2017 RANKING & REVIEWS

TOP RANKING CREDIT UNIONS IN JACKSONVILLE

Finding the Top Credit Unions in Jacksonville, FL

Credit unions differ from traditional banking institutions in that credit union account holders are co-owners of the credit union. Typically, an eligible member will open a share savings account with the credit union, and this share account will serve as the member’s share ownership of the union.

Credit unions have varied minimum deposit amounts for opening a share savings account, and some may have a minimum account balance requirement. All credit unions have membership eligibility requirements, and this is no different for the credit unions in Jacksonville.

Some limit membership to those who live in particular zip codes, while others limit account holders to persons affiliated with particular organizations, such as government employees or medical health professionals.

Award Emblem: Best Credit Unions in Jacksonville, Florida

Award Emblem: Best Credit Unions in Jacksonville, Florida

Each credit union carries its own rules for membership, so you will need to do some research to determine which credit union in Jacksonville will allow you to open an account.

Due to the structural differences of the above mentioned institutions, you may be attracted to a traditional bank or a credit union. If you’ve already made the decision to work with one of the credit unions in Jacksonville, this list may provide some insight regarding credit unions in the area.

This list includes some of the membership guidelines and offerings of a few of the top credit unions Jacksonville, FL, has to offer, but it is not a comprehensive list of all credit union offerings, services, accounts, rates, and fees.

You should do your own research and conduct a thorough search before opening an account with a particular credit union. Be sure to review the websites yourself and to discuss with a credit union professional to make sure you are fully aware of how a particular credit union in Jacksonville, FL, may serve you and what fees, terms, and benefits they have to offer.

List of the Best Credit Unions in Jacksonville, FL

- 121 Financial Credit Union

- Alive Credit Union

- City Police Federal Credit Union

- Coastline Federal Credit Union

- Community First Credit Union

- First Florida Credit Union

- Florida Baptist Credit Union

- Jacksonville Fireman’s Credit Union

- Jacksonville Postal & Professional Credit Union

- Jax Federal Credit Union

- Jax Metro Credit Union

- JM Associates Federal Credit Union

- Metro North Federal Credit Union

- Vystar Credit Union

List is sorted alphabetically (click any of the names above to go directly to the detailed review section for that credit union)

Methodology for Selecting Credit Unions in Jacksonville, Florida

What methodology did we use in selecting this list of best credit unions in Jacksonville?

Using publicly available sources, AdvisoryHQ identified a wide range of accounting firms that provide services in Jacksonville and the surrounding areas.

We then applied AdvisoryHQ’s “Breakthrough Selection Methodology” to identify the final list of top credit unions that provide services to communities in and around Jacksonville.

Click here for a detailed review of our methodology: Methodology for Ranking Top Banks and Credit Unions in the U.S.

Top Credit Unions in Jacksonville, FL (Statewide)

| Credit Union | Location |

| 121 Financial Credit Union | Jacksonville |

| Alive Credit Union | Jacksonville |

| City Police Federal Credit Union | Jacksonville |

| Coastline Federal Credit Union | Jacksonville |

| Community First Credit Union | Jacksonville |

| First Florida Credit Union | Jacksonville |

| Florida Baptist Credit Union | Jacksonville |

| Jacksonville Firemen’s Credit Union | Jacksonville |

| Jacksonville Postal & Professional Credit Union | Jacksonville |

| Jax Federal Credit Union | Jacksonville |

| Jax Metro Credit Union | Jacksonville |

| JM Associates Federal Credit Union | Jacksonville |

| Metro North Federal Credit Union | Jacksonville |

| Vystar Credit Union | Jacksonville |

(List is sorted alphabetically)

Detailed Review – Top Ranking Credit Unions in Jacksonville, Florida

Below, please find the detailed review of each firm on our list of top credit unions in Jacksonville. We have highlighted some of the factors that allowed these Jacksonville credit unions to score so highly in our selection ranking.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

City & Police Federal Credit Union Review

City & Police Federal Credit Union was chartered on January 14, 1935, as the Jacksonville Police Credit Union. The organization operated as the Jax Police Credit Union for 55 years, and after a few mergers and changes, the union ultimately changed its name to the City & Police Federal Credit Union in 2001.

Key Factors that Enabled This Credit Union to Rank as a Top Credit Union

Below are key factors that enabled City & Police Federal Credit Union to rank as a top credit union in Jacksonville, Florida.

Membership Eligibility

Membership is open to employees who work in, or are supervised from, Jacksonville within the following agencies:

- Jacksonville Sheriff’s Office

- Jacksonville Port Authority Police

- Clerk of the Court

- Jacksonville City Motor Pool

- Jacksonville Parks & Recreation Department

- Jacksonville Transportation Authority

Employees who work in Duval, Clay, Nassau, and St. Johns counties and from the following agencies:

- Florida Highway Patrol

- Florida Marine Patrol

- Florida Game and Fresh Water Fish Commission

- Florida Beverage Commission

- Florida Department of Law Enforcement

- Office of the Judiciary

- Florida State Attorney’s Office

- Florida Public Defender

- Clay County Sheriff’s Office

- Nassau County Sheriff’s Office

- St. John’s County Sheriff’s Office

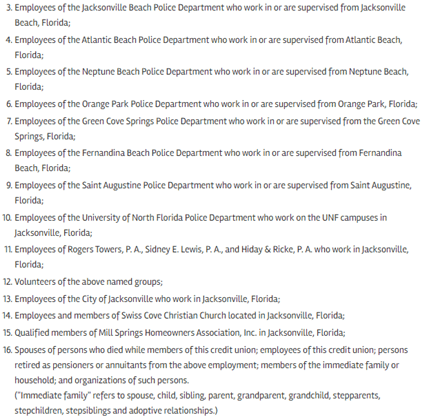

Note some additional membership eligibility here:

Image Source: City & Police Federal Credit Union

Community Outreach

City & Police Federal Credit Union explains that its members work hard to serve their community as first responders; thus, credit union employees strive to serve as well.

This year, in connection with several local credit unions, City & Police Federal Credit Union participated in Mad City Money, an event that allows teens to participate in a simulation that provides a taste of the “real world” by managing mock occupations, salaries, families, debts, and medical insurance payments.

Savings and Checking Accounts

City & Police Federal Credit Union has several savings and checking accounts available for eligible members to open.

Loans and Credit Cards

Available loans for application include:

- Auto loans

- First time auto buyer

- City Advance loans

- Home equity loans

- Home mortgages

- Personal loans

- Recreational loans

- Secured loans

The credit union also has MasterCard credit cards available for application. Contact a City & Police Federal Credit Union representative to learn more about the terms of these MasterCard credit cards.

Some additional services at City & Police Federal Credit Union include investment services and insurance products.

Be sure to check the City & Police Federal Credit Union website and to contact a credit union representative to be sure that you are fully aware of all membership and account requirements, fees, terms, rates, conditions, and benefits.

Florida Baptist Credit Union Review

Florida Baptist Credit Union is a Jacksonville credit union that has been in operation for almost 30 years. The credit union serves Florida Southern Baptist members, including churches, ministries, associations, and church members and their businesses. The organization tithes to the church in order to promote growth in Florida.

Key Factors that Enabled This Credit Union to Rank as a Top Credit Union

Below are key factors that enabled First Baptist Credit Union to rank as a top credit union in Jacksonville.

Checking Accounts

Checking accounts may be opened for individuals, ministries, and businesses. Overdraft protection services may be linked to these checking accounts. Check with a First Baptist Credit Union representative to learn about the overdraft protection service and any associated terms and fees connected with the program.

Savings Accounts

For Individuals

Several savings accounts are available for individuals, including:

- Share savings accounts

- Money market accounts

- Term certificates

- IRAs

- Special savings accounts

- Noah’s Ark Club (Youth accounts)

For Ministries

Several savings accounts are available for ministries:

- Share savings

- Money market accounts

- Term certificates

- Special savings accounts

- Noah’s Ark Club

For Businesses

Several savings accounts are available for small businesses:

- Share savings accounts

- Money market accounts

- Term certificates

- IRAs

- Special savings accounts

Loans

Various loans are also available for individuals, ministries, and businesses.

Individuals

- Auto loans

- Personal loans

- Personal line of credit

- Recreational vehicle loans

Ministries

- Auto/vehicle loans

- Church line of credit

Businesses

- Auto/vehicle loans

Be sure to check the First Baptist Credit Union website and to contact a credit union representative to be sure that you are fully aware of all membership and account requirements, fees, terms, rates, conditions, and benefits.

Jacksonville Fireman’s Credit Union Review

Jacksonville Fireman’s Credit Union was first established in 1933. Membership is open to regular employees or public officials of Fire/Rescue Departments in Duval, Clay, Nassau, St. Johns, Flagler, Columbia, Putnam, and Volusia counties. Membership is also open to any association of employees, volunteer organizations associated with professional firefighters, emergency services personnel, associated government employees, and members of the family of people within these groups.

Image Source: BigStock

Key Factors that Enabled This Credit Union to Rank as a Top Credit Union

Below are key factors that enabled Jacksonville Fireman’s Credit Union to rank as one of the top Jacksonville, FL, credit unions.

Online Banking

Jacksonville Fireman’s Credit Union (JFCU) has set up an online banking platform that members may use to access their accounts. Services available online include:

- View account balances and transaction history

- Make transfer or loan payments

- Submit change of address forms or other forms

- Pay bills

Mobile Banking

The credit union has also made a mobile app available. This application allows members to conveniently access accounts 24/7 at the touch of their fingertips using only an internet connection and a compatible mobile phone.

Savings Accounts

Regular share accounts may be opened by eligible persons at Jacksonville Fireman’s Credit Union. Savings accounts include:

- Regular share account

- Certificates of deposit (terms up to 5 years)

- IRAs

- Club and Organization Accounts

Checking Accounts

There are several checking accounts that may be opened at this credit union. Some of the benefits of these accounts include:

- No monthly service charge if specified minimum daily balance is maintained

- No per check charges – unlimited check writing

- Overdraft protection to share savings account (Fees may apply)

- Low-cost check printing

- Earn daily interest on the ending day’s balance

- No charge for direct deposit, preauthorize charges, or automatic transfers

- No ATM fees at JFCU ATM machines

- Choose between several checking accounts based on minimum balance (higher minimum balance accounts will earn higher daily interest; subject to credit check to qualify)

The above information was made available on the Jacksonville Fireman’s Credit Union website as of July 2016.

Additional Services

Various loans may also be applied for at JFCU.

Be sure to check the Jacksonville Fireman’s Credit Union website and to contact a credit union representative to be sure that you are fully aware of all membership and account requirements, fees, terms, rates, conditions, and benefits.

Jacksonville Postal & Professional Credit Union Review

This credit union was first chartered in 1929, making Jacksonville Postal & Professional Credit Union the first state chartered credit union in Florida. The union was organized by twelve founding members who contributed to the union’s total assets of $60. By 2010, the credit union was comprised of 5,000 members and $42,000,000 in assets.

Key Factors that Enabled This Credit Union to Rank as a Top Credit Union

Below are key factors that enabled Jacksonville Postal & Professional Credit Union to rank as one of the top Jacksonville, FL, credit unions.

Membership Eligibility

At Jacksonville Postal & Professional Credit Union (JPPCU), membership is open to:

- Employees of the postal service

- Professionals (Attorneys, CPAs, Certified Engineers, Architects, Physicians, Dentists, Optometrists, Psychologist, Veterinarians, Abstractors, Appraisers, Real Estate Brokers, Funeral Directors, Air Chartered Groups) practicing in Duval, Clay, Nassau, St. Johns, and Volusia

- Employees with such groups, members of immediate families, including parents, children, spouse, or surviving spouse of the member, or relatives by blood, marriage, adoption, even if they do not reside in the same household with the member

- Residents living or working in zip codes 32207, 32211, 32216, 32224, 32225, 32233, 32246, 32250, 32266, 32277

Savings Accounts

Many savings accounts may be opened by eligible members at JPPCU. Savings accounts include:

- Regular account

- Club account

- IRA account

Checking Account

Members may also open a checking account at JPPCU. Some of the checking account features include:

- $2 monthly service charge

- VISA debit card

- Unlimited check writing

- No minimum balance requirements

- And more

Above terms and rates were made available on the JPPCU website as of July 2016.

Overdraft Protection

Overdraft protection services may also be set up by linking a checking account to a savings account or another checking account. The credit union’s website explains that several overdraft protection options are available, so inquire with a JPPCU representative to be sure of all fees, terms, and options.

Home Banking

Members may also access accounts using JPPCU’s home banking, where they may access services such as viewing accounts balances, transfers, and bill pay.

Members may also access accounts through the credit union’s Audio Annie service, which is an =-interactive phone service.

Additional Services

Loans are also available at JPPCU.

Be sure to check the Jacksonville Postal & Professional Credit Union website and to contact a credit union representative to be sure that you are fully aware of all membership and account requirements, fees, terms, rates, conditions, and benefits.

Jax Metro Credit Union Review

Jax Metro Credit Union first received its charter in 1935 and served electric, water, distribution, department docks, and terminals industries. Since then, membership has expanded and is described in further detail below.

Key Factors that Enabled This Credit Union to Rank as a Top Credit Union

Below are key factors that enabled Jax Metro Credit Union to rank as a top credit union in Jacksonville.

Membership Eligibility

Membership is open to Jax Metro employees and their family members, as well as employees, current or retired, of the following groups, including family members. Also eligible is any association of people working for such groups, listed below:

- City of Jacksonville

- Jacksonville Electric Authority

- Jacksonville Port Authority

- St. Johns River Power Park

- The Energy Authority

- Jacksonville Housing Authority

- Jacksonville Transportation Authority

- Duval County School Board

- Federal employees working within 5 miles of a JUECU office

- Special purpose contracted persons with the aforementioned groups

- The King Company employees assigned to aforementioned groups

- Zachary Company

- Fluor Global Services

- Temp Force Staffing employees assigned to above groups

- Mirabilis HR – North Florida District

- JEA customers who have qualified and utilized Shop Smart program benefits

- North Florida Yacht sales employees and up to a maximum of 500 patrons each year

- Persons who live or work in the geographical zip codes of 32206, 32202, 32205, 32208, 32211, 32218, 32220, 32226, and 32254 in Duval County, Florida

- Persons who live or work in the JEA service area or JEA’s local agreement service areas

Bank Accounts

Several accounts are available for members at Jax Metro Credit Union. There are a few checking accounts, more than one savings account, certificate accounts, IRA accounts, and Youth accounts.

Overdraft Privilege

Members may opt into overdraft privilege for personal checking accounts. If the account is in good standing, Jax Metro Credit Union may pay reasonable overdrafts on a discretionary basis.

Fees will apply for each transaction that would create an overdraft on the account. The credit union will send a notice each time an overdraft occurs. Be sure to inquire about all of the fees, terms, and benefits of using overdraft protection. Information regarding overdraft protection at Jax Metro Credit Union were made available on its website as of July 2016.

Overdraft Protection

Overdraft protection may also be set up with a checking account, which is a program that will cover overdrawn transactions with an auto advance against a pre-approved loan account for the insufficient amount. A minimum advance of $100 is required. Limitations may apply. Be sure to inquire about all the details with a Jax Metro Credit Union representative.

Home Banking

Several options are available for members to manage accounts without having to go to the branch location.

eBanking

This service allows members to access accounts from home using a personal computer. With eBanking, account holders may utilize tools such as view balances, transaction history, transfer funds, bill pay, and more.

Mobile Banking

Mobile banking provides members with access to their accounts at the touch of their fingertips. Sign in and view account balances and history, make transfers, process person-to-person transfer, and make remote check deposits using a mobile device.

Phone Banking

Members can also utilize a phone banking system to manage accounts. The phone system may be used 24/7.

Check the Jax Metro Credit Union website and contact a credit union representative to be sure that you are fully aware of all membership and account requirements, fees, terms, rates, conditions, and benefits.

Metro North Federal Credit Union Review

Metro North Federal Credit Union has operated as a Jacksonville credit union since 1954. Employees of member affiliated organizations are eligible for membership. Family members, including spouses’ parents, are eligible, as well as retired employees of affiliated member organizations. Contact the credit union to learn more about specific member affiliated organizations.

Key Factors that Enabled This Credit Union to Rank as a Top Credit Union

Below are key factors that enabled Metro North Federal Credit Union to rank as a top credit union in Jacksonville.

Member Accounts

Several accounts are available for eligible persons to open with Metro North Federal Credit Union. The credit union has savings accounts, as well as a share draft account (similar to checking), Christmas club account, IRA account, and certificates of deposit. Check with a Metro North Federal CU representative regarding account details.

Share Savings Accounts

As is generally the norm for credit unions, a share savings account is a member’s initial account with Metro North Federal Credit Union. A member must deposit at least $25 to open a share account, and deposits may be made in person, by mail, or via payroll deduction or direct deposit. (Minimum deposit amount made available on Metro North Federal’s website as of July, 2016.)

A share account pays periodic dividends on accounts with balances of at least $300. Rates are set by the board of directors.

Holiday Club Account

This is a “set-aside” account designed to help account holders save for major expenses this year. The account will be handled like a share savings account. (As stated on Metro North Federal Credit Union’s website as of July, 2016.)

Credit Cards and Loans

A Visa credit card is available for application with this credit union.

Loans are also available. Check with a Metro North Federal representative to learn about specific available loans.

Be sure to check the Metro North Federal Credit Union website and to contact a credit union representative to be sure that you are fully aware of all membership and account requirements, fees, terms, rates, conditions, and benefits.

Free Wealth & Finance Software - Get Yours Now ►

To browse exclusive reviews of all top rated credit unions in Jacksonville, please click on any of the links below.

- 121 Financial Credit Union

- Alive Credit Union

- City Police Federal Credit Union

- Coastline Federal Credit Union

- Community First Credit Union

- First Florida Credit Union

- Florida Baptist Credit Union

- Jacksonville Fireman’s Credit Union

- Jacksonville Postal & Professional Credit Union

- Jax Federal Credit Union

- Jax Metro Credit Union

- JM Associates Federal Credit Union

- Metro North Federal Credit Union

- Vystar Credit Union

Conclusion – Top 14 Best Credit Unions in Jacksonville

Hopefully, this article has offered some insight into what credit unions may potentially offer their members. We suggest that you dive deeper into your research and contact the credit unions to learn more about specific rates, fees, and benefits that may affect you as an account holder.

A good place to start in your research is membership eligibility requirements. This may be your first area of interest when looking into a particular credit union, because if you are not eligible for membership, you won’t be able to open an account with that credit union.

Once you’ve learned whether you qualify for eligibility at a particular Jacksonville credit union, you may feel ready to look into the additional services that it offers members. Everyone’s needs will vary, so choose a credit union that matches your particular needs, financial goals, and values.

This article is not a comprehensive list of all services and rates from the above credit unions, and this is not financial advice. You should conduct your own research. The services, prices, and other information in this article regarding these credit unions was available on their websites as of July 2016.

To be sure that the information has not changed, and to verify for yourself, review the websites yourself or contact a credit union representative. You can also head to the banking locations to learn more about the institution and the terms, fees, and conditions of all the accounts and products before opening an account.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.