Overview: Financial Advisory

Financial advisor jobs are on the rise, and US News & World Report ranks financial advisors as the fourth best business job in America. US News also rates the financial advisor position a 7/10 in terms of future growth and viability.

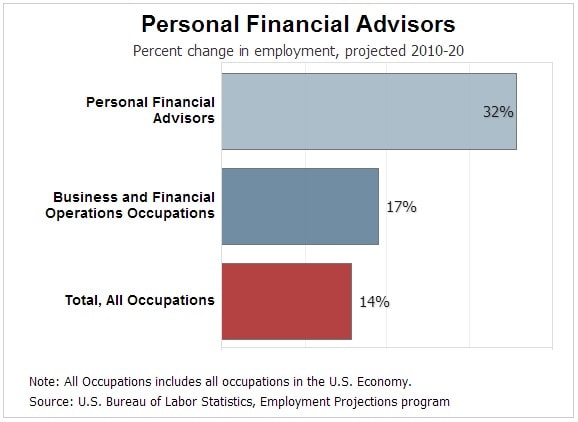

The U.S. Bureau of Labor Statistics estimates that, by the year 2020, the financial advisor business will grow by 32% —considerably higher than average for most industries.

Image Source: Bureau of Labor Statistics

This translates into a 10-year increase in the number of jobs, from just over 205,000 all the way to more than 270,000.

New Kid on the Financial Block

Financial advisory as an occupation is relatively new within the financial services industry. As recently as four decades ago, the financial advisor position didn’t exist.

Instead, the closest representative to a contemporary financial advisor job came in the form of a stock broker, insurance salesperson or manager at a community bank. These roles evidenced only a modicum of the more intimate, one-on-one relationship customary to modern-day financial advisors and their clients.

Reasons for Growth

The decentralization of traditional wealth management organizations, such as the aforementioned banks, brokerages, and insurance companies, contributed to the rise of independent financial advisory firms.

The average personal investor wanted options when it came to how and with whom one could invest his/her wealth. These individuals did not want to be shoehorned into the same investment and money management profiles that had become the norm throughout the financial services industry.

With the rise of independent financial advisors and wealth managers, investors now had the choice of diversifying asset allocation completely to their liking. Not only that, but they could do so without the undue influence and conflict of interest inherent in dealing with a bank, broker or insurance company.

Furthermore, the clientele for banks, insurance companies, and brokers was typically very large on account of the organization’s size and lack of options. As a result, many investors began feeling lost within such sizable clientele.

Thus, the desire among investors to deal with smaller, more personable finance professionals began to grow. Once the industry shifted from its standard service providers, independent financial advisory firms were able to gain a foothold. They have flourished ever since.

While these factors—smaller size, less conflict of interest, and one-on-one interaction with a dedicated advisor—may have spurred the separation of financial advisory firms from conventional ones, and other variables have since come to influence the financial advisor landscape.

One very big contributing factor is the acceleration of baby boomer retirements. Boomers were already projected to begin retiring en masse as early as 2010, and that trend will continue until at least 2024.

As a result, financial advisors will be needed more than ever to assist with these transitions. Naturally, the increase in demand will produce a corresponding increase in how much financial advisors make in the coming years.

How Much Does the Average Financial Advisor Make?

In 2010, the annual median salary for a financial advisor was almost $65,000. This is certainly above average compared to the majority of jobs across the country.

But how much do investment advisors make on the low and high ends of the spectrum?

Financial advisors who earn on the lower end of the scale often bring in between $35,000-40,000 per year. Advisors on the higher end, however, tend to earn $90,000 or more annually.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How Much Can a Financial Advisor Make?

However, these are only averages. Forbes.com, for one, estimates a much higher ceiling for financial advisors, suggesting that they can make in excess of $1 million per year.

That’s a far cry from $40,000. So, how exactly can financial advisors make the astronomical amounts that Forbes suggests?

How Fee Structures Determine How Much a Financial Advisor Makes

How much can a financial advisor make in a year? The answer depends primarily on the advisor’s code of ethics.

Commissions and bonuses are popular with many advisors. The process is simple: meet the quota, earn a bonus. Such quotas are typically determined in-house or by a parent company.

Other forms of sales-based income for financial advisors include recommending certain services or products. These financial items usually come at extra expense to the client and, depending on the advisor’s scruples, may or may not be 100% necessary.

This creates a conflict-of-interest for the advisor. While there is nothing technically illegal about receiving commissions on recommendations, there is no way to guarantee the client that he/she is receiving unbiased, objective advice.

Naturally, not all financial advisors are comfortable with this arrangement. Many advisors, in order to gain the trust and continued business of the client, will not take sales-based or performance-based bonuses.

These kinds of advisors are either called “fee-only” or “fee-based.”

Fee-based advisors will still earn extra money on the products and services they recommend. While some may still call this a commission, many fee-based advisors point out that advisors of their ilk are much more likely to disclose extra fees upfront.

This stands in contrast to the typical performance- or sales-based advisor who will not disclose the bonuses received for certain recommendations.

On the other side are the “fee-only” advisors. These advisors charge a single fee and nothing more. The fee is disclosed to the client very early on, usually during the initial interview between client and advisor.

Fees charged by fee-only advisors can range from a single fee for financial planning and/or implementation to a percentage of assets under management, or AUM (also known as FUM, or funds under management).

If Fee-Only, How Do Financial Advisors Make Money at Six Figures or More?

Just like the factors that contribute to how much money a financial advisor makes, additional factors play into how fee-only advisors make money, too.

As mentioned previously, many fee-only advisors charge a percentage of assets under management (AUM). The individual advisor’s earnings may fluctuate depending on certain key points when it comes to assets under management. Those include the below points.

Percentage Amount

The average for equity assets is anywhere between 0.50-1.00%. For fixed income, the typical rate is 0.30%. It stands to reason that a higher percentage applied to a client’s assets under management yields higher earnings for the financial advisor.

However, most advisors aren’t greedy; their percentages are on a sliding scale that goes down as the amount of assets under management goes up. Not only will the client accrue more returns on a successful portfolio, but the advisor will still earn more money despite a lower percentage of AUM.

Amount of Assets Under Management

Just as it makes sense for a higher percentage amount on a client’s AUM to produce more revenue for a financial advisor, the same is true for the amount of a client’s assets under management. On the surface, this has the potential to lead certain advisors to allocate assets in violation of a client’s risk tolerance.

However, any risk-heavy portfolio can produce losses negatively impacting both client and advisor. For this reason, it is prudent for advisors, whether commission- or fee-based, to not allocate more assets than reasonable given the client’s financial posture.

Number of Clients

It is an unfortunate truth that some financial advisors rarely meet with their clients past the initial interview. Too often, assistant advisors or even office staff will field questions or comments from clients once they’ve signed their advisor contracts.

This arrangement is acceptable if the client agrees to it upfront. Nevertheless, such a system does allow financial advisors to handle a larger roster of clients than if they were made regularly available to clients one-on-one. More clients equal more earnings.

Focus on Elite Clientele

Some financial advisory firms accept all types of clients, whether working class or affluent. Other firms do business only with high-net-worth individuals. High-net-worth clients enjoy greater returns on their portfolios which translate into greater revenue for the financial advisor.

Foundations, Institutions, Trusts & Family Offices

Not all of what financial advisors make in a year comes from individual investors. While it’s true that many advisory firms focus on individuals and their families, they may also assist foundations, institutions, corporations, trusts, and charities, among other organizations. This can increase the revenue that financial advisors earn annually. The same is true for advisors who offer family office services for high-net-worth families.

Certifications, Designations, and Education

By now, we’ve discussed the biggest influences on a financial advisor’s salary, including the manner in which payments are structured and by how much. Do financial planners make more money, however, when other variables are dropped into the mix?

Things such as education, training, and certification may not pop up on the radar of new or inexperienced investors. For others, they only want results, and a successful track record from a financial advisor is enough to get their business.

However, there are other investors who require more from their advisors. Education is important to this type of investor.

Has the advisor gone to college? If so, what did he/she major in? Does it contribute to the advisor’s understanding of financial planning?

Perhaps an advisor’s college degree is relevant without being strictly concerned with finance or business administration. When dealing with these advisors, the savvy investor then turns his/her attention to certifications and designations.

Is the advisor a Certified Financial Planner? A Chartered Financial Analyst? Does he/she have a Series 6 license?

Being without relevant education, certifications or designations can be enough to turn away potential clients. Whether a financial advisor can make up this lost business rests more upon his/her powers of persuasion and establishing a successful track record with clients.

How much do financial consultants make? In short, not as much as they could be making if they forego continuing education.

How much Certified Financial Planners make boils down to the fee structure under which individual advisors operate.

How Much a Financial Advisor Can Make Hinges on Several Variables

Without a doubt, commissioned or even fee-based advisors can earn an untold amount when many or all of the aforementioned factors work in concert to the advisor’s favor.

But how much do certified financial planners make when all variables are considered? Is there a specific number or range that can serve as a guide?

It really depends on the nature of the variable itself.

Image Source: BigStock

Image Source: BigStock

Take location, for instance. The more populated, the better. Financial advisors who earn the most tend to work in cities—not small towns or rural areas. At the very least, they work in the suburbs of a big city—a feature that allows them to service an even bigger list of clients.

While this could give us a window into the advisor’s earning potential, it is, nonetheless, not as crucial as it once was. This mostly owes to many firms’ ability to service out-of-state clients by phone or Internet.

Advisors who work for bigger or more established firms will tend to draw more share of the market than their competitors. Exceptions exist, of course, as many investors are seeking smaller firms who can give more one-on-one attention compared to bigger firms.

Still, factors such as size, reputation, and legacy are more often seen as a boon to advisors’ income potential rather than a liability. Big firms with lengthy client rosters and decades of service hold a certain amount of prestige that can draw in long-term or lifetime clients much more easily than younger firms.

With these considerations in mind, we need to ask again, “How much does a financial planner make?”

The answer seems to rest on your combined ethics, specialization, expertise, credentials, experience, firm, and location, among other factors.

Technological Advances That Impede How Much a Financial Advisor Makes

So, how much do certified financial planners make when technology outpaces brick-and-mortar firms? Unfortunately, the possibility exists that advisors of the future won’t earn what their predecessors did.

Despite steady growth, financial advisor jobs will likely be stunted due to the surging online advisory market. Clients are signing up for robo-advisors more than ever, and if the trend continues, they may put a crimp in the income of human advisors.

Many of the same social forces that supported the rise of independent financial advisory firms are now helping grow online advisors, too.

Lower costs, convenience, no need for face-to-face meetings, and clients’ preferred mix of autonomy and professional consultation—these factors, among others, are leading many independent-minded investors to the Internet.

After all, why go to all the trouble of setting up and then sitting through several meetings with a human when you can stay on your couch while a robot builds you a low-risk portfolio?

Needless to say, if these services continue to grow in popularity, they will have a very real impact on how much money a financial advisor makes.

In Conclusion: A Caveat

You’ve seen by now that numbers, at least averages, are pretty easy.

How much does a financial advisor make a year?

- On the low end: $40,000

- Mean average: $65,000

- On the high end: $90,000+

You’ve seen that there are many data points that can influence an advisor’s income—everything from earning undisclosed commission to the population size of the city in which the advisor works. Not to mention the size of the advisor’s firm, its reputation, and the variety of services it offers.

With the right clientele, the right visibility, and the right credibility vis-à-vis accreditation and certifications, financial advisors don’t necessarily have a ceiling when it comes to revenue.

However, like anything, it requires hard work. Perhaps, more importantly, it takes a clear appraisal of your ethics and what your conscience allows.

As a financial advisor, would you be willing to receive undisclosed commission for selling additional products and services? Or would such a practice make you feel uncomfortable? If it’s the latter, you may not earn as much money.

Are you willing to spend the extra money, time, and effort in continuing your education? If so, you could gain extra credibility in the eyes of potential clients, thereby increasing your chances of doing business with them.

Do you want to only work with high-net-worth individuals? Or are you guided by the idea that everybody deserves access to quality financial planning regardless of income?

If it’s the latter, you may not make as much as advisors who focus on high-net-worth clients and families. You may feel more fulfilled in your work, but your income will likely not match that of an advisor who boasts elite clientele.

For all these reasons and more, answering the question, “How much do investment advisors make?” is tricky. Unfortunately, there is no one-size-fits-all answer. We can tell you the averages, but the averages reflect a diversity in philosophy, approach, and operation that cannot be quantified or contained.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.