Intro – Vanguard Personal Advisor Services Review (Vanguard Robo Advisor)

Vanguard has been an innovator since its beginnings, when its founder, John C. Bogle, developed one of the first index funds in 1976.

Vanguard was the first to offer an index bond fund to individual investors. Continuing its efforts to offer newer and better products, the company has introduced Vanguard Personal Advisor Services (VPAS), often referred to as Vanguard Robo Advisor.

How is Vanguard Personal Advisor Services different from other robo advisory firms?

Vanguard Robo Advisor is different from established robo-advisors, like Betterment and Wealthfront, in that it combines traditional financial advice (face-to-face with a human advisor) with the use of computer technology (robo investment). In this way, you get the savings of an online, automated approach with the personal touch of a human professional.

See Also: Top Robo-Advisors (Reviews) | A Changing Trend in the Robo-Investment Field

Quick Facts about Vanguard

- More than $3 trillion under management

- Client-owned

- Oldest fund dates from 1929

- 14,000 employees

- Offices in 9 countries

- Vanguard Personal Advisor Services launched in 2013

- VPAS holds $31 billion in client assets

Vanguard Robo Advisor

Although Vanguard does not like the term, you will often hear its service called a robo advisor.

What is a robo advisor?

A robo advisor is a new type of investment service that manages your portfolio online with algorithms and computers, not humans.

The trend started a few years ago with Betterment and Wealthfront. In 2013, investing giant Vanguard entered the field with an asset requirement of $100,000. To compete with its rivals, Vanguard’s robo advisor recently dropped its minimum investment to $50,000.

The company argues that its service is more than an algorithm. It’s really a hybrid between a Vanguard personal advisor and a computer-based Vanguard Robo Advisor.

Image source: Raconteur

What Is the Application Process Like?

On Vanguard’s website, you must login to register for the service. Then, you will get a phone consultation with a Vanguard personal advisor who gets to know you and your life goals. This advisor will work with you to develop a “custom-tailored financial plan.”

Your plan will also take into account non-Vanguard products like:

- Trusts

- IRAs

- 529 college savings plans

- 401(k)s

If you have any changes in your life, like a new baby, you can discuss them by email or video chat and update your plan as often as necessary. These professionals are also available to talk if you’re nervous about your plan or if there is a fall in the stock market.

There aren’t many Vanguard robo advisor reviews online of individuals that have actually gone through the application process.

However, here is one from Millenial Money in which the individual filled out an emailed questionnaire to discuss his risk tolerance for investing. After waiting a month, he was able to schedule a call with a financial advisor. He believes that the current wait time has now dropped to 2 weeks.

During the call, his Vanguard personal advisor asked him many questions about his lifestyle and retirement goals. She then tailored her recommendations based on his answers. Two weeks after the call, he received a simple, individualized investment plan.

Don’t Miss: Best Online Financial Advisors (Human Advisor, Robo-Advisor, and Hybrid)

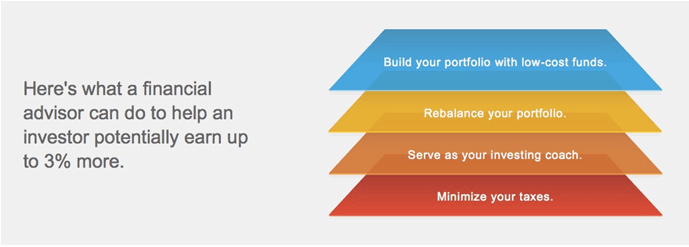

Personal Advisor Adds 3%

Vanguard Personal Advisor Services is very proud of the “partnership” that clients have with their advisors.

The company’s research shows that your portfolio can earn up to 3% more if you follow Vanguard’s advice.

Having personal support means that you may make many better decisions while gaining slowly over time, or it can help you avoid bad decisions due to market turbulence and keep you from abandoning your plan.

Vanguard Personal advisors can increase your gains by acting as “coaches” and also by helping you pick low-cost investments.

They can rebalance a portfolio if one asset is performing much better than others. The service also considers the impact on your tax bill when buying and selling funds.

One important aspect about Vanguard personal advisors is that they don’t earn commissions, meaning they aren’t motivated to steer you toward certain funds or sell you more than you can afford.

One thing to keep in mind is that Vanguard personal advisors are not independent brokers. In this regard, we can expect that they will mostly suggest their own index funds or exchange-traded funds (ETFs).

Image source: Bigstock

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

What Is the Minimum Balance for a Vanguard Personal Advisor?

The minimum balance for a Vanguard personal advisor dropped last year from $100,000 to $50,000. You can also combine multiple accounts to add up to the $50,000 threshold.

Previously, this level of service from Vanguard required a portfolio of $500,000, which is a big improvement. On the other hand, $50,000 is too high for many investors, especially Millenials. Other companies, like blooom or WiseBanyan, cost little to nothing to open an account.

Related: Betterment vs. Wealthfront vs. Vanguard – Ranking & Review

How Does Vanguard Use Technology?

TheVanguard robo advisor uses algorithms to determine what diversified stock and bond funds are best for your personal situation. You receive a “goal analysis” report with charts that suggests how much money to put in each fund. The service automatically rebalances your portfolio if it moves more than 5% from your target.

Vanguard keeps you up to date with a quarterly report on your portfolio. If you want to know your progress before then, you can always log into your account from your smartphone or tablet.

Can Vanguard’s Robo Advisor Save Me Money on My Taxes?

We all want to save money on our taxes, and Vanguard offers a few ways to help. Its software will try to recommend funds with a low-tax burden, or it will structure your assets so they are in “tax-advantaged accounts.” It may also decide to hold or sell investments based on the tax consequences.

Another benefit that Vanguard Personal Advisor Services offers is tax-loss harvesting. This means if a fund drops in price dramatically, VPAS can sell it, creating a loss. Then it will repurchase a similar, but not identical, fund to replace it. When you file your taxes, you can take this loss against your income, therefore lowering your tax payment.

On the other hand, this tax loss harvesting is not a daily automatic process like with some robo advisors. It requires a discussion with your Vanguard personal advisor. The company’s research indicates that it has risks, like higher tax bills in the future, and doesn’t recommend it on a regular basis.

What Are the Fees?

Unlike traditional brokerages, Vanguard personal robo advisor fees are very low.

Its fee structure is as follows:

- 0.30% – below $5 million

- 0.20%–from $5 million to below $10 million

- 0.10%–from $10 million to below $25 million

- 0.05%– for $25 million and above

In contrast, the industry average fee costs 0.99% annually. Even another hybrid advisor, Personal Capital, charges0.89% for the first $1 million.

Vanguard personal advisors also save you money by offering you funds with low fees. Vanguard is famous for having very low expense ratios, or the cost of running the fund that is passed on to you. For example, the Total World Stock ETF only charges 0.17% annually. The Total Stock Market Index Fund’s Admiral shares are even lower at 0.05%.

While it’s true that Vanguard’s robo advisor is cheaper than most financial advisors, it doesn’t have the lowest fees. Wealthfront charges only 0.25%, and accounts with less than $10,000 don’t even pay that. Betterment costs 0.35% for the smallest portfolios and only 0.15% for balances over $100,000.

Also, while many competitors absorb transaction fees, Vanguard’s robo advisor does not. This can really add up, especially if you have non-Vanguard funds.

These additional charges may include:

- Mutual fund loads

- Sales charges

- Transaction fees

- Brokerage charges

- Account removal fees

- Trade commissions

- IRA service fees

- Purchase and redemption fees

- Account service and processing fees

Popular Article: Best Online Investment Companies | Review and Ranking for Online Investing

Some Positive Vanguard Personal Advisor Services Reviews

Many Vanguard robo advisor reviews highly praise the service. MainStreet wrote an article which put Vanguard in its list of top 10 online investing services.

Some Vanguard Personal Advisor Services reviews shared their excellent experiences with the financial planners they talked to. Millenial Money noted that he was “blown away” by the high-quality conversation he had with his advisor.

Nerdwallet wrote a Vanguard robo advisor review, calling the service “best for access to a financial advisor.” It tied with Personal Capital in this category, beating it in fees but requiring twice the account minimum.

Negative Vanguard Personal Advisor Services Reviews

Other Vanguard personal advisor reviews were more negative on the customer service experience.

One reviewer changed to Betterment because of Vanguard’s “clunky” interface and “relatively unpleasant” interactions with staff. The individual also noted that making any changes was very time-consuming, and that he received too much junk mail despite asking for it to stop.

On InvestorPlace, a Vanguard personal advisor review mentioned that lower balances get the assistance that’s not so personal. If you have under $500,000 invested in the fund, you get access to a team, not your own financial planner. This person may not be familiar with you, just whatever information he/she can access in your file.

While not many people have written Vanguard robo advisor reviews, the general feedback for the firm is mixed. On Top Rated Firms, the brokerage gets only 3 stars out of 5. Multiple commenters described the customer service representatives as “incompetent” or “arrogant.”

Yelp was even more negative, with 52 reviews and a 2-star rating. Common problems included Vanguard losing checks for weeks and long telephone hold times. A couple of commenters even suspected fraud, as transfers were not done as requested or changes were made without authorization.

Conclusion

If you are looking for a new investment advisor or you’re ready to jump into the world of investing, Vanguard Personal Advisor Services is worth a look. Here is a brief summary of the pros and cons:

Vanguard’s Robo Advisor Is for You If:

- You have a larger portfolio

- You need affordable financial advice

- You have an established college savings plan or IRA

- You want automatic rebalancing

- You like Vanguard funds

- You want a simple plan

- You are a baby boomer needing help with retirement planning

Vanguard’s Robo Advisor Is NOT for You If:

- You have less than $50,000 to invest

- You are financially sophisticated

- You like making your own plan

- You don’t have/don’t want Vanguard funds

- You want daily tax-loss harvesting

- You need a lot of customer service

If you have over $50,000 to invest in index funds and you don’t have the time or interest to do it yourself, Vanguard Personal Advisor Services may be a good fit. The company also offers personal financial guidance at a low price.

While the advisors give personal support, Vanguard Personal Advisor reviews indicate that general customer service is average to poor. If waiting on the phone annoys you or you need to make a lot of changes to your plan, you may prefer a more automated service like Betterment.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.