Intro to Investment Strategy (Best Way to Invest $5,000 Dollars)

You’ve saved up about $5,000 that can be set aside for the time being. You can save that money in a high-yield interest paying account or you can invest that 5,000 dollars.

If you are looking to invest and are seeking information on the best way to invest 5,000 for your future, then this article has been published for you.

Less Than 66% of Americans Have Less Than $1,000 to Save or Invest

A recent survey by MarketWatch found that roughly two thirds of Americans have less than $1,000 in savings. Twenty-one percent don’t even have a savings account. So, saving up enough that you can even ask how to invest 5,000 is a huge step.

Letting your money sit in savings means that you will take a hit once you factor in inflation. That money you tucked away simply will not be worth as much when you take it out much later down the road, especially if you want to invest toward your retirement goal. Instead, considering how to invest $5,000 in a productive way is the best course of action.

Figuring out how to do this requires you to think about your investment goals and, by extension, your investment strategy. Ask yourself whether you have short-term investment goals or long-term investment goals.

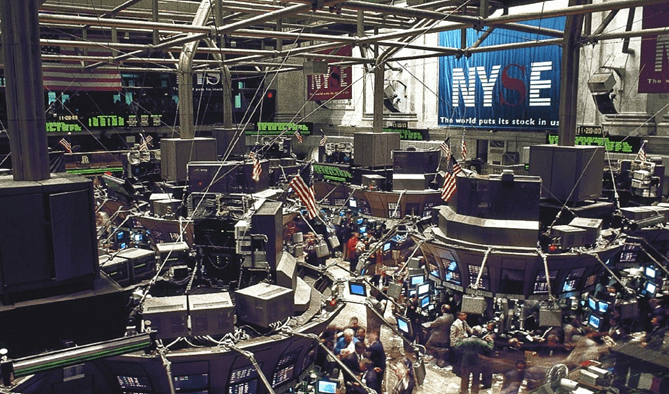

Image source: Big Stock

See Also: ForexMentor.com Review – Learn to Trade Forex! (Training Course Review)

Best Way to Invest $5,000: What Is a Short-Term Investing Goal?

If you’re mulling over the best way to invest 5000 dollars, consider what you are saving that money for. If the money is meant to go towards an immediate goal (within the next ten years), then that will impact your choice of how to invest your money.

If it is a short-term goal you are savings towards, the best way to invest 5,000 is conservatively. If you’re saving for a grad school program in a couple of years, you cannot afford a huge hit to your savings due to market fluctuations. As a result, you should have a thoughtful split between fixed-income assets (i.e., bonds) and stocks.

While you want more of your money to be in bonds to protect it, you do not want to invest 5,000 entirely in bonds since you will not make as much money. Additionally, mutual funds and exchange-traded funds are also attractive options since they protect your wealth with low risk.

Best Way to Invest $5,000: What Is a Long-Term Goal?

Long-term goals are traditionally geared towards retirement. In this case, you hopefully would not be tapping into that money until much later in life. Conversely, you may not have a long-term goal or a short-term goal and, as a result, just need a long-term investing strategy when it comes to deciding how to invest 5,000 dollars.

You may simply be planning to put money aside for security or capital growth. In this case, time is on your side. Moreover, you have additional flexibility when it comes to diversifying your assets and learning about different investment vehicles. Those planning for the long game should make sure to get started as early as possible, even if they only contribute a small percentage of their paycheck.

Don’t Miss: Investment Advisor Search – Top Investment Companies

How to Invest $5,000 for a Short-Term Goal

You’ve figured out that your needs are short term, so now you’re wondering how to invest your money. Deciding where to invest depends on what kind of an investor you are.

How to Invest $5,000: The Hands-off Investor

There are many educated individuals in well-paid jobs that are eager to make their money work as hard as they do. That said, they are not in the upper crust of society that can afford to pay for swanky financial advisors. What are such individuals to do when it comes to obtaining advice? They will be hard-pressed to find a financial advisor willing to take them on only to invest 5,000.

The financial technology industry is addressing this gap that has been underserviced by traditional financial institutions. Websites like Mint were exceptionally proactive about tapping into this demographic and providing a service that facilitated smart conversations about money management. Rob advisors also provide easy-to-use tools for individuals with investing goals.

However, just because you are not particularly interested in the world of investing doesn’t mean you are not interested in where your money is going. You may be hesitant to believe that the best way to invest 5,000 dollars is in robo advising apps. This largely depends on your situation.

Financial advisors are quick to point out that there are nuances to financial planning that apps simply cannot address. This is a fair criticism, but access to the human advisors who can meet such needs is quite restricted. Since financial advisors make their money from a percentage of the managed funds, they typically work with people who have a large amount of capital to invest. They are, therefore, largely uninterested in the question of how to invest $5,000.

That being said, the benefits of investing your money, even with occasional missed opportunities, are better than not investing at all. The rule of thumb is this: If you have enough wealth to afford a financial advisor, it’s probably best to hire one (or opt for the human/technology combo offered by Vanguard). If you do not, a robo advisor is most likely your best bet to invest 5,000 dollars.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Where to Invest 5,000 Dollars: Robo advisors

If you do decide that, given your circumstances, the best way to invest $5,000 is with robo advisors, then there are a number of fintech companies to choose from. Some of the most well-known names include companies like Betterment and Wealthfront.

Perhaps the most famous robo advisor is Betterment. Betterment allows users to easily get started with no minimum account balance and easy questions that quickly determine your retirement status, financial goals, and annual income. This allows Betterment to determine what your asset allocation should be. If you invest 5,000 dollars through Betterment, you gain access to easy-to-understand tools for new investors, and as your investments grow, you can benefit from Betterment’s tax-loss harvesting service.

Wealthfront is another option for how to invest $5,000. It does carry a minimum balance of $500, but if you are looking to invest 5,000, you are set, even if you only decide to put a certain percentage – say $1,000 – towards Wealthfront.

Other options include:

Robo advising is the term generally used for such technology, but each company’s offering varies. Apps like Wealthfront and Betterment take a proactive approach, where users can simply invest 5,000 up front if they like or contribute a monthly amount. Other robo advisors, like FutureAdvisor, offer a service where they evaluate your existing investment accounts and make recommendations. For a price, some will execute those recommendations for you.

Related: Best Asset Management Firms | Best Asset Managers

Where to Invest 5,000 Dollars: Stocks and Bonds

While there are a number of entities to trade in, if you have a short-term investing goal, and you are relatively new to investing, the best way to invest $5,000 of your hard-earned money is traditionally through stocks and bonds. If you are taking a more hands-on approach, invest a percentage in stocks in order to make some nice returns but have a larger portion in bonds. Bonds are more reliable, and they will soften any blows caused by drops in your stock prices.

Popular Article: Setting Investment Goals – Complete Guide on Goal-Based Investing (Short & Long Term)

Where to Invest 5,000 Dollars: Mutual Funds

Another safe strategy for protecting and growing your wealth in the short term is by investing in mutual funds. A mutual fund is a collection of money to be invested that is furnished by several contributors and handled by an expert fund manager.

These funds’ investments are diversified among different asset classes and spread out between different markets and industries. This makes them low risk, but they also do not reap as much return. Still, if you’re stuck about where to invest 5,000 dollars without exposing yourself to too much risk, mutual funds may be the answer.

Some take issue with mutual funds because of the pricey fees meant to pay fund managers. Fund participators are required to pay these fees whether the fund performs well that year or poorly. If you invest 5,000, you most likely won’t lose all your money, but paying for the service of maintaining the fund both when it’s successful and mediocre will dent your earnings.

A solution pioneered by Vanguard is indexed mutual funds. These do not have active fund managers but, instead, track indices. Instead of trying to beat the market, they aim to mimic the market, and these have been enormously successful. Just as importantly, they’re cheap. Indexed mutual funds are an alternative to actively managed mutual funds when it comes to choosing where to invest 5,000 dollars.

Exchange-traded funds are a different way to invest 5,000 dollars. They share similarities with indexed mutual funds. They also track indices, but, unlike mutual funds, they can be traded like securities.

Image source: Big Stock

How to Invest $5,000 for a Long-Term Goal

When it comes to long-term goals, you have more flexibility when figuring out how to invest $5,000.

The most obvious consideration is investing towards retirement. If you are not actively saving towards a specific goal, but you have not put any serious thought into retirement planning, then perhaps you should use that $5,000 to get started.

There are a number of tax-advantaged accounts that Americans can take advantage of in order to build up a comfortable income for their retirement years. A 401(k) account allows employees to defer paying taxes on their income until after retirement. This is especially lucrative when you consider the fact that your income is lower in retirement. If you are in a higher tax bracket, you will be paying less on taxes on that money than you would have during your working years.

Deciding to invest 5,000 dollars in a 401(k) will also help you reap the matched contributions of your employer. Whether you are particularly inclined to contribute to your 401(k) account or not, contributing the maximum amount that your employer matches, at the very least, is a smart move, because it is essentially free money that you would otherwise miss out on.

A 401(k) is not the only retirement account option available. You can opt for a traditional IRA, Roth IRA, Roth 401(k), or SEP IRA. If you’re facing indecisiveness about the best way to invest 5,000 dollars, putting some or all of it towards retirement is a safe bet.

Additionally, long-term investing provides individuals with the flexibility to explore different investing options, like commodities, gold, and real estate. Taking the time to figure out how to invest $5,000 instead of spending it indicates that you have the right attitude about diversifying your assets and growing your wealth.

Read More: What Is a Timeshare? Overview of Buying and Selling Timeshares

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.