Vanguard Review

In this Vanguard review article, AdvisoryHQ News provides a brief history of the Vanguard group, as well as Vanguard fees, including Vanguard IRA fees, Vanguard brokerage fees, and mutual fund fees.

We also review how the firm’s ownership structure impacts your rate of return.

In addition, we analyze the various Vanguard mutual funds, products, and services that the firm provides as well as a benchmark analysis of Vanguard versus other investment management firms.

What Is Vanguard? (Vanguard Review)

What exactly is Vanguard, and why is it such a globally recognized and highly acclaimed financial institution?

Vanguard is a multi-national, global financial and investment management firm that provides services and funds to:

- Personal investors (direct investments in individual accounts – including IRAs and rollovers; in joint, college savings, or small-business accounts; or in annuities)

- Retirement plan participants (401k, IRA, and other retirement planning recipients)

- Institutional investors (for retirement plan sponsors, consultants, and nonprofit representatives)

- Wealth managers and financial advisors

Vanguard has a remarkable history (see the section below) and is one of the top 5 largest investment firms worldwide. The firm offers the largest selection of low-cost ETFs, mutual funds, and related investment services to a wide range of investors.

Click here for a list of all Vanguard funds: Vanguard Funds List.

If you have a 401k, IRA or other type of retirement account, there is a high possibility that your account is managed by the Vanguard Group or invested in one of its many funds.

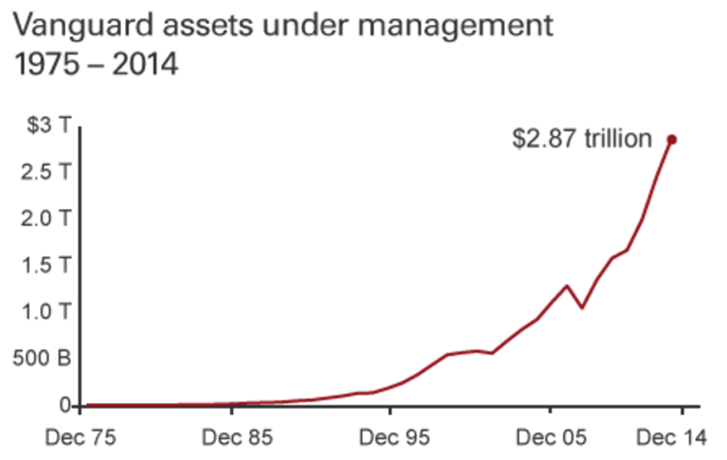

Vanguard began operations in May of 1975, and today, it has approximately $3 trillion in global assets under management (AUM). It has over 20 million investors, which is an extremely high number of investors utilizing a single investment management firm’s services at any one point in time.

Vanguard Reviews – Strong AUM Growth

History – Vanguard Funds Reviews

How and when did Vanguard start?

Vanguard was launched in 1975 at the height of the longest bear market since the Great Depression. This is when the company’s founder, John C. Bogle, decided to launch the first ever mutual fund company that would be owned by its individual member funds rather than a fund that was designed to earn profits for a specific management firm, which was the normal practice back then.

After launching the company, John rolled out the first ever index-based mutual fund, an action that ushered in an era of low-cost index investing.

John started out by not charging any sales commissions and kept operating expenses very low.

As the 70s turned into the 80s, news about Vanguard’s mutual funds started to spread via word of mouth, as early clients told their families and friends about their mutual fund company.

As Vanguard grew over the years, it steadily reduced its fund expense ratio from an average of 0.89% to 0.18% as of last year.

Today, Vanguard maintains over 275 low-cost funds and ETFs (see: list of Vanguard funds), and has 16 locations across the globe with more than 14,000 staff members.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Vanguard Funds Review – Who Really Owns Vanguard?

Although the firm was launched by Mr. Bogle, Vanguard is actually owned by the individual mutual funds that comprises its entire portfolio of funds.

As a direct result, Vanguard is owned by the investors in the individual funds, including you if you have a retirement, IRA, 401K or other investment account with the firm.

In a nutshell, Vanguard was structured specifically by Mr. Bogle to build wealth for its client owners – similar to how credit unions are structured to build wealth for their member clients.

The Vanguard group is very proud of its ownership structure. The firm’s management team often goes out of its way to emphasize how the firm’s ownership structure benefits its investors compared to its peers. The Vanguard team states:

“Investment management firms are generally owned by external owners and outside stockholders; which means that they have to charge higher fees in order to pay these external owners. Such fees end up reducing returns for investors who are invested in these companies. But at Vanguard, there are no outside owners, and therefore, no conflicting loyalties. Because of our ownership structure, we are able to maintain lower expenses, which allows our clients (including you, if you are invested with Vanguard) to keep more of their returns and earn more money over time.”

Review of Vanguard Funds Products

See below for the various products, accounts, and rollover services provided by Vanguard.

Vanguard Investment Product Review:

- Vanguard ETFs

- Vanguard mutual funds

- Bonds

- Certificate of deposits

- Other companies’ funds & ETFs

- Stocks

Types of Accounts at Vanguard:

- Roth IRAs

- Traditional IRAs

- Individual accounts

- Annuities

- SEPs

- SIMPLEs

- i401(k)s

- Joint accounts

- 529 college savings plans

Rollovers & Transfer Services:

- 401(k)

- 403(b)

- Account transfers

If you are interested in a list of Vanguard index funds, click here: Vanguard Index Funds List.

Vanguard Funds Review

Today, the Vanguard Group has a portfolio of over 50 low-cost ETF options that are available for investing and portfolio diversification. In total, the firm has over 275 low-cost funds and ETFs.

Do Vanguard funds come with a lot of fees?

No, they don’t.

Investors do not pay any commissions when investing in Vanguard ETFs. However, you’ll need to buy and sell Vanguard ETFs directly through Vanguard in order to avoid paying broker-related fees. Brokerage firms charge broker fees to execute buy/sell trades. Investing directly with Vanguard means you cut out the middle man (brokers).

In addition, the firm does not charge execution fees if you choose to have a Vanguard wealth manager or investment advisor place trades for you, versus you placing the trade yourself using your online account.

Do You Have to Pay Vanguard ETF Expense Fees?

Yes, you’ll need to pay ETF expense fees. All investment management firms and ETF providers incur expenses to create, provide, and manage the many ETFs and mutual fund products that they provide.

So, although you don’t have to pay commissions to Vanguard to invest or trade its products (if investing directly), you still have to pay Vanguard for the expenses it incurs to manage the funds.

However, you can reduce your investment costs by signing up for the firm’s e-service package, which involves getting your financial statements and other docs online versus mail delivery.

Vanguard ETF Expense Ratio

Below is the Vanguard ETF expense ratio you would expect to pay if investing in a Vanguard ETF.

Note that this number is about 76% less than the average ETF expense ratio charged by other investment management firms.

- Vanguard average ETF expense ratio: 0.13%

- Industry average/benchmark ETF expense ratio: 0.55%

Click below for a complete list of Vanguard expense ratios for each Vanguard fund:

Vanguard Funds List (Complete List of Vanguard Funds, Expense Ratios, and Performance)

Vanguard Review – Savings Potential

Based on the low expense ratio and other reduced investment management fees charged by Vanguard, how much would you expect to save over the long term by using Vanguard vs. its competitors?

It depends.

Image Source: Vanguard Reviews

Assuming you were to invest $100,000 with Vanguard versus other investment management firms, you could potentially save the below amounts based on the lower fees you would pay at Vanguard:

- $7,294 in 10 years

- $25,259 in 20 years

- $65,602 in 30 years

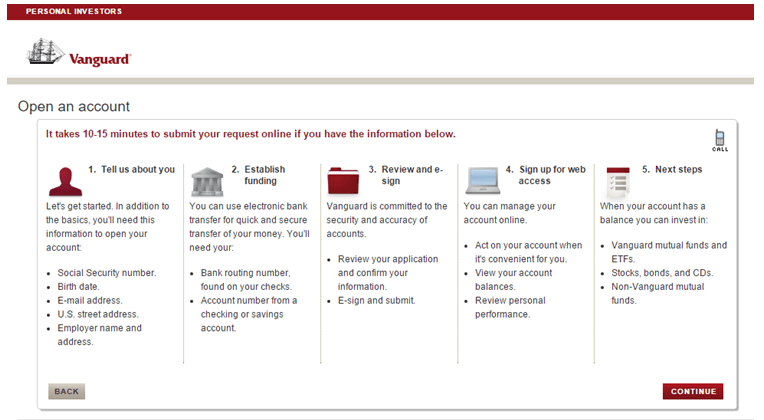

Opening a New Brokerage Account with Vanguard

Below is the process for opening a brokerage account with the Vanguard Group:

(1) Click here to open your Vanguard account.

Image Source: Vanguard

(2) Provide your personal and professional information.

(3) Deposit at least $3,000. (Note: If you already own a Vanguard Prime Money Market or a Vanguard Tax-Exempt Money Market Fund, you can use that account and bypass depositing $3,000 in new funds.)

(4) Review and e-sign your disclosures.

(5) Start investing after your funds have settled in your account.

ETF Minimums

What are Vanguard’s ETF minimum requirements?

Once you’ve opened and funded your new brokerage account, the minimum ETF purchase is one share.

Free Wealth & Finance Software - Get Yours Now ►

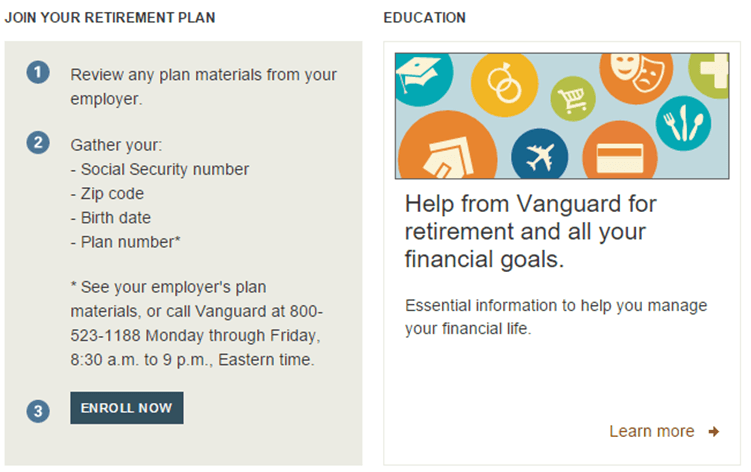

Vanguard Retirement Plan and IRA Review

Do you have a retirement plan, IRA or employer contributed 401K at Vanguard? Then this section will be of interest to you.

There are two ways that you can manage your assets at Vanguard:

- Manage your funds by yourself (only do this if you are confident of your investing experience and decisions).

- Manage your funds using Vanguard’s Managed Account program (this option allows you to partner with a Vanguard advisor for investing planning and execution).

Managing your Funds Yourself (Vanguard Review for Individual Investors)

Your 401K or IRA funds at Vanguard have no sales commissions, meaning that you don’t pay any brokerage fees or commissions. In addition, you do not pay any monthly account service fees if you sign up online to manage your Vanguard funds.

By opening a Vanguard Brokerage IRA online account, you are provided with unlimited access to highly advanced Vanguard retirement planning tools, including Vanguard’s Personal Online Advisor robo-advisory platform (click to read: Best Robo-Advisors and Online Financial Advisors).

Your Vanguard Brokerage IRA online account allows you to:

- Manage your 401(k) funds and investments

- Manage your individual IRA funds

- Transfer an existing IRA from another investment manager to Vanguard

- Take ownership of an inherited IRA

A Vanguard Brokerage IRA online account also comes with competitive trading commissions on:

- Non-Vanguard mutual funds and ETFs

- Bonds

- Individual stocks (not part of an ETF or fund)

- Other securities

Do-it-Yourself Investing – Vanguard Personal Online Advisor Review

Your Vanguard Personal Online Advisor platform is provided to you through your 401K, IRA or other retirement plan for no additional fees.

You can open your retirement account using the Vanguard Retirement Portal.

Image Source: Vanguard Retirement Portal

After logging into your account, you can quickly review and easily change your investment diversification and asset allocations based on your current risk tolerance.

Click on the “Review my Performance” tab and then on “Get Help Planning for Retirement.” On that page, you’ll then select “Do it Yourself.”

There are many ETFs and mutual fund options for a wide range of risk tolerances including:

- Conservative

- Moderately conservative

- Moderate

- Moderately Aggressive

- Aggressive

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

Vanguard Reviews – Managing Your Funds Using Vanguard’s Managed Program

If you decide that you would rather use the help of a professional to manage your IRA, retirement, and other investments, then you’ll want to consider Vanguard’s Managed Account Program.

Vanguard Vanguard’s Managed Account Program has partnered with Financial Engines to manage its Vanguard Managed Account Program. Financial Engines is an independent, fee-only Registered Investment Advisory firm that does not charge commission and has a fiduciary duty to its clients.

How it works:

- Sign up for a Vanguard Managed Account Program.

- Vanguard sends you a customized plan.

- If you accept the recommended plan, then your plan is put into action by adjusting your investment mix.

- The firm then performs regular monitoring of your account and makes any needed adjustments to keep your portfolio aligned with your risk tolerance.

- Managed Account specialists are also available if you need to discuss your plan or investment portfolio.

- The firm also keeps you informed with regular retirement statements and updates.

Vanguard Manage Account Program Fees:

How much would you have to pay to use the Vanguard Manage Account Program?

The Vanguard Manage Account Program fee, which is deducted on a monthly basis, is generally 0.40% of your annual account balance.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.