Overview: Best Ways to Open a Business Checking Account Online

If you are thinking of starting a new business or you are getting one off the ground, you might have a few questions about banking.

Here at AdvisoryHQ, we want to provide all the information you need to open a business account online. Everything is done online these days, right? So can you open a business account online? Yes!

In this article, we will examine:

- Business trends for this year

- Why you need access to online business checking

- A checklist of documents to open a business account online

- The best way to open a business checking account online

Small Business Trends for this year

Small business is big business in the USA right now. To give you an idea of the world of small businesses and what the landscape is going to be like this year, here are some statistics about the current state of small businesses:

- There are 28 million small businesses in America

- Small businesses account for 55% of jobs

- More than 500,000 people started a business every month in 2014

- More than a third of US employees work in a business with fewer than 100 staff members

Best Ways to Open a Business Checking Account Online

A big trend in small business for this year is the rise of businesses owned by minority groups including:

Banks are more than aware of the needs of business owners and are giving plenty of options to those entrepreneurs, which we will discuss below.

See Also: Best Banks for Small Business Banking | Reviews & Comparison

Starting a Business? You NEED a Checking Account

You may well be among the people who are starting a business or planning to start one. Business is about money, so one of the first things you need to sort out a bank account. If you have a business, you need a business checking account—even cash based businesses.

One of the key benefits, other than receiving and making payments, is that it is best practice to keep personal finances separate, no matter how small your business is. In addition to making it easier to have a picture of how healthy the business is, it will also make it a whole lot easier when it comes to calculating and paying tax.

There are so many institutions that can offer you services for online business checking, including:

- Big, national banks

- Small, local banks

- Credit unions

- Online banks

- Online payment systems (e.g. PayPal)

AdvisoryHQ will guide you with some pros and cons of each of these types of financial institutions so that you can decide the best way for you to open a business bank account online.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Too Expensive? How to Open a Free Business Checking Account Online

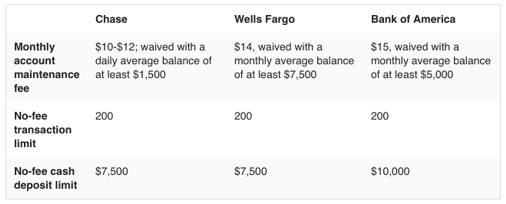

It may seem most logical to you to open a business checking account online with one of the household name banks—Wells Fargo, Bank of America, or Chase. They do offer great options for an online business checking account. The only catch is that using these big-name banks comes at a price.

How to Open a Free Business Checking Account Online

As you can see, unless you are maintaining a hefty balance (varying between $1,500 and $5,000), you are going to end up paying nearly $200 per year in account maintenance fees. On top of that, any transactions more than $200 are going to come at a price as well.

But it is not all doom and gloom. Some major banks do offer a free business checking account online, depending on what the business is. For example, if you are starting a business that is not going to have many monthly transactions—maybe a consultancy firm or the like, US Bank’s Silver Package might suit you.

Everbank also offers completely free online business checking, but only for sole proprietorships.

If you are a corporation, don’t worry—you may still be able to open a free business checking account online, or at least one that won’t cost you your entire start-up capital. After all, you are more than likely just starting out, and you don’t need to be spending hundreds on your online business checking account. Do your research online to try and find those banks offering free business checking accounts online.

Don’t Miss: Best Bad Credit Business Loan Lenders | Get Start-Up Business Loans with Bad Credit

Open a Free Business Checking Account Online with Your Local Bank

What’s the difference between a huge, national bank and a small, locally-owned bank? If you are a small fry, your local bank may be able to give you more time and attention. Small, local banks are good at developing relationships, and they are willing to negotiate costs. Technically, they are a local business, and you are a local business, so why not do business together?

Furthermore, smaller banks have smaller overheads, so they are in a better position to help you to open a free business checking account online.

Free Business Checking Accounts

Go to a Credit Union to Open a Business Bank Account Online

Credit unions are non-profit organizations. They are membership organizations that were created for groups of people to support each other financially. Credit unions are not looking to rip you off. They may be a good place to start when you are looking for options to open business account online.

Their websites may not be as fancy as the big banks that you know and trust, but credit unions can offer a lot when it comes to online business checking. Many can offer you more incentives to open a business checking account online than their larger banking counterparts.

Just one example of a credit union with promising options for those looking for a business checking account online is Beth Page Federal Credit Union. This organization, among other things, offers interest on your online business checking account.

Aside from this, their website promises:

- Earn interest on your balance

- No minimum balance required

- No monthly service charge

- No transaction limit

- No deposit fees

- Free business debit card

- Free online banking

Other credit unions offering similar packages to open a business bank account online are:

- Sound Credit Union

- Safe Credit Union

- America First Credit Union

For more information on what credit unions have to offer businesses, check out Advisory HQ’s “Top Credit Unions For Business.”

Using Online Payment Services

Most of us have used PayPal (or other online payment services) to pay someone for a service or item—so is this a viable option for business owners looking to open a business bank account online? Yes and no. Let’s be clear here—PayPal and other online payment services are not bank accounts. But that does not mean that they are not useful for small business owners.

If you have a small, home-based business, an option like PayPal has a lot to offer. Some of the pros include:

- It is an internationally recognized payment system (good for international customers)

- It is easy to make transfers

- No sharing of credit/debit card information

- It is free to sign up

- It is a secure site

Using Online Payment Services

However, there are some pitfalls, including charges and commission on transactions (2.9%), difficulties to find a human-to-human customer service contact, and lack of control when there are disputes (your account could be frozen without warning).

PayPal once offered interest to customers who left a healthy balance in their account.

Without this enticement, there is less reason to leave large sums of money in your PayPal account, and it may be advisable to transfer it to your online business checking account.

It is good to have a PayPal account for some transactions, but many advise that you should not think of it as an online business checking account.

Related: Top Banks for Free Business Checking | Ranking & Review

What Do You Need From Your Online Business Checking Account?

One way to quickly cut to the chase when you want to open a business checking account online is to figure out what you will need from the account before you start looking at what is on offer.

Before you open a business account online, ask yourself these questions about your business.

- How many transactions are you likely to make per month?

- Will you be making international transactions?

- Will you have staff members that need access to the account?

- Do you need a debit or credit card?

- Will your staff members need debit or credit cards?

If you have this information clear in your mind, it will make it much easier for you to decide which online business checking package is best for your business. This is because you will be able to calculate the costs of transactions, international transfers, cash withdrawals, and extra signatories.

Documentation Required to Open a Business Account Online

Although it just takes moments to start the application process to open a business checking account online, the bank or financial institution that you are applying with may need some documentation to support your application, which can be brought into a branch or posted to the bank.

To save yourself some time, it is good to have the relevant documents on hand so that you can finalize the process to open a business account online.

Requirements to open a business account online vary from bank to bank. You will need identification and personal details such as address (and proof of address) and social security number.

Furthermore, you will need detail relating to your business. Here is a sample checklist to open a business bank account online:

- Completed bank mandate form

- Specimen signatures for all those authorized to do transactions on the account

- Cash or checks to open the account

- Memorandum/Articles of Association

- Certificate of Incorporation (if relevant)

- Certificate of business name (if relevant)

Popular Article: Best Business Checking Accounts |Ranking | Best Bank Accounts

Funds to Open a Business Bank Account Online

Unless you have found an option to open a business account online without a deposit, it is good to bear in mind that you may need a little bit of money on hand. Many banks require a minimum deposit to open a business checking account online. Here are some examples:

- Town Center Bank requires an opening deposit of $100 to open a business account online

- Wells Fargo says they need a minimum deposit of $25 to open a Business Choice Checking Account

- American Commerce Bank requires $250 to open a business checking account online

- BofI Federal Bank is an online bank that requires a much higher deposit of $1,000 in order to open a business checking account online

This may not seem like much when you are planning to be the next Bill Gates, but successful business depends on good planning—so keep these costs in mind when you open a business bank account online.

Best Online Business Checking Accounts on the Market for this year

As we enter this year, small businesses continue to open every day. With more minority groups succeeding in entrepreneurialism, banks and financial institutions have started to offer more personalized business checking accounts. So which one suits you?

It is always good to be able to compare what offers are out there when it comes to online business checking. As with all types of financial arrangements, what is best for one business may not be the best for you. In this section, we will look at a few of the country’s favorite online business checking offers.

You can refer to AdvisoryHQ’s thorough review of checking accounts here: “Advisory HQ’s Top Business Checking Accounts.”

A recent examination by Nerd Wallet of free online checking accounts concluded that some of the best packages are on offer from:

- U.S. Bank Silver Business

- Capital One Spark Business

- Wells Fargo Business Choice

Investopedia also carried out research into the best online business checking accounts, without the emphasis on free accounting.

- Bank of America

- Wells Fargo

- Citi

While the big banks have a lot to offer, they may not be the best option for small businesses due to some requirements such as minimum balance.

Free Wealth & Finance Software - Get Yours Now ►

Summary—How to Open a Business Checking Account Online

This year is going to herald in more diversity and growth than ever in small businesses in America.

Millennials are joining the business community, more work is being done online, and e-commerce is continuing to boom. Banks and financial institutions are aware of these developments, and there is a lot on offer for those hoping to open a business checking account online.

Every business is different, so businesses need to find the right online business checking account for them or their company. Some banks have three or more types of online business checking packages so that you can find one that suits you. As discussed, your decision will be based on the costs of transactions and other factors.

The good news is that there is a vast amount of choices for you. The bad news is that you have to do a bit of digging to find the right one for you. Here is a reminder of our top tips to get ahead of the game in order to open a business account online:

- Know your business (number of transactions, number of staff, international presence)

- Know the terms and conditions (minimum deposits, maintenance fees, transaction fees)

- If you’re small, think local—build relationships with local banks and credit unions

- Use supplementary payment sites—tools such as PayPal can be helpful if you have international clients and you are finding your feet

Read More: Best Online Business Banks | Ranking & Review

Image Sources:

- https://expertbeacon.com/

- https://www.thesimpledollar.com/banking/checking-and-savings/free-business-checking/

- https://rsfiber.coop/wp-content/uploads/2015/03/farmer-SS_113948509.jpg

- https://indiebusinessnetwork.com/wp-content/uploads/2014/12/paypal-iphone.jpg

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.