What You Need to Know About Optimus Futures

If you’re looking for a competitive futures broker that can provide industry-leading trading platforms, low day trading margins, and direct market access to global exchanges through low-latency order routing, then put Optimus Futures on your radar.

Like many professional independent brokers (IBs), Optimus meets the necessary requirements that virtually all traders expect: access to multiple clearing firms (FCM’s) who have memberships across several commodities exchanges in the US and worldwide.

But Optimus seems to have an extended capacity to provide service and guidance to traders no matter where they are in their careers–from beginners to professionals. This service comes with the type of technologies, data feeds, platforms, and competitive prices that are suited for the range of needs that different traders may have.

Every brokerage will claim this type of customer-driven flexibility, but Optimus is a broker who can actually deliver. This is especially true of their brokerage support services, which are expansive and consistent enough to give the impression that Optimus is larger than the tight-knit boutique operation it essentially is–more than just a notable achievement, it’s a competitive advantage.

Why Might Traders Consider Optimus Futures?

Two words: variety and flexibility.

As a trader, you have an account size, geographical location, technology requirement, and trading style that is unique to your own endeavors. Optimus has a wide range of clearing firms and offers over 40 trading platforms to support your specific needs. Plus, their support staff knows the ins and outs of each software, meaning they can help you if you ever get stuck on a functionality feature.

Depending on your location, they can also match you with the right data feed to provide a more seamless and low-latency connection. Their technology providers supply servers worldwide, so whether you are trading in Asia, Australia, the USA or the Middle East, they can help you find a stable connection–a real plus if you’re in a remote location.

Bottom Line: Optimus Futures offer solutions that are not only tailored to individual traders’ personal preferences but can also adapt should their needs change over time.

How does Optimus Futures operate?

Optimus believes that a trader’s previous experience plays a major role in which software they should trade on and what clearing firm they should choose, and that is why they place a tremendous effort into onboarding each new customer.

What does this mean, exactly?

It means if you’re a beginning or intermediate trader, one who is not used to using institutional software (say, the Bloomberg terminal), then you might need help with regards to the kinds of platforms that may best suit you. Optimus staff is quite knowledgeable and does a great of job matching clients to technologies.

Here’s something else to think about: “why should I go through an IB rather than directly through the FCM?”. Certainly, you’ve thought about this, along with most other traders. Well, let’s see how Optimus answers this question, taking text directly from their site:

Trade execution, exchange floor and back office operations are handled by our Futures Commission Merchants while we maintain the relationship with our clients. This arrangement allows us to give you the personal attention you deserve along with the powerful resources you require. We have the experience to provide our clients with the best possible brokerage services, but remain a nimble, customer-focused company with a complete lack of bureaucracy – Genuine, personal assistance and counsel to take your investment choices seriously.

Okay, okay. Let’s look past the squeaky-clean “institution-speak” that’s common to every broker and break it down to what’s really important: what all of this means to you as a trader.

“Personal attention” is the reason why FCMs work with IBs. FCMs are “exchange members” whose primary role is to interact with the various exchanges they transact with on behalf of clients like you. They are busy overseeing the transactions, settlement, and margins risks of each contract and client. FCMs rely on the expertise of their IBs to assist customers in certain areas, and in the case of some IBs, they rely on their knowledge of technology and trading platforms.

Hence, IBs like Optimus Futures exist to provide the personalized service and expertise that clients need. Their customer support team is more than happy to answer all your questions and/or concerns on the phone, by email or live chat.

If you like to do your own research, you will be impressed with their knowledge base of informative articles, YouTube channel with hundreds of tutorials and an active trading community where you can talk with other retail traders.

You can even get help after hours from their 24/7 Help Desk through their clearing partners. Trust us on this–when you need help around the clock (particularly if you hold an “overnight” position), you’ll be very grateful to have a broker who can provide just that.

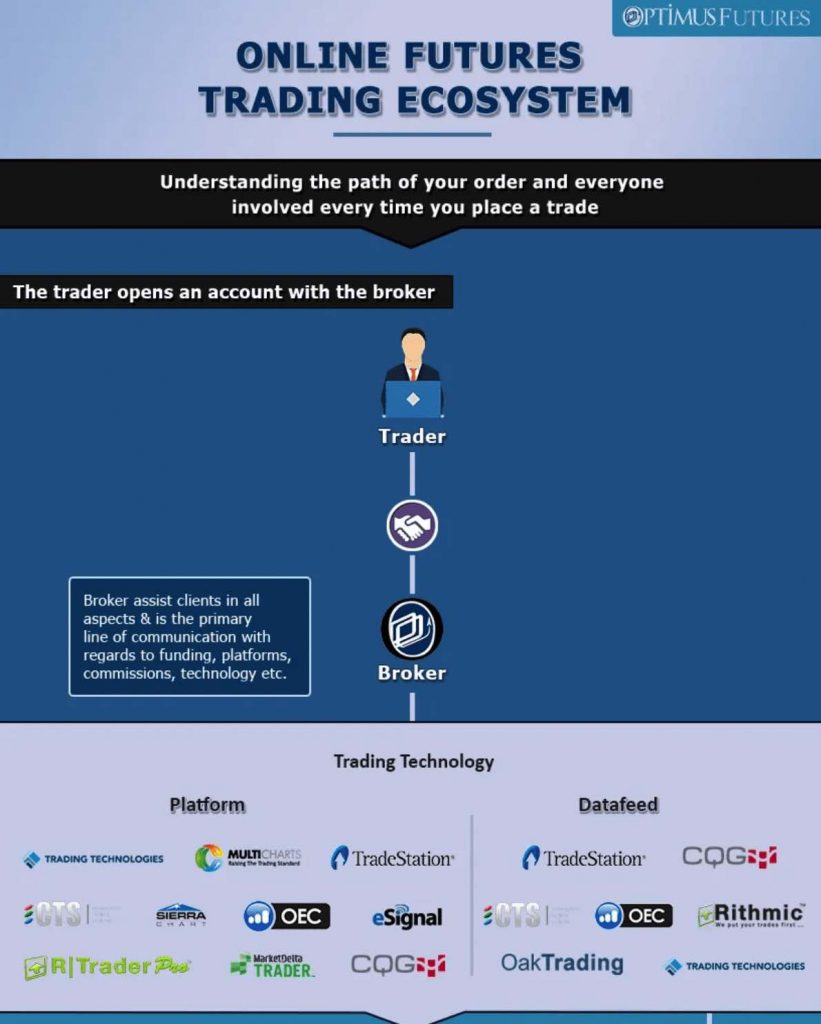

And in keeping with Optimus Futures’ spirit of complete transparency, we also found a very handy infographic that they created in order to help their customers, or anyone interested in learning more about futures, about how the futures industry works.

Click on the infographic to expand

Infographic Source: Optimus Futures

Transparent Pricing and Commissions

Pricing is an issue for most traders shopping around for competitive brokers. The reason for this is not necessarily because of price but because brokers tend to cloud their pricing policy.

Why do brokers do this?

As petty as it may seem, they’re trying to hide the higher costs in plain sight, or in language that isn’t all that transparent. If you’ve shopped around long enough, you’ve likely come across the strange variations in language that, strangely enough, can be broken down into a) commissions plus b) fees on a round-turn basis.

Optimus Futures provides transparent commissions to match your trading frequency, technology and platform. Fair pricing is their policy. The pricing will vary, of course, depending on whether you are a day trader (assisting with low day trading commissions), position trader, or swing trader.

Optimus understands the impact of cost and transactions on performance, so they do their best in communicating the cost in a straightforward manner so there are never any surprises.

Day Trading Margins

Under specific conditions, Optimus Futures can provide traders with very low day trading margins for the major futures markets like the EMini S&P, EMini NASDAQ, Emini Dow, Emini Russell, Crude Oil Futures and Gold Futures.

According to their site, day trading margins are determined by the clearing firms and is based on market volatility, open interest, customer credit profile and the level of funding.

Check out their day trading margins here.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.

Trading from Multiple Locations

If you are constantly on the go, you may need a desktop, iPad, and mobile phone to monitor, adjust, or execute your trades.

One plus is that Optimus Futures has access to a variety of platforms that are either downloadable or mobile. In other words, you can switch trading environments when necessity calls for it.

Also, you may need to connect several trading platforms at the same time into one workspace. This is one unique service that Optimus Futures provides.

Just so you know, you can have access to an advanced web-based trading platform such as Trading Technologies, CQG Desktop and CTS-T4 that are used by professional traders worldwide. Optimus also has tight integration with platforms such as MultiCharts, Sierra Chart and others that will work with the CQG and Rithmic data feeds.

Fast Execution

Let’s talk about speed. As a day trader, you know how important speed is when it comes to trade execution. Faster speeds can mean lower levels of slippage. It can also mean the difference between entering and missing a trade.

How do you solve the issue of slow execution? Using a low latency data feed whose speed can be measured. Optimus Futures provides quite a few data feeds on the low-latency spectrum, and it might be worth giving them a call to see for yourself (and compare with other brokers).

Also, bear in mind that location can make a big difference. Optimus Futures can help you decide which data feed to use based on your location, computer setup, third party software and other variables that may be of impact on your trading setup. Then they connect you to one of the premier connections such as CQG, Trading Technologies, Rithmic or CQG.

Optimus also provides API in different programming language for those who have their own front-end solution.

Global Market Access through Multiple Futures Commission Merchants

We mentioned this about (multiple FCMs) but let’s get to the nitty-gritty. Which exchanges or countries are accessible through Optimus? Here’s the list:

- CME Group (CME, CBOT, NYMEN and COMEX)

- Intercontinental Exchange (ICE)

- Eurex

- Osaka – Japan (JPX)

- Sydney Futures Exchange (SFE)

- Hong Kong Futures Exchange (HKEX)

- Singapore (SGX)

Proficient Technical Support and Trading Education

When you start with Optimus Futures you will get a comprehensive video guide to help you learn the different functions that the platform offers. Optimus has created extensive videos on their YouTube channel along with Knowledge Base documentation with in-depth, step-by-step guides.

While your broker would be your main contact for things such as costs, margin, and market access, the dedicated technical support staff will help you with your software and data connectivity. Any issues arising from the use of the software would be handled first by Optimus Futures in-house staff.

Support is provided via phone, live chat, email or screen share in cases when necessary. Additionally, you can ask questions on their online futures trading forum, which is open to customers and non-customers.

Lastly, you can clearly see their efforts behind their futures trading blog with fresh and relevant content covering topics concerning the issues that futures traders encounter.

Customer Exclusives

Based on their style of service, Optimus Futures is interested in more than just the transactional business of their customers. They care about sustainability–and that can only come about if customers are successful in their trading.

Hence, Optimus offers an assortment of tools to help customers make good trading decisions. One such tool is Optimus News, which allows you to see which economic announcements can potentially affect your trading. For example, you will see the specific dates and hours for the American Petroleum Institute or the COT report coming out of the CFTC. You can filter the news by market or country.

Optimus Futures has also written a free indicator that allows trader to gauge volatility over certain periods. It is called the MTF indicator and it tracks Volatility and Price Action through the daily trend, range and momentum.

If you are a Sierra chart user, you can get discounted prices through their specific clearing arrangements.

In-House Trading Agency

Blogs, Community, Podcasts, YouTube, Platform Guides–all of these are available to assist your trading and enhance your own personal knowledge base.

Online Reputation

As with most traders who care about due diligence, you’ve likely checked out Optimus’ reputation online, scouring through customer and 3rd party reviews. If you have, you’ll notice that the broker’s reputation speaks for itself. Haven’t done so yet? Just Google them. You’ll find out rather quickly.

Conclusion: Optimus Futures May Be A Discount Futures Broker by Name, but it is an Exceedingly High-Quality Operation by Nature

If you are serious about trading futures and have done your homework on how the retail space operates, your path will eventually cross with Optimus Futures.

While other brokers may offer similar technologies around similar price points, you will be hard-pressed to find one that can match the sheer breadth and magnitude of futures trading solutions, in terms of platforms, datafeeds, clearing firms and exchange access, that Optimus Futures can offer.

Give them a call and see for yourself.

If you’re perfectly content with your progress as a futures trader or if you view trading as a mere hobby, then maybe Optimus isn’t the right fit.

But if you want to become a professional trader, learn the ins and outs of day trading as a career and are willing to learn to use the same tools institutional traders use to take their trading to the next level, you owe it to yourself to give Optimus Futures a call. The cool thing is that an actual person will answer your call (hard to find these days as automated communications abound).

Also, Optimus avoids the one thing that almost every person hates: a main line that is nothing more than a sales channel. Yes, there actually are knowledgeable people on the other end that are willing to help (not just sell). You can call for tech support, platform outage, execution slippage, funding and deposits and whatever else you need help with. You will be routed to an experienced professional that will be more than happy to assist you.

In other words, if you want to become a potentially better trader and need dedicated personal assistance and a brokerage that evolves with you as you grow, Optimus Futures may just be what you’re looking for.

Learn More at Optimus Futures.

Optimus Futures Contact

Toll Free N. America (800) 771-6748

International: (561) 367-8686

Email: [email protected]

Click Here for Live Chat

Click Here to Chat via Facebook Messenger

Text / WhatsApp: (954) 388-9149

Disclaimer:

Trading futures and options involves substantial risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of future results. The risk of loss in trading commodity interests can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity interest trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Optimus Futures, LLC is not affiliated with nor does it endorse any trading system, methodologies, newsletter or other similar service. We urge you to conduct your own due diligence.

AdvisoryHQ’s Objective Standards & Our Personalized Page Service

Our focus is on the everyday consumer. All of our research and publications are conducted from the end-user consumer’s perspective, and we publish our top-ranking reviews for anyone to view for free.

Both ranked and non-ranked firms can request to have a separate personalized profile, like the one above, which incurs a charge.

For additional information on AdvisoryHQ’s methodologies, click here: AdvisoryHQ Methodologies. For information on AdvisoryHQ’s objectivity approach, click here: AdvisoryHQ’s Objective Process.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.