AdvisoryHQ’s Methodology for Selecting UK Banks, Credit Unions, & Building Societies

Is Digital Banking Our Future?

The relationship with a bank or building society normally ends up being a long-term relationship. Are you the type of consumer who prefers a face-to-face interaction at a brick-and-mortar bank, or do you prefer conducting your banking transactions on the go or from your own home using a smart phone, tablet, or computer?

According to a study performed by Accenture Global Consumer

Pulse Research, “every banking customer is a digital customer.” While not all consumers have embraced the digital world, it has become more and more important to consumers across the board.

Accenture’s research has showed that consumers just opening a banking account at 18 through the age of 34 who have grown up in the digital world are two to three times more likely than consumers 55 and older to have a preference for more digital interactions than what companies currently provide. Yet, through its research it has found that the older group is open to broadening their portfolio and experimenting with digital interactions.

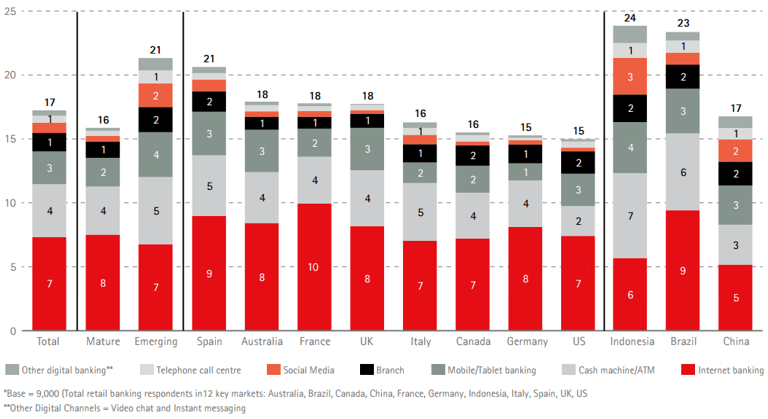

As you can see from the figure below, the majority of consumers in the UK. prefer to conduct their banking via the internet:

Along with how and where you want to do your banking transactions, you also want to consider the fees charged and the types of services provided by the bank or building society.

So, based on the wide-ranging spectrum of banking fees, combined with a wide range of interest paying accounts, how are you supposed to find time to conduct the detailed comparison research needed to identify “the best financial institution for you?”

That’s where AdvisoryHQ comes in.

AdvisoryHQ’s Objectivity

Our review and ranking articles are always 100% independently researched and written.

Firms do not pay to be included in our ranking. In fact, most firms do not even realize that they are being reviewed by AdvisoryHQ until after our reviews have been completed and published to the public.

Read more: AdvisoryHQ’s Objective Approach.

AdvisoryHQ’s Methodology for Selecting and Rating Banks, Credit Unions, and Building Societies in the UK

Conventional methodologies used by firms, like Forbes and Bankrate.com, to rank financial institutions are typically focused on return on average equity, profitability/efficiency ratios, nonperforming loans, interest margins, return on assets, and other key financial ratios and metrics.

To generate a more reflective ranking, AdvisoryHQ went beyond fees, ratios, and metrics. We developed the below breakthrough “Bank and Building Society Selection Methodology” that is based on the quality of services and overall value provided by the financial firm and not on financial ratios.

Key Questions to Ask

When seeking top rated banks, credit unions, or building societies to bank with, the first thing you need to figure out is what you want from a bank, credit union, or building society.

- Do you just want a checking account? Or a savings account, too?

- Do you want to use one financial institution for all your needs, including a personal loan, mortgage, home equity line, car loan, and other products?

- Are you seeking a financial firm that provides fee-free ATM withdrawals, higher yields, or a friendly neighborhood branch?

- If you are more comfortable performing most of your transactions online and are interested in earning a higher annual percentage yield (APY) on a free checking or savings account, then have you considered using an online-only bank with high-yielding accounts?

These are just some key questions that you’ll need to ask yourself as you review the top rated banks, credit unions, and building society lists published by AdvisoryHQ News.

Building Our Bank, Credit Union, & Building Society Ranking Methodology

When building our “top-down selecting methodology” for identifying and ranking banks, credit unions, and building societies in the UK., AdvisoryHQ’s review and selection team considered the factors presented below.

A big focus was given to banks, credit unions, and building societies that provided a vast array of services and products, including checking, savings, online banking, loans, mortgage, and other credit products.

Not everyone knows how to keep good track of their spending or savings/checking accounts, so firms that are education-friendly were highly favored when developing our selection logic.

Other considerations included:

- Legitimacy/Trustworthiness (reputation of the bank)

- ATMs (Are they are part of a network of machines that won’t cost you, or will you pay ATM fees every time you use your ATM card?)

- ATM coverage (only a few locations or across the state?)

- # of branches

- Asset sizes

- Hours and convenient locations

- If you travel, will the bank/building society travel with you?

- Online banking capabilities and services

- Product/service range & quality

- Competitive pricing & monthly fees

- Bill pay services & mobile app availability

- Overdraft protection (and the cost)

- Innovation

- And many more

AdvisoryHQ’s Four-Step Selection Methodology Structure

Below is a step-by-step breakdown of our methodology process.

Step 1: Develop a Comprehensive List

Using publicly available sources, AdvisoryHQ identifies a wide range of banks, credit unions, and building societies that are providing banking services and products in a designated area, city, state, country, or geographical location.

Step 2: Apply Initial Threshold Filters

After developing a comprehensive list of banks, credit unions, and building societies, AdvisoryHQ then applies the initial methodology filters below to narrow down the list.

Initial Filters (List):

- Full-service (scale of service)

- Size of assets and deposits

- # of branches

- Checking account options

- Savings account options

- Overdraft protection

- Credit cards & rewards

- Loans offered

- Mobile banking option

- Transparency

- Quality of the bank/building society’s website

Initial Filters (Overview):

Full-Service (Scale of Service)

With full-service banking, you can do more than just simply open a checking and/or savings account. Typically, these services include:

- Consumer credit

- Mortgage financing

- Commercial lending

- Trust services

- Pensions

- IRAs

- Insurance

- And more

Our methodology has been designed to favor full-service banks, credit unions, and building societies, to ensure that consumers are able to select a firm that can meet their wide-ranging financial needs.

Firms with a broad listing of services, products, and experienced staff are best positioned to provide comprehensive banking support to individuals, families, and institutions throughout the life of each relationship.

Building Societies & Credit Unions:

Building Societies

In the UK, they not only have banks where you can conduct your financial business; they also have Building Societies. A Building Society is owned by its members. Customers automatically become a member of a society when they take out a mortgage or simply open a savings account.

If you are a member of a certain society and have a savings account or mortgage you have certain rights to receive information and vote, as well as the ability to attend and speak at meetings. It doesn’t matter how much money a member has invested or borrowed, or how many accounts they have, each member is allowed one vote. Each building society has a selected Board of Directors.

Building societies take pride in how they conduct business. Some of these factors include:

- Increase in net mortgage lending

- Superior service to its members

- Competitive fixed and variable mortgage interest rates

- Fewer fines (than those of high street banks)

- Lower but more stable levels of profitability

- Small number of new complaints

Building societies differ from banks in a couple of ways. Banks are companies (listed on the stock market) and are owned by, and run for, their shareholder. Societies do not have external shareholders and are not companies. Because of this, they are able to run on lower costs and offer cheaper mortgages, and better rates of interest on savings.

Another difference between banks and societies is that societies have a limit on the proportion of funds that they can raise from wholesale money markets. A building society may not raise more than 50% of its funds from any wholesale market. On average, funds raised by building societies from wholesale markets is 30%.

The Building Societies Association (BSA) supports and is the voice for building societies and other financial service providers in the UK. Combined, these organisations serve over 20 million customers/members throughout the UK and have total assets of over £345 billion. There are currently 49 building societies throughout the UK.

According to the latest update from the BSA annual reports, building socieites have lower net interest margins than the big banks, which allows them to offer members an overall better rate.

Image Source: Building Societies Association (BSA)

Credit Unions

Credit unions in the UK are a lot like building societies in that they are member-owned, volunteer-staffed, financial co-operatives that operate with the purpose of providing credit and other financial services to a particular group or community that share a common bond. Such common bonds could be living or working in a certain geographical area, belonging to a specific organisation, or working for a particular employer.

To have the ability to conduct financial business with a credit union, one must be a member, often for a nominal fee. Generally, credit unions primarily provide loans and savings to its members, but many have branched out and now offer specialty services such as basic bank/checking accounts, online banking/apps, cash ISAs (Individual Savings Accounts), and more.

The PRA or Prudential Regulation Authority regulates around 500 credit unions with approximately one million members throughout the UK. These credit unions are spread across the UK with about 47% based in England, 19.1% in Scotland, 3.6% in Wales, and 30.2% in Northern Ireland. Approximately 1.5% of the adult population are members of a credit union in England, compared to 2.1% in Wales, 6.8% in Scotland, and 36.9% in Northern Ireland where credit unions are exceedingly more popular.

When reviewing building societies and credit unions for ranking, AdvisoryHQ considers each credit union and building society’s overall asset size. Building societies and credit unions with higher asset sizes are favored more on AdvisoryHQ’s selection methodology.

Building societies and credit unions with larger asset sizes can achieve greater levels of economies of scale.

Banks

When developing our methodology for selecting banks, we also considered total assets as part of our selection logic. However, total assets were not given as much weight in our methodology formulas as they were given for building societies and credit unions.

When it comes to banks in the UK, the consumers are what matters. Taking into account what the consumers want, you can see by this chart that they value the fees charged, return on savings, security, the ethics and stability of the bank, and other concerns, all of which we took into account when generating our list.

Along with what banks in the UK already offer, the consumer wants more. Some of the filters used in generating our list of top UK banks are listed below:

# of Branches (Banks)

The number of branches a bank has weighs higher in our selection methodology for ranking top banks in a specific geographic location. This is important because a bank that has only one or a few branches may not be as convenient to do business with if a consumer is located far away from a branch.

Checking Accounts

Finding a financial institution that fits all of your needs can be a tricky task.

When developing our selection methodology, we integrated search elements for firms that offer various checking account options to allow you to choose the option that best suits your needs.

While some banking firms and credit unions offer basic checking accounts with no monthly maintenance fee, others offer accounts with additional “value-add” features and charge monthly fees for the use of such accounts.

Savings Accounts

Finding a savings solution that meets your unique needs is of utmost importance to most consumers. Our methodology favors banks and credit unions with versatile features that can help you with your savings goals.

Do you simply want a basic savings account to put away money for that summer vacation, or are you looking for a savings account with higher interest rates to help maximize your savings to save for your child’s college tuition or pay off your debt?

Either way, our reviews will provide you with the pertinent information to make the right choice when choosing a savings account.

Overdraft Protection

Let’s be honest; it happens. We make a purchase and don’t actually have the funds to cover the payment. Having overdraft protection on your account will allow you to avoid overdraft fees. Should you find yourself in a situation such as this, the bank or building society would cover the purchase using either money from your savings account or debit card.

Credit Cards and Rewards

You can find the card that’s right for you, right at your bank or building society, without having to apply to a credit card-focused financial firm (For example, Capital One)!

Depending on the type you are looking for, you may be able to qualify for a credit card where you can gain rewards for the amount you spend or where you use it. Rewards can range from airline miles and hotel accommodations to earning points when you pay for gas or groceries. Typically, these points can be redeemed as cash, merchandise, gift cards, travel, or you can even choose to donate to an affiliated charity.

Loans

At some point in everyone’s life, a loan of some sort will likely be needed. Whether it is a home improvement loan to remodel your house, a home equity loan to buy a new one, or a student loan to go back and finish that degree, the more information you have, the better off you’ll be.

Knowing which firm offers the type of loan you need and what its payment options are is invaluable information that we aim to present on our top ranked review publications.

Mobile Banking Option

Have you ever left the house and remembered you forgot to pay your electric bill or transferred some money from your checking to your savings account?

With mobile banking, this is a non-issue; you can pay these bills or perform the transfer from your phone or tablet using the banking app.

Financial firms that provide this feature make it easier for their members to pay their bills or conduct online transactions. A study by Fujitsu shows that 37% (more than a third of the population) prefer to interact with their bank online and would threaten to leave their current provider if they don’t offer this feature and up-to-date technology.

Transparency

You always want to know upfront the types of fees you are going to be required to pay for certain accounts, overdraft fees, etc. Knowing such fees or rates will also assist you when deciding what type of bank to choose. Banks that make these types of fees clear are the types of banks you want to work with. As such, our methodology has been designed to favor such banking firms.

Quality & Quantity of Information on Products Services

We know that consumers value their time, so we have helped out by selecting banks that provide quality information on its services, so you, the consumer don’t have to.

Quality of Bank/Building Society’s Website

We want to provide you, the consumer, with firms that are easy to navigate online. Yes, we are reviewing mostly brick-and-mortar banks that you can physically visit, but there will be times when getting online to do your banking is your only option.

Also, when learning more about a banking institution, consumers often visit the bank or building society’s website for additional information.

Therefore, we designed our selection logic to favor banks, credit unions, and building societies with user-friendly and easy-to-navigate websites.

Step 3: Deep Dive Assessment

After trimming down our initial list using our initial methodology filters, we then conduct a deep dive assessment of the remaining banks/credit unions/building societies to select our final list of the top financial institutions.

Step 4: Generating the Final List of Top Banks Credit Unions & Building Societies

Based on the results of our overall assessment, we then select the entities that make it onto our list of the top rated banks, top rated credit unions, and top ranked building societies.

The firms we review and rank often do not realize they are being reviewed until after we’ve published our ranking and comparison reviews to the general public. This is to ensure an absolute level of objectivity in our reviews.

Scale of AdvisoryHQ’s Methodology Selection Factors and What’s Not Included

Please note that our methodology does not factor in the below analytical elements when ranking/selecting top rated banks, credit unions, and building societies:

- Return on average equity

- Return on assets

- Return on investments

- Profitability/efficiency ratios

- Nonperforming loans (NPLs) as a percentage of loans

- Return on average tangible common equity

- Net charge-offs as a percent of total loans

- Net interest margin

- Nonperforming assets as a percent of assets

- Reserves as a percent of NPLs

- Two capital ratios (Tier 1 and risk-based)

- Revenue growth over the last 12 months

There are hundreds, if not thousands, of possible factors, filters, and selection criteria that can be applied to any ranking and rating selection across any industry. It is nearly impossible for any ranking or review company to accommodate all possible selection filters when developing a selection methodology.

Also, the research performed by AdvisoryHQ and the top ranking publications and findings we publish are meant for everyday consumers.

As such, we focused our groundbreaking methodology on those banking elements that provide real and overall value to our key constituents: the average U.S. consumer.

If you are an investor who is seeking bank/credit union/building society financial valuations (ROE, ROI, ROA, etc.) or looking to invest in a financial institution, then you can explore the online brokers below that provide key reporting and analytical metrics.

- TradeKing Online Broker (Trade stocks for Just $4.95/Trade in Any Market – Bear or Bull)

- FirsTrade Broker (Get up to $2,500 Cash Back and 30 Days Free Trades – Limited-Time Offer!)

- SureTrader Broker (Non U.S. Investors)

- OptionsHouse Broker

($1,000 Worth of Commissions on Online Trades (Serious Value for Serious Traders)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.