation to Rank as One of the Top Cincinnati Financial Planners

Extensive Financial Services

A good financial plan integrates all components of your fiscal life. This is something that the team at Foster & Motley understands and uses as a basis for all of their financial services.

Backed by an investment philosophy that emphasizes income, value, and quality, Foster & Motley offers clients a broad array of financial planning and wealth management services, including:

- Retirement Planning

- Tax Planning

- Estate Planning

- Portfolio Creation & Management

- Insurance Planning

- Cash Flow Planning

- Wealth Optimization

- Net Worth Analysis

- College Planning

- Money Movement

- Charitable Gifting

- Stock Option Planning

2021-2022 Best Financial Planning Firms in Cincinnati

To ensure each client stays on track financially, the dedicated team at Foster & Motley will schedule an initial meeting where your advisor will get to know you, your current financial situation, and your goals for the future. Best of all, initial consultations with these Cincinnati financial planners are always free.

Continuing Education

Any personal wealth management firm in Cincinnati needs to foster a culture of continuing education and keeping abreast with any industry changes.

As one of the top Cincinnati financial planners, Foster & Motley does just that. Not only do they regularly review their processes to ensure they’re evolving as needed, but they also encourage their employees to keep themselves current.

Foster & Motley invests in the continuing education of their employees and requires each one to complete and maintain professional certification.

Rating Summary

Foster & Motley’s fee-only, independent structure fosters a foundation of trust and transparency that gets every client-advisor relationship off to a great start.

With integrated financial services, tiered financial planning fees, and a client-centric approach, Foster & Motley also earns a 5-star rating as one of the best Cincinnati financial advisors to consider partnering with in 2021-2022.

Popular Article: Top Financial Advisors in Wisconsin

HCM Wealth Advisors Review

HCM Wealth Advisors is a Cincinnati-based financial advisory firm focused on providing comprehensive wealth management, tax, and accounting services in order to help its clients to retire comfortably.

This fee-only Cincinnati financial planning firm has been serving clients locally and across the country since 1990.

Key Factors That Enabled HCM Wealth Advisors to Rank as One of the Top Cincinnati Wealth Management Firm

HCM Wealth Advisors Retirement Roadmap™

A successful retirement requires the realization of multiple personal and financial goals. The HCM Retirement Roadmap™ is designed to integrate the complexities of retirement planning into a comprehensive and executable strategy.

This team of top financial advisors in Cincinnati focuses on what’s important to you in order to help you execute the best options for your financial plan.

Cincinnati Financial Advisory and Retirement Planning

HCM’s proprietary retirement roadmap identifies five primary retirement goal sets:

- Safety Net Reserve

- Base Expense Goals

- Lifestyle Expense Goals

- Personal & Family Goals

- Legacy Goals

The process created by these seasoned wealth managers in Cincinnati operates with an objective to fund your base goals, protect your unique lifestyle dreams, and design a diversified and low-cost portfolio to help reach long-term objectives.

Wealth Enhancement Services

The team at HCM takes a comprehensive approach to investment management which includes detailed portfolio planning and implementation to best support each family’s individual wealth plan.

HCM’s investment process includes the following steps:

- First, the team will determine your risk tolerance in order to configure the best allocation for growth, income, and defensive assets.

- Next, a team of investment professionals will work with your advisors to choose the best vehicles to meet your needs.

- Implementation is then executed with a globally diversified portfolio that is tax-efficient and utilizes low-expense securities.

- For high-net-worth clients, the signature HCM Dividend Growth Portfolio™ is also incorporated into the asset mix.

Rating Summary

The team at HCM Wealth Advisors has a long history of working with some of the region’s largest employers. Through their proprietary process, they work to ensure that your retirement planning includes both short-term needs and long-term goals.

With multiple integrated services such as tax planning and family office investing, a specialty focus on retirement planning, and a whole-team approach, HCM Wealth Advisors earns a 5-star rating as a top financial advisor in Cincinnati for 2021-2022.

Johnson Investment Counsel, Inc. Review

Johnson Investment Counsel, Inc. has been providing financial advisory counseling in Cincinnati for over 55 years. On top of that, it is also one of the largest independent investment advisory firms in the United States. The firm has six offices, with two in Cincinnati, and one each in Cleveland/Akron, Dayton, Columbus, and Chicago.

As an employee-owned, fee-only Cincinnati financial planning firm, Johnson Investment supports each client with a dedicated team of investment professionals, attorneys, and trust officers.

Key Factors That Enabled Johnson Investment Counsel, Inc. to Rank as One of the Top Cincinnati Wealth Management Firms

Broad Range of Financial Divisions

In order to best serve the diverse and detailed needs of their clients, Johnson Investment Counsel maintains a broad range of financial divisions. These include:

- Wealth Management: Integrated financial services that use in-house resources for unique planning techniques, investment allocation, and security selection.

- Family Office Services: For ultra-high-net-worth families, Johnson uses a highly personalized approach to help navigate even the most complex financial situations.

- Trust Company: Helps families align their estate plan with their values with trust services for individuals, charitable organizations, endowments, foundations, and retirement plans to ensure the right decisions are made to preserve its clients’ wealth over time.

- Asset Management: Serves organizations with a disciplined and thoughtful approach to deliver superior results.

- Mutual Funds: Acts as an advisor for the Johnson Mutual Funds which offers five publicly available mutual funds.

Best Wealth Management Firms in Cincinnati

Integrated Wealth Management Services

Johnson Investment Counsel offers its clients a full-scope of wealth management services such as:

- Goal-based Planning

- Investment Management

- Retirement Planning

- Cash Flow Planning

- Estate Planning

- Asset Protection Planning

- Income Tax Planning

- Charitable Planning

In addition to the above-mentioned services, this Cincinnati wealth management firm also offers a full suite of family office services for ultra-high-net-worth families. To meet these needs, Johnson Investment Counsel financial advisors are highly credentialed and have experience serving multiple generations of families.

Rating Summary

Johnson Investment Counsel works with many different types of clients, making financial services both accessible and customizable.

With a client-focused philosophy, a large and accomplished team, and a wide range of wealth management services, Johnson Investment Counsel also scores a 5-star rating as one of the best Cincinnati wealth management firms to consider partnering with in 2021-2022.

Read More: Best Financial Advisorsin Ohio

Madison Wealth Management Review

Madison Wealth Management is an employee-owned Cincinnati wealth management firm founded in 2000. It serves as a trusted financial planner and investment management firm to individuals, multi-generational families, business owners, and charitable foundations.

MWM is a fee-only independent financial planning and investment management firm with offices in Cincinnati, Ohio, and Washington, DC.

Key Factors That Enabled Madison Wealth Management to Rank as a Top Cincinnati Wealth Management Firm

Guiding Principles

The team at Madison Wealth employs a credentialed team of experienced fiduciary investment advisors who adhere to a set of disciplined guiding principles. These principles are the driving force behind their operations:

- Client-aligned Interests

- Transparency

- Low client-to-advisor Ratio

- Independence

- Best-in-class Partners

- Philosophy of Asset Allocation & Diversification

- Fiduciary Standard

- Confidentiality

- Objectivity

- Education

Your Path to Success – Your Trust, Invested Wisely℠

The advisory team at Madison Wealth Management understands that communication, mutual respect, and trust make up the foundation of a successful professional relationship.

Whether you’re planning for retirement, selling a business, or handling an inheritance, this team is dedicated to helping you reach your financial goals through:

- Holistic Financial Planning

- Thorough Investment Implementation

- Coordination with Trusted Advisors

- Ongoing Monitoring, Reporting & Communication

- Competitive Results

- Responsive Service

- Peace of Mind

Madison Wealth Management specialty services include:

- Investment Management

- Retirement Planning

- Estate Planning

- Tax Considerations

- Risk Management

- Education Planning

Madison Wealth Management’s Specialties

Rating Summary

Madison Wealth is fully committed to serving its clients and takes its fiduciary duty very seriously. The team’s collaborative approach addresses and anticipates each client’s needs, making a great base for a long-term relationship built upon understanding, trust, and mutual respect.

With a highly experienced and dedicated team, in-depth financial planning services, and a strong client commitment, Madison Wealth Management easily solidifies its 5-star rating as one of the best wealth management firms in Cincinnati to consider partnering with this year.

The Asset Advisory Group Review

The Asset Advisory Group is based in Cincinnati, OH and was founded in 1988. Whether you’re looking to establish, build, or preserve your wealth, this team of Cincinnati financial advisors aims to help its clients through expert wealth management and financial coaching.

This Cincinnati financial advisor has a fee-only structure and works with clients who are building wealth with household incomes over $200,000. Wealth management clients are typically near retirement with investment portfolios of $1 million to $10 million.

Key Factors That Enabled The Asset Advisory Group to Rank as Top Cincinnati Wealth Management Firm

Wide Range of Financial Services

For many clients, finding the best financial advisor means connecting with a team that can handle more than just investing and can help them address several areas of their financial life.

The Asset Advisory Group takes a holistic approach and offers a wide range of financial services and capabilities, including:

- Financial Coaching

- Investment Planning

- Cash Flow

- Tax Planning

- Risk Management

- Retirement Planning

- College Planning

- Estate Planning

This firm also offers two complimentary meetings to assess client needs and ensure that clients have a clear picture of what to expect from their partnership.

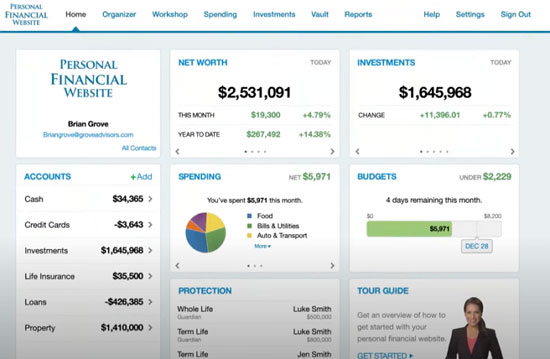

TAAG 360° Dashboard

As a top-rated Cincinnati financial planner, The Asset Advisory Group gives its clients 24/7 access to their financial health through the TAAG 360° dashboard. This best-in-class technology allows clients to access their personal dashboard on mobile or desktop in order to:

- View current balances of TAAG accounts, bank accounts, loans, and credit cards

- Send, store, and access their financial documents

- View spending trends across all accounts

- Create monthly budgets

- Monitor the daily impact of changes

- Track their net worth over time

TAAG 360 Dashboard – Best Cincinnati Financial Advisors

Rating Summary

The Asset Advisory Group enhances the well-being of its clients through expert consulting, financial planning, and investment management. New clients will appreciate and benefit from TAAG’s introductory no-obligation meetings to discuss financial needs and evaluate whether the relationship is a good fit.

Offering a wide array of services, a cutting-edge account dashboard, and a team of experienced professionals, The Asset Advisory Group also earns a 5-star rating as one of the best Cincinnati financial advisors to consider partnering with in 2021-2022.

Related: Top Wealth Management Firms in Charlotte & Asheville, NC

Total Wealth Planning Review

For over 30 years, Total Wealth Planning has been committed to providing an outstanding client experience to multiple generations of families in the greater Cincinnati area. As of 2020, Total Wealth Planning’s team of 11 financial advisors serves more than 440 client families.

The firm is an independent, fee-only Cincinnati financial advisor that fosters long-term collaborative relationships and provides clear, objective financial planning advice for their clients.

Key Factors That Enabled Total Wealth Planning to Rank as Top Cincinnati Wealth Management Firm

The Investment Process – Win by Not Losing

Total Wealth’s approach to client portfolios is to “win by not losing”. These Cincinnati wealth planners use investment philosophies that are based upon the Nobel Prize-winning research of Harry Markowitz and William Sharpe.

The firm provides investment opportunities in 15-20 different asset classes, all with relative correlation to one another. In addition to managing risk, Total Wealth’s strategy includes creating wealth through opportunistic profit-taking, tax-loss harvesting, and rebalancing.

Top Wealth Managers in Cincinnati

Client-Centric Values

As one of the top-rated financial advisors in Cincinnati, Total Wealth Planning adheres to a strong set of company values that places clients’ needs first.

These values include:

- Outstanding Client Experience: The firm emphasizes respect and confidentiality while establishing long-term client relationships that span through generations.

- Independence: All advice is clear, objective, and completely unbiased, with no hidden agendas whatsoever.

- Clients First: Each Cincinnati financial advisor adheres to the fiduciary standard of client care and transparency.

- Sincerity and Truthfulness: Establishing long-term relationships means prioritizing passion, empathy, and integrity.

Rating Summary

Total Wealth Planning provides a foundation of client-centered service, trust, and transparency for corporate executives, wealth-building families, retirees, and business owners alike.

This Cincinnati financial planner works to uphold the highest standards of transparency with its clients, instilling trust and supporting long-term relationships that span multiple generations.

With a passion for helping their clients succeed, as well as a time-tested and disciplined approach, Total Wealth Planning easily earns a 5-star rating as one of the best financial advisors in Cincinnati to consider partnering with this year.

Truepoint Wealth Counsel Review

Founded in 1990, Truepoint Wealth Counsel is an employee-owned financial advisory firm in Cincinnati that takes a personal and intellectually honest approach to wealth management. The firm’s main goal is to simplify its clients’ lives by creating the best personal financial advisory experience possible.

As a top independent wealth management firm in Cincinnati, Truepoint was one of the region’s first fee-only firms. Their advisors are highly collaborative, bringing together several different specialties in order to best serve the needs of clients across 39 states.

Key Factors That Enabled Truepoint Wealth Counsel to Rank as a Top Cincinnati Wealth Management Firm

Intellectually Honest Investment Strategies

When it comes to investing, it’s important to have a financial advisor that you can trust to be on your side with the best advice possible.

Truepoint uses decades of market intelligence and extensive academic research to inform the portfolio choices they make for their clients. These trusted Cincinnati financial advisors work under an intellectually honest, evidence-based philosophy.

Truepoint Wealth Counsel’s investment services include:

- Investing according to an evidence-based philosophy

- Designing a tax-efficient, low-cost portfolio

- Monitoring portfolio with real-time rebalancing

- Leveraging tax-loss harvesting strategies in taxable accounts

The one-size-fits-all approach doesn’t exist when it comes to personal finance. Instead, clients working with Truepoint will benefit from the team’s holistic approach that brings experts in multiple disciplines together to execute your plan.

Cincinnati’s Best Financial Planning Firms

Women’s Wealth Counsel

A unique specialty of this Cincinnati financial advisory firm is meeting the financial needs of women. In an industry typically dominated by men, Truepoint’s Women’s Wealth Counsel stands out because it is specifically designed to address the distinct needs of managing wealth for women.

Women control 51% of the personal wealth in the United States, make 80% of household buying decisions, and often outlive men by 5-6 years.

Truepoint aims to assist women in the following areas:

- Reviewing spending plans

- Change of career or job

- Retirement preparation

- Caring for aging parents

- Shifting to an empty nest

- Managing post-divorce finances

- Coping with a spouse’s illness or death

- Assisting with educational funding for children or grandchildren

Rating Summary

Truepoint fosters long-term client relationships by being authentic and honest. In addition to being a close-knit team, this wealth management firm also emphasizes that same type of relationship with its clients, keeping their client-to-employee ratio at 19:1.

The firm’s grounded approach to investment management as well as their team-based philosophy both help solidify Truepoint Wealth Counsel’s 5-star rating, making it one of the best Cincinnati financial advisors to partner with this year.

Don’t Miss: Best Financial Advisors in San Diego, CA

OJM Group, LLC Review

OJM Group, LLC is a multidisciplinary financial management firm headquartered in Cincinnati with additional offices in Arizona and Florida. Its team members have worked with over 1,000 clients in 48 states and have written more than a dozen wealth management books.

OJM Group’ ADV states that OJM or Supervised Persons may receive commissions, which points to it being a fee-based firm. However, the company takes its fiduciary duty seriously and its advisors recognize that trust is of utmost importance.

As always, we recommend verifying fee structure before partnering with any financial advisor in Cincinnati.

Key Factors That Enabled OJM Group, LLC to Rank as a Top Cincinnati Wealth Management Firm

Broad Range of Services for Multiple Clients

OJM works with physicians, individual investors, business owners, and entrepreneurs to help them preserve and grow their wealth with a wide array of financial planning services.

Some of the services that clients of this top-rated Cincinnati wealth management firm can expect are:

- Investment Management: By offering tailored advice with a transparent fee structure, OJM takes an institutional approach to the safeguarding of assets.

- Consulting: Through a truly unique division that assists with both personal and corporate financial planning, this Cincinnati financial advisor becomes your “financial quarterback.”

- Insurance: OJM Group reviews existing policies in order to optimize insurance coverage and integrate them with other aspects of a client’s wealth goals.

- Benefits Planning: These top-rated financial planners in Cincinnati can also help with qualified retirement plans and executive benefits plans in order to build opportunities for both owners and employees.

OJM Group – Best Financial Advisors in Cincinnati, Ohio

Educational Resources

OJM Group puts education at the center of everything they do – for both their clients and their employees.

This Cincinnati wealth management firm’s website offers a variety of financial education resources to help foster knowledge so clients can make better financial decisions.

These educational resources include:

- An Online Bookstore

- Articles

- Videos

- Lectures

- Podcasts (one of the podcasts is dedicated to improving physician’s finances)

- Seminars

Rating Summary

OJM Group’s well-rounded, integrated approach to financial planning and wealth management benefits its clients by providing them with a customized financial strategy as well as continuous education.

Although we typically prefer fee-only firms, this Cincinnati fee-based advisors stands out by providing tailored and well-coordinated niche wealth management services. Therefore, they have earned a 5-star rating and a spot on our 2021-2022 ranking list.

Osborn Williams & Donohoe, LLC Review

Osborn Williams & Donohoe, LLC is a popular Cincinnati investment advisory firm founded on the belief that a boutique advisory firm with a clear focus and investment discipline can serve clients better than the large investment firms.

This fee-only Cincinnati financial advisor was founded in 2012 to serve high-net-worth individuals, medical professionals, and corporate clients that typically have a minimum of $500,000 of investable assets.

Key Factors That Enabled Osborn Williams & Donohoe, LLC to Rank as a Top Cincinnati Wealth Management Firm

“Price-to-Intrinsic Value” Methodology

Osborn Williams & Donohoe conducts in-depth evaluations to identify undervalued securities. By carefully formulating a strategic asset allocation and applying its “Price-to-Intrinsic” methodology, the firm works towards avoiding overpriced securities with unfavorable risk/reward characteristics.

The equity strategies include:

- Dividend Growth

- Income Equity

- Opportunity Growth

- Balanced Portfolio Strategy

- Fixed-Income Strategy

Cincinnati Investment Advisory Firm

Commitment to Superb Client Service

This Cincinnati-based financial advisory firm prides itself on its dedication and ability to collaborate with its clients. By taking into consideration their clients’ entire financial picture, this team effectively determines the best approach and offers guidance on total wealth – not just the assets managed by OW&D.

At Osborn Williams & Donohoe, each and every client receives the following:

- Dedicated attention of its investment professionals and supporting staff

- Flow of information and insight into financial issues

- Direct contact regarding personal financial questions and/or issues

- Unbiased advice and guidance on their total wealth (including investments managed outside the firm)

- Quarterly reports and straightforward market insights

- Portfolio reviews

Rating Summary

Osborn Williams & Donohoe’s dedication to superb client service and transparency along with a disciplined approach to investing makes this Cincinnati advisory firm stand out among its peers.

Continuous professionalism and high ethical standards paired with a personalized approach to investment management have earned the team a well-deserved 5-star rating on our 2021-2022 ranking of the Best Financial Advisors in Cincinnati, Ohio.

Ritter Daniher Financial Advisory, LLC Review

Ritter Daniher Financial Advisory, LLC was founded in 1999 with a mission to educate, motivate, and support its clients by meaningfully participating in their lives and helping them reach their financial goals. This Cincinnati-based wealth management firm works with clients who have a minimum liquid net worth of $500,000 as well as with NextGen Accumulators.

RDFA is a trusted fee-only financial planning and investment management firm in Cincinnati that currently serves more than 325 clients while managing nearly $400,000,000.

Key Factors That Enabled Ritter Daniher Financial Advisory, LLC to Rank One of the Top Wealth Management Firms in Cincinnati

Personal Wealth Management

Ritter Daniher helps clients with streamlined wealth management services, which is a proven and effective way to help clients seamlessly reach their goals.

With an organized, fiduciary-based approach, ongoing reviews, and an adaptable philosophy, RDFA offers a wide range of wealth management services such as:

- Goal Clarification/Establishment

- Discretionary Asset Management

- Financial Planning

- Cash Flow Planning

- Income Tax Planning

- Estate Planning

- Insurance Planning

- Employee Benefits

- Fiduciary Education

Best Wealth Management Firms in Cincinnati, OH

Experienced Advisory Team

Ritter Daniher has an experienced team composed of top leaders in the field. Some of the team’s past leadership positions include: President of the Financial Planning Association of Greater Cincinnati and Chair of the NAPFA Ethics Committee.

These top Cincinnati financial planners utilize a diverse range of experience and industry accreditations to solve a variety of financial challenges, including:

- CFP®—Certified Financial Planner

- CFS—Certified Fund Specialist

- CTFA—Certified Trust and Fund Advisor

- CLU—Chartered Life Underwriter

- AEP®—Accredited Estate Planner

Rating Summary

As a fee-only and fiduciary financial advisor, Ritter Daniher is committed to putting its clients’ needs above all else, resulting in a strong foundation of trust.

While RDFA employs an experienced advisory team and offers a diverse range of financial planning services, the firm doesn’t provide much information about its investment management approach.

The lack of information on the firm’s website makes it more difficult for clients to fully evaluate it – especially now when most people prefer to research companies and gather information online rather than in person. For those reasons, we’ve given Ritter Daniher Financial Advisory a modest 3-star rating.

Popular Article: Reviews of Top Financial Advisors in Florida

Free Wealth & Finance Software - Get Yours Now ►

Conclusion –Top 12 Best Financial Advisory Firms in Cincinnati, Ohio for 2021-2022

Making smart financial choices can be a challenging process. Important life decisions such as planning for retirement, integrating tax and investment strategies, and saving for funding a child’s education can all be made much easier and less stressful with the help of a top Cincinnati financial advisor.

Each of the 12 firms on our 2021-2022 Ranking of Best Financial Advisory Firms offers a wide variety of specialties, ranging from financial services specially tailored for women to retirement plans custom-made for businesses.

The next step to finding the best financial planning firm in Cincinnati for you would be to select three to five top firms that you could potentially partner with.

All of the firms on our list offer one or more complimentary meetings that can help you learn more about their services and determine if they would be a good fit for your own unique financial situation and future goals.

We hope this list has helped you find a top Cincinnati financial planning firm that works for you!

Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the rate table(s) displayed on this page.

Image sources:

- https://www.pexels.com/photo/glowing-city-embankment-with-amusement-park-in-nighttime-3474830/

- https://bartlett1898.com/

- https://www.bernofinmgt.com/

- https://www.fosterandmotley.com/about-foster-and-motley

- https://hcmwealthadvisors.com/

- https://www.johnsoninv.com/overview

- https://www.madisonadvisors.com/about-us/

- https://www.taaginc.com/how-we-work/

- https://www.twpteam.com/page/30-years

- https://truepointwealth.com/

- https://truepointwealth.com/our-history/

- https://www.ojmgroup.com/about/team/

- https://www.orw-d.com/index.html

- https://www.ritterdaniher.com/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.