About AdvisoryHQ

AdvisoryHQ News was launched in 2015 and has since become one of the fastest-growing review and ranking media for the financial advisory, banking, mortgage, investment, wealth management, and accounting sectors. Read more: Overview of AdvisoryHQ News.

Building Our Ranking Methodology

Based on detailed keyword analysis using Google, Bing, Yahoo!, Ask.com, AOL, and other search mediums, AdvisoryHQ has determined that the average Canadian consumer searches for financial advisors and investment managers that fit some or all of the following dimensions:

- Independent financial planners, advisors, and asset management firms

- Advisors that are client-focused and have taken on fiduciary responsibilities

- Firms that provide customized services

- Firms that ensure total objectivity and conflict-free decision making

- Fee-only advisors and wealth managers

- Fee-based advisors that also act as a fiduciary to their client

- Advisors that operate on a fee-for-service or advice-only basis

- Firms that have a well-established advisory team with extensive experience

When constructing the logic for AdvisoryHQ’s selection methodology, the review team integrated the above requirements as part of our selection criteria. The following sections provide a detailed review of our methodology criteria, factors, and ranking process.

Note: AdvisoryHQ reviews and ranks advisory and investment companies only. We do not review or rank people (financial professionals, investment individuals, etc.)

Fiduciary Responsibilities (Defined)

A fiduciary is any person, institution, or entity that holds a legal or an ethical relationship of trust with another person or persons. Typically, a financial advisor that prudently takes care of money or other asset for a client and places that client’s interests ahead of their own at all times could be deemed a fiduciary.

An investment manager or financial advisory firm could act as a fiduciary based on regulatory, ethical, or business-based reasons. Irrespective of the reasons for taking on fiduciary responsibilities, such an advisor, wealth manager, or financial planner is required to act in the best interest of the party whose assets they are managing.

A fiduciary advisor is expected to manage his or her clients’ assets for the complete benefit of the client rather than for his or her own profit. This is what is known as the Prudent Person Rule of Care, a standard that originated from an 1830 legal ruling.

Don’t Miss:

- Ranked by AdvisoryHQ? Permission to Use Your FREE Award Emblem

- How Other Advisors are Promoting Their Award/Recognition

- About AdvisoryHQ

- Meet the AdvisoryHQ Team

- Do Advisors Have a Say in Their Review & Ranking?

- How Long Does an Advisor Remain on the Top Ranking List?

- Can Advisors Request Corrections/Additions to Their Reviews?

- Can Anyone Request a Review of an Advisory Firm?

- Do Firms Pay for Their Ranking?

- Permissions for Reprints

Objectivity

Our review and ranking articles are always 100% independently researched and written. Firms do not even realize that they are being reviewed by AdvisoryHQ until after our reviews have been completed and published to the public. Read more: AdvisoryHQ's Objective Approach.

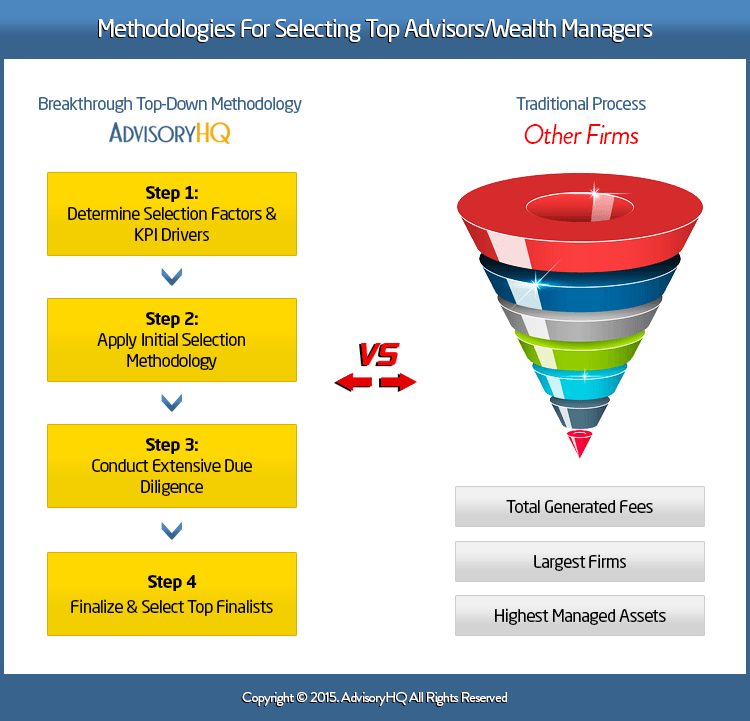

Selection Methodology for Identifying Top Advisors in Canada

Below is a step-by-step breakdown of our methodology process.

Step 1: Develop a Comprehensive List

Using publicly available sources, AdvisoryHQ identifies a wide range of financial advisors, registered investment managers, wealth managers, and financial planners that provide services in a designated area.

Step 2: Apply Initial Threshold Filters

After developing a comprehensive list of firms, our review team then applies the initial methodology filters to narrow down the list of identified firms.

Initial Filters:

- Fee Structure (fee-only vs. advice-only vs. fee-based vs. commission-based)

- Fiduciaries

- Independence (a status that minimizes conflict of interest issues)

- Scale of innovation

Fee Structure (Fee-Only vs. Advice-Only vs. Fee-Based vs. Commission-Based)

Based on what a lot of consumers in Canada are searching for, AdvisoryHQ’s methodology logic is “fee-only” and “fee-based (only if the advisor is a fiduciary)” centric. However, there are times when the review team will identify and rank one or more advisory firms that have a commission-based structure based on reasons explained below.

Advisory firms in Canada often offer more than one fee structure, depending on the type of service you desire. Therefore, some of the firms listed in our articles may be fee-only and fee-based, or fee-based with a commission fee structure option. AdvisoryHQ will only include fee-based firms that put their clients’ interests ahead of their own and all other interests.

Fee-Only (or Advice-Only):

Fee-only (or advice-only) financial advisors, financial planners, and wealth managers do not accept commissions or third-party referral payments. Their only source of advisory payments is their clients. In Canada, you might notice these types of firms being referred to as “Advice-Only” since the financial advisor is paid by their clients for the advice and recommendations they give. Advice-only firms provide professional advice on an hourly or retainer basis.

A fee-only (or advice-only) structure minimizes the inherent conflicts of interest that come with selling and recommending financial products. While a client’s objectives, not the advisor’s method of compensation, should drive the advisor’s recommendations, this is not always the case. This approach is devised to aid you in feeling safe when fully disclosing your personal financial status, so that the firm can provide you with comprehensive advice and make the right financial decisions for you.

Across the financial industry, a lot of firms and individuals that call themselves “financial advisors” are actually commission-based financial product salespeople. Their compensation is determined solely by the quantity of financial products they sell rather than the quality of their advice.

AdvisoryHQ’s selection factors and logic have been designed toward identifying, selecting, and ranking the top fee-only and fee-based (fiduciary) advisory firms across Canada.

Fee-Based and Client-Focused:

Our methodology also favors fee-based advisory firms that act in the clients’ best interest. Fee-based advisors that are also fiduciaries are expected to fully disclose any conflicts of interest and are also expected to always place their clients’ interests ahead of their own.

Many consumers confuse fee-based advisors with fee-only advisors, and that is unfortunate because there are some critical differences between these two types of compensation models. Fee-based advisors receive some of their compensation directly from their clients, but they are also free to accept commissions from the companies whose financial products they sell.

Oftentimes, the fact that the advisor earns commissions is not readily provided to the client or apparent in the client’s statement.

Our goal when presenting our rankings is to provide a wide range of top rated advisors to a wide range of client types. In some cities, we have observed fee-based advisory firms that provide an amazing level of service to clients and have fees that are sometimes less than those charged by fee-only advisory firms that operate in that same geographical location.

Here at AdvisoryHQ, our methodology is focused on identifying, ranking, and presenting the top-rated, fee-only and fee-based fiduciary wealth advisors and investment managers. However, we do acknowledge that there are good-intentioned wealth advisors who choose to work under different compensation structures; however, too often their clients are unaware of the conflicts of interest that exist in some of these models.

Commission-Based Advisors:

Although AdvisoryHQ’s selection methodology favors fee-only, advice-only, and fee-based (fiduciary) wealth managers and financial advisory firms, we might sometimes (in extremely rare cases) include one commission-based firm to the list of top-ranking advisors.

Here is why…

Our goal is to identify and provide broad ranging lists of advisory firms who can meet the needs of different consumer types, including high and ultra-high-net-worth investors. Ultra-high-net-worth investors are those with investable assets of at least $30 million. High-net-worth investors are those with an excess of $1 million in investable assets.

Some ultra/high-net-worth individuals and families seek out some unique, “velvet-glove” services that may be provided best by a particular advisory firm that is fee-based or commission-based in a particular city or state.

Fiduciaries

AdvisoryHQ’s methodology strongly favors Canadian financial advisors, planners, and wealth managers that act in their clients’ best interest from a fiduciary capacity (see the above section for an overview and definition of “fiduciary”). Here at AdvisoryHQ, we also refer to fiduciaries as “client-focused advisors.”

When working with a client-focused fiduciary advisor, you should feel comfortable that products and services will not be pushed onto you just to line the advisor’s pocket and increase their profits. When a client-focused fiduciary firm makes a recommendation, you can be sure that it’s done with the aim of further growing your investments and improving your financial portrait.

As a client-focused advisory firm, your advisor’s only thought when providing advice or selecting investment products for your portfolio is how the advice/investments will help you reach your financial objectives.

Independence (A Situation that Minimizes Conflict of Interest Issues)

AdvisoryHQ’s selection logic is designed to favor independent financial advisors and wealth management firms. These are firms that provide services and recommend financial products that are not based on any affiliation with a major bank or financial institution. An independent structure leads to a reduced conflict of interest situation.

Unlike an in-house advisor or broker, who is limited to the menu of products approved by his/her employer, independent financial advisors can help clients make informed and objective investment choices from a wide selection of financial products.

Scale of Innovation

The relationship with a financial advisor, planner, or wealth manager is normally a very long-term relationship. As such, it is essential to seek advisors who are constantly improving their services and business practices.

You will benefit from the most accurate and timely advice because such advisors invest in their team continually, including continuing education that is far beyond minimum industry requirements. AdvisoryHQ’s selection logic is designed to favor firms that emphasize innovation and consistent improvement as part of their overall policy, mission, goal, and strategy.

Step 3: Apply Integrated Selection Filters

After trimming down the initial list using AdvisoryHQ’s initial methodology filters, AdvisoryHQ’s review team then conducts a deep-dive assessment of the remaining advisors to select the final list of top-ranking advisors, planners, and wealth managers.

When performing their deep-dive assessment and due diligence, the team applies the following selection filters.

Selection Criteria | Why Is This Important? |

Resource Availability | An advisory firm’s greatest strength is its dedicated team of advisors, RIAs, R.F.P.s, CIMs, TEPs, MBAs, CFPs, wealth managers, financial planners, client service professionals, and other supporting staff members. One of the key dimensions that AdvisoryHQ reviews as part of its final methodology selection logic is the number of “available” advisory professionals and supporting staff. Firms with a broad listing of advisors, planners, asset managers, and other supporting staff will have the necessary bandwidth to provide the right level of support to a broad base of individuals, families, and institutions. However, our biggest focus is the number of advisors relative to the number of clients. As an example, a firm with a small number of advisors can still rank high if it only caters to a select number of clients, or if it provides niche services. |

Experience Level | In addition to the number of available resources, AdvisoryHQ also considers the combined experience level of the advisory team, including years of experience, certification, and leading roles within their fields of expertise. A team with a broad level of expertise and extensive years of experience will have the appropriate skillset to deal with a wide range of client financial issues. |

Transparency | Our selection methodology favors advisory firms whose fees are completely transparent. (Don’t miss: Average Financial Advisor Fees–Wealth Managers, Planners, and Fee-Only Advisors) Before beginning any work, your advisor should disclose their fees to you. This way, there are no surprises or hidden fees. |

Customized Services | The level of flexibility in providing customized services is another factor used in our analytical logic. AdvisoryHQ’s selection logic favors firms that provide services that are tailored toward their clients’ unique situations. |

Quality of Advisor’s Website | Consumers like to review an advisor’s website in detail before contacting that advisor. As such, AdvisoryHQ considers the ease of use, graphical design, and functionality of an advisor’s website as part of our methodology. |

Open Door Policy | AdvisoryHQ also favors firms that emphasize an open door policy. An open door policy encourages you to ask questions, get to know their staff, and feel at home in their office. Such firms will actively encourage you to contact them throughout the year before you make major financial decisions or whenever you have financial questions. |

Audience | Advisors cater to various audience types. Some advisors mainly focus on providing services to individual investors, while others cater solely or mainly to institutional clients. Our focus is to identify and rank those advisors and wealth managers who cater to and work with individuals and families. |

Step 4: Generate the Final List

Based on the results of our assessment, AdvisoryHQ then selects the individuals and entities that make it into our various lists of top financial advisors, planners, and asset managers.

Scale of AdvisoryHQ’s Methodology Selection Factors

Please note that there are hundreds, if not thousands, of possible factors, filters, and selection criteria that can be applied to any ranking and rating selection across any industry. It is nearly impossible for any ranking or review company to accommodate all possible selection filters when developing a selection methodology. The selection filters outlined above are the only selection filters that we currently accommodate.

Note: AdvisoryHQ reviews and ranks companies and not individuals.

AdvisoryHQ is NOT a Financial Advisory Firm

The content provided on AdvisoryHQ.com is provided for news and information purposes only and is not to be regarded as financial advice. AdvisoryHQ is not a financial advisor, registered investment advisor, broker/dealer, wealth manager, financial consultant, financial analyst, securities broker, or any type of financial advisory firm.

The information we provide is for information purposes only. The content on AdvisoryHQ.com is general in nature and has been prepared without considering your specific objectives, financial situation, or needs. AdvisoryHQ is not responsible for any investment or financial decision made by you.

You and you alone are responsible for your own financial/investment research and investment decisions. Before acting on any information on our website, we strongly encourage you to first seek the advice of a qualified financial advisor, planner, and/or wealth manager. Please review our Terms carefully, as by accessing or otherwise using this site, you are agreeing to be bound contractually by the Terms stipulated here.