Guide: How to Find and Open Free Business Checking Accounts for Small Businesses

When it comes to small businesses, saving money wherever possible is in their best interest. In the current economy, small businesses are often competing against large, well-established corporations. In order to manage their payroll, accept payments, and reimburse vendors, small businesses need checking accounts. The issue is finding a free small business checking account to meet their needs.

If you work for or own a small business that is looking for a free business bank account, this article is essential. In order to get the best free business checking account for your business, there are many variables to take into consideration. This article will help answer your questions centered around free business checking accounts, such as:

- Are there free business checking accounts for small businesses?

- What are some banks with free business checking accounts?

- Can you open a free business checking account online?

- What are the best free business checking accounts?

- What should you look for in a free small business checking account?

See Also: Best Banks for Small Business Banking | Ranking | Reviews & Comparison

What Is a Free Business Checking Account?

A free business checking account is a bank account for businesses that either doesn’t come with a monthly service charge or allows you to waive the fee with a minimum balance or other requirement. This is a great option for any small business that is trying to limit unnecessary expenses. For many reasons, a business checking account is necessary, but the lofty fees that come with them are not.

There are a few options when looking to open a free business checking account. You can either open a free business checking account online, or you can look for a local bank branch that allows you to walk in. There are several banks with free business checking accounts, but finding the right one for your business is important.

How to Find the Best Free Business Checking Account for Small Business

Given the competitive landscape today, small businesses cannot afford to pay fees on checking accounts. Free business checking accounts are a great way to cut down on expenses. When you are looking for a free small business checking account, it is important that you find the best free business checking account for small business. Not all banks offer a free business bank account, and not all free business checking accounts are created equally.

Image source: Freeimages

Here are four steps to help you find the best free business checking account for your small business:

- Find a list of banks with free business checking accounts for small businesses

- Compare local vs. national banks that offer free small business checking accounts

- Look at other bank offerings and associated fees

- Determine what you classify as the best free business checking account for small business

If you’ve been wondering if there are any banks with free business checking accounts, the answer is yes. Your first step should be to determine which banks offer free small business checking accounts. Thankfully, we have already done this step for you on the section below to save you time and effort.

Do you want a bank that offers a free business checking account that you can interact with locally, a bank that is solely online, or a combination of the two? It is important to determine how important it is to you to have a bank that you can physically walk into. There are positives and negatives to the local versus national debate. Banks that are not local will require you to open a free business checking account online, but some people would rather visit a bank branch in person and establish a relationship with a bank representative.

Don’t Miss: Best Bad Credit Business Loan Lenders | Get Startup Business Loans with Bad Credit

You also need to determine what other banking needs you have and what associated fees come with certain accounts. Chances are that even a small business will want more than just a free small business checking account. Even if a certain bank offers the best free business checking accounts in regard to transaction and deposit fees, you may want to look at savings accounts, credit cards, or bill pay options before making your decision.

Finally, you need to know what features make a free business checking account appealing. The best free business checking account will vary according to different people. Some like the option to open a free business checking account online, while others are more concerned with the balance requirements in their free business checking account. So ask yourself, what do you need to in a free business checking account to consider it the best free business checking account?

Banks with the Best Free Business Checking Accounts

When you look for a list of banks with free business checking accounts, the list is actually quite long. The trick is narrowing it down to select the best free business checking account. These six banks below offer some of the best free business checking accounts in the United States:

1) Capital One

Capital One Spark Business is a phenomenal free business checking account. The bank offers online banking that has no monthly fees. Where other banks have limits on transactions allowed per month, Capital One Spark Business accounts have unlimited transactions. That means that there is no limit on transfers, withdrawals, and deposits.

Capital One is also easy to work with and has a variety of benefits. You can open a free business checking account online, without needing to visit a branch. To deposit a check, you simply take a picture and upload it to your account. The free business checking account also allows you to withdraw money, fee-free, from any Capital One or Allpoint ATM located throughout the country.

Every free business checking member also has access to Spark Business Features, with a full set of financial tools. The drawbacks with Capital One’s free business checking account is that branches do not provide any support for Capital One Spark Business accounts. Also, you can only deposit cash at a Capital One ATM, and only a few states have access to these. While this is one of the best free business checking accounts, it may not be ideal for anyone needing customer support and frequent cash deposits.

Related: Top Banks for Free Business Checking | Ranking & Review

2) Wells Fargo

For just $25, you can open a Wells Fargo Business Choice checking account. This free business checking account comes with 200 transactions free per month, and then a charge of $.50 per transaction after that. The free business checking account also includes the first $7,500 of deposits per month at no charge. After that, there is a $.30 charge per $100 deposited.

The Wells Fargo Business Choice account also comes with a $14 monthly service fee, which is on the higher end. However, this free business checking account is the best free business checking account for those looking for ways to avoid a monthly service fee. To avoid the fee, you can maintain a $7,500 balance, have 10 or more debit card purchases/payments from the account, or link to a Direct Pay service. You can also have a qualifying transaction from a linked Wells Fargo Merchant Services account or linked Wells Fargo Business Payroll Services Account.

While there are some fees associated with this free business checking account, there are added features. You will have access to the Wells Fargo Business Online and Business Bill Pay, as well as online statements with check images. Another nice thing about the Wells Fargo Business Choice checking account is that you can add Business Savings Accounts, Business Credit Cards, and Payroll Services. This is a good way to manage all of your banking in one place, especially if your small business begins to grow.

3) Chase

Chase Business Checking is a free business checking account that has a wide variety of benefits. While Chase offers several types of business checking accounts, Chase Total Business Checking is the free small business checking account for small businesses.

The Chase Business Checking account comes with a monthly service fee of $12 for those with paper statements, but the fee is dropped to $10 if you enroll in Paperless Statements. To take advantage of this free business checking account and avoid the fee altogether, you just need to maintain a minimum daily balance of $1,500.

Chase also allows up to 200 transactions per month with no fees associated on their free business checking account. Every month, you can also have cash deposits totaling $7,500 without a fee. In total, you can have $50,00o in cash deposits and withdrawals without any additional fees. However, you cannot exceed $50,000 for 4 months in a rolling 12-month period, or your account might be converted to another level of Chase Business Checking. This would likely be Chase Performance Business Checking for mid-sized businesses.

As an added bonus, Chase permits outgoing and incoming domestic wires, incoming international wires, and 24/7 access to telephone banking and Chase.com. Their free small business checking account is a good option for those who would like low minimum balance requirements. It is also a good option because there are several account options to grow into as your small business grows.

Popular Article: Top Business Checking Accounts | Ranking | Best Bank Accounts

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

4) U.S. Bank

U.S. Bank Silver Business is another option for your best free business checking account. You can open an account with only $25, with the opportunity to open a Package Money Market Savings account at the same time. This will waive the monthly maintenance fee of $8.95. If you want to waive the monthly fee without opening a Package Money Market Savings account, you can also enroll for online statements and either deposit $1,000 or more monthly or maintain an average monthly balance of $1,500.

Image source: Freeimages

You also get a complimentary U.S. Bank Visa Debit Card when you open a free business checking account. Opening a free business checking account at U.S. Bank will also get you access to Online/Mobile Banking, mobile check deposit, and bill pay services.

U.S. Bank is a good option for a free business checking account if you live in one of the 25 states where its 3,000 branches are located, and if you don’t rack up many transactions per month. The real drawback is that it has the lowest number of allowed fee-free transactions of all the free small business checking accounts listed. For every transaction over 150 a month, you will be charged a $0.50 fee.

5) Bank of America

Bank of America offers a good free business bank account for your checking needs. At $18, Bank of America’s Fundamentals Checking has the highest monthly maintenance fee. There are several ways to get this fee waived. You can spend $250 on a business debit or credit card, maintain a daily balance of $3,000, or have a monthly average balance of $5,000.

Like most others, Bank of America also gives you access to their mobile and online banking platforms so you can deposit checks and transfer money right from your smartphone. The live chat feature on their website is a bonus too. You can make up to 200 fee-free transactions a month before a $0.45 per transaction fee goes into place.

Another area where Bank of America is a better free business checking option than others is that it allows up to $7,500 in cash deposits a month, before a fee of $0.30 per $100 kicks in. Overall, for those planning to use a debit card for a few larger purchases, or are able to meet the minimum monthly requirements, the Bank of America Business Fundamentals is a good free business checking account to have.

6) Bank of Internet Federal Bank

For those who like to conduct their business banking online, the Bank of Internet Federal Bank Basic Business Checking is a good option for a free small business checking account. Though it takes $1,000 to open this free business checking account, it could be the best free business checking account for you.

You can make up to 200 transactions per month, with only a $0.30 fee for every transaction after that. This is $0.20 less than most other free business checking accounts. It also offers free bill pay and other online banking tools. With a surcharge-free ATM network, you can make withdrawals across the nation. There is also no monthly maintenance fee, so you don’t need to worry about maintaining certain monthly or daily balances.

The Bank of Internet Federal Bank Basic Business Checking is a great option for a free business bank account. If you don’t mind not earning any interest on your checking account, and that there are no local branches for you to visit, this might be the best free business checking account for you.

What Is the Best Free Business Checking Account for Me?

The best bank is not simply the bank that offers a free business bank account. Not all free business checking accounts are created equally. To find the bank that offers the best free business checking accounts, you need to find the bank that works best for you and with you. The best free business checking account for you could be completely different from a national or even a local competitor.

It is important to follow the steps covered throughout the article to select the best free business checking account to meet your needs. If you need a bank that offers savings accounts, or superior customer service, then you need to consider those. There are many banks with free business checking accounts, but not every free business checking account is right for you.

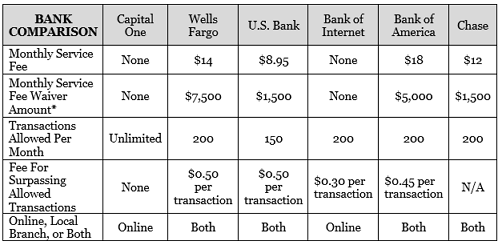

While there is no single answer for what is the best free business checking account for small business, it is time to find out what free business checking account is the best option for you. With so many variables, it can be hard to determine what is the best free business checking account. We compiled a list of important features, comparing the six top free business checking accounts:

*This is the average minimum balance that needs to be held throughout a month to get a monthly service fee waiver

After doing some research and using the tools and information provided to you throughout this guide, you should feel comfortable in selecting a free business checking account that is best for your small business.

Read More: Best Online Business Banks | Ranking & Review

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.