2017 RANKING & REVIEWS

TOP RANKING BEST INVESTMENT BANKS

Introduction: An Overview of Investment Banking

Investment banking firms serve a multitude of purposes in the world of finances and investing. Top investment banks handle the underwriting and issuing of new stocks, oversee mergers and acquisitions, and provide asset management and financial advisory services to clients.

Investment banking companies regularly work with businesses and government entities to guide them on aspects of financing, raising capital, and acquiring outside assets.

Many businesses seek guidance from top investment banking firms on raising capital. The best investment banks will be able to advise the best way to raise funds. When the best path to raising capital includes offering public stock options or borrowing through public bonds, a top investment bank is able to utilize comprehensive financial models to help determine the best pricing scenarios.

Award Emblem: Best 10 Top Investment Banks

Other functions of big investment banks include researching and offering stock recommendations, trading and selling stocks and bonds on clients’ behalf, wealth management for corporations and individuals, and securitized products.

At the end of the day, the top investment banks play an important role in helping individuals, corporations, and government entities make well-informed financial decisions and raise capital to fund their enterprises.

Choosing the Right Investment Banking Firm

There are many factors to consider when considering investment banking companies to work with. For the best possible outcome, it is important to do your due diligence and make sure to hire one of the best investment banks to represent your financial interests.

While some investors decide to concentrate solely on the largest investment banks, it is best to carefully consider all of the options available before making a final decision. That is why, through our comprehensive selection methodology, we have curated this list of the best investment banking firms.

On our investment bank ranking of the ten top investment banks, you will find some of the biggest investment banks as well as some lesser known choices. Regardless of size, all of the best investment banks on our investment bank list offer superior quality products and outstanding customer service.

See Also: Top Banks in Illinois | Ranking | Banks in Chicago, Aurora & Other IL Cities

AdvisoryHQ’s List of the Best Investment Banks

- Bank of America Merrill Lynch

- Barclays

- Citigroup

- Credit Suisse

- Deutsche Bank

- Goldman Sachs

- JPMorgan Chase

- Morgan Stanley

- UBS AG

- Wells Fargo

List is sorted alphabetically (click any of the names above to go directly to the detailed review section for that bank)

Top Investment Banks:

Banks | Websites |

| Bank of America Merrill Lynch | http://www.bofaml.com/en-us/content/global-corporate-investment-banking.html |

| Barclays | https://www.investmentbank.barclays.com/banking.html |

| Citigroup | http://icg.citi.com/icg/corporateandinvestmentbanking/invest_banking.html |

| Credit Suisse | https://www.credit-suisse.com/us/en/investment-banking.html |

| Deutsche Bank | |

| Goldman Sachs | http://www.goldmansachs.com/what-we-do/investment-banking/ |

| JPMorgan Chase | https://www.jpmorgan.com/global/cib/investment-banking |

| Morgan Stanley | http://www.morganstanley.com/what-we-do/investment-banking |

| UBS AG | https://www.ubs.com/global/en/investment-bank.html |

| Wells Fargo | https://www.wellsfargo.com/com/securities/investment-banking/ |

Table: Best 10 Top Investment Banks | above list is sorted alphabetically

Methodology for Selecting the Best Investment Banking Companies

What methodology did we use in selecting this list of top investment banks?

Using publicly available sources, AdvisoryHQ identified a wide range of investment banking firms that provide services to corporations and consumers.

We then applied AdvisoryHQ’s “Breakthrough Selection Methodology” to identify the final list of best investment banks that provide the most value for consumers.

Detailed Review – Top Investment Bank Ranking

Below, please find the detailed review of each firm on our list of top investment banks.

We have highlighted some of the factors that allowed these investment banking companies to score so highly in our selection ranking.

Don’t Miss: Best Banks in Pennsylvania | Ranking of Top Banks in Philadelphia, Pittsburgh, etc.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Bank of America Merrill Lynch Review

Merrill Lynch is a well-known name among investment banking firms and became the corporate and investment banking division of Bank of America after the banking giant acquired them in 2009.

Merrill Lynch Bank of America is a global investment bank with divisions in the Asia Pacific, Europe, Middle East and Africa, Latin America, and the United States and Canada. They are one of the largest investment banks in the world, ranking fifth globally in terms of total revenue produced.

Key Factors That Enabled This Firm to Rank as a Top Investment Bank

Below are key factors that enabled Merrill Lynch Bank of America to be rated as one of this year’s best investment banks.

Industry Leader in Global Research

In order to guide their clients in making informed and profitable financial decisions, Merrill Lynch employs expert research analysts to provide objective, in-depth research on the global markets.

The top investment bank has been named the top global research firm by Institutional Investor magazine the past five years in a row and is considered a leader in the industry.

The vast research capabilities of this top investment banking firm includes:

- Global equity research

- Global credit and GEMs fixed income research

- Global investment strategy

- Global economics

- Global rates and currency research

- Global commodities and derivatives research

- Corporate access

Capital Strategy

When starting a new business venture, one of the main concerns is raising enough capital to turn a business idea into a reality. Through their long-term relationships and vast experience in the industry, Merrill Lynch is able to connect businesses at all levels to sophisticated global investors.

The large investment banking firm can advise businesses in the following areas:

- Prime brokerage solutions

- Securities lending

- Custody, agency, and escrow

- Hedge fund consulting

Self-Directed Investing Platform

BOA Merrill Lynch provides consumers with self-directed investment options through their online trading platform, Merrill Edge. With Merrill Edge, consumers can enjoy unlimited online equity and ETF trades for a simple, flat monthly rate of $6.95.

The top investment bank’s online platform offers an array of account options to help investors meet their financial goals, including:

- Online brokerage accounts

- Retirement accounts

- College planning accounts

- Small business accounts

Investment options offered by the platform include:

- Stocks

- ETFs

- Mutual funds

- Fixed income

CashPro

CashPro is BOA Merrill Lynch’s online account management platform. As one of the top investment banking companies, they offer a comprehensive platform where customers can manage all of their banking relationships.

Capabilities of the platform include:

- Making payments

- Receiving funds

- Investing excess liquidity

- Viewing account balances in real time

The top investment bank designed their CashPro platform with input from their existing clients, and it features robust security measures to keep clients’ information safe.

The CashPro platform is designed to allow business to simplify and integrate their treasury activities. Through the platform, clients are able to access interactive training, tech support, and timely assistance for transaction inquiries.

Barclays Investment Bank Review

Barclays Investment Bank is the investment banking division of Barclays Bank, headquartered in London. The firm is among the investment banking firms with a global presence, currently operating offices in more than 29 countries.

The top investment bank acquired the main U.S. division on Lehman Brothers in 2008 amid the financial crisis, a move that greatly bolstered their North American presence. The bank provides advisory and financing services to an array of clients, including large companies, institutions, and government entities.

Image Source: Best Investment Banks Review

Key Factors That Enabled This Firm to Rank Among the Top Investment Banks

Below are key factors that enabled Barclays Investment Bank to be rated as one of this year’s best investment banks.

Industry Coverage

Barclays Investment Bank offers an integrated coverage model that provides their clients access to industry expertise across all products. The best investment bank’s goal is to ensure that clients globally are provided with informed strategic advice and comprehensive financial solutions for wherever they are located in the world.

This big investment bank’s geography-specific industry coverage teams offer expertise in a wide range of areas, including:

- Consumer retail

- Financial institutions

- Financial sponsors

- Healthcare

- Industrials

- Natural resources

- Power and utilities

- Real estate

- Technology, media, and telecommunications

Mergers and Acquisitions

Barclays Investment Bank’s Merger and Acquisitions group provides clients with strategic advice and services on challenging and complex transactions. The top investment bank’s global mergers and acquisitions team works alongside their industry coverage bankers to provide unique insights and help clients grow and manage their businesses.

The best investment bank’s merger and acquisitions capabilities include:

- Acquisitions

- Defense/activism

- Divestitures

- Exclusive sales

- Fairness opinions

- Joint ventures

- Leverage buyouts

- Mergers

- Restructuring

- Special committee assignments

- Spin-offs

Execution and Risk Management Tools

This top investment bank has a focus on helping their investor clients understand developments in global markets. The large investment banking firm offers execution and risk management tools across each major asset class.

They provide financial and advisory services in the areas of:

- Credit

- Equities liquid markets

- Macro

- Prime brokerage services

- Structured and financing markets

BARX

BARX is this top investment banking firm’s award-winning e-trading platform. The comprehensive trading tool is currently only available to companies and institutional clients and offers access to e-trading solutions across multiple platforms, including:

- Fixed income

- Foreign exchange

- Future exchanges

- Emerging markets

- Money markets

Barclays Live

Barclays Live is the top investment banking company’s client-facing portal. The platform provides clients with tools that allow them to perform comprehensive equity research.

Through Barclays Live, clients have access to Barclays’s award-winning global research, their award-winning electronic trading service BARX, and sophisticated analytical tools and market monitors.

Barclays Live was voted as the number one web-based tool in the U.S. and Europe by Institutional Investor magazine in 2014.

Related: Best Banks in Missouri (Ranking & Reviews)

Citigroup Review

Headquartered in New York City, Citigroup is one of the ten largest banks in the world by market capitalization. Formed in 1998 through the merger of Traveler’s Group and CitiCorp, the financial conglomerate offers investment banking services through its institutional clients group division.

Among the top investment banks, Citigroup’s investment banking firm offers a wide range of corporate and investment banking services and products to corporations, governments, institutions, and high-net worth individuals.

Key Factors That Enabled This Firm to Rank Among the Top Investment Banks

Below are key factors that enabled Citigroup to be rated as one of this year’s best investment banks.

Financial Strategy and Solutions

Citigroup’s financial strategy and solutions group serves as the top investment banking firm’s thought leader on global trends.

Through its financial strategy and solutions experts, the big investment bank is able to advise corporate and financial institution clients worldwide on a wide range of global finance issues, such as:

- Valuation

- Capital structure

- Credit ratings

- Risk management

- Liability management

- Shareholder distributions

- Acquisition and funding strategies

This specialized group is at the core of many of Citigroup’s most complex transactions and plays a vital role in developing relationships with some of the firm’s most sophisticated clients.

Corporate Banking

Citigroup’s corporate banking division is a leading provider of financial services to top-tier clients all across the world. As one of the largest investment banks in the world, this division serves some of the globe’s preeminent corporations and financial institutions with a wide range of corporate banking solutions.

Organized along industry lines and serving clients in more than 100 countries, corporate bankers at this top investment bank have an in-depth understanding of the complex financial issues faced by their multi-national clientele. This specialized understanding and knowledge allows Citigroup to effectively deliver innovative financial solutions to clients all across the globe.

Financial solutions handled by the corporate banking division of this best investment banking firm include:

- Cash management

- Foreign exchange

- Trade finance

- Custody

- Clearing and loans

- Capital markets

- Derivatives

- Structured products

Diverse Range of Products

As one of the foremost investment banking companies in the world, Citigroup offers a diverse range of investment products and services encompassing even the most complex financial solutions.

Products and solutions are offered by this top investment bank in the areas of:

- Fixed income

- Commodities

- Credit

- Equities

- FX and EM local markets

- Futures, clearing, and collateral

- Global securitized markets

- Investor services

- Multi-asset investment and trading products

- Municipals

- Capital markets origination

- Markets quantitative analysis

- Research

Awards and Accolades

Year after year, Citigroup is consistently ranked as being among the best investment banking firms in the world. One of the reasons that they made our investment bank list of the best investment banks is because they are so highly regarded within the industry.

Recent awards and accolades awarded to the top investment bank include:

- Triple A asset Asian awards 2013 & 2014

- Asian investor service provider awards for asset services 2013

- Custody risk award 2013

- EnergyRisk awards 2015

- EnergyRisk Asia awards 2015

- Global custodian agent banks in emerging markets survey winner 2013

- Global custodian hedge fund administration survey winner 2013

- Global custodian securities lending survey winner 2013

- Global finance world’s best internet banks 2013

- Global Finance world’s best sub custodian bank awards 2013

- Global finance world’s best foreign exchange provider awards 2013

- Global investor investment excellent award 2013

- Hedge week global award 2013

- HFM week fund of hedge fund award 2013

Popular Article: Best Private Banks | Ranking | Top Private Wealth Management Banks

Credit Suisse Review

Founded in 1856, Credit Suisse is a leading global wealth manager with specialist investment banking capabilities and a strong presence in their home market of Switzerland. Credit Suisse is among the biggest investment banks in the world and enjoys a global reach with operations in more than 50 countries.

Credit Suisse currently employs more than 48,000 employees worldwide and has more than 3,800 relationship managers globally. The investment banking firm holds more than $820 billion in assets.

Key Factors That Enabled This Firm to Rank Among the Top Investment Banks

Below are key factors that enabled Credit Suisse to be rated as one of this year’s best investment banks.

Product Offerings

The primary goal of Credit Suisse’s investment banking team is to help their clients thrive. This top investment bank accomplishes this by providing a broad range of financial products and services to the corporations, governments, institutions, and private individuals that they serve around the world.

As one of the biggest investment banks, Credit Suisse offers clients:

- Advanced execution services

- Capital markets

- Convertibles

- Corporate access

- Corporate insights

- Emerging markets

- Equity derivatives

- Equity sales and trading

- Exchange traded funds

- Fixed income

- Financial sponsors

- Fund linked products

- HOLT

- Industry experience

- Mergers and acquisitions

- Prime services

- Private placements

Research Capabilities

At the heart of all of Credit Suisse’s products and solutions is research. As one of the world’s largest investment banks, the investment banking firm employs leading experts including strategists, economists, fixed income product analysts, and equity sector analysts.

This top investment bank’s macro teams offer insightful forecasting and analysis, and their product and sector teams provide in-depth insights across asset classes. These two teams work together to bring clients unique investment information and access to a global view.

Areas of research provided by Credit Suisse include:

- Equities research

- Fixed income research

- Global indices and alpha strategies

- Investment solutions

- Macro research

- Technical analysis

Global Reach

Though headquartered in Switzerland, Credit Suisse enjoys a global presence. The top investment bank operates a multitude of offices throughout the globe.

As one of the biggest investment banks, Credit Suisse operates in more than 50 countries. The best investment bank’s operations encompass four main regions:

- Americas: this region is represented by offices in 44 cities spanning 14 countries across the U.S., Canada, the Caribbean, and Latin America.

- Asia Pacific: this region is represented by 18 offices in 12 markets including Australia, China, Hong Kong, Korea, Japan, Southeast Asia, and India.

- EMEA: this region is represented by offices in 78 cities in 26 countries across Europe, the Middle East, and Africa (EMEA).

- Switzerland: headquartered in Zurich, Credit Suisse enjoys a strong presence in their home market of Switzerland.

Deutsche Bank Review

Founded in 1870 as a specialist bank for foreign trade, Deutsche Bank is a German global banking and financial services company headquartered in Frankfurt. With over 100,000 employees across more than 70 countries, Deutsche Bank ranks among the big investment banks.

This top investment bank is headquartered in Germany but enjoys a large presence in Europe, the Americas, Asia-Pacific, and the emerging markets. The bank’s core business is investment banking, where they offer financial services and products to corporate and institutional clients as well as to private and business clients.

Key Factors That Enabled This Firm to Rank Among the Top Investment Banks

Below are key factors that enabled Deutsche Bank to be rated as one of this year’s best investment banks.

Cash Management

Deutsche Bank understands that corporations and institutions have great demands for transparency around their cash flows and payment procedures. The need to meet increased regulatory requirements also demands the need for stricter controls and better standardization.

As one of the largest investment banks, Deutsche offers global cash management services that allow companies to benefit from effective ways to generate synergies and realize cost benefits across borders, currencies, and payment types.

The top investment bank’s cash management business is built upon a global platform that encompasses Central and Eastern Europe, the Eurozone, Switzerland, the Nordics, Russia, Turkey, the U.K., Saudi Arabia and the United Arab Emirates, Asia, and the Americas.

Deutsche offers a wide-range of global solutions for specific issues, including:

- Bulk payments

- Checks

- Cross currencies

- Cross-border payments

- Single payments and receipts

- Liquidity management services

- Clearing services worldwide

- FX transactions

Trade Finance

As one of the best investment banking firms, Deutsche understands the complexities of international and domestic trade. Their trade finance division delivers fast, efficient, reliable, and comprehensive solutions to support their clients’ foreign trade activities.

The investment banking company’s global network spans over 80 locations in more than 40 countries, enabling clients to manage risks and other issues related to trade transactions on a global scale.

Deutsche Bank’s trade finance division helps clients manage all aspects of their import, export, and domestic trade transactions, including:

- International trade products

- Financial supply chain management

- Custom-made and performance-risk finance solutions

- Structured export and commodity trade finance

- Documentary business

- Guarantees and standby letters of credit

Investor Services

This top investment banking firm understands that financial intermediaries such as global custodians, broker/dealers, and prime brokers need to focus on achieving their business goals. That is why Deutsche Bank provides investor services in more than 30 markets around the world.

As one of the top investment banking companies, Deutsche provides a wide range of global investor solutions, including:

- Agency securities lending

- Custody and clearing services

- Fund services

Read More: Best Second Chance Checking Accounts | Ranking & Review

Goldman Sachs Review

Founded in 1869, Goldman Sachs is a global leader in investment banking, securities, and investment management. The top investment bank is headquartered in New York and maintains offices in all of the major financial centers across the globe.

Goldman Sachs is one of the 10 biggest investment banks and is the largest investment bank by revenue. The best investment banking firm provides services to a diversified client base that includes corporations, financial institutions, governments, and individuals. Services provided by the big investment bank include asset management, acquisitions, mergers, and prime brokerage.

Key Factors That Enabled This Firm to Rank Among the Top Investment Banking Companies

Below are key factors that enabled Goldman Sachs to be rated as one of this year’s best investment banks.

Financing

The most vital part of any operation is securing financing. Goldman Sachs structures and executes a variety of transactions relating to financing, including equity offerings, debt issuances, and derivative transactions.

This top investment bank’s specialized financing teams offer a wide range of products and services to clients, including:

- Corporate derivatives

- Corporate finance solutions

- Latin America financing

- Equity capital markets

- Investment grade capital markets

- Leveraged finance capital markets

- Liability management

- Strats

- Structured finance

Mergers and Acquisitions

As one of the biggest investment banks, Goldman Sachs is a longstanding market leader in advising on mergers and acquisitions. One of the best investment banking firms for mergers and acquisitions, this top investment bank advises a range of clients across the globe, including businesses, private investors, government agencies, private individuals and families.

This big investment bank provides advice on a full range of transactions related to mergers and acquisitions, including:

- Sell-side advice

- Raid and activism defenses

- Cross-border M&A

- Special committee assignments

- Mergers

- Sales

- Acquisitions

- Leveraged buyouts

- Joint ventures

- Spin-offs

- Divestitures and other restructurings

Specialized Industry Sectors

As one of the leading investment banking companies, Goldman Sachs serves clients across a wide range of industries. The top investment bank offers specialized groups across a range of industry sectors. Each group is experienced and knowledgeable in their particular sector and is able to provide specialized advice to industry clients.

Goldman Sachs’s industry sector groups work with clients of all sizes, including corporations, families and founders, financial sponsors, government organizations, and nonprofit groups.

Industry sector groups offered by this best investment bank are:

- Consumer retail and healthcare

- Financial institutions

- Financial and strategic investors

- Industrial

- Municipal finance

- Natural resources

- Real estate

- Technology, media, and telecommunications

10,000 Women Initiative

As one of the foremost investment banking companies, Goldman Sachs has a dedication to helping the citizens of the world. As part of their citizenship campaign, the big investment bank launched their 10,000 Women initiative to help women entrepreneurs overcome their biggest obstacle – access to capital.

Goldman Sachs’s 10,000 Women is a global initiative whose purpose is to foster economic growth by providing women entrepreneurs around the world with business and management education, mentoring and networking, and access to capital.

This top investment bank launched the program in 2008 in response to a growing body of research to support the economic opportunity of investing in women. To date, the program has reached more than 10,000 women from across 56 countries and resulted in immediate and sustained business growth for graduates of the program.

Related: Best Online Checking Accounts | Rates & Features

Free Wealth & Finance Software - Get Yours Now ►

JP Morgan Chase Review

Headquartered in New York City, JP Morgan Chase is among the largest investment banking companies in the world and has an investment bank ranking of third largest in terms of total revenue. The large investment bank enjoys a strong global presence with operations in 60 countries around the world.

Boasting a net asset of $2 trillion, this top investment bank is the sixth largest bank by total assets in the world and is the fifth largest public company in the world.

Key Factors That Enabled This Firm to Rank Among the Top Investment Banking Companies

Below are key factors that enabled JP Morgan Chase to be rated as one of this year’s best investment banks.

Investment Strategies

As one of the world’s largest investment banks, JP Morgan Chase is a global leader in asset management. This top investment bank provides capital markets knowledge and investment expertise to clients across every strategic asset class and investment region. The investment giant currently has $1.7 trillion in assets under management across more than 400 investment strategies that encompass global and local markets.

As a leader in investment banking, JP Morgan Chase has the expertise to generate the best risk-adjusted outcomes and deliver the latest investment opportunities to clients.

The top investment bank’s investment strategies encompass a wide range of investment opportunities, including:

- Equity

- Fixed income

- Global real assets alternatives

- Hedge fund alternatives

- Private equity and debt alternatives

- Multi-asset solutions

- Global liquidity

Wealth Planning

As one of the world’s best investment banking firms, JP Morgan Chase knows what it takes to build and manage wealth, as well as what it takes to preserve it. This top investment bank understands that, for most people, wealth represents the freedom to enjoy a certain lifestyle and pursue the activities that matter most as well as leaving a legacy behind for generations to come.

That is why the financial advisors at this big investment bank take the time to develop personalized recommendations and strategies for their clients. Many of the clients of this best investment banking firm have complicated financial service needs, something that their experienced and knowledgeable financial advisors are well versed in handling.

This top investment bank offers a wide-range of wealth planning services to meet the needs of all of their clients, including:

- Transferring wealth

- Executive services

- Retirement planning

- Education funding

- Corporate plans

- Stock plan services

Initiatives

For JP Morgan Chase, part of being a good corporate citizen is operating with integrity while helping to build communities and economies globally. In this vein, the best investment bank has launched several initiatives to help foster growth and education around the globe.

Initiatives launched and operated by this big investment bank for the greater good are:

- New Skills at Work: a $250 million worldwide initiative to provide training to jobseekers so they can compete and prosper in the global economy

- Global Cities: aims to help business, civic, and government leaders with the information and policy ideas they need to help their municipalities thrive

- Social Finance: as one of the world’s biggest investment banks, JP Morgan Chase invests their capital and provides advice to serve the growing market for impact investments with the goal of generating a positive impact and financial return

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

Morgan Stanley Review

Founded in 1935, Morgan Stanley is a global financial services provider headquartered in New York City. The top investment bank serves a large range of clients, including corporations, governments, financial institutions, and individuals and families.

With offices across 24 countries, the top investment banking firm enjoys a strong global presence. With more than a trillion dollars under management and more than $32 billion in revenue recorded in 2015, Morgan Stanley is one of the biggest investment banks in the world. In fact, the investment banking giant holds an investment bank ranking of second largest in the world by total revenue.

Key Factors That Enabled This Firm to Rank Among the Top Investment Banking Companies

Below are key factors that enabled Morgan Stanley to be rated as one of this year’s best investment banks.

Mergers and Acquisitions

Morgan Stanley’s Mergers and Acquisitions department is responsible for devising and executing innovative and customized solutions for clients’ most challenging issues. The team at this big investment bank has extensive knowledge and experience with global industries, regions, and banking products, giving them the resources they need to meet clients’ short-term and long-term strategic objectives.

The Mergers and Acquisitions department of this best investment banking firm is able to assist clients with a wide range of international and domestic transactions, including:

- Acquisitions

- Divestitures

- Mergers

- Joint ventures

- Corporate restructurings

- Recapitalizations

- Spin-offs

- Exchange offers

- Leveraged buyouts

- Takeover defenses

- Shareholder relations

Global Capital Markets

Morgan Stanley’s Global Capital Market division provides market judgements and ingenuity to help clients with their needs for capital. This specialized department integrates their expertise in sales, trading, and investment banking to provide clients with seamless advice and sophisticated financial solutions for such transactions as IPOs, debt offerings, and leveraged buyouts.

As one of the largest investment banks in the world, Morgan Stanley’s Global Capital Market division is able to originate, structure, and execute public and private placement of a wide range of securities, including:

- Equities

- Investment-grade debt

- Noninvestment-grade debt

- Other related products

Industry Specializations

In business for more than 80 years and considered by many to be one of the best investment banking firms in the world, Morgan Stanley has helped thousands of businesses, big and small, grow and prosper.

This top investment banking company employs teams that hold a wealth of knowledge and expertise across a large range of industries. The team at Morgan Stanley is able to provide businesses with advice and research that is based specifically on their industry, making their advisory services all the more valuable.

Morgan Stanley is able to bring its clients a deep understanding of many industries, including:

- Consumer products and retail

- Technology services

- Transportation

- Basic materials

- Healthcare

- Communications

- Energy

- Financial institutions

- Financial sponsors

- Industrials

- Power and utilities

- Real estate

Don’t Miss: Best Banks to Bank with – No Fees, High-Yield Savings, Largest Banks, and Credit Unions

Free Wealth Management for AdvisoryHQ Readers

UBS AG Review

UBS AG is a global financial services company headquartered in Switzerland. The bank is one of the largest investment banks in the world and is considered to be the world’s largest manager of private wealth assets with more than $2 trillion in invested assets.

The top investment bank serves private, corporate, and institutional clients across the globe with wealth management, asset management, and investment banking services. The big investment bank also offers services to retail clients in Switzerland.

Key Factors That Enabled This Firm to Rank Among the Top Investment Banking Companies

Below are key factors that enabled UBS AG to be rated as one of this year’s best investment banks.

Industry Access

Through their global reach and longstanding relationships, UBS is able to help their clients gain access to the people and perspectives that can help them unearth lucrative investment opportunities.

This top investment bank has an extended network that they utilize to help bring companies and investors together. They host a wealth of conferences and industry-specific events that offer their clients market perspectives that can help them shape ideas on specific sectors and topics of interest.

UBS doesn’t treat their clients like they are just another number on a spreadsheet. This big investment bank takes a personalized approach to financial advising by organizing field trips and bespoke roadshows to help clients make first-hand connections with experts, policy makers, and companies in their field.

Global Financing Services

As one of the largest investment banks in the world, UBS has the resources needed to help asset management firms with front-to-back prime brokerage and financing services.

As one of the big investment banks, UBS is connected to a global network that enables them to provide core services such as clearing and settlement capabilities to companies and firms. They are also able to provide a range of complementary services such as capital introduction and business consulting.

This top investment bank is committed to providing clients with consultancy services over the life of a business, helping clients navigate the ever-changing landscape within which they operate from start to finish.

Sales and Trading

As one of the biggest investment banks, UBS is able to offer clients a wide range of sales, trading, execution, and trading services. When offering these sometimes complex services, the top investment bank strives to make them simple, intuitive, and flexible for their clients to use.

This best investment bank gives clients access to a wide range of products and liquidity, including:

- Cash equities

- Credit

- Derivatives

- Emerging markets

- Fixed income

- Foreign exchange

UBS Neo

To allow their clients to stay up-to-date on their investment efforts, this top investment bank provides them with access to their award-winning investment banking platform, UBS Neo.

The highly innovative, cross-asset investment banking platform was named Risk magazine’s 2015 OTC Trading Platform of the Year and enables clients to collaborate, analyze, trade, and manage all in one place.

In addition to providing access to industry research and analytics, UBS Neo stands out for its aggregation of prices from 10 swap execution facilities. This feature allows clients access to multiple swap execution facilities without the need to become a direct participant of the facilities.

UBS if the first investment bank to provide such services, which gives clients access to greater liquidity.

Free Money Management Software

Wells Fargo Review

Wells Fargo is a multinational financial services company founded in 1852 and headquartered in San Francisco, California. The company provides banking and financial services to retail and business clients.

Wells Fargo is considered to be one of the top banks in the world and places tenth on the investment bank list of the largest investment banks by total revenue. The banking giant ranked seventh on the Forbes Magazine Global 2000’s list of largest public companies in the world.

Key Factors That Enabled This Firm to Rank Among the Top Investment Banking Companies

Below are key factors that enabled Wells Fargo to be rated as one of this year’s best investment banks.

Industry Expertise

Wells Fargo knows that business investors expect their investment banking company to have a deep understanding of their company and industry. That’s why they employ a team of industry experts with a deep understanding of product knowledge and market expertise across a wide range of industries.

At Wells Fargo, clients have access to trusted advisors who can provide strategic and capital markets expertise, advice, and execution for the following industries:

- Public finance

- Real estate

- Consumer and retail

- Energy and power

- Financial institutions

- Financial sponsors

- Gaming

- Healthcare

- Industrials

- Media and education

- Technology

- Telecommunications and infrastructure

Advisory Services

As one of the biggest investment banks, Wells Fargo is able to offer advisory services across a wide range of financial situations. Their product specialists work closely with their industry bankers to deliver expert financial advice to their clients.

Advisory services offered by this big investment bank include:

- Mergers and acquisitions

- Quantitative corporate finance

- Financial restructurings

- Strategic alternative assessments

- Private placements

- Ratings advisory

- Defense advisory

- Fairness opinions

- Liability management

Debt and Equity Capital Markets

As one of the big investment banks, Wells Fargo is able to provide clients with comprehensive origination and underwriting across the equity and debt capital markets.

This top investment bank’s capabilities in the equity capital market include:

- Primary and secondary common stock offerings

- Initial public offerings

- At-the-market offerings

- Convertible securities

- Market risk management

This best investment bank’s capabilities in the debt capital markets include:

- High grade offerings

- Leveraged finance offerings

- Preferred stock offerings

- Syndicated loans

- Asset-backed finance and securitization

- Market risk management

Equity Risk Management

Wells Fargo is a top investment bank that offers tools and strategies to help clients manage equity exposure across all major equity indices, stocks, and ETFs. The investment banking firm can tailor a variety of equity risk management products to help businesses reach their financial goals.

Once a strategy has been made, Wells Fargo can help clients execute it efficiently. Their specialists work with clients to minimize the impact that a change in prices will have on their financial results.

The best investment bank’s strategy specialists can help tailor a risk management strategy for clients in order to help them:

- Protect existing equity value

- Extract liquidity or monetize a position

- Increase borrowing capacity

- Hedge equity-linked liabilities

Conclusion: Best 10 Top Investment Banks

Many of the investment banking companies on our investment bank list have been in business for close to a century or more. Many of the advisors and specialists they employ have decades of experience in investment banking and hold a vast wealth of knowledge and insight into particular industries and markets.

Our investment bank ranking includes many of the biggest investment banks in the U.S. as well as some of the largest investment banks in the world. These big investment banks have access to countless resources with which to help investors succeed. Most of the top investment banks on our list house a top global research department that provide strong insights into today’s market.

The 10 best investment banks on our list have a strong global presence. In fact, the majority of the best investment banking firms on our list operate offices across multiple countries and continents, benefiting clients through their global reach.

While the investment banking firms on our list are considered to be among the top investment banking firms in the world, careful research should be done when considering which investment bank to work with. Be sure to do your due diligence in researching each firm before deciding on the top investment bank for your particular financial needs and goals.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.

PREVIOUS RANKING: 2016 RANKING

TOP INVESTMENT BANKS

Top Investment Banks (Investment Banking Ranking & Comparison Review)

Here is this year’s list of the top investment banks in the United States based on total asset size.

The ranking and comparison table presented in this top investment bank article includes key financial statistics (total asset, revenue, bank ID, # of domestic and international branches) for each investment bank.

The firms presented here are all full-service multi-national investment banking and securities firms that engage in global investment banking, advisory, mergers and acquisition, investment management, sales and trading, wealth management and other institutional financial services.

Top Investment Banking Firms – Sorted by Total Assets

| Bank Name / Holding Co Name | Bank ID | Bank Location | Consol Assets (Mil $) |

| JPMORGAN CHASE BK NA/JPMORGAN CHASE & CO | 852218 | COLUMBUS, OH | 2,002,047 |

| BANK OF AMER NA/BANK OF AMER CORP | 480228 | CHARLOTTE, NC | 1,454,742 |

| WELLS FARGO BK NA/WELLS FARGO & CO | 451965 | SIOUX FALLS, SD | 1,436,828 |

| CITIBANK NA/CITIGROUP | 476810 | SIOUX FALLS, SD | 1,375,847 |

| MORGAN STANLEY BK NA/MORGAN STANLEY | 1456501 | SALT LAKE CITY, UT | 110,651 |

| GOLDMAN SACHS BK USA/GOLDMAN SACHS GROUP THE | 2182786 | NEW YORK, NY | 109,532 |

Source: Federal Reserve Statistical Release

Top Investment Banks Based on Advisory Revenues

(in $ mil) | Q4-2013 | Q1-2014 | Q2-2014 | Q3-2014 | Q3-2014 | Full Year 13 | Full Year 14 |

Goldman Sachs | 585 | 682 | 506 | 594 | 692 | 1,978 | 2,474 |

Morgan Stanley | 451 | 336 | 418 | 392 | 488 | 1,310 | 1,634 |

JPMorgan | 434 | 383 | 397 | 413 | 434 | 1,315 | 1,627 |

Bank of America | 356 | 286 | 264 | 316 | 341 | 1,131 | 1,207 |

Citigroup | 266 | 175 | 193 | 318 | 263 | 852 | 949 |

Total | 2,092 | 1,862 | 1,778 | 2,033 | 2,218 | 6,586 | 7,891 |

Services provided by these top investment banks include broker-dealer services (intermediary between sellers and buyers of securities) and proprietary trading (Investment Bankers trading for their firm’s accounts).

Goldman Sachs – Top Invesment Banking Firm

Goldman Sachs: Goldman Sachs remains the most well-known investment bank.

Year over year, the firm has been on the list of top five most profitable top investment banks across various investment banking categories.

It is rated the best investment bank based on a consistent level of top performance.

For 2014 Goldman Sachs announced earnings that beat stock analysts’ consensus.

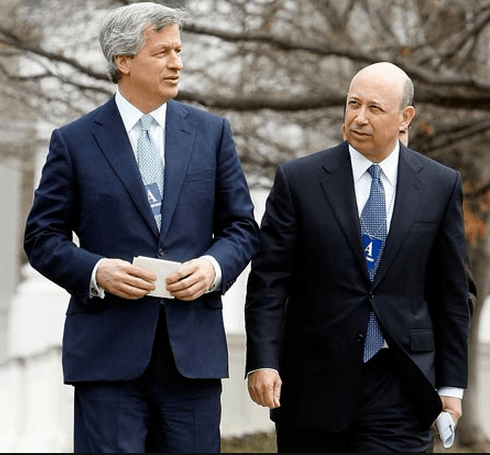

Jamie Dimon (CEO – JP Morgan Chase) and Lloyd Blankfein (CEO – Goldman Sachs)

J.P. Morgan

J.P. Morgan is considered a leading top investment bank as well as a major retail and commercial banking firm.

JPMorgan Chase maintained its position as one of the top investment bank after reporting revenues that surpassed Wall Street whisper (expected) numbers.

JP Morgan is the second leading investment bank based on total asset.