Intro: Review of Genus Capital Management

Many Canadian investors are becoming more aware of the impact that their investments have on the planet. They would rather support sustainable companies than those still firmly rooted in fossil fuels.

A study by the Responsible Investment Association found that 77% of Canadian investors were interested in responsible investing and 82% stated they’d like sustainable investments to make up at least a portion of their portfolio.

One Vancouver, BC investment management firm has become a leader in helping clients invest profitably and sustainably with the planet in mind.

Genus Capital Management is a Certified B Corp asset manager that has been at the forefront of sustainable investing for over 30 years. Impact and sustainable investing have grown to become the core of Genus’ offerings after decades of evolution, designed to meet the needs of investors who are passionate about climate action.

Today, Genus Capital is at the forefront of Canada’s Divest-Invest movement with a complete suite of fossil fuel-free funds that are tailored to meet the needs of investors who wish to invest in a sustainable, clean energy future.

Image courtesy of Vancouver investment manager, Genus Capital Management

About Genus Capital Management & Who It Serves

This top Vancouver investment advisor has been serving clients since 1989. Its global perspective utilizes data technology for gaining valuable investment insights for its clients.

This is an independent fiduciary Canadian sustainable investment firm that serves individuals, families, and institutional investors with a mission to help build a better future.

The core values of Genus include:

- Foster client success

- Drive innovation

- Create impact

Removing Conflicts of Interest

Genus Capital Management works to garner client trust and to avoid potential conflicts of interest. It does not receive any third-party compensation from the sale of third-party financial products. This ensures that recommendations made are completely in the best interests of its clients.

Further, the firm provides disclosures of all fees and charges relating to developing and managing client portfolios. Genus does not sell any products to clients for investment purposes that have embedded compensation.

Dedicated Advisory Team

As an employee-owned company, Genus Capital Management has a team dedicated to helping clients reach their financial goals and make a positive contribution to society at the same time.

This dynamic team has seven portfolio managers, nine expert professionals on its investment team. It additionally has a robust leadership team and operations team.

You can find a full list of the team at Genus along with bios and contact details on this page.

Here are some of the extensive qualifications that you’ll find with the leadership team at Genus:

- Leslie G. Cliff, BSc, OC, CFA, Co-Founder & Chair of the Board

- Stephen Au, MBA, CPA, CGA, CEO/Partner

- Mary Lou Miles, CFA, TEP, Director of Wealth Management/Partner

- Sue-May Talbot, CIM, Portfolio Manager/Partner

- Mike Thiessen, CFA, MBA, Chief Sustainability Officer/Partner

- Wayne Wachell, CFA, MBA, Executive Chair Person & Chief Investment Officer

- Shannon Ward, BA, Chief Revenue Officer

- Virginia Yu, BSc, Director of Information Technology/Partner

- Huanyu (Lisa) Zhang, CFA, MSc, MA, Director of Equity Investments/Partner

- Fred Yeo, CPA, CMA, Chief Compliance Officer

Straight-Forward Investment Approach

This boutique Vancouver impact investment firm provides investors and potential investors with a straightforward investment approach that is designed to minimize risk and use data-driven insights to maximize returns.

This is refreshing to see, as some Canadian investment firms aren’t as transparent about how investments are approached or the principles guiding how client portfolios are put together.

The investment approach of Genus is based upon five pillars:

Risk-Controlled

An institutional approach is used that is meticulous and targets consistent portfolio returns.

Disciplined

Investment choices at Genus are not based on commissions or whims. They are based on quantitative metrics that drive a systematic, and data-driven process that ensures more consistent results.

Specialized

Investment portfolios are customized for clients and solutions chosen based upon both in-house expertise and outsourced specialized teams of professionals.

Diversified

Putting all your eggs in one basket is a high-risk strategy that Genus Capital’s team avoids. It builds diversification into client portfolios to reduce risk and ensure a portfolio composition that is global and incorporates a variety of asset classes, sectors, and investment styles.

Active

The team at Genus understands that portfolios should not be static. They need to recalibrate according to changing markets. This is why its financial advisors actively manage portfolios and adjust as needed to keep client goals on track.

Flexible Individual Investment Services

Genus works with both individual investors and families. It has worked with some of Canada’s most successful families to manage generational wealth and provides the same investment technology to its individual/family investors as it does to its institutional investors.

The 30+ years of experience that this Vancouver investment manager brings to the table provides stability and a track record that you may not find with newer wealth management firms.

Two Main Options

Genus Capital Management offers two main investment routes for individuals and families. These are:

- Digital Wealth Management – Investment of $100K+ (Annual cost of 0.90% or less)

- Personal Wealth Management – Investment of $500K+ (Annual cost of 1.25% or less)

The digital wealth management option includes a kick-off and annual consultation with an experienced portfolio manager. The personal wealth management option includes detailed planning consultation and a semi-annual consultation.

But if you choose the digital route, you don’t have to worry about not having access to your investment professional between your annual meetings. Genus offers on-demand expert “human” advice via phone, chat, email, and video.

Those that choose the personal plan, get all the digital wealth management features, plus extras like:

- Customized portfolio

- Tax-efficient portfolio strategy

- Liaise with other advisors working on your portfolio

- Exclusive networking opportunities

- And more

Institutional Investment Services

The other side of Genus Capital Management’s client base makes up institutional investors. It offers cutting-edge solutions for those representing a pension, foundation, or indigenous community.

For institutional investors, this Vancouver investment management firm offers unique, sustainable, and impact investment options that may not be found with other financial advisory firms in Canada.

It has a goal to help investors meet their objectives while staying true to corporate social responsibilities values and sustainability.

Genus Fossil Free™ was created in 2013 by the firm to offer progressive investment answers for the pressing socio-economic and environmental challenges facing the world. It tailors investment options for each institutional client and has a full suite of fossil fuel-free funds.

Because Genus is a leader in sustainable investing and has been for more than three decades, you aren’t limited as to investment choices. It can integrate public securities with private investments to maximize impact and return.

Achievements & B-Corp Certification

Genus is a Canadian financial advisor and investment management firm that doesn’t only help organizations, families, and individuals with their sustainable investments, it also is a sustainable company itself.

Genus notes on its website that it was the first wealth management firm in Canada to become a Certified B Corporation. This certification signifies businesses that meet the highest standards of social and environmental performance, transparency, and legal accountability.

Additional achievements/recognitions that Genus Capital Management has garnered over the years include:

- Genus CEO (at the time), Wayne Wachell, was listed as an honouree of the Clear 16 individuals in Canada in 2019.

- Genus was a runner-up for the 2020 RIA (Responsible Investment Association) Leadership Award – Market Education.

- Genus was a runner-up for the Vancouver Board of Trade Business Reinvention Awards 2021.

- Genus co-founder, Leslie Cliff, was named one of British Columbia’s most influential women in finance by BC Business in 2019.

Other accolades are listed on the company’s website.

Why are these things important? Because it indicates a commitment to making a positive impact on the planet by an investment advisor that helps its clients do the same. The business recognitions illustrate that Genus and its leadership are active pioneers in the financial services and sustainable investing areas in Canada.

Fossil-Free Portfolio Examples

When looking for investments of any kind, it’s helpful to see what a portfolio might look like. Genus illustrates its transparency (one of the attributes of earning certification as a B Corporation) by providing four examples of fossil-free portfolios.

Those interested in sustainable and impact investing can review portfolio options in four different target categories:

- Income focused

- Stability focused

- Balanced focused

- Growth focused

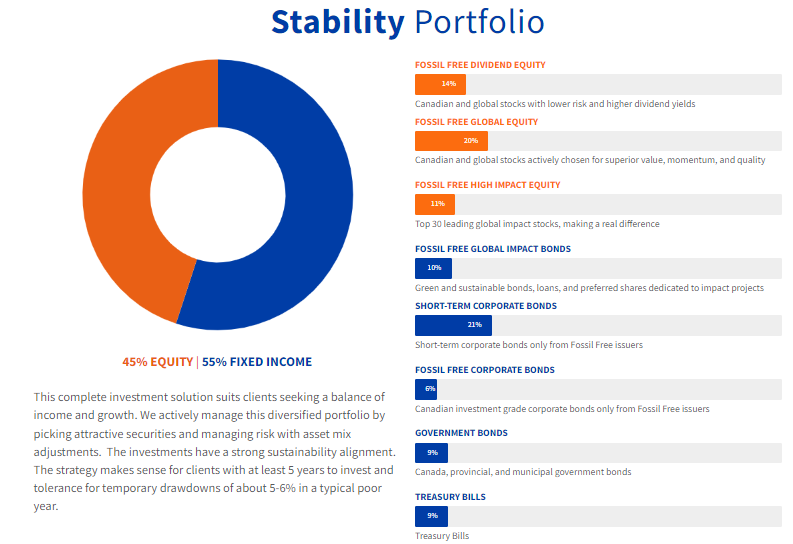

Example of a Genus Capital Management fossil-free portfolio targeting stability.

Each portfolio example shows the mix of equity vs fixed income investments and a detail of the balance of eight different investment vehicles. The way that Genus has this laid out and color-coded is very comprehensive, even for those new to investing.

Measurement of Your Net Impact Score™

When you choose sustainable investments, how do you know how much impact you are actually making? This can be difficult for some BC and Canadian investment firms to quantify. But being a leader in impact and sustainable investing, Genus, has this figured out.

Genus Capital Management’s Net Impact Score™ is calculated for all client portfolios. It incorporates both positive and negative impacts, so clients see the net effect that tells the whole story of the benefit their investments are making.

This holistic score is a helpful benchmark for understanding the overall environmental impact of your entire portfolio. An example that Genus provides is that if one part of your portfolio includes an investment in renewable energy, this score helps to ensure you don’t negate that by simultaneously investing in a coal utility in another part of your portfolio.

Conclusion: Future Outlook for Genus Capital Management

Attention is only increasing when it comes to the environment, renewable energy, and sustainability. Investors will be looking at their investments with a “green lens” in increasing numbers.

As Genus Capital Management has been in the impact and sustainable investment space for more than three decades, it’s well ahead of the curve and has been a pioneer in this area of investment.

The firm’s reputation for transparency and its efforts to remove any potential conflicts of interest also make it a wealth manager choice that instills trust with new and experienced investors.

Statistics show that interest in responsible investing is rising and investment firms that aren’t as well versed in this arena will likely fall behind.

We anticipate that Genus will continue to pioneer the sustainable investment space, as it has done with offerings like its Net Impact Score. It is well-positioned to lead the next generation of investors that desire to make a positive impact on the future.

Images sources:

- https://genuscap.com/

- https://genuscap.com/services/for-individuals-families/

- https://genuscap.com/fossil-free-impact/portfolio-options/

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.