The J.P. Morgan Investment Account Reviews & Ranking

AdvisoryHQ recently published its list and review of the top stock brokers firms in the UK, a list that included The J.P. Morgan Investment Account.

Below we have highlighted some of the many reasons The J.P. Morgan Investment Account was selected as one of the best stock broker firms in UK.

Click here for a detailed review of AdvisoryHQ’s various selection methodology: Ranking Methodologies.

J.P. Morgan Investment Account Review

Among share brokers in the UK and UK stockbrokers, J.P. Morgan is one of the most well-known names. Specifically, J.P. Morgan Asset Management is based on a collaborative approach to investment management, expertise in key asset classes and markets, and innovation that provides broader investment opportunities to clients.

J.P. Morgan Asset Management is part of JPMorgan Chase & Co., which is a worldwide, full-service financial provider with services including retail banking, as well as investment and asset management. J.P. Morgan Asset Management is also supported by a solid reputation that goes back 150 years.

Image Source: Pixabay

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Stock Broker Firms

Upon completing our detailed review, The J.P. Morgan Investment Account was included in AdvisoryHQ’s ranking of this year’s best stock brokers firms based on the following factors.

The J.P. Morgan Investment Account Review: Range of Funds

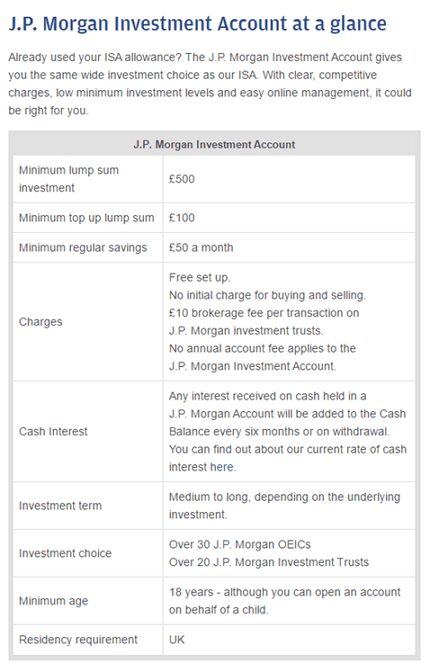

The J.P. Morgan Investment Account, a platform that’s one of the best online stock brokers in the UK, features an extensive and diverse range of funds investors can choose from. There are more than 30 J.P. Morgan OEIC funds available, as well as more than 20 investment trusts.

Investors can look at the J.P. Morgan Investment Account website, where they’ll find a comprehensive guide to prices and facts about the available funds. The information they can view includes key points, fund objectives, and prices. Investors can also search funds by name or ISIN, and refine their search based on sector, asset class, investment style, MorningStar rating, and launch date.

The J.P. Morgan Investment Account Review: Account Charges

Among UK online share brokers, J.P. Morgan works to excel in every area, including how they charge fees and their transparency. They work to keep costs not only competitive but also straightforward and easy to understand.

There is an Annual Account Charge, but it’s a low fixed rate of 0.10% of the value of an investment trust. There is no charge on the J.P. Morgan Investment Account.

Additionally, there is no charge to buy or sell J.P. Morgan Funds, and there is no charge for buying J.P. Morgan investment trusts through a regular savings plan.

Image Source: J.P. Morgan

The J.P. Morgan Investment Account Review: Simplicity and Flexibility

To compile the final ranking of the leading UK brokers and online UK stockbrokers, convenience and simplicity were very important. J.P. Morgan Investment Account does well in both areas.

To begin, investors can start with as little as £50 a month or a £500 lump sum and £100 top-ups. Investors can also create automated regular payments set at intervals, which could be monthly, quarterly, half-yearly, or yearly. There is no upper limit on investment amounts.

Additionally, the J.P. Morgan Investment account was selected for this ranking of the leading share brokers in the UK because of its flexibility. Investors can open several accounts and designate them for different objectives and investment goals.

Investors can also initiate an account in joint names or for their child.

The J.P. Morgan Investment Account Review: Guidance & Planning

As a contender for best UK share broker and also one of the most established UK stock brokers, J.P. Morgan offers extensive information to help investors make decisions. They have in-depth guides on their products, including the following:

- “Which Account Is Right For You?”

- “What Should You Consider”

- “What You Can Invest In”

- “Attitude to Risk”

Also available are guides to help investors decide between OEICs or investment trusts, and there is an exclusive guide on investment goals, which aims to help investors choose the right funds and create a valuable, individualised investment strategy for their needs, balancing funds that will achieve personal objectives.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.