2017 RANKING & REVIEWS

TOP RANKING CREDIT UNIONS IN GEORGIA

Intro: Locating the Best Credit Unions in Georgia

Being named one of the 10 top credit unions in Georgia is no small feat. Making it to the top of the list of best credit unions in Georgia requires a steadfast dedication and commitment to providing outstanding service to consumers, something that each of the credit unions in Georgia on our list possesses.

In addition to a strong commitment to customer satisfaction, each Georgia credit union on our list of credit unions in Georgia also provide top financial products, access to the latest technological conveniences, and a commitment to community involvement.

Award Emblem: Top 10 Best Credit Unions in Georgia

A credit union in Georgia can provide consumers with an advantage over a traditional bank in that they provide many of the same services at lower or no costs and at better rates. In our comprehensive reviews of each of the 10 best credit unions in Georgia on our list, we will go into detail about the products and services that make these credit unions in Georgia stand out above the rest.

The top credit unions in Georgia on our list encompass the entire state of Georgia, including the credit unions in Atlanta as well as credit unions in Savannah, Georgia and credit unions in Augusta, Georgia. Whether you are looking for a small-town Georgia credit union or wish to locate the best credit unions in Atlanta, our list has something for everyone.

AdvisoryHQ’s List of the Top 10 Best Credit Unions in Georgia

List is sorted alphabetically (click any of the names below to go directly to the detailed review section for that credit union)

- Associated Credit Union

- Atlanta Postal Credit Union

- Delta Community Credit Union

- DOCO Credit Union

- Georgia United Credit Union

- Georgia’s Own Credit Union

- Kinetic Credit Union

- LGE Community Credit Union

- Peach State Federal Credit Union

- Robins Financial Credit Union

Click here for 2016’s Top 10 Best Credit Unions in Georgia

Top 10 Best Credit Unions in Georgia | Brief Comparison

| Top Credit Unions in Georgia | Highlighted Features |

| Associated Credit Union | Rate Reward Auto Loans |

| Atlanta Postal Credit Union | High Yield Certificates |

| Delta Community Credit Union | Business Accounts |

| DOCO Credit Union | BudgetSmart |

| Georgia United Credit Union | Flexible Checking Account Options |

| Georgia’s Own Credit Union | Own Your Rate Certificate |

| Kinetic Credit Union | Business Services |

| LGE Community Credit Union | Investment and Retirement Services |

| Peach State Federal Credit Union | BALANCE Financial Fitness Program |

| Robins Financial Credit Union | Credit Builder Loan |

Table: Top 10 Best Credit Unions in Georgia | Above list is sorted alphabetically

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Credit Unions in Georgia

Below, please find the detailed review of each firm on our list of the credit unions in Georgia. We have highlighted some of the factors that allowed these Georgia credit unions to score so highly in our selection ranking.

See Also: Best Credit Card Deals and Best Credit Card Offers | Ranking & Reviews

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Associated Credit Union Review

One of the oldest credit unions in Georgia, Associated Credit Union was founded in 1930. Not only is this Georgia credit union one of the top credit unions in Georgia, but it is also ranked in the top 150 credit unions in the nation. As a member-owned, not-for-profit financial cooperative, Associated Credit Union operates with a mission to provide low-cost financial services to its members.

With more than 160,000 members and over $1.4 billion in assets, Associated Credit Union serves members from their 28 branch locations. Services offered include share drafts, share certificates, bill pay services, lines of credit, and real estate loans.

Top Georgia Credit Unions

Key Factors That Enabled This Credit Union to Rank as a Top Georgia Credit Union

Below are key factors that enabled Associated Credit Union to be rated as one of this year’s best credit unions in Georgia.

Low Auto Loan Rates

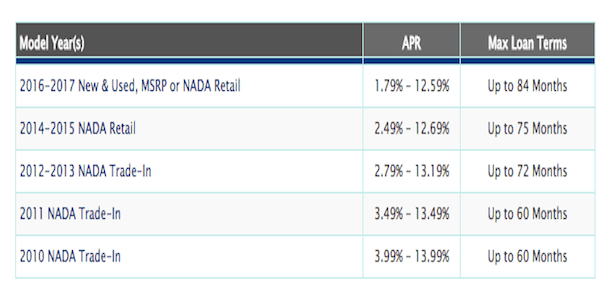

If you are in the market to buy a car, Associated Credit Union is the place to go. Their rates are extremely competitive, and they offer flexible repayment terms. Consumers will be hard-pressed to find rates better than theirs at other credit unions in Georgia.

With new and used car rates from this top credit union in Georgia starting as low as 1.79% APR with 100% financing, this top credit union in GA affords more purchasing power to their members.

Source: Associated Credit Union

Source: Associated Credit Union

IRAs and Education Accounts

Associated Credit Union offers an array of options to help members save for retirement or higher education expenses. With so many options to choose from, this top credit union in Georgia has a retirement or education savings product to fit each member’s financial needs.

Interest on all retirement and education savings accounts is compounded and credited quarterly.

IRAs and education savings account options at this credit union in GA are:

- Traditional IRA Share: tax-deferred retirement savings account with $50 minimum to open

- Traditional IRA CD: earns higher interest for tax-deferred savings over a fixed term with $200 minimum to open

- Roth IRA Share: tax-free retirement savings account with $50 minimum to open

- Roth IRA CD: earns higher interest for tax-free retirement savings over a fixed term with $200 minimum to open

- Coverdell ESA Share: savings account to save for education expenses tax-free with $50 minimum to open

- Coverdell ESA CD: earns higher interest on education savings over a fixed term with $200 minimum to open

Rate Reward Auto Loans

Rate Reward Auto Loans is an auto loan program offered by Associated Credit Union to help those who can only qualify for high-interest rate auto loans due to a less-than-perfect credit rating.

This helpful program offered by this top Georgia credit union rewards those with high-interest rate auto loans with up to a 3% reduction in their interest rate for making timely payments consistently.

When a member of this top credit union in Georgia who qualified with a credit score of 669 or under makes twelve consecutive on-time auto loan payments, Associated Credit Union will reduce their loan’s interest rate by 1%. Once another twelve months of consecutive on-time payments have been made, the interest rate is reduced by another 1%, and so on until their rate has been reduced by a full 3%.

This program has the potential to save members thousands in interest over the term of their auto loan and is just one way this top credit union in Georgia rewards its members.

Atlanta Postal Credit Union Review

Chartered in 1925, Atlanta Postal Credit Union has the distinction of being the oldest credit union in Georgia and is one of the best credit unions in Atlanta. This top notch Georgia credit union was founded with a primary goal to provide affordable financial services to fellow Atlanta Postal employees and their families. Beginning with an initial investment of just $2,404 in 1925, this top credit union in Atlanta now boasts assets in excess of $2 billion.

Today, Atlanta Postal Credit Union serves more than 100,000 members from 10 full service branch locations. This highly ranked credit union in Georgia operates on a unique set of guiding principles: only people who are credit union members may borrow there, loans should be for prudent and productive purposes, and a person’s character and desire to repay a loan are considered as important as a person’s income.

Key Factors That Enabled This Credit Union to Rank as a Top Georgia Credit Union

Below are key factors that enabled Atlanta Postal Credit Union to be rated as one of this year’s best credit unions in Georgia.

Low Consumer Loan Rates

If you have been itching for a new car, Jet Ski, boat, RV, or motorcycle, then Atlanta Postal Credit Union is the right credit union in Atlanta for you. They offer incredibly low rates on consumer-secured loans, broadening their members’ purchasing power and saving them potentially thousands of dollars in interest compared to most traditional banks’ loan rates.

In fact, most of their consumer loan rates have been certified by Datatrac as being up to 69% lower than the national average rates, earning them a Great Rate Award.

Consumer loans for new and used autos, motorcycles, RVs, Jet Skis, and other recreational vehicles start at rates as low as 1.79%.

Personal loans begin with rates starting at 7.90% and share- or certificate-secured loans only charge 2% above the dividend rate.

High-Yield Certificates

With flexible terms on standard certificates ranging from 91 days to 60 months, members of this credit union in Georgia can choose the term that best suits their own individual needs. Atlanta Postal Credit Union offers a variety of rates that vary by term, but all are extremely competitive and much more lucrative than most traditional banks offer.

There is a $500 minimum deposit requirement when obtaining a certificate from this top credit union in Georgia.

Certificate rates by term are:

- 91 days—50% APY

- 6 months—65% APY

- 12 months—1.00% APY

- 24 months—1.25% APY

- 30 months—1.30% APY

- 36 months—1.50% APY

- 48 months—1.75% APY

- 60 months—2.00% APY

IRA Certificates are also available in terms ranging from 12 months to 60 months with a $2,000 minimum deposit requirement to open and with the same APYs as listed above.

Regular Checking Account

When it comes to an Atlanta Postal Credit Union regular checking account, their aim is to keep things simple. This interest-bearing checking account from this top credit union in Georgia is a great deal with a rate of 0.40% APY with dividends compounded and credited monthly.

This simple checking account from this top credit union in Georgia also comes with no monthly service fees when members have their paycheck direct deposited into the account or when they keep the minimum daily balance at $250. There are no requirements to avoid the monthly service charge for full-time students or those aged 55 and older.

Other benefits of this checking account at this top credit union in Georgia include unlimited check writing and the first supply of 50 personalized checks free.

Don’t Miss: Best Credit Unions in Atlanta, Georgia | Ranking & Comparison Reviews

Delta Community Credit Union Review

In 1940, with just $45 in capital, eight Delta Air Lines employees founded the Delta Community Credit Union. The not-for-profit financial cooperative was formed in order to help their peers achieve financial success.

From its humble beginnings, Delta Community Credit Union has grown to become the largest credit union in Georgia with close to 300,000 members and $4.6 billion in assets. This impressive credit union serves its members from 26 branch locations and is considered to be among the best credit unions in Atlanta.

They still embrace their founding philosophy by sharing their earnings with their members instead of outside investors.

This credit union in Georgia is dedicated to supporting the metro Atlanta community and actively partners with local chambers of commerce, schools, and charitable organizations in giving back to the community.

Key Factors That Enabled This Credit Union to Rank as a Top Georgia Credit Union

Below are key factors that enabled Delta Community Credit Union to be rated as one of this year’s best credit unions in Georgia.

Free Checking

Delta Community Credit Union is a credit union in GA that understands that today’s checking account needs are much different than those of years ago. Today’s consumers need a checking account that has evolved with the times, and customers want to leave all the gimmicks and hidden fees behind.

Checking at Delta Community Credit Union is free of all the hassles that come with checking accounts from many traditional banking institutions.

Benefits of a personal checking account from this top credit union in Atlanta include:

- No monthly fee

- No minimum balance requirement

- No per check charges

- Automatic overdraft protection from savings

- Tiered interest earning on balances of $5,000 or more

Mortgage Products

Owning a home is an important goal for most Americans, and Delta Community Credit Union wants to help their members achieve that goal. Whether a member is a first-time home buyer, looking to refinance their existing loan, or hoping to finance some much needed home improvements, this top rated Georgia credit union has them covered.

Mortgage loans available from this top credit union in Atlanta are:

- First-time home buyer program

- Fixed-rate mortgage

- Adjustable-rate mortgage

- Home equity loan

- Home equity line of credit

- Land lot loan

- Purchase money second mortgage

Business Accounts

Delta Community Credit Union fully supports the Atlanta metro community and wants to do their part to help keep local businesses moving forward. In this aspect, this Georgia credit union offers both checking and savings accounts designed exclusively for their business members.

This large credit union in Georgia offers two checking accounts for businesses to choose from. Both accounts are designed to provide everything businesses need in a checking account to be able to conduct their business the way they want to.

Available business checking accounts are:

- Business Value Checking: available with no monthly fee when you maintain a low minimum balance, includes a Visa Business Check card and free online banking

- Business Checking: a dividend earning account with greater transaction flexibility

In addition to business checking accounts, this top credit union in Georgia also offers two business savings account options to businesses:

- Business Savings: basic savings account with no annual fee and low minimum balance requirements

- Business Money Market: high-dividend earning account with no monthly fee and 25 free transactions per month

DOCO Credit Union Review

Chartered in 1959, DOCO Credit Union has been serving its members in and around the Albany, Georgia area with exceptional financial products for more than fifty years. The Georgia credit union operates with a primary objective of providing low-cost or free financial services to their members. As such, members of this top credit union in Georgia enjoy lower interest rates on loans and higher dividends on deposits.

DOCO Credit Union provides a full array of financial products and services to employees of their more than 200 sponsor organizations. They cater to a multitude of employers including educational facilities, healthcare providers, industrial organizations, and small businesses. This impressive credit union in Georgia currently serves more than 35,000 members across 8 Georgia locations and holds more than $120 million in assets.

Key Factors That Enabled This Credit Union to Rank as a Top Georgia Credit Union

Below are key factors that enabled DOCO Credit Union to be rated as one of this year’s best credit unions in Georgia.

Savings and Investment Options

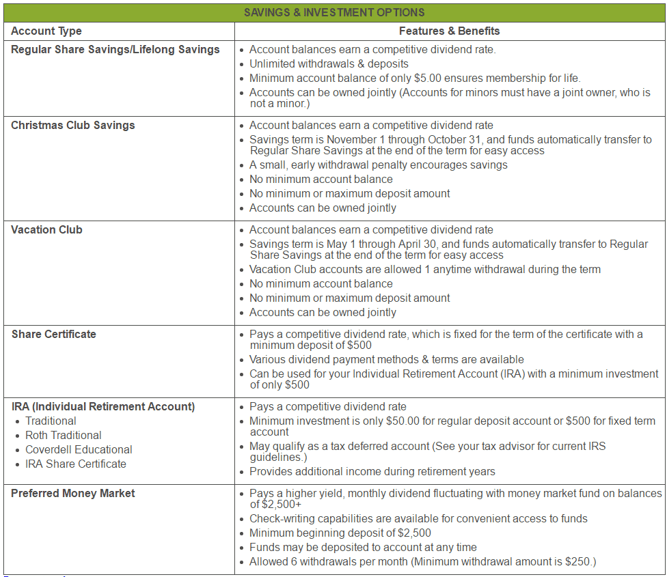

DOCO Credit Union is in the business of helping people grow personal wealth. That is why they offer a variety of savings and investment options to help their members save and grow their money so they can reach their financial goals.

Savings and investment account options available from this top credit union in Georgia are:

- Regular Share Savings/Lifelong Savings: share savings account establishes membership with $5 opening deposit, unlimited withdrawals and deposits, earns competitive dividends

- Christmas Club Savings: savings term is November 1 through October 31 with funds automatically transferring at the end of the term, no minimum balance requirements

- Vacation Club: savings term is May 1 through April 30 with funds automatically transferring at the end of the term, no minimum balance requirements

- Share Certificate: minimum deposit of $500 to open, various dividend payment methods and terms available

- Individual Retirement Account: minimum investment only $50 for regular deposit account or $500 for an IRA Share Certificate, may qualify as tax-deferred, pays a competitive dividend rate

- Preferred Money Market Account: pays a higher yield, monthly dividends fluctuating with money market funds on balances of $2,500 or more, check writing capabilities, minimum opening deposit of $2,500, unlimited deposits

Source: DOCO Credit Union

Checking Account Options

DOCO Credit Union has several checking account options designed to suit the needs of members of all ages and lifestyles. From a student starting out with their first checking account to someone who has hit a rough patch and needs a fresh start, this highly ranked credit union in Georgia has a checking account for everyone.

Checking account options from DOCO Credit Union are:

- Classic Checking: free checking with no monthly charge and no minimum balance, unlimited check writing, earns dividends at competitive rate

- Classic Plus Checking: designed for members aged 55 and older, same great benefits as Classic Checking with the addition of free checks

- Fresh Start Checking: a special account designed to help members who truly need a fresh start and have had trouble getting a checking account in the past

BudgetSmart

BudgetSmart is a software program that helps consumers budget and save money. This innovative software program is available to DOCO Credit Union members at no cost.

The easy-to-use software uses simple graphics, pop-up boxes, and bar charts to help members of this tech-savvy credit union in Georgia manage their money more effectively.

The BudgetSmart program can be used to:

- Establish a budget

- Track spending

- View tips for improving areas of overspending

- Determine how a major purchase or change in income would impact their budget

This amazing program is available for free download for members of this top Georgia credit union.

Related: Best Credit Unions in Sydney and Melbourne, Australia | Ranking

Georgia United Credit Union Review

Georgia United Credit Union was chartered in 1958 when seven DeKalb County, Georgia educators came together and pledged $5 each to form a credit union. The venture was a success, with assets rapidly growing by more than a million dollars each year over the first 25 years.

In 2010, this credit union in Georgia made the change from a federal charter to a state charter and opened their field of membership to residents of eight counties rather than just select employer groups.

Today this top credit union in Georgia has 19 branch locations and over $1 billion in assets. Georgia United Credit Union continually looks for ways to improve and adapt their products to meet the changing needs of their members. Their main goal is to be their members’ primary financial institution throughout all of the stages of their financial life.

Key Factors That Enabled This Credit Union to Rank as a Top Georgia Credit Union

Below are key factors that enabled Georgia United Credit Union to be rated as one of this year’s best credit unions in Georgia.

Low Auto Loan Rates

Most credit unions offer extremely competitive interest rates on auto loans when compared to traditional banks, but Georgia United Credit Union’s rates are amazingly low, even for a credit union.

With rates starting as low as 1.49%, this top credit union in Georgia affords their members with more purchasing power when it comes to shopping for a new or used car.

Visa Credit Cards

Georgia United Credit Union offers a credit card to suite everyone’s credit needs. A credit card from this top credit union in Georgia provides the flexible spending power members and comes with these great benefits:

- No annual fee

- Emergency cash disbursement and card replacement service

- Auto rental collision damage waiver

- Roadside dispatch

- Travel and emergency assistance

- Warranty management service

- Zero liability for fraudulent purchases

Available credit cards are:

- Visa Cash Back Card: 1.99% APR for first 12 billing cycles, then a variable rate

- Visa Platinum Credit Card: 1.99% APR for first 12 billing cycles then a variable rate

Flexible Checking Account Options

As one of the best credit unions in Georgia, Georgia United Credit Union offers a variety of checking accounts to suit every stage of life. As an added bonus for members, each checking account offered at this credit union in Georgia features free identity theft protection.

Checking account options at Georgia United Credit Union are:

- Free Checking: no monthly service charge when enrolled in direct deposit or eStatements, no minimum balance requirements, unlimited check writing

- Thrifty Checking: no minimum balance requirements, first 20 transactions free, monthly service charge of $2.50 per month

- Premier Checking: interest-bearing checking account, minimum balance of $1,000 to earn dividends and avoid monthly fee, unlimited check writing

- Upper Class Checking: free checking for members aged 55 and older, no minimum balance requirements, unlimited check writing, and free checks

- Restart Checking: for those who need a second chance for a checking account, $12 monthly service charge, minimum opening deposit of $25, direct deposit required

All checking accounts at this top credit union in Georgia offer overdraft protection and courtesy pay, access to Visa debit cards, online banking with bill pay, eStatements, and free direct deposit.

Georgia’s Own Credit Union Review

Founded in 1934 by a group of telephone employees with an initial investment of $160, Georgia’s Own Credit Union has since grown to become one of the largest credit unions in Georgia. This homegrown Georgia credit union is dedicated to providing its members with exceptional savings and quality services.

Georgia’s Own Credit Union currently serves more than 184,000 members and holds an impressive $2 billion in assets. The Georgia credit union offers a wide variety of financial products and services to members including savings, savings certificates, IRAs, checking accounts, auto loans, personal loans, mortgage services, and credit cards.

This top Georgia credit union also offer many electronic services for the convenience of their members such as online banking and bill pay.

Key Factors That Enabled This Credit Union to Rank as a Top Georgia Credit Union

Below are key factors that enabled Georgia’s Own Credit Union to be rated as one of this year’s best credit unions in Georgia.

Green Loans

Georgia’s Own Credit Union stands for a healthy planet. To encourage their members to be kind to the planet, this environmentally conscious credit union in Georgia has created incentives for members who purchase a hybrid vehicle, purchase Energy Star–rated products, or make home improvements that meet Energy Star ratings.

This credit union in Georgia’s Green Loans are a great way for members to get the financing they need for a new purchase or home improvements while enjoying rebates and doing their part for the environment.

Green Loan options are:

- Green Auto Loan: a 0.5% rate reduction on auto loans for hybrid and alternative fuel vehicles

- Green Lifestyle Loan: personal loan with a 1% rebate on money borrowed for qualified Energy Star products

- Home Equity Line of Credit and Loans: 1% rebate on total amount borrowed up to $500 for Energy Star qualified eco-friendly home improvements

- Green Mortgage: $300 off closing costs for Energy Start qualified home or Earth Craft homes on loans of $50,000 or more, $250 off closing costs on loans less than $50,000

Own Your Rate Certificates

Share Certificates are a great way to earn higher dividends on your funds at a guaranteed rate of return and no risk. Rates on certificates are locked in for the term of the certificate, which means that there is no risk of losing money if the market takes a downturn during the life of the certificate. There is also the risk of being locked into a lower rate if the market takes an upturn and rates become more lucrative.

At Georgia’s Own Credit Union they offer something different from most credit unions—a chance for members to bump up the rate on their certificate if rates improve during the life of the certificate. This gives members more earning power and flexibility to members so they don’t have to worry about being locked into a low rate if rates go up.

This top credit union in Georgia’s Own Your Rate Certificate is a great way to earn more on savings while minimizing risk and maximizing gain.

Available terms for this special certificates are 22, 33, and 44 months for one bump in rate during the term of the certificate, and 55 months for two bumps in rate during the term of the certificate.

Members may call or visit one of this best credit unions in Georgia’s locations if rates go up any time during the term of the certificate and have the interest raised to match the new, higher rate for the remainder of the term of their certificate.

Mortgage Products

For those looking to purchase a new home, Georgia’s Own Credit Union offers an array of great mortgage products. This homegrown credit union in GA offers mortgages with competitive rates, low closing costs, and personalized service.

Benefits of a secure and affordable mortgage from this top credit union in Georgia are:

- Working with an established mortgage lender members can trust

- Competitive rates

- Low closing costs

- Personalized service

- Automatic payment debit

- Local processing

- No lock-in or hidden fees

Mortgage products available from Georgia’s Own Credit Union are:

- Real estate services to help members find their new home

- Fixed payment mortgages

- First-time home buyer program

- Accelerated home payoff program

- Jumbo loans

- Adjustable rate mortgages

Popular Article: Best Credit Unions in New York, NY (Ranking & Review)

Free Wealth & Finance Software - Get Yours Now ►

Kinetic Credit Union Review

Kinetic Credit Union was founded in 1956 to provide financial support to the civilian employees of Fort Benning, Georgia. In 2005, the Georgia credit union expanded its charter to a community charter, allowing anyone who lives, works, or worships in its charter counties to be eligible for membership.

With their merger in April 2016 with MEA Federal Credit Union, Kinetic Credit Union became the official credit union in Georgia for the teachers, administrators, and support staff for the various school districts in their communities.

Today Kinetic Credit Union serves more than 41,000 members and has $279 million in assets. As one of the top credit unions in Georgia, they fully subscribe to the credit union philosophy of people helping people and support local area service organizations through their time, talents, and dollars.

Key Factors That Enabled This Credit Union to Rank as a Top Georgia Credit Union

Below are key factors that enabled Kinetic Credit Union to be rated as one of this year’s best credit unions in Georgia.

Checking Account Options

Kinetic Credit Union offers a range of checking account options designed with the needs of their members in mind. This Georgia credit union wants to make checking easy for its members, so its checking accounts are offered to members absolutely free.

As an added perk, all checking accounts come with free online banking, bill pay, eDeposit, and mobile banking. This top-notch credit union in Georgia also provides free notary services and free coin-counting services to their checking account holders.

Available checking account options are:

- Free Rewards Checking: free checking account that earns higher dividends as the account balance grows

- Free Smart Rate Checking: free checking account designed for members who keep a high monthly balance, comes with a high-yield rate

- Free Next Generation Checking: designed for young adults who are always on the go, includes unlimited check writing

eServices

Kinetic Credit Union realizes that in today’s hectic world, their members are constantly on the go. For this reason, this progressive credit union in Georgia strives to provide a wide range of eServices to ensure that their members are able to manage their finances anytime from anywhere.

eServices provided by this top credit union in Georgia are:

- Mobile banking with Touch ID capability

- eDeposit and mobile deposit

- FinanceWorks money management tool

- Funds transfer

- eBranch

- Bill pay

- Purchase rewards management

- eDocuments

- Flexible online payment options

- PopMoney people to people payment services

Business Services

Kinetic Credit Union is dedicated to helping local businesses meet their financial needs and grow their business. To that effect, this credit union in Georgia offers a diverse range of business service products to meet the needs of their business members.

Business services available from this top credit union in GA are:

- Business checking

- Business savings

- Business money market

- Business share certificates

- Commercial mortgages

- Business term loans

- Business lines of credit

- Business Visa credit card

- Merchant services

- Payroll services

- Business investments and insurance

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

LGE Community Credit Union Review

Established in 1951, LGE Community Credit Union is a state-chartered credit union headquartered in Marietta, Georgia. This established Georgia credit union has been providing cost-effective financial products to their community for more than sixty years.

With more than 103,000 members and $989 million in assets, LGE Community Credit Union is one of the best credit unions in Georgia. This financially strong top credit union in Georgia operates on a mission to improve the financial well-being of its members through economically priced and conveniently delivered services, caring personal service, and sound financial management.

Key Factors That Enabled This Credit Union to Rank as a Top Georgia Credit Union

Below are key factors that enabled LGE Community Credit Union to be rated as one of this year’s best credit unions in Georgia.

Checking Account Options

LGE Community Credit Union offers several cost-effective checking account options for members. Each checking account from this Georgia credit union comes with its own set of benefits, giving members the flexibility to choose what they do and don’t want from their checking account.

For members who like to stick to the basics, this Georgia credit union offers their Simply Checking account. Benefits of a Simply Checking account are:

- Free Visa debit card

- No minimum balance requirements

- Free eStatements

- Free bill pay

- Free online banking, mobile banking, and mobile app

- Free checks for members aged 55 and up

- No per-check fees

- Free notary service and free signature guarantees (by appointment)

For members who like the idea of earning a high-yield dividend on their account, LGE Community Credit Union offers their High Rate Checking account. A High Rate Checking account comes with all the same great benefits of the Simply Checking account, but also pays high dividends up to 1.50% APY when certain criteria are met.

The criteria required to earn dividends on this high-end checking account offered by this top credit union in Georgia are:

- Log on to online banking, mobile banking, or mobile app at least once a month

- Receive eStatements instead of paper statements

- Provide and maintain a valid email address

- Have at least one monthly direct deposit or one monthly automatic payment set up

- Perform any combination of 20 or more debit card or credit card transactions totaling $250 or more each month

With criteria that most people already perform each month, earning a high-yield dividend rate on the High Rate Checking account couldn’t be easier.

Both Simply Free Checking and High Rate Checking accounts are also available as youth accounts to those aged 16 or older with a valid government-issued ID.

Business Checking Accounts

LGE Community Credit Union offers an array of business services to local business owners. Among the services offered are four distinct analysis business checking account plans designed to meet the needs of their business members.

As one of the best credit unions in Georgia, LGE Community Credit Union includes a VISA debit card with all business checking accounts at no cost.

Business checking account options from this best credit union in Georgia are:

- Primary Checking: designed for start-up businesses with low transaction volumes, minimum average daily balance requirement of $2,500 to avoid monthly fee, 150 free transactions per month

- Growth Checking: designed for small businesses with moderate transaction volumes, earns dividends, $10,000 minimum average daily balance requirement to avoid monthly fee, 250 free transactions per month

- Volume Checking: designed for high-volume businesses with heavy cash or check volume, no minimum average daily balance requirement to avoid monthly fee, 250 free transactions per month

- Non-Profit Checking: designed for non-profit organizations, no minimum average daily balance requirement, no monthly maintenance fee, unlimited free transactions per month

All business checking accounts offered by this top Georgia credit union have merchant services and merchant capture services available.

Investment and Retirement Services

LGE Community Credit Union wants to help their members plan for their future. That’s why this top-rated credit union in Georgia offers investment and retirement planning services to their members.

Their financial advisors give members a complimentary consultation and can provide them with a variety of services.

Investment and retirement services offered by this credit union in Georgia are:

- Retirement planning

- 401K/Pension rollovers

- IRAs

- College planning

- Estate planning

Read More: Best Credit Unions in Texas (Ranking & Review)

Free Wealth Management for AdvisoryHQ Readers

Peach State Federal Credit Union Review

Originally founded in 1961 as Gwinnett Teachers Credit Union, Peach State Federal Credit Union serves members in Barrow, Clarke, DeKalb, Gwinnett, Jackson, Oconee, Richmond, and Walton counties. In 2012, the name was changed to Peach State Federal Credit Union after a vote by the Georgia credit union’s Board of Directors.

Key Factors That Enabled This Credit Union to Rank as a Top Georgia Credit Union

Below are key factors that enabled Peach State Federal Credit Union to be rated as one of this year’s best credit unions in Georgia.

Individual Retirement Accounts

Individual Retirement Accounts (IRAs) are a great way to save for the future. The great thing about IRAs is that they can be opened and funded without any employer participation, so members can begin saving for retirement immediately on their own terms.

Traditional IRAs are available from this top credit union in Georgia as a share club account that pays monthly dividends or as an IRA Certificate that pays dividends at a fixed rate over a specified term.

Contributions and dividend earnings for a traditional IRA are tax-deferred until retirement. Unlike many employer retirement plans, funds in an IRA are accessible, though there is a 10% early withdrawal penalty before the age of 59½.

Roth IRAs are also available from this top credit union in Georgia. Contributions to Roth IRAs differ from those made to a traditional IRA in that the contributed money has already been taxed. Because of this, the principal amount is never subject to taxes or penalties in the future as long as contribution guidelines are followed.

Members of this highly ranked credit union in Georgia can grow their retirement funds faster by investing their IRA funds in an Advantage IRA Certificate offered by this best credit union in GA. Peach State FCU’s Advantage IRA Certificates come with a five-year term and a very lucrative rate of 1.50% APY.

Checking Account Types

Peach State FCU offers several great checking account types for members to choose from. From a basic account to premium interest-bearing checking, this top Georgia credit union offers a checking account to suite all of their members’ financial needs.

Checking account types offered are:

- Basic Checking: no monthly service fee, no minimum balance requirement, no per check charges

- Premium Checking: earns dividends on balances, no per check charges, monthly fee can be avoided by maintaining daily balance of $1,000

- eXtreme Checking: designed for young adults aged 14–21, no monthly fee, no minimum balance requirement, first 40 checks free

- Fresh Start Checking: for those who have had trouble getting a checking account in the past, nominal monthly fee, Visa debit card available, after 12 months in good standing may be upgraded to a Basic or Premium Checking account

BALANCE Financial Fitness Program

Peach State FCU has partnered with BALANCE Financial Fitness Program to offer their services to the Georgia credit union’s members at no charge. This program offers members the services of BALANCE’s confidential financial counseling and education program free of charge.

Services offered by the BALANCE program are:

- Free access to certified financial counselors via their toll-free info line

- Housing counseling for those hoping to purchase a home

- Debt management to help provide a plan to get a struggling member back on track with debt payments

- Identity theft solutions to help members take steps to protect themselves or recover from identity theft if damage has already occurred

- Money management to help members develop a financial plan so they can achieve their goals

- Credit report review to help members understand the information in their credit report and know their rights

Free Money Management Software

Robins Financial Credit Union Review

Since being established in 1954, Robins Financial Credit Union has enjoyed rapid growth. In January 2016, they further expanded their field of membership when they converted from a federal credit union to a state chartered Georgia credit union. This has allowed them to offer financial services and products to family members of their existing members as well as to those that live in 21 counties across Georgia.

Robins Financial Credit Union serves more than 175,000 members and holds more than $2.2 billion in assets. The dedicated employees of this credit union in Georgia proudly serve members across the state.

Key Factors That Enabled This Credit Union to Rank as a Top Georgia Credit Union

Below are key factors that enabled Robins Financial Federal Credit Union to be rated as one of this year’s best credit unions in Georgia.

MyMoney MyWay Accounts

Robins Financial Credit Union knows that better banking means a brighter financial future. That is why this top credit union in Georgia designed their line of MyMoney MyWay accounts for members aged 16 to 26.

The goal of MyMoney MyWay accounts it to help young adults establish good financial habits early in their life. MyMoney MyWay products from this credit union in GA can help put young adults on the path to a bright financial future through learning how to budget spending with a checking account and helping to establish good credit with a credit card and first-time auto loan accounts.

The line of products available with the MyMoney MyWay program are:

- MyMoney MyWay Checking: $25 minimum opening deposit, free first box of checks

- MyMoney MyWay Savings: $25 minimum opening deposit, $100 minimum balance required to avoid monthly fee and earn dividends

- First-Time Auto Loan: special low rate to help establish credit, 100% financing on new and used vehicles, no loan processing fees

- MyMoney MyWay Visa: competitive low rates, credit limits up to $1,000, no annual fee and no fee for cash advances or balance transfers

Credit Builder Loan

A Credit Builder Loan from Robins Financial Credit Union is designed to help members in learning the importance of making loan payments in a timely manner. This helpful loan from this top credit union in Georgia can help a member build or rebuild their credit.

Here’s how the Credit Builder Loan works:

- $1,000 loan amount with 12-month repayment term

- Once the loan is funded to the member’s share account, the proceeds are placed on hold for the term of the loan

- At the end of the repayment period, the $1,000 is released to the member

Business Services

Robins Financial Credit Union offers a variety of business products and solutions for businesses. No matter how small or large the business, this best credit union in Georgia offers the right accounts for them.

As one of the best credit unions in Georgia, Robins Financial offers checking and money market accounts to help businesses with all of their deposit account needs.

In addition to checking and savings, Robins Financial Credit Union also offers commercial loan products to help provide businesses with the financing they need in order to grow and succeed.

Commercial loan products available from this top Georgia credit union are:

- Commercial real estate loans

- SBA loans

- Construction loans

- Secured and unsecured revolving lines of credit

- Business Visa Platinum

- Commercial equipment loans

- Business auto loans

Conclusion—Top 10 Best Credit Unions in Georgia

There are many factors that go into choosing the Georgia credit union that is right for you. While there are many great credit unions in Georgia on our list of credit unions in Georgia to choose from, they are not one size fits all.

In this article, we have reviewed the best credit unions in Georgia, including some of the best credit unions in Atlanta. Though all of these credit unions in Georgia offer exceptional customer service and state-of-the-art financial products and services, it is still important that you do your own due diligence.

When it comes to selecting the credit union in Georgia that is right for you there are many factors that should be considered. It is important to research a credit union’s eligibility requirements to be sure you qualify for membership and to research their financial services and products to be sure they are a good fit for your own individual financial needs.

The top credit unions in Georgia on this list can give you a good starting point when it comes to find a financial institution in Georgia that puts your interests first.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.