Intro: First Volunteer Bank Reviews & Ranking

First Volunteer Bank was recently ranked and reviewed by AdvisoryHQ as a top-rated banking firm. Firms on our top-rated lists were selected after they successfully passed AdvisoryHQ’s groundbreaking four-step banks and credit unions selection methodology.

Click here for a step-by-step breakdown of the methodology and selection process used during our First Volunteer Bank review: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

The First Volunteer Bank review below provides a detailed assessment, including some of the factors used by AdvisoryHQ News in its ranking and selection of First Volunteer Bank.

First Volunteer Bank Review

Originating as Marion Trust and Banking in 1904, First Volunteer Bank now has 24 full-service branches serving Tennessee and Northwest Georgia.

Image Source: First Volunteer Bank

This bank changed names from Community Group, Inc. to First Volunteer Bank in 1999 after decades of growth and acquisitions, which included:

- 1980: Marion Trust & Banking Company

- 1986: Fentress County Bank and First State Bank

- 1992: Volunteer Bank & Trust Company

- 1995: McMinn Bank & Trust

Additional acquisitions in the 2000s included:

- Carter-Wilson-Hewgley Insurance Agency

- Chattanooga Insurance Agency

- Benton Banking Company

In early 2012, First Volunteer purchased Gateway Bank & Trust in Georgia, making it the bank’s first venture outside the state of Tennessee. The purchase included 3 full-service branches in Ringgold, Fort Oglethorpe, and LaFayette in the northwestern region of Georgia.

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Banking Firms

Upon completing our detailed reviews, First Volunteer Bank was included in AdvisoryHQ’s ranking of this year’s best banking firms based on the following factors.

Commercial Loans and Lines of Credit

First Volunteer assists with a wide assortment of lending options. Small- and mid-sized businesses and their owners can benefit from financing that is specialized to the needs of smaller and individually owned local and regional companies.

First Volunteer lending products include:

- Construction loans

- Commercial real estate loans

- Small business loans

- Letters of credit

- Equipment loans

- Working capital loans and lines of credit

- Commercial lines of credit

Community Service

The FDIC reported in a recent review of First Volunteer that they showed “excellent performance regarding the types of services that primarily benefit low- and moderate-income individuals.”

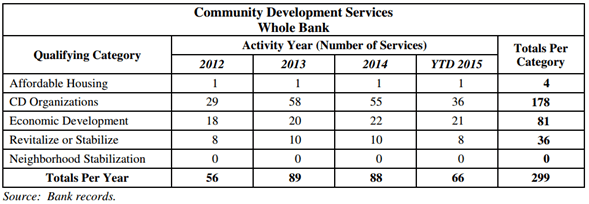

See a chart from the FDIC’s review of First Volunteer, below, showing the number of community services performed by bank staff members per year.

Photo courtesy of: FDIC

First Volunteer Bank has also been an active partner with several community and professional organizations, assisting to support education and to help empower consumers and youth financially.

Some of these joint initiatives include supporting Junior Achievement; the American Bankers Association’s Teach Children to Save program; and the Get Smart about Credit program.

First Volunteer also works with the FDIC’s Money Smart program to deliver financial education to youth and adults.

Locations and Branch Concentrations

First Volunteer Bank’s branches are located in the larger population centers of Eastern Tennessee.

In addition, with multiple branches in key cities like Chattanooga and Knoxville, First Volunteer Bank is able to provide not only the financial products customers expect, but also easy access to branches and ATMs.

In addition to reviewing the above First Volunteer Bank review, you can click on any of the links below to browse exclusive reviews of AdvisoryHQ’s top rated banking firms:

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.