2017 RANKING & REVIEWS

TOP RANKING BEST BANKS IN MASSACHUSETTS, U.S.

Finding the Best Banks in Massachusetts

Does the Massachusetts bank you choose really matter?

The answer to this question is a big yes. There are a number of Massachusetts banks to choose from, and the bank of Massachusetts you decide to open an account with can determine whether you’re paying high fees, the benefits and perks you receive as a customer, and even how much interest you’re earning on your idle money.

Unfortunately, many consumers don’t realize the importance of choosing the right bank in Massachusetts, and they may be doing themselves and their money a disservice as a result.

There’s a common misconception floating around that every bank is essentially the same. In reality, every bank not only approaches things like customers service in a unique way, but they are also going to offer different kinds of products. The same is true for the many different banks in Massachusetts.

Award Emblem: Top 10 Best Banks in Massachusetts

It’s with this importance in mind that the following ranking of the best Massachusetts banks was compiled. The names on this list of banks in Massachusetts all have many advantages, benefits, and value-creating products and services that make them excellent choices for consumers seeking the very best in financial services. Each of the names on this list represents banks from across the entire state, including the Central, Western, Eastern, and Southeastern regions.

See Also: The Best Bank For Students | PNC vs Bank of America vs U.S. Bank Student Banking

AdvisoryHQ’s List of the Top 10 Best Banks in Massachusetts

List is sorted alphabetically (click any of the bank names below to go directly to the detailed review section for that bank):

- Bank of America

- Berkshire Bank

- Citizens Bank

- Eastern Bank

- People’s United Bank

- PeoplesBank

- Rockland Trust Company

- Santander Bank, N.A.

- TD Bank

- Webster Bank

Click here for 2016’s Top 10 Banks in Massachusetts

Top 10 Best Banks in Massachusetts | Brief Comparison

Massachusetts Banks | Highlighted Products |

| Bank of America | Complimentary FICO score |

| Berkshire Bank | MyBanker |

| Citizens Bank | One Deposit checking |

| Eastern Bank | Intuit Quicken Integration |

| PeoplesBank | Interest Relationship checking account |

| Peoples United Bank | Prewards debit card |

| Rockland Trust | OKtoPAY |

| Santander | Switching Services |

| TD Bank | Clover Merchant Solution |

| Webster Bank | Opportunity checking |

Table: Top 10 Banks in Massachusetts | Above list is sorted alphabetically

What Types of Fees Do Banks Charge?

For many consumers, one of the first things they will consider when selecting a Massachusetts bank to do business with is the fees they charge. Banks have developed a reputation for charging extremely high fees on even very basic services, so this is an important focus area when ranking the best Massachusetts banks.

The following are some of the most common bank fees consumers are charged:

- Checking account maintenance fees: Many people don’t even realize that they’re probably being charged a fee just for having a checking account with a Massachusetts bank. This is one that most banks do charge, but it can depend on your account and whether you meet certain criteria. For example, many banks offer free basic checking accounts, and they also frequently offer options to have fees waived if you maintain a certain balance level. This fee can also be called a minimum balance fee; if you don’t keep your account above a certain threshold, you may have to pay for it.

- Monthly or annual savings account maintenance fees: It’s not just checking accounts that are subject to fees. Many savings accounts also carry monthly and/or annual maintenance fees, but again, many banks also offer options to have these charges waived.

Image Source: Banks in Massachusetts

- Statement fees: In an effort to move more customers toward paperless and online banking, many banks charge paper statement fees, so that if you receive your statement via a hard copy in the mail each month, you could be paying for it. This can be waived if you simply sign up to receive emailed or online account statements.

- ATM fees: This is a big source of contention between consumers and financial institutions because people feel like they’re unfairly charged to access their own money. Many banks will allow customers to use their own ATMs free of charge, but out-of-network ATM usage can bring hefty costs.

Don’t Miss: The Best Banks for College Students | Chase vs Wells vs Bank of America

How Can You Choose the Right Massachusetts Bank for You?

Choosing the right bank in Massachusetts for your lifestyle and your financial needs is a personal decision, but some pretty standard criteria should affect your decision.

Along with fees, which we discussed above, another important consideration is convenience. Are you going to find it easy to access your money, your account information, and your financial institution with your bank in Massachusetts? What if you have questions or concerns? Would you prefer to visit a bank branch in person, or will online and phone service work best for you?

You should also think about the level of customer service provided, the types of accounts a bank has available, and whether there are extended services available, such as wealth management. This can be important for consumers who want to manage all of their accounts and financial needs at one institution.

Finally, what about the technology available from your Massachusetts bank? Sometimes local and regional banks may not put as much emphasis on things like mobile and online banking, so if this is important to you, be sure that you know where your bank stands.

What Is Important to Consider When Opening a Checking Account at a Bank in Massachusetts?

One of the most common accounts people open at a bank is a checking account. A checking account can provide a secure, organized, and convenient way to manage your money, as opposed to carrying cash.

Checking accounts can have features that make them even more beneficial, ranging from accounts that earn interest, much like a savings account, to options that offer spending rewards so you can earn just for making everyday purchases.

Some of the key things to consider before selecting or opening a checking account include the following:

- Per-check fees: This can be incredibly frustrating for consumers because some banks and accounts will charge you a fee simply for writing a check from your account. Before you sign up for a new account with a bank in Massachusetts, see if this fee exists, and also if there is any limit on how many checks you can write for free before you begin incurring that fee.

- ATM fees: This is something touched on above, and it’s a big one for many consumers, particularly those individuals who require cash on a regular basis. Are you going to be charged a fee just for out-of-network ATMs, or ATMs that are operated by your bank as well? Additionally, some banks offer programs that provide reimbursements for out-of-network ATM usage, so think about finding an account with a Massachusetts bank that provides this service if it’s something that you think will save you money.

- Overdraft protection: Some consumers want overdraft protection so that even if they have insufficient funds in their account, their transaction will go through, and they will then be responsible for fees. Other banking customers prefer to opt-out of this type of coverage, which means their transactions will be declined, but they also won’t incur fees.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review—Top-Ranking Best Banks in Massachusetts

Below, please find the detailed review of each bank on our list of the best banks in Massachusetts. We have highlighted some of the factors that allowed these Massachusetts banks to score so high in our selection ranking.

Berkshire Bank Review

Berkshire Bank operates under the parent company Berkshire Hills Bancorp, which has about $9 billion in assets and 99 full-service branches located in Massachusetts, New York, Connecticut, and Vermont. Established in 1846, Berkshire is one of the oldest and largest independent banks in Massachusetts, and it’s also the largest bank based in Western Massachusetts.

Along with being one of the most respected banks in Massachusetts, Berkshire offers a full range of products and services that include not only banking but also insurance and wealth management.

Key Factors That Enabled Us To Rank This As One of the Best Banks in Massachusetts

The following are some of the essential reasons Berkshire Bank was selected as one of the best banks in Massachusetts.

NOW Checking

Berkshire Bank offers a useful product called NOW Checking, which is an account from this Massachusetts bank that has all of the convenience of the free account while also earning account holders interest on their deposits.

The NOW Checking account carries no monthly service charge as long as a $750 minimum balance is maintained, and even if the balance falls below that minimum any day during the statement cycle, the fee is only $7 a month.

There is no per check charge, online and mobile banking are free, and online statements with check images are also free. The account includes a free MasterCard Debit Card, and combined statements are available, making financial management easy and streamlined.

Pure Excitement Money Market

Berkshire Bank offers quite a few different savings options for Massachusetts banking customers, including Statement Savings, the traditional Money Market account, Health Savings account, and CDs.

One of the most popular options from this Massachusetts bank, however, is the Pure Excitement Money Market. This account earns some of the most competitive interest rates, and it requires a Berkshire Bank checking account with a monthly direct deposit or a minimum daily balance of $5,000.

There is no monthly service charge, and there is some flexibility because of limited check writing options with this Massachusetts bank account. This account also includes online and mobile banking, and an ATM card is available with no annual fee and unlimited withdrawals at Berkshire ATMs.

MyBanker

MyBanker is a personalized banking tool that pairs customers with a dedicated relationship manager, who serves as their exclusive point of contact for all their financial needs. The MyBanker program is a concierge-level offering that tailors the services of Berkshire to the exact needs and specifications of clients, which saves them time and money.

All Berkshire Bank customers are eligible for this service, not just private banking clients.

This relationship manager is accessible and available, and can work to arrange personal meetings when it’s most convenient for the customer.

MyBanker services include financial planning, ensuring transactions go through as scheduled, and even visiting the home of customers to help them learn the ropes of online banking.

Mobile Banking

Image Source: Pexels

Berkshire offers not only online banking, but also mobile options available to users of iPads, iPhones, Androids, and any web-based phone. One of the newest offerings of mobile banking from Berkshire is the ability to deposit checks from a mobile device.

Other features include real-time access to account information, the ability to transfer money between accounts, bill pay services, and ATM and branch location tools.

Related: Best Online Savings Accounts | Ranking, Rates & Features

Eastern Bank Review

Eastern Bank is the oldest and largest mutual bank in the U.S., which was founded in 1818. Eastern Bank is headquartered in Boston, and the company offers not only individual banking services but investments and insurance as well. This Boston bank has more than $10 billion in assets and about 100 branches throughout Massachusetts and New Hampshire.

Services available from this bank in Boston, Massachusetts, include checking and savings accounts, online and mobile banking, extended branch hours, and also loan and insurance products. Eastern is also a leading small business lender.

Key Factors That Allowed This to Rank As One Of The Best Banks in Massachusetts

Listed below are details of why Eastern Bank was included in this ranking of not only the best banks in Boston, but also throughout the entire state.

Awards and Recognition

Eastern Bank was included in this ranking of the best banks in Boston and Massachusetts for many reasons, including their numerous awards and recognitions.

Some of the recent awards include the following:

- Highest Customer Satisfaction in Retail Banking in the New England Region by J.D. Power for several consecutive years

- Named the number one SBA lender in Massachusetts from 2009 to 2015, consecutively

- Eastern Bank was recognized as one of the “Best Places to Work for Lesbian, Gay, Bisexual, and Transgender Equality” by the Human Rights Campaign’s Corporate Equality Index

- The Boston Globe has named Eastern Bank one of the “Top Places to Work in Massachusetts” every year since 2008

- Boston Business Journal named the bank a “Leader in Diversity” in 2010, 2011, and 2014

Security Center

Eastern Bank finds it incredibly important to maintain the utmost in privacy and security for customers, so in addition to putting in place the highest technological measures, this Massachusetts bank also has an online security center. This is an area where bank customers can go to research and report anything related to their financial privacy and security.

As one of the best banks in Massachusetts, Eastern provides guides on topics like recognizing, preventing, and protecting against fraud, as well as guides on identity theft, fake checks and scams, and credit reports.

All of the guides and tips provided by this Boston bank are actionable and easy to understand.

Intuit Quicken Integration

Eastern Bank strives to make banking and financial management as convenient as possible for clients, and one of the ways this Massachusetts bank does this is by offering robust online banking features.

As part of their online banking options, customers with this bank in Boston can integrate their account information with Intuit Quicken. Users can download transaction activity directly from their Eastern Bank accounts, create expense and income categories, transfer funds, and create electronic bill payments.

There are also options to create recurring fixed payments, such as mortgages, and update pending bill payments. Quicken also offers options to create reports and graphs highlighting your budget and spending.

Debit Cards

Available to checking account holders at Eastern Bank are two different types of debit cards.

The first is the Eastern Bank Debit MasterCard, which is designed for customers whose primary focus is convenience. With the Eastern Bank Premium Debit MasterCard, consumers have an eZ Checking or Premier Checking account, and they receive extra benefits as a result.

Both types of debit cards include free ATM banking at more than 5,000 SUM Program ATMs throughout the country, fraud protection with MasterCard Zero Liability, and online purchase protection with MasterCard SecureCode.

Popular Article: Best Online Banks | Ranking & Comparison Review

PeoplesBank Review

Since 1885, PeoplesBank has been serving the needs of Massachusetts banking customers, particularly in the Pioneer Valley region. The corporate philosophy of PeoplesBank is a commitment to customers, maintaining corporate responsibility, creating a great place to work, and always striving to improve their environment.

Personal banking from PeoplesBank includes checking, savings and CDs, loans, debit and credit and prepaid cards, and online and mobile banking. This Massachusetts bank is also locally owned and independent.

Key Factors That Enabled Us To Rank This As One of the Top Massachusetts Banks

Highlighted below are key reasons PeoplesBank was included in this ranking of the best banks in Massachusetts.

Checking Options

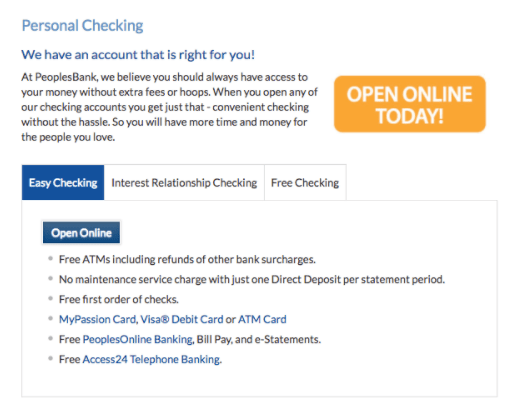

PeoplesBank offers three different checking account options: Easy Checking, Interest Relationship Checking, and Free Checking.

With each of these options from this Massachusetts bank, users can access their money without paying extra fees. When you open a PeoplesBank Easy Checking account with direct deposit, it’s free of service charges, monthly maintenance fees, or any other inconveniences.

With the Interest Relationship Checking account, as long as account holders maintain a daily balance of $5,000 in any combination of deposits and/or loans, there are no maintenance service charges, and they’re earning competitive interest.

Source: PeoplesBank

Savings Accounts

As well as offering several different checking account options aimed at addressing a range of financial needs, this bank in Massachusetts also features several savings account options. These include:

- Easy Savings: This account has no maintenance service charge, and no checking account is required to open it. It includes free ATM transactions, e-Statements, and online banking.

- Student Savings: This can be opened with just a $1 deposit, and there is no maintenance service charge or checking account requirement.

- Holiday Club Savings: There is no maintenance service charge with this account, and account holders can create automatic deductions from their PeoplesBank checking account to simplify how they save money.

- Vacation Club Savings: With this account, there is no service charge, automatic checking account deductions are set up, and a PeoplesBank checking account is required.

PeoplesOnline Banking

PeoplesOnline Banking is a convenient way for customers to bank anytime and from anywhere. They can use PeoplesOnline Bill Pay, which is secure and convenient, and users can pay almost anyone in the U.S. Long-term recurring payments can be scheduled, and with Payment Guarantee, customers know their payments are going to get to their destinations on time.

PeoplesOnline Banking also includes e-Statements, which offer fast statement access and 16 months of previous statements with check images.

Account alerts can be customized to let users know when there’s account activity happening, or if there’s a low or high balance threshold that’s reached.

Mobile Banking

PeoplesBank was included in this ranking of the best banks in Massachusetts for several reasons, one of which is their mobile app. This app allows customers to do most of their online banking directly from their mobile device, and it’s free, secure, and convenient.

The PeoplesBank mobile app includes the ability to view account balances, pending transactions, and history. Users can also transfer funds, schedule bill payments, and deposit checks.

If necessary, the app can be used to turn a linked debit card on or off, and users can send and receive secure messages through the app, which is available for iPhone and Android.

Read More: Best Kentucky Banks | Ranking | Top banks in Kentucky

Rockland Trust Review

Rockland Trust is part of the parent company Independent Bank Corp., with about $7.7 billion in assets. Rockland Trust Company is a full-service commercial bank, with its headquarters in Massachusetts, offering everything from banking to investment and insurance. Rockland serves the needs of not only individual consumers but also commercial and business entities. There are also residential lending centers located in Eastern Massachusetts and Rhode Island.

Rockland serves the needs of more than 200,000 individual and business customers and is also an integral part of the communities it serves. Personal banking products include deposit accounts, electronic banking, mortgages, refinancing, and international and foreign currency exchange.

Key Factors That Enabled This To Be Named One of the Best Banks in Massachusetts

Critical reasons Rockland Trust was included in this ranking of the top Mass banks are listed below.

Free Checking

One of the reasons Rockland was included in this ranking of the best banks in Boston and the best banks in Massachusetts is because of their dedication to keeping fees low. For consumers who don’t want to pay fees but want the advantages of a checking account, there is the Free Checking option.

This account includes the fundamentals of a checking account but carries with it no minimum monthly balance or a monthly maintenance fee.

Account holders can take advantage of free mobile banking with mobile check deposit, free online banking with bill pay, and a Debit MasterCard that’s included with the account.

Free Checking also includes a free first order of standard checks, and customers can apply to open this account online.

Overdraft Protection

There are several different overdraft protection options available to Rockland Trust customers.

The first is an Overdraft Protection Line of Credit. This provides automatic coverage in the event of an overdraft through an available credit line. This can be used for check writing or when a withdrawal is made that exceeds the balance of a checking account.

Overdraft Protection from Savings is another automatic option in which funds are taken from a linked savings account and deposited into the associated checking account if an overdraft occurs.

With Overdraft Privilege, which is a standard service, Rockland may authorize and pay checks written, bill payments, or electronic transactions that exceed available funds, if an account is in good standing. This will then mean the customer must pay fees, and there is a limit to this privilege.

OKtoPAY is a signature Rockland offering that covers everyday purchases and withdrawals made with a debit card. This provides more flexibility to account holders and reduces the likelihood a transaction will be denied.

Online Banking

Rockland’s Online Banking Center is full of features.

These features include a bill pay option so users can schedule one-time and recurring payments or send same-day or overnight payments when applicable. With e-Bills, account holders can manage and pay their monthly bills when they’re sent directly to their Rockland Trust account.

Customized email or text alerts can be set up for bill pay date reminders, balance notifications, and transaction notifications.

Users can send money to anyone, even at outside financial institutions by using online banking, and all they need is their phone number or email address.

Additionally, unlike many other accounts, Rockland allows customers to apply for and potentially open their account online.

Apple Pay Debit Cards

Account debit cards from Rockland include Apple Pay functionality. Apple Pay is a contactless mobile pay service that lets users make purchases in stores or apps by using their Apple Device.

With this service, a Rockland Trust card number isn’t stored anywhere or given to a merchant. Instead, a device has a unique digital code that’s used during transactions. Payments require Touch ID or a passcode, so payments can only be made when a device is unlocked.

Apple Pay retains account information so that it’s never given to merchants, and numbers used during a transaction can’t be tied to an individual.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion—The Best Banks in Massachusetts

The above ranking and review covers Massachusetts banks from across the state. These banks in Massachusetts offer consumers the opportunity to explore the available options and select the bank most appropriate for their financial needs.

The ranking is based on a broad range of factors, from the fees each bank charges to its accessibility through platforms such as online and mobile banking.

Each of the above banks in Massachusetts are unique because they put the needs of customers first, work to remain innovative, and have been longtime participants in the diverse communities they serve. We hope that, with the help of this list and your own research, you can find the best bank in Massachusetts for you.

Related: Best Private Banks | Ranking | Top Private Wealth Management Banks

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.