Intro – Huntington Bancshares Reviews & Ranking

Huntington Bancshares was recently ranked and reviewed by AdvisoryHQ as a top rated banking firm. Firms on our top rated lists were selected after they successfully passed AdvisoryHQ’s ground-breaking, four-step banks and credit unions selection methodology.

Click here for a step-by-step breakdown of the methodology and selection process used during our Huntington Bancshares, Inc. review: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

The review below provides a detailed review of some of the factors used by AdvisoryHQ News in its ranking and selection of Huntington Bancshares, Inc.

Huntington Bancshares Review

Celebrating its 150th year of service, Huntington Bancshares, Inc. is still driven by the same values that gave Huntington its start a century and a half ago. As a full-service bank, it places high priority on one indispensable asset within its business: YOU.

This is evident from its “welcome” business philosophy all the way to the wide range of custom-tailored services extended to its clients. For both personal and small business needs, Huntington believes in serving your best interests first.

Image Source: Huntington

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Banking Firms

Upon completing our Huntington Bancshares, Inc. review, Huntington was included in AdvisoryHQ’s ranking of this year’s best banking firms based on the following factors listed below.

Huntington Bancshares Review: Core Values to Bank on

Huntington demonstrates its commitment to clients every day through the following set of core values:

- Accountability: Own it

- Communication: Be open, honest, and collaborative

- Continuous Improvement: Always get better

- Inclusion: Be open-minded to all

- Passion: Act with positivity and persistence

- Service: Earn customer loyalty for life

- Teamwork: Work with and look out for each other

Huntington Bancshares Review: Premier Checking Services

Personal checking account options through Huntington allow you to pinpoint exactly the types of services that are the most important to you – and leave the rest behind. No matter what kind of checking account you choose, you’ll receive these benefits:

- 24-hour grace overdraft fee relief

- Free overdraft protection transfers

- Free mobile banking

- Free alerts

- No minimum savings accounts

- Free online bill pay

- Convenient all-day deposits from ATM and mobile

- Access to over 700 branches and 1,400 ATMs

Now let’s take a look at the different types of personal checking accounts and their driving features:

- Asterisk-Free Checking: Free to open, followed by no monthly maintenance fees and no minimum balances

- Huntington 5 Checking: Earn a 0.15% APY and only a $5 monthly maintenance fee

- Huntington 25 Checking: Earn a higher 0.25% APY and 10% credit card reward bonus

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Huntington Bancshares, Inc. Review: A Wide Range of Lending Services

From first-time home buying experiences to that next big home improvement, there’s a lending option from Huntington with flexible rates and terms that will work with you, not against you. Alongside expert loan officers standing by to get you where you want to be, take a look at the following types of mortgages available:

- Home mortgages

- Specialty mortgages

- Home equity loans

- Auto loans

- Personal loans

- SBA loans

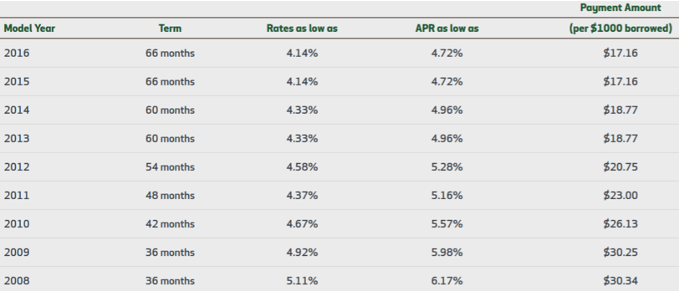

Next, we’ll take a look at current auto loan rates based on model and term length:

Image Source: Huntington

Huntington Bancshares Review: High Investment Potential

As a trusted investment advisor, Huntington stands by just one approach: listen, plan, and advise. Without this, there’s no possible way to do anything but sell you generic products, and that’s definitely not what you need. So, when you are ready, the team at Huntington is ready to take the first step. Here’s a glimpse of what lies ahead:

- Life and Income Planning: Work with a team to plan for college, retirement, and everything in between.

- Grow and Manage Your Wealth: Create a proactive investment strategy to grow your wealth.

- Manage Your Risks: Safeguard your hard-earned money with insurance for a variety of needs.

- Trust and Asset Management: Receive timely advice to help you manage your assets now and for the future.

Huntington Bancshares Review: Protect What Matters to You

Protect yourself and your family from the unknown, but make sure you do it with the coverage that reflects your specific situation, not some one-size-fits-all policy. Huntington offers custom insurance options for the following situations:

- Home

- Individual health

- Life

- Motor vehicle

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.