Intro: How Much Do Financial Advisors Cost?

Since we launched in 2015, AdvisoryHQ News has become one of the fastest-growing review and ranking site for financial advisors and wealth management firms.

We recently observed a high level of consumer interests in finding out the cost of a financial advisor.

Key questions frequently asked by consumers and investors include:

- How much do financial advisors cost?

- How much does it cost to hire a top investment management firm?

- What’s the average cost of fee-only financial advisors?

- What percentage do financial advisors charge to manage client assets?

- What do financial planners charge on an hourly basis for financial planning services?

This 2016 article on financial advisor costs has been published to help answer the above questions, and to present a comprehensive review of the cost structure for the financial advisory and investment industry.

Pricing Structures Used Across the Industry to Present Financial Advisor Costs

Image Source: BigStock

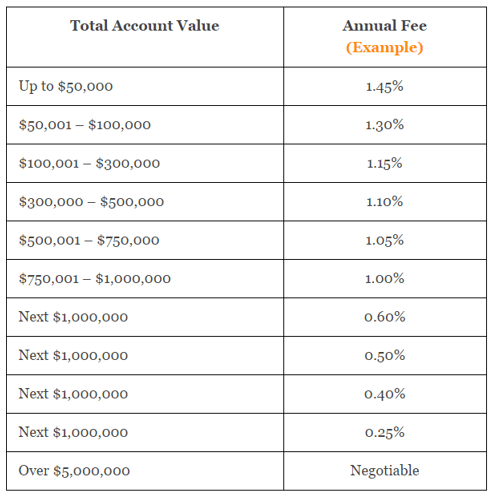

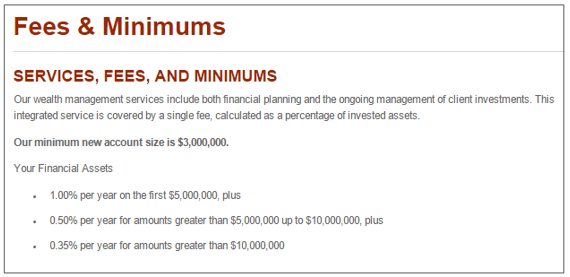

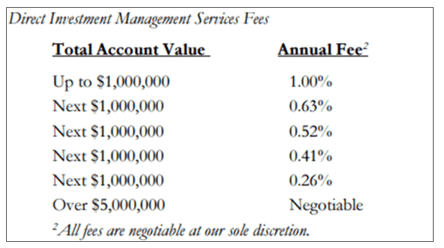

Before we continue, we would like to discuss the standard “Advisor Cost Structure” table used across the industry. Wealth management firms and financial planners often present their advisor and investment management costs to clients in the form of a cost structure table.

This cost structure is basically a comparison outline of what a firm would charge for its services and for managing assets for a client.

See the table below for an example of an investment management firm’s cost structure (comparison by invested amounts).

Image Source: AdvisoryHQ

Across the industry, financial advisors, planners, and registered investment management firms often post their asset management and financial advisor cost structures on their websites. If this information cannot be found online, you can request this information from the wealth management firm.

For registered investment advisors (RIAs), you can view their charges on their Form ADV. RIAs normally post a link to their Form ADV at the bottom of their homepage.

Different Financial Advisory Cost Rates

Before we dive deeper into answering the how much financial advisors cost, we’ll first need to quickly cover the various types of financial and investment charges. These are the various types of charges used by financial planners, advisors, and investment managers.

It is best to understand the different types of costs before contacting and using the services of a financial advisor or investment manager.

1. A Percentage of the Asset Being Managed (% of AUM): This type of cost is the most commonly used across the industry. It is as simple as giving your investment manager a particular sum of money to invest on your behalf, and in return, your investment manager charges a percentage of the asset under his or her management. For example, your financial advisor cost might be 1.10% of the amount your advisor manages on your behalf. In regards to the question “how much do financial advisors cost”, a 1.10% rate would cost you $5,500 in a particular year if your advisor managed $500,000 of assets on your behalf.

2. Percentage—Tiered Rate Structure: In general, financial advisors and RIAs would reduce their rate as the assets they manage on your behalf increases. A tiered percentage rate structure involves multiple rates and tiers. For example, an asset manager might charge 1.17% for managed assets of $200,000 or less, 1.05% for assets between $200,001 and $500,000, 0.96% for amounts between $500,001 and $750,000, and 0.92% for amounts greater than $750,000.

3. Fixed Financial Advisor Costs: This type of financial planner cost is very easy to understand. It involves a flat cost to you for using the services of a financial planner. For example, your financial planner cost might be $1,500 for simple financial plans and $3,500 for highly complex financial, tax and retirement strategies and planning.

4. Financial Advisor Cost per Hour: This is exactly what it means—when an advisor charges by the hour for services provided

5. Annual Retainer Cost: Financial planners sometimes charge an annual retainer cost. This cost is normally set at the beginning of the contract and specified on the terms sheet. The cost can change over time.

6. Hybrid Cost of a Financial Advisor: Oftentimes, financial advisors and investment managers utilize a mix of different costs structures for the various types of financial planning services and investment management functions they provide.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Average Financial Advisor Costs

Click any of the links below to jump directly to the financial advisor cost that is of interest to you:

- Average Percentage Costs (% of AUM)

- Financial Advisor Costs (Tiered)

- Average Flat Advisor Cost

- Average hourly fees

- Average annual fees/retainer

- Hybrid fee structures

Our Methodology

What methodology did AdvisoryHQ use to identify and present this year’s costs of financial advisors, RIAs, and planners? Click here for a detailed review of our methodology: Methodology for Identifying the Average Cost of Financial Advisors.

Average Percentage Financial Advisor Costs (Percentage of AUM)

Charging a percentage of the asset being managed is a relatively simple financial advisor cost structure, and it is the most commonly used cost structure today. You give an investment manager an amount and he or she charges you a simple percentage of that amount.

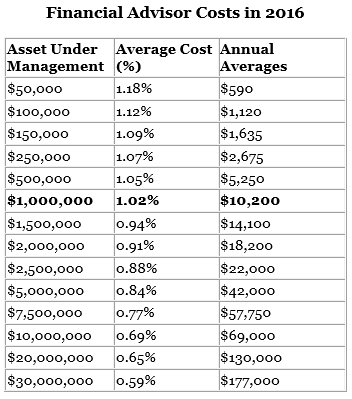

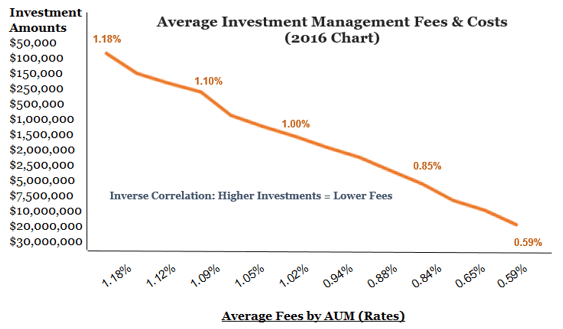

For 2016, what percentage do financial advisors charge on average? The table below presents the average percentage costs of financial advisors based on assets being managed.

AdvisoryHQ’s editorial team applied the theory of “random sampling” to identify the often asked question of “how much do financial advisors charge?” Click here for additional information on AdvisoryHQ’s equal probability of advisor selection approach.

Image Source: AdvisoryHQ

Image Source: AdvisoryHQ

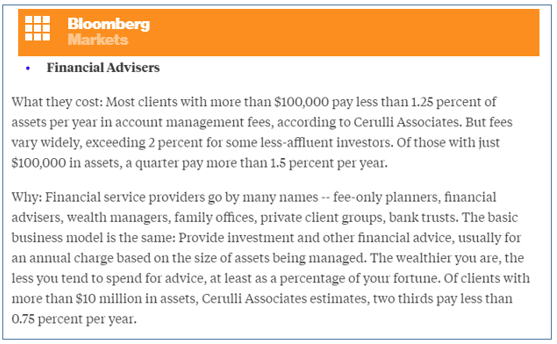

The average advisor costs presented above is in line with Bloomberg’s report on financial advisor fees. Bloomberg’s report shows that investors with more than $100,000 in managed assets are charged less than 1.25% annually (on average) in financial advisor costs.

The financial advisor cost for investors with asset sizes below $100,000 is more than 1.25% per year.

Image Source: Bloomberg’s report

Financial Advisor Costs (Tiered)

As referenced in the sections above, financial advisors rarely have the same rate for each dollar of asset that a client gives them to invest.

Investors and high–net worth clients are often encouraged (incentivized) to invest higher amounts, based on a tiered rate structure. (See the “Financial Advisor Fees” table above.)

Below is a great illustration in which a top-ranking asset management firm provides a tiered financial advisor cost structure to clients:

Image Source: Yeske & Blue

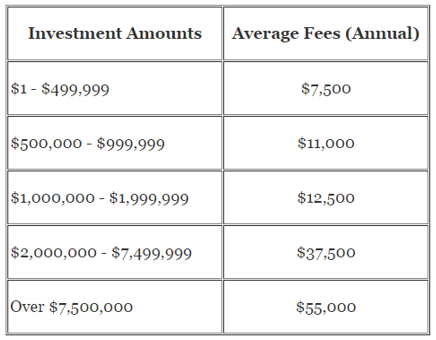

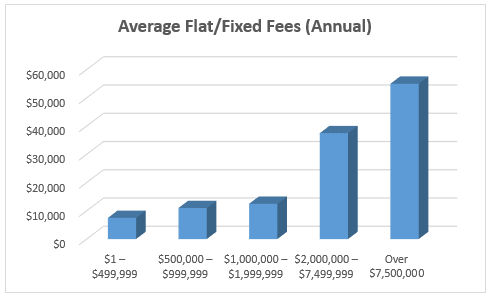

Average Flat Advisor Cost

(Fixed Rate Per Asset Under Management)

In addition to being presented with a financial advisor cost structure based on a percentage of asset under management, you may also be presented with a flat cost structure. This is when the advisor charges you a fixed investment management cost based on how much he or she manages on your behalf.

The table below presents this year’s overview of fixed costs, including how much financial advisors charge (fixed) per the amounts they manage on your behalf.

Average Flat Financial Advisor Costs (Annual Fees)

Image Source: AdvisoryHQ

Image Source: AdvisoryHQ

An example of an actual financial advisor cost structure is below. It presents RTD Financial Advisors’ financial planning charges, as well as the investment management rates that it charges its clients.

Image Source: RTD

Financial Advisor Cost Per Hour

If you are looking to use a financial advisor or planner, you might be wondering, “What is the financial advisor hourly rate I should expect to pay?”

The answer is that it depends on the firm you are interested in, and it also depends on your location. A firm’s exclusiveness, types of services, and demand for its services would impact the “financial advisor cost per hour” it would charge or offer to you.

On average, across the U.S., a financial advisor’s hourly rate ranges from $120 to $300 per hour hour based on the location of the advisor.

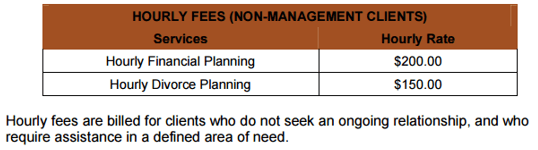

For example, Financial Connections is one of AdvisoryHQ’s top-ranked advisors in California. The firm charges an hourly rate of $200 for financial planning and $150 for divorce planning.

Image Source: Fee Schedule

Average Annual Retainer Financial Planning Rates

So how much do financial advisors cost if you are looking to retain one?

Your retainer cost for hiring a financial advisor, planners and investment management firm would range from $6,000 to$11,000 a year based on which U.S. state you reside in and also based on the level of demand for advisers in your location.

When should you hire an advisor on a retainer basis? Similar to going the “hourly planner cost” route, paying an annual retainer cost is ideal if you need:

- Annual financial check-ups

- Second opinions

- Ongoing retirement strategies touchpoints

- Annual 401(K) reviews

- Annual life changes

- Wealth enhancement and protection

Free Wealth & Finance Software - Get Yours Now ►

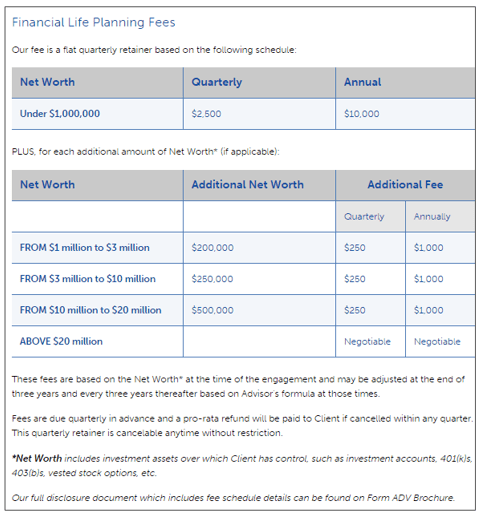

Hybrid Fee Structure

Wealth management companies often utilize a hybrid financial advisor cost structure.

A hybrid financial advisor cost structure involves a mix-and-match variation of the various financial planning costs and investment management rates reviewed above.

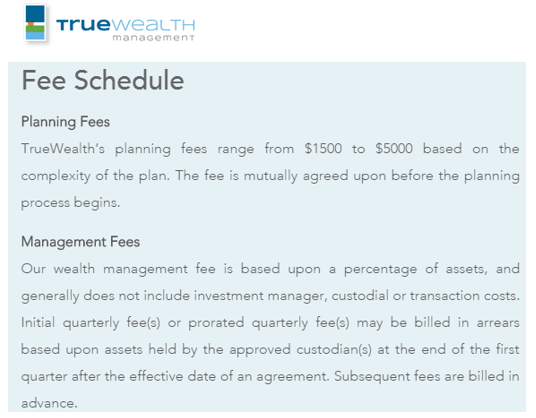

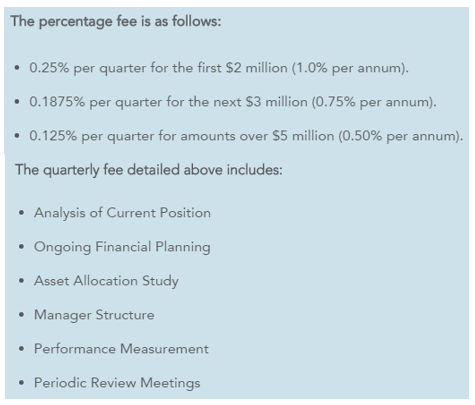

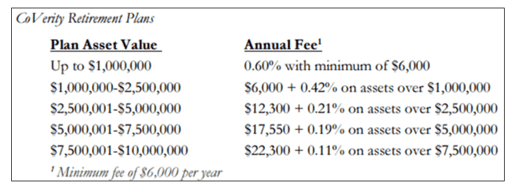

Below are examples of hybrid cost structures.

Image Source: True Wealth Fee Schedule

Persium Group Advisors Cost Structure

Image Source: True Wealth Fee Schedule

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.