Is Personal Capital Safe? What to Know about the Personal Capital App

When it comes to tracking your finances, many people may refer to the Mint app. Sure, Mint is great for keeping track of your spending habits, but there are alternative options out there that also have a lot of potential.

That’s where the Personal Capital app comes in. As one of the top money management apps on the market today, the Personal Capital app does much more than track your spending habits.

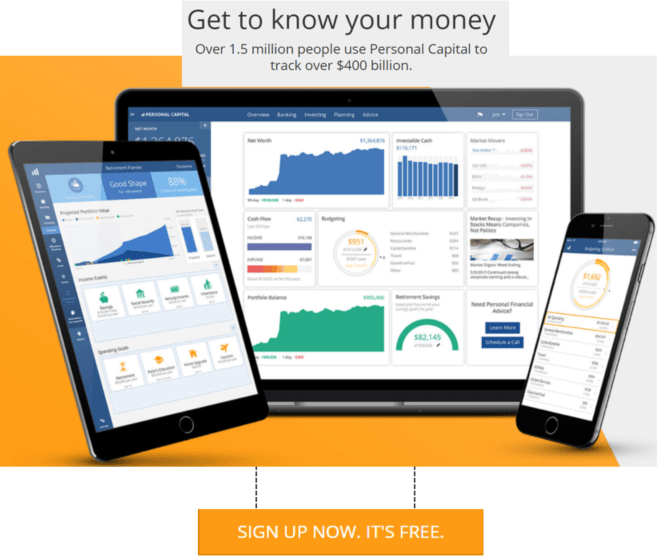

The Personal Capital money and investing tools provide a way to merge all of your separate financial accounts into one beautiful dashboard.

Sure, Mint has an easy-to-use interface. However, if you think you’ll miss Mint’s user interface, you’ll be pleasantly surprised with the Personal Capital app.

With this interface, you’ll be able to view your investments, IRAs, mortgages, credit cards, net worth, and so much more.

What’s great about the Personal Capital app’s dashboard is that it brings everything on to one screen, giving you an overall bird’s eye view of your financial status.

On top of bringing your accounts together, there are additional features, such as bill tracking, retirement planning, security, and financial advice from real advisors.

In this Personal Capital app review, we will be taking an in-depth look at all of these features.

See Also: Best Budget Apps | Budgeting Software Reviews

Personal Capital App Review

The founders of Personal Capital designed their software with one goal in mind: to build a better money management experience for consumers. It is with this philosophy that all Personal Capital money and investing tools are created.

To date, Personal Capital has 1.3 million users, $312 billion in tracked accounts, and $3.9 billion in assets under management.

Personal Capital App Review

With such exponential growth, it is no wonder that the Personal Capital app is one of the most popular money management apps available.

To better guide users toward determining which money management apps are right for them, our Personal Capital review will focus on highlighting the core features, programs, and functionality of the Personal Capital app.

With this Personal Capital review as a guide, we hope to provide users with all of the necessary information to make the best financial decisions when choosing between money management apps.

Who Is the Personal Capital App For?

You may be asking, “Why use the Personal Capital app when I have Mint?” Mint is certainly a useful application—however, the Personal Capital app has many features that Mint doesn’t.

If you just need simple bill tracking, stick with Mint. If you don’t have a lot of financial accounts to watch over, Mint should be more than enough.

However, if you tend to have trouble keeping track of all your financial accounts and need help investing in stocks, the Personal Capital app could become your best friend.

You can think of the Personal Capital app as a financial account aggregator. The Personal Capital money and investing app is designed to move everything into one place.

If you find yourself constantly checking different accounts and personally adding up your net worth, you would likely benefit from this app.

Many of us have IRAs, mortgages, and credit card transactions that require consistent monitoring. Keeping track of these things doesn’t exactly fit the definition of fun.

If you find yourself flustered by your financial life, the Personal Capital app was built with you in mind.

How Does the Personal Capital App Work?

Our Personal Capital review found that signing up for the Personal Capital app is free and straightforward. After you sign up, you will be taken to the dashboard. From there, you can easily add all of your financial accounts.

From banking accounts to mortgages, adding and authorizing an account is a few clicks away. After you add your financial accounts, the Personal Capital app essentially does the magic for you.

The Personal Capital app will give you your overall net worth, your standing on a successful retirement, and so on.

Don’t Miss: Detailed Wave Accounting Review—Is Wave Safe? Wave Accounting vs. QuickBooks

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

The Dashboard

The dashboard is the most important aspect when it comes to the Personal Capital app. You can view net worth graphs, cash flow reports, portfolio account balances, and the performance of your investments.

For our Personal Capital review, this is where the Personal Capital app shines.

Everything you’ll need is all in one place. Those with lots to manage usually have many different accounts spread across different apps. The Personal Capital App looks to bring everything together.

>> Click Here to Join Personal Capital Now! <<

The big sell of the dashboard is how much time and effort it will save you when you want to track spending, review investment/stock progress, and see overall cash in/cash out. The Personal Capital app makes this both easy and accessible.

For those who are interested in a full listing, our Personal Capital review has highlighted the full spectrum of dashboard tools, which includes:

- Net worth

- Cash flow

- Portfolio balances & allocations

- Key holdings

- Top gainers & losers

- Account balances & transactions

- Spending by account & category

- Income reports

- Spending reports & upcoming bills

- Investment returns

- Projected investment fees

Tracking Your Spending & Savings

Like Mint, you can track your saving down to the dime. You can even organize your spending into groups. For example, all restaurant and grocery bills can go into a “food” category. Office supplies can go into a “business” category and so on.

Our Personal Capital review found that the Personal Capital app makes this easy with a slick user interface. You will be able to view every spending category all in one neat circle chart.

>> Get Free Financial Tools at PersonalCapital.com <<

The Personal Capital app will also keep track of any bills you owe and give you reminders on upcoming bills. On top of tracking overall spending habits, you can also keep up with any upcoming bills.

Other Personal Capital app reviews report that the Personal Capital app’s spending tracker is about as pleasant to use as Mint.

If you’re familiar with Mint, you may be pleasantly surprised with how the Personal Capital app handles tracking.

Accessibility

If you need to check your portfolio progress or track your spending on the go, the Personal Capital app gives you a lot of flexibility.

Personal Capital app reviews demonstrated that the Personal Capital app can be accessed through almost any device, including phones, tablets, laptops, and just about anything with an Internet connection.

FREE Finance Software – State of the Art

(Click Below)

►► Get Your Free Highly Advanced Software from Personal Capital◄◄

Much like Mint, the Personal Capital app makes tracking everything simple. The difference is that you have access to more features than you would with Mint.

If you need to pull up information about your stock investments or retirement plan, all you need is your phone.

Retirement Planner

The retirement planner is perhaps one of the most useful tools in the Personal Capital app. With the retirement planner, you can plan and adjust your spending to ensure you have a successful retirement.

This section will give an overall standing of your retirement status based on large spending events, future investments, and savings. The Personal Capital app’s algorithms will take every variable into account and give you accurate future projections.

The Personal Capital app’s algorithms also take unexpected spending into account. This means that if you have to unexpectedly spend a large chunk of money, the planner can adjust accordingly.

Perhaps you are about to purchase a home, or you want to create a college fund for your children. Whatever big financial decisions you make, the retirement planner will take them into account and adjust the projections accordingly.

>> Improve your investing with Personal Capital NOW! <<

Our Personal Capital review found that the best feature of all may be the lack of involvement on your part. The retirement planner will automatically calculate your chances based on your financial status and accounts.

All you have to do is track your finances throughout the Personal Capital app, and the planner will take care of the rest.

Security

When it comes to managing your finances, security is an absolute must. Is Personal Capital safe to use? What type of Personal Capital security features are in place to protect financial information?

For those who are asking if Personal Capital is safe to use, the answer is yes, it is safe.

One big sell of the Personal Capital app are the extra security measures it takes to protect your money. Personal Capital security measures involve two-step authentication and registration of each device.

When you sign up, you’ll have to complete an authorization step through your email and through a phone text message. This may seem inconvenient, but it’s a must when it comes to security.

The Personal Capital app also requires you to register each new device. If you want to access the app with your phone, there’s a little song and dance you’ll have to go through before you can get things going.

This process is generally simple and is only a one-time measure. When it comes to financial matters, all financial institutions should apply extra security measures.

With multiple layers of security, Personal Capital security takes extra measures to keep financial information safe. This should be a big priority for just about anybody who wants to manage their finances.

Real Financial Advisors

The Personal Capital app has its fair share of algorithms and calculations, but it also provides help from real experts. Purchasing a home or having a child is a big decision. Sometimes, you need help from somebody who can guide you in the right direction.

The Personal Capital app recognized this and sought to connect experts to those in need. You can get advice for just about anything. From there, you can find out what you’re doing right, what can be improved, and what could be hindering your future.

There’s no better individual to catch a mistake than an expert. Personal Capital app reviews report that advisors on the Personal Capital app know their stuff and point others in the right direction. You’d be smart to use this to your advantage!

Popular Article: Top Money Management Software and Apps for All Devices (This Year’s Rankings)

Personal Capital Review: Summary

With so much to offer in such a simple interface, it’s easy to see value in the Personal Capital app.

To summarize, our Personal Capital app review has outlined a list of pros and cons. The pros include what this Personal Capital review has covered, and the cons signify possible red flags for investors who don’t have a high net worth.

You’ll find that the Personal Capital app is geared more toward individuals who do have a higher net worth; however, this doesn’t have to stop you from using the app.

Pros

Accessibility & Flexibility

As one of the top money management apps, Personal Capital comes with high accessibility and flexibility. You can use the Personal Capital app on a phone, tablet, or laptop.

Simple Use

Not only is the user interface pleasant, but the way in which the Personal Capital app aggregates data across many accounts makes things much easier for the user.

Strong Security Measures

Those who are asking “Is Personal Capital safe to use?” will be happy to know that the Personal Capital app is up to date with modern cybersecurity practices.

With multiple authentication methods, Personal Capital security makes it safe to connect financial data.

Retirement Planning

Using the Personal Capital app allows you to strategically plan for your retirement, even through any financial hiccups that may occur.

Free Financial Tools

Many of the beneficial tools and programs within the Personal Capital app are available free of charge.

While our Personal Capital review did find that there are certain services that incur fees (see the section below), the majority of users will be able to benefit from the Personal Capital app without using these additional services.

Notifications & Visual Aids

The Personal Capital app can be set up to send regular alerts and notifications to your email or your phone. This helps keep you on track and updated on any recent changes.

The financial graphs generated through the Personal Capital app are straightforward, making them easy for anyone to understand.

Thankfully, with the Personal Capital app, you don’t have to be a financial genius to understand how you can invest or save better.

Cons

Minimum Investment for Advising Services

For those who are planning on using the Personal Capital app’s advising services, be prepared to invest a minimum of $25,000. For some, this may be a steep requirement, causing the feature to be inaccessible.

The financial advisors on the Personal Capital app are clearly meant for high net worth investors.

Paid Services

While there are plenty of free services available through the Personal Capital app, our Personal Capital review found that there are fees associated with some services.

For example, those who are planning to invest $1 million or more through the app should expect fees ranging between 0.79% to 0.49%.

High Fee Structure

Our Personal Capital review found that the fees associated with Personal Capital money and investing tools tend to be a little higher than others.

Software Glitches

Every now and then, the interface can experience some bugs and glitches. Make sure that your Personal Capital app is up to date, as this often solves these minor issues.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Final Outcome of Our Personal Capital Review

Overall, the Personal Capital app is the Mint for investors who take their finances more seriously. The interface is dead simple, the graphs and charts allow you to easily monitor progress, and the dashboard keeps you on track.

On top of an overall bird’s eye view of your financial progress, you also get many extra features, with most of these features coming free of charge. These include the retirement planner, financial advisors, a bill and spending tracker, and more.

More importantly, in response to the question, “Is the Personal Capital app safe?” the answer is, yes.

You shouldn’t have any trouble getting started with the Personal Capital app. Most of the useful features are free, and signing up is as simple as can be, making it a great option for those looking for a better way to manage their finances.

Image Sources:

- https://www.bigstockphoto.com/image-82252127/stock-photo-analyzing-investment-charts-with-laptop

- https://www.personalcapital.com/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.