2017 RANKING & REVIEWS

TOP RANKING CREDIT UNIONS IN TEXAS

Intro: The Growth of Fort Worth Credit Unions

100 million Americans. That’s the astounding number of people who are members of credit unions in the United States. What does that account for?

According to CUNA Mutual Group, credit union lending is approaching the fastest growth rate in nearly twenty years, with a seasonally-adjusted annualized loan growth rate that reached 12% in March of 2016.

Why are member-owned financial co-ops becoming so popular?

One big reason is that consumers are increasingly looking at alternatives to the standard bank. Banks are for-profit institutions, so everything they do is with the goal of earning money and improving profitability.

For consumers wondering why their checking account monthly fees continue to increase or the interest they earn on that money market account is decreasing, the reason is the profit-driven structure that banks follow, unlike credit unions in Fort Worth.

Award Emblem: Best Credit Unions in Fort Worth, Texas

Award Emblem: Best Credit Unions in Fort Worth, Texas

Another reason people are finding themselves drawn to the credit union concept and credit unions in Fort Worth is that these financial institutions have come leaps and bounds over recent years. Credit unions used to be seen as tiny – often with only one branch – having limited products and services, and there were hurdles to accessing your money if you weren’t near that one branch or the handful of ATMs a credit union might operate in the area.

These barriers at Fort Worth credit unions are being eliminated, however. Credit unions can offer greater accessibility and conveniences, not only because of brick-and-mortar expansion and participation in ATM co-op networks but also through online and mobile banking.

For consumers searching for the top Fort Worth credit unions, the following list highlights eight of the best in the area. Each of the credit unions in Fort Worth included on this list provide value for consumers and a viable alternative to the standard bank.

AdvisoryHQ List of the Best Credit Unions in Fort Worth

- American Airlines Credit Union

- EECU Credit Union

- First Class American Credit Union

- Fort Worth City Credit Union

- Fort Worth Community Credit Union

- Tarrant County Credit Union

- Texas Trust Credit Union

- Unity One Credit Union

This list is sorted alphabetically (click any of the above names to go directly to the detailed review for that credit union).

What Is the History of Credit Unions?

Before delving into the specifics of the top credit unions in Fort Worth, Texas, it can be valuable to take a brief look at the history of these unique financial institutions to fully understand what they bring to the table for consumers.

While credit unions are found throughout the world, they first came to America at the beginning of the 20th century in response to loan sharks that were charging extremely high interest rates to people. Credit unions in North America were established as a way to combat unfair lending and give working-class families access to affordable credit opportunities. The first credit union was called the St. Mary’s Cooperative Credit Association, which opened in 1909.

Image Source: Pixabay

Image Source: Pixabay

During the 1920s, the concept grew in popularity as consumers and families had more money to save. They also needed more ways to get inexpensive loan products, and, in response, Massachusetts chartered 19 new credit unions in 1920 alone.

In 1934, the Federal Credit Union Act was signed into law. The result of the legislation was a national system of chartered credit unions, with federal supervision and oversight, and by 1960, there were more than six million people that were members of credit unions. The National Credit Union Administration (NCUA) was created in 1970.

As a result of the financial collapse of 2007 and 2008, a red flag system was established to identify potential problems a credit union could experience in order to avoid those issues early on. The result of such actions led to more than 96% of credit unions being classified as “well capitalized” by the end of 2009.

What Are Some of the Modern Services Offered by Credit Unions?

As mentioned at the start of this review and ranking of the best credit unions in Fort Worth, these financial institutions have come a long way in recent years and have worked to expand their products, services, and overall offerings. The result has been more accessibility and greater convenience for members, which is a big reason why credit unions are experiencing so much growth right now.

Below are some of the latest additions many credit unions are introducing:

- Mobile Banking: Mobile banking is one of the top features many consumers look for when selecting a credit union in Fort Worth. Just a few years ago, mobile banking was seen as something only offered by the largest national and multinational banks, but, over recent years, it’s become increasingly available to members of credit unions as well.

- Share branches: To combat the idea that credit unions don’t offer accessibility and many branches, share branches have been introduced. Share branches mean credit unions become part of a network, and, as a result, members can do many banking activities at any branch that is part of this network.

- Business banking: As well as traditional individual banking products and services, many credit unions are also increasing their availability of business banking options, including business loans.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How Do You Find a Credit Union to Join?

After exploring this ranking of the leading credit unions in Fort Worth, TX, you might be wondering how to find one to join that works for your needs, both financially and logistically.

The first step to finding a credit union in Fort Worth is to consider location. Many credit unions have membership opportunities that extend to people who live, work or worship within a certain radius. You can utilize the NCUA’s credit union search tool, which allows you to find credit unions anywhere from 5 miles to 60 miles from your location.

As well as considering credit unions located near you, you can also see if you’re eligible for membership due to an association or work affiliation. Many groups have their own credit unions as well as employers.

Related (Please Review):

- Permission to Use Your FREE Award Emblems

- Promoting Your “Top Ranking” Award Emblem and Recognition

- Can Anyone Request a Review of a Credit Union?

- Do Credit Unions Have a Say in Their Review & Ranking?

- Can Credit Unions Request Corrections & Additions to Their Reviews?

Methodology for Selecting Top Banks and Credit Unions

What methodology did we use in selecting this list of the best credit unions in Fort Worth?

Using publicly available sources, AdvisoryHQ identified a wide range of credit unions in Fort Worth that provide services in the metro and the surrounding areas.

We then applied AdvisoryHQ’s “Breakthrough Selection Methodology” to identify the final list of top credit unions that provide services to communities in and around Fort Worth.

Click here for a detailed explanation of our methodology: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

Top Credit Unions in Fort Worth, Texas

| Credit Union | Location |

| American Airlines Credit Union | Fort Worth |

| EECU | Fort Worth |

| First Class American Credit Union | Fort Worth |

| Fort Worth City Credit Union | Fort Worth |

| Fort Worth Community Credit Union | Fort Worth |

| Tarrant County’s Credit Union | Fort Worth |

| Texas Trust Credit Union | Fort Worth |

| Unity One Credit Union | Fort Worth |

(List is sorted alphabetically)

Detailed Review – Top Ranking Credit Unions in Fort Worth

After carefully considering Fort Worth credit unions, we created the following list of the top 8. As you continue reading, you’ll find detailed reviews for each of our picks as well as specifics of some of the factors we used in our decision-making process.

American Airlines Credit Union Review

Founded in 1936 by a group of American Airlines employees, American Airlines Credit Union has been a member-owned financial cooperative for more than 80 years. Throughout these years of service, AA Credit Union has continued to grow and expand, with a current net worth that exceeds $623.4 million and assets in excess of $5.96 billion.

Designed to meet the needs of airline employees, there are locations of AA Credit Union in most of the country’s main airports, and this credit union in Fort Worth also offers access to the Co-Op ATM Network and the Co-Op Shared Branch network.

Key Factors That Allowed This Credit Union to Rank as One of the Best Credit Unions in Fort Worth

Considerations used to include American Airlines Credit Union on this ranking of the leading credit unions in Fort Worth, TX are below.

Bounce Protection Plus

To offer peace of mind for members, American Airlines Credit Union introduced the Bounce Protection Plus service which complies with the Federal Reserve’s Regulation E, if members alert the credit union they want their transactions to be eligible for this service.

When members opt-in to Bounce Protection Plus, they pay online one cent per overdraft. Transactions are approved at the merchant as well. To be eligible, in addition to opting in to the service, members must correct the overdraft before 8 pm (CT) or it must have been a small overdraft that didn’t take the end-of-day account balance into the negative by more than $10.

There is no cost to enroll in Bounce Protection Plus, and there’s no fee unless the service is used.

Priority Checking

Priority Checking is a signature account from AA Credit Union that offers not just free checking, including no monthly maintenance fees or minimum balance requirements, but also a number of other perks and benefits.

Some of these include free Mobile Banking and Mobile Deposit, online banking access, free Bill Pay, and surcharge-free access to almost 30,000 ATMs, which are part of the Co-Op Network.

It also includes a free debit card equipped with Zero Liability for unauthorized transactions, constant fraud monitoring, and Apple Pay.

Account holders also have the option to choose from safeguards, including Bounce Protection Plus, or they can set up account transfers with linked accounts to cover possible overdrafts.

Owner Rewards

As a member of AA Credit Union, one of the most respected Fort Worth credit unions, there are a number of rewards available to members. For example, the credit union pays out more than $12 million in bonus dividends to member-owners. Dividends are usually based on the number of products a member has as well as the amount of interest paid on loans or received on deposits.

Other rewards include:

- Direct Deposit Discount: There is an additional 0.25% APR discount when members fund a new or used auto, boat, plane or RV and have a Direct Deposit into the checking account.

- Loyalty Discount: A 0.25% discount is available when members fund a new or used auto or home equity loan. To be eligible, members should have funded or paid off two or more loans in the past two years.

- Welcome Aboard Discount: This is offered to members who fund a new or used auto or home equity loan, and it’s available to members within their first 90 days of membership.

Education Loans

As part of a full suite of loans offered by this credit union in Fort Worth, American Airlines Credit Union provides education loans. These loans are open-ended with variable rates and terms up to 120 months. The interest rate is adjustable, and the loan can be used for private school, college or trade school expenses.

In addition to education loans, American Airlines Credit Union also offers home loans, including a home equity line of credit, auto and vehicle loans, credit cards, and personal loans with flexible terms and rates.

EECU Review

EECU strives to go beyond the typical credit union or financial institution and instead serves as a financial advocate for each member. EECU was started in 1934 by a small group of education system employees from Fort Worth, and now there are more than 170,000 members located across the Metroplex.

While EECU was initially created by and for Fort Worth teachers and administrators, membership eligibility has since grown to include anyone who lives or works in the greater Fort Worth metro.

Key Factors Considered When Ranking This as a Top Credit Union in Fort Worth, Texas

Highlighted below are considerations that led to the inclusion of EECU on this list of the best credit unions in Fort Worth.

Online Banking Security

EECU, one of the most reputable Fort Worth credit unions, offers online banking technology, and members can also download software to make their experience and account management even more secure.

This is made possible through a partnership with Trusteer, which is a trusted online security provider that works with some of the world’s top financial institutions. Trusteer offers an application called Rapport that fills in the gaps created by standard anti-virus and firewall protections. This allows online banking with EECU to be protected from the most advanced and sophisticated attacks.

It’s a free application, so members of EECU can conduct online banking and transactions with the most stringent security protections.

Personal Checking

EECU offers a variety of personal checking accounts, including Real Worth Checking, Real Worth with Interest Checking, Value Added Extras, and 65 and Better Checking.

Regardless of the account a member of EECU selects, they all have certain benefits, which include:

- Free Debit MasterCard

- Free online banking

- Free mobile banking

- Free online Bill Pay

- 0.25% discount on certain loans

- Purchase Rewards with debit card usage

- Courtesy overdraft protection

- Free usage of 50,000 ATMs through the Allpoint network, which includes locations in Target and 7-Eleven

Personal Credit Cards

This credit union in Forth Worth includes a couple of different, valuable credit card options for individuals. The first is the Platinum Plus MasterCard, which includes a low APR on balance transfers made within 90 days of opening an account. It also has no annual fee and no balance transfer fee.

The World Rewards MasterCard includes a low APR on balance transfers made within 90 days of account opening as well as rewards points for spending and 10,000 bonus points for cardholders who spend $6,000 in the first 90 days. It also has no annual fee and no balance transfer fee.

The Cash Rewards MasterCard includes even higher cash rewards on every purchase than the World Rewards Card offers, with no annual fee and no balance transfer fee.

Young Adults

EECU is a credit union in Fort Worth that caters to the needs of people from all age groups and stages of life, and it has programs that exclusively focus on the unique needs of young adults. As part of the young adults program offered by EECU, there are educational tools and resources, including tips for budgeting and saving, worksheets, and financial calculators.

There is also a full range of products for young adults, including checking accounts, savings and CDs, credit cards, retirement savings accounts, loans, and mobile and online banking.

Finally, EECU also features education loans such as the Texas Extra Credit Education Loan

First Class American Credit Union Review

Servicing members of the Fort Worth community, First Class American Credit Union (FCACU) was created in 1929 by nine people, and just days after its charter, the Great Depression began. FCACU was able to withstand the challenges of that time, and, in 1992, what was originally Fort Worth Postal Credit Union became First Class American Credit Union. The name change was designed to reflect the expansion of the credit union’s membership eligibility to include people within a specified range in Tarrant County.

Since that time, First Class American Credit Union has remained a leading credit union in Fort Worth, with a long, established history and dedication to expansion and growth.

Key Factors Leading Us to Rank This Credit Union as a Top Fort Worth Credit Union

When reviewing and ranking credit unions in Fort Worth, the following factors were considered regarding FCACU.

Concierge Banking

One of the many advantages of banking with this credit union in Fort Worth are the available concierge services. Concierge banking was established as a way to meet and exceed the financial needs of members while also ensuring convenience for their lifestyles. The concierge banking from FCACU won the Member Benefit Award from the Credit Union National Association.

This program excels regarding quality, service, and value. There is a focus on customized, personalized service and attention that’s unrivaled by most other financial institutions, not just in Fort Worth but throughout the country.

Remote Deposit

In the name of convenience paired with security, First Class American Credit Union offers a few different remote deposit options. One option is called Freedom Deposit. With Freedom Deposit, members use their smart device, such as a smartphone or tablet, to make check deposits.

Also available is Priority Deposit, which is a tool that lets users make a remote deposit of a check, have the money credited to their account, and then mail the hard copy of the check in to be deposited. The check must be received within 10 days of the initial remote deposit or the credit amount is taken out of the account.

Shared Branching

FCACU is part of the Shared Branching network, through Co-Op Shared Branch. This means that members can visit more than 5,000 nationwide credit union branches or service centers and receive excellent service.

Many of the banking options are the same as they would be if you visited an FCACU branch, including the ability to deposit, transfer funds, and withdraw funds.

Through Shared Branching, members can also make payments on their existing loans, buy money orders and traveler’s checks, and more.

Pay It Forward Checking and Savings

A unique offering available from this top credit union in Fort Worth is the Pay It Forward Checking and Savings accounts. Each time a participant uses their debit card or writes a check, the purchase amount is rounded up and deducted from a Pay It Forward Checking Account. That amount is then deposited into a designated Pay It Forward High-Yield Savings Account.

The benefit of this program is that it’s an easy way to save more money effortlessly. There are no minimum balance requirements or monthly service charges with these accounts, and if members have an existing FCACU checking account, it can be switched to a Pay It Forward account.

Free Wealth & Finance Software - Get Yours Now ►

Texas Trust Credit Union Review

Texas Trust Credit Union has been serving the local community since 1936 and, during that time, has grown to include assets of nearly one billion dollars. Along with serving Tarrant County, Texas Trust also serves Dallas, Henderson, and most of Ellis and Johnson Counties. Based on asset size, Texas Trust is the 21st largest credit union in Texas, and it’s the largest residential lender in the Dallas-Fort Worth Metroplex.

There are 15 branch locations of Texas Trust, 75,000 members, and full-service offerings available that include checking, savings, mortgages, credit cards, CDs, investment products, and more. There are also business services available from this credit union in Fort Worth.

Key Factors That Enabled This to Rank as a Best Credit Union in Fort Worth

Reasons Texas Trust was included in this ranking of the best credit unions in Fort Worth are cited below.

Online Banking

Along with multiple branch locations throughout the Metroplex, Texas Trust strives to make banking convenient for members through robust and advanced online banking services and functionality.

Some of these include:

- Easy-to-Read Transaction Histories: When you log on to your online banking account, you can see all of your transactions, including debits, credits, and balance information, in different columns. You can separate them by days or date ranges as well.

- eAlerts: Members can use online banking to create customized email or smartphone alerts that will let them know if they have low balances, have received a direct deposit or other options.

- Personalized Account Names: You can set up your savings and checking accounts with the names you choose.

- Online Bill Pay: Add payees, get reminders, and manage bill payment easily.

- Member Summary: This section of online banking shows all account information in one place, including deposit and loan account balances.

Checking20

Checking20 is the signature checking account from Texas Trust that includes access to online and Mobile Banking, online and mobile deposit, and mobile Bill Pay.

It also features eStatements, a MasterCard Debit Card with Debit Rewards, unlimited free use of more than 55,000 ATMs, MasterCard Zero Liability protection, and overdraft privilege options.

Furthermore, this account provides the option to take advantage of free, lifetime enrollment in IDProtect.

Also included in this account is a monthly bonus program, with cash bonuses based on how often you use your credit card and whether or not you have a consumer loan or mortgage with Texas Trust.

Home Loans

Banking with Texas Trust means you have access to expert mortgage professionals. There are a variety of fixed-rate products available from Texas Trust, with a range of terms.

The home loan types offered by this Fort Worth credit union include:

- Purchase: Members who want to purchase a home can take advantage of this conventional loan option, with terms ranging from 10 to 30 years.

- Refinance: Refinance an existing mortgage and save money on your payment each month.

- Home Equity/Property Improvement Loans: These can be used to make repairs or upgrades to an existing home.

- My Community Programs: This is designed specifically for borrowers with low to moderate income, and if applicants qualify, they receive flexible finances. There are also additional benefits for groups, including teachers, firefighters, health care workers, and disabled applicants.

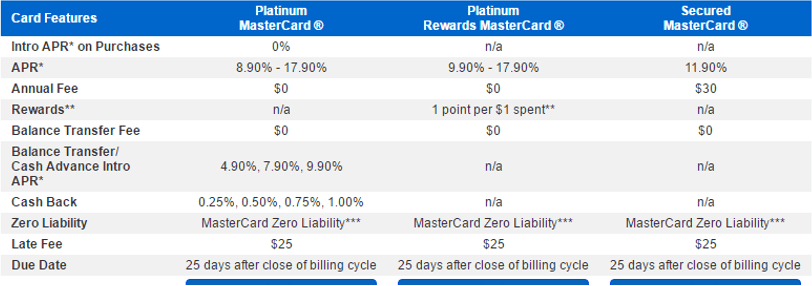

Credit Cards

This credit union in Fort Worth, TX features three primary credit card options members can take advantage of.

The Platinum MasterCard includes a 0% introductory rate on purchases made during the first six months after opening the account if your credit rating and history make you eligible. After the introductory rate period, the APR remains low, and there is no annual fee.

The Platinum Rewards MasterCard also has a low APR, and cardholders can earn rewards that can then be redeemed for travel, merchandise, and more. This card also has no annual fee.

Finally, there is a Secured MasterCard, with a low annual fee, no balance transfer fee, and MasterCard Zero Liability Protection.

Image Source: Texas Trust Credit Union

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

To browse exclusive reviews of all top rated credit unions in Fort Worth, Texas, please click on any of the links below.

- American Airlines Credit Union

- EECU Credit Union

- First Class American Credit Union

- Fort Worth City Credit Union

- Fort Worth Community Credit Union

- Tarrant County Credit Union

- Texas Trust Credit Union

- Unity One Credit Union

Conclusion – Top 8 Credit Unions in Fort Worth

For the people, by the people.

That’s a key concept that guides the products and services offered by Fort Worth credit unions and credit unions throughout the country and even the world. Credit unions are designed to help consumers move away from a profit-driven setup and toward one where the members are the owners and the decision-makers. Credit unions continue to grow and expand their offerings as their appeal is similarly increasing.

Consumers see they can turn to a credit union as a way to free themselves from conventional banking. Fort Worth credit unions offer a viable alternative to restrictive, expensive banking.

Each of the credit unions in Fort Worth, TX included on this ranking represent what started as a grassroots initiative, often by a very small group of individuals, to transform the way they managed their money and obtained lending. While the products and technology may have expanded since then, the mission remains the same.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.