Intro: Review of Woodgate Financial, Inc.

Financial planners are taking on a whole new level of importance in Canada as many baby boomers face retirement in the coming years.

According to Canada’s The Globe and Mail, retirement income is an urgent problem for many, with 1 in 5 citizens expected to be over 65 by 2024. Yet only about a quarter of Canadian tax filers contributed to Registered Retirement Savings Plans (RRSPs) between 2018-2019.

Having the guidance of an experienced financial planning and wealth management firm is important when it comes to growing wealth, balancing personal and business financial needs, and saving for future goals, such as a comfortable retirement.

But it is important that you find a financial planning firm you can trust, that is knowledgeable, and has a good reputation.

One such firm that is located in Toronto, Canada is Woodgate Financial, Inc. The firm was founded in 2007 and is a privately-held wealth management firm dedicated to wealth building and solid management solutions for its clients.

Woodgate has also made quite a name for itself, with Partner & Senior Financial Consultant Jason Pereira becoming a recognized and sought-after voice for insight on financial industry trends in Canada. You’ll find his contributions in places such as Financial Planning Association® Canada, The Globe and Mail, and Wealth Professional.

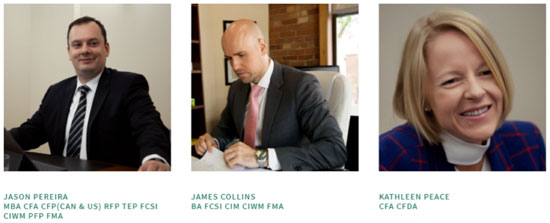

This top Toronto financial planning firm has a team of seven highly qualified professionals. The firm also works with multiple partner consultants that specialize in everything from accounting to medical insurance. This allows it to offer a wide range of integrated financial services.

Image courtesy of: Woodgate Financial

High Standard & Code of Ethics

Woodgate is a fee-based financial planner that receives commissions from the sale of insurance products. The firm upholds high ethical standards and lists a Code of Ethics on its website.

This is a welcome sign to many investors and those seeking financial planning guidance as it speaks to the trustworthiness of this Toronto-based team.

As part of the ethical commitment made to clients, the firm’s advisors belong to several professional organizations that have codes and standards that members must adhere to. For example, one or more advisors of the Woodgate team are members of the CFA Institute, which requires members to put the client’s best interests first and act with integrity, competence, and in an ethical manner.

This is just one of the many industry affiliations and standards codes that the Woodgate team adheres to. As a testament to transparency, the firm offers links to each code of conduct applicable to advisor affiliations, which include:

- Chartered Financial Analysts Institute (CFA)

- Certified Financial Planner™ (CFP®)

- Fellow of the Canadian Securities Institute (FCSI®)

- Personal Financial Planning (PFP®)

- Chartered Investment Manager (CIM®)

- Certified International Wealth Manager (CIWM®)

- Certified Divorce Financial Analyst (CDFA®)

Additionally, the Woodgate team stands firmly behind the Statement of Investor Rights, which comes from the CFA Institute. It lays out multiple rights of investors, such as having a financial planner that is honest and ethical, and enjoying complete confidentiality of all information shared.

Knowledgeable Team

The value of the financial guidance and advice a client receives from a financial planner is directly tied to the advisor’s knowledge and experience.

Woodgate’s team offers a wealth of industry expertise, with over 100 years of combined experience in the financial services industry. The firm’s three partners hold multiple financial certifications, and each brings the lessons and knowledge from a prestigious career to the firm.

This Toronto wealth management firm takes a team-based approach so it can offer clients the full benefit of multiple minds helping them chart the most direct financial path to reach their goals.

Here are brief overviews of the expertise and credentials of each of Woodgate’s partners.

Image courtesy of: Woodgate Financial

Jason Pereira, Partner & Senior Financial Consultant

Mr. Pereira began his financial career in 1997 and is an ongoing contributor to the betterment of the financial industry as a whole. In addition to his position at Woodgate Financial, he is the President of the Financial Planning Association of Canada, he volunteers with the Financial Planning Standards Council, and is a lecturer at the Schulich School of Business at York University.

Mr. Pereira has also been recognized by several awards throughout his career, including being a three-time winner of the Global Financial Planning Award from PlanPlus (2015, 2017, 2018) and being named one of the Top 50 Financial Advisors in Canada (2015-2017).

The following designations and certifications have been earned by Mr. Pereira:

- MBA

- CFA

- CFP® (CAN & US)

- RFP

- TEP

- FCSI®

- CIWM®

- PFP®

- FMA

James Collins, Partner & Senior Financial Consultant

Born in London, Mr. Collins earned a B.A. degree from Southampton University and began his career in the investment industry in Canada in 2000.

He has an extensive education in the industry, passing multiple courses, including the Canadian Securities Course, Canadian Insurance Course, and Professional Financial Planning Course, among others.

The following designations and certifications have been earned by Mr. Collins:

- CIM®

- FCSI®

- FMA

- CIWM®

Kathleen Peace, Partner & Senior Financial Consultant

Ms. Peace has over two decades of experience working in the financial industry. She is also a mentor, resource, and personal CFO for female entrepreneurs and a champion of building a community and network for successful women.

Specialties include corporate/trust structures, corporate reorganization, liquidity event planning, socially responsible/ESG investing, finances during divorce, risk management, and more.

The following designations and certifications have been earned by Ms. Peace:

- CFA

- CFDA®

Client Profiles

Woodgate aims to assist busy people with complex financial affairs, helping them take control of their financial life.

This top-rated Toronto financial planner has three main client profiles: individuals/private clients, corporate executives, and business owners. The firm’s advisors take an invested interest in each clients’ success, serving as their personal Chief Financial Officer (CFO).

Individuals/Private Clients

Woodgate advisors help individuals will multiple areas of financial planning and asset management. The firm’s team has an in-depth process by which advisors truly get to know a client’s financial situation and future objectives, so they can put them on a path to success.

Corporate Executives

A specialty area of Woodgate is assisting executives and managers with their unique professional and personal financial challenges.

Corporate executives often have more complex financial needs, including understanding executive compensation packages and balancing one job offer against another. This team stands ready to offer expert consulting in these areas and others unique to this group.

Business Owners

Business owners often face issues balancing their personal finances and their businesses’ finances.

The Woodgate team puts these clients on the right path and helps them harmonize financial requirements for all areas of their life. The firm also helps executives with succession and business sale consulting, group compensation planning, and other unique needs of those running their own business.

Award-Winning 5-Step Process

Financial planning can be complicated, and it can also be frustrating if you don’t have a cohesive strategy whereby all parts of your financial life are pulling together towards the same goals.

Woodgate Financial has developed an award-winning 5-step process that ensures a holistic financial strategy that incorporates all facets of a client’s financial life.

When each financial area, such as financial planning and risk management planning, are developed with the other in mind, it leads to more successful outcomes.

Image courtesy of: Woodgate Financial

Below, are the areas of Woodgate’s 5-step process.

1. Financial Planning

This step in Woodgate’s process involves an audit of your current “financial reality” and the uncovering of potential growth opportunities. A written plan is developed to take you from where you are now to where you want to be in the future.

2. Investment Planning

The findings from your financial plan are used as a jumping-off point for developing your investment portfolio. The firm hires world-class investment managers that customize investment plans to balance needs, goals, and risk tolerance.

3. Risk Management Planning

The advisors at Woodgate help clients prepare for any potential risks so they can ensure they’re properly prepared. This includes risks from cash emergencies, life, disability, critical illness, longevity, and more. The team helps clients zero in on the coverage they need and avoid unneeded coverage.

4. Tax Planning

With a goal to help clients pay less in taxes so they can save more money, Woodgate advisors offer insightful tax education to clients and help them develop tax-efficient financial strategies.

5. Estate Planning

The fifth step is ensuring that estate planning is well taken care of. This includes reviewing wills and powers of attorney and addressing any areas of concern. Your team works with you to develop a complete plan that you can have in advance of meeting with a lawyer.

Ongoing: Progress Review

Once your holistic wealth management planning is in motion, Woodgate ensures that your strategy stays on track by performing regular progress reviews and adjusting your plan as needed.

Range of Helpful Services

The Woodgate team goes above and beyond for its clients when it comes to providing both financial and non-financial services. If you’re looking for a partner that has your back and can direct you to other important professionals, then Woodgate will be a top option for you.

Beyond the services provided in the firm’s 5-step process (financial planning, investment, risk management, tax, and estate planning), clients will find several other helpful services offered by this top-rated Toronto financial planning firm.

These additional services include:

- Compensation consulting

- Job offer consulting

- Company stock risk management

- Executive top-ups

- Corporate structure planning

- Executive & group compensation planning

- Business owner wealth planning

- Succession & business sale consulting

- Charitable giving

- Environmental, social & governance

- Cross border financial services

First Call Program

A unique resource offered by Woodgate is its First Call Program. This complimentary offering for clients leverages the firm’s extensive network of other professional services, both financial and non-financial.

Woodgate Financial’s network of trusted specialists covers multiple needs, including:

- Accountants

- Advanced Tax Case Planning

- Corporate Trustee

- Actuarial

- Group Insurance

- Medical Insurance

- Mortgage & Lending

- Legal (including several specialties)

Competitive Rates, Transparent Fees

One factor that makes Woodgate Financial stand out among other fee-based financial planners in Canada is that the firm has a completely transparent fee process and discloses all fees to clients for approval before they’re charged.

Clients will pay a fee before going through the initial 5-step process. After that, competitive rates are charged on a sliding scale for ongoing asset management, planning, and account maintenance.

The only commissions received, as noted by Woodgate, are on insurance products. Any other professionals that you choose to work with through a referral, such as an accountant, will charge you directly.

Woodgate offers new clients a complimentary introductory meeting to learn how its expert advisors can help you with your financial goals.

Conclusion: Future Outlook for Woodgate Financial

Any time you’re planning to work with a financial planning and wealth management firm, it’s important to know what its future outlook is projected to be. Financial relationships tend to be long-term, so you want a partner that’s going to be with you for decades to keep your wealth planning on course.

While no one has a crystal ball, we can confidently state that Woodgate Financial looks to have a bright future. We fully expect it to continue being a pioneer in the Canadian financial services industry for years to come.

The firm’s partners are professional resources that publications look to for insight on future industry trends. Woodgate’s partners are also fully entrenched in the financial services industry and the community at large through charitable pursuits as well as teaching up and coming professionals the best practices of the industry.

Woodgate has a straight-forward and holistic wealth management process that works well. It also services three key client sectors and has strategic partnerships with other professionals, which is a win-win for everyone involved.

We believe that not only will Woodgate Financial continue prospering in the years to come, but the firm’s flexibility and pioneering spirit will also actually help shape the look of financial services in Toronto and Canada in the future.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.