Aldermore Bank 2020 Review: What You Need to Know About Aldermore Savings, Mortgages & More

During turbulent economic times, people often seek the safety of a bank in the UK they can trust. Preferably one that will help them save with attractive interest rates and where they can go for mortgages, financing, and ISA needs.

One institution that people may consider is Aldermore Bank. The bank was founded in 2009 and provides financial services to Britain’s savers, homeowners, and small and medium-sized enterprises (SMEs).

Since it is a relatively new bank, consumers have wondered, “Is Aldermore Bank safe?” In this review, we will answer the question, “How safe is Aldermore bank?” discuss what customers say about it, and the pros and cons of banking with Aldermore Bank.

AdvisoryHQ Aldermore Bank Review

But just how safe is Aldermore Bank?

The bank’s website notes that it is covered by the Financial Services Compensation Scheme, which protects eligible deposits up to ₤85,000. This kind of compensation should give some comfort to consumers looking to save in an Aldermore ISA (individual savings account) or other bank accounts.

What kind of gains can you expect from Aldermore’s savings rates on personal or Aldermore business savings?

We’ll go through those details in this Aldermore Bank review, along with information on Aldermore mortgages for intermediaries, bank background information, and more.

See Also: Lloyds Bank Review (UK) – Get All the Facts!

Why Is Aldermore Bank Safe?

You can find additional information in response to the question, “How safe is Aldermore Bank?” below.

- Aldermore reviews from its annual report show a steady increase in customers, going from 130,000 in 2013 to 238,000 as of June 2018.

- Aldermore was listed on the London Stock Exchange in March 2015. An Aldermore Bank review in the Telegraph pointed out that this was a significant accomplishment for a bank that was just four years old at the time it was listed.

- In March of 2018, Aldermore became part of FirstRand Group, one of the largest financial services institutions in South Africa, further expanding its base of assets and resources.

- While “online-only” banks without branches may have been unusual when Aldermore finance and savings services first started, they are now becoming the norm, with multiple banks adopting a similar model.

Who Owns Aldermore Bank?

If you’re wondering, “Who owns Aldermore bank?”, Aldermore Bank reviews by financial journalists note that it was initially founded by former Barclay’s executive, Philip Monks, in partnership with AnaCap Financial Corporation.

Aldermore finance solutions are designed to give consumers something radically different than what they had available. The mission was to offer simple and transparent banking solutions and financial products.

Who owns Aldermore Bank changed as of 2018. Our Aldermore Bank review of the company’s “about us” page notes that after the bank became a part of FirstRandGroup, Aldermore successfully integrated one of its entities, MotoNovo, which provides financing and insurance solutions.

Don’t Miss: Everything to Know About Barclays UK

Aldermore Bank Reviews | Bank Overview

Aldermore is considered a “challenger bank.” This term refers to a relatively small retail bank set up with the intention of competing for business with large, long-established national banks.

Through Aldermore mortgages for intermediaries, Aldermore ISAs, and Aldermore finance options the banknotes it has “opened up the lending market to many” and offered opportunities to customers where other banks did not.

Many Aldermore Bank reviews by customers back up this customer-centric philosophy. We’ll get into those in detail shortly.

Aldermore ISAs & Aldermore Business Savings

Aldermore Reviews | Bank Services Overview

Customers doing Aldermore reviews will find that the main services offered by the bank include:

- Personal Savings (Aldermore ISA)

- Business Savings

- Personal & business mortgages

- Aldermore finance services for business

- Aldermore mortgages for Intermediaries

- Aldermore finance for intermediaries

Aldermore Savings Rates

Aldermore savings rates, just as at any bank, are subject to change depending upon market conditions. Below are the Aldermore savings rates currently being advertised on the bank’s website at the time of this writing.

- Personal Savings Account: 1.00% AER (annual equivalent rate)

- Aldermore Business Savings Account: 1.00% AER

When researching Aldermore business savings accounts, you’ll find a Corporate Treasury option, which states, “you get access to competitive cash deposit returns.”

We’ll get into more detail about each Aldermore Bank service next.

Related: Rankings of Best Banks in London

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Aldermore Bank Reviews for Business Accounts

Those looking for simple, secure banking services will find that Aldermore finance solutions are designed for business and individual customers alike. The following are reviews of Aldermore’s business services.

Aldermore Reviews | Business Savings Accounts

Aldermore Bank offers two types of savings accounts for companies. Business savings accounts are available for deposits up to £1 million (Easy Access) and for those over £1 million (Corporate Treasury). Both accounts have received good Aldermore reviews.

Aldermore Bank’s business savings account customer reviews are overall very positive. Here are two examples from Trustpilot, which gives the bank an overall rating of 4.3 out of 5, based upon 512 Aldermore bank reviews.

- A recent Aldermore review noted hassle-free banking. The reviewer stated in their Aldermore bank review: “I have had several business savings accounts and a personal Cash ISA and have never had any problems.”

- In another review of Aldermore’s business account, the customer had signed up for invoice factoring for their growing business after having a negative experience with another bank. They stated: “I would not hesitate to recommend Aldermore to others who are thinking of using their services.”

- The negative Aldermore savings reviews seemed to revolve around poor or rigid customer service policies, with one reviewer stating: “…rates are good, but don’t expect them to act outside of their very rigid processes.”

Aldermore Mortgages Reviews | Commercial and Buy-to-Let Mortgages

Aldermore offers the following types of mortgages for SMEs and business people:

- Buy-to-Let mortgages

- Buy-t0-Let mortgages for limited companies

- Commercial mortgages

- Property development finance

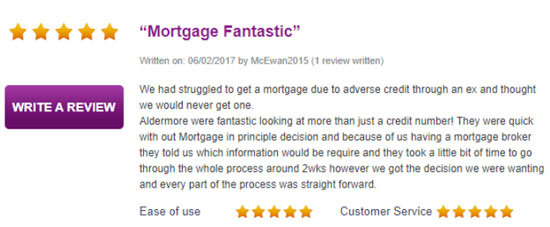

Customers who wrote Aldermore mortgages reviews had mixed experiences. The following are two examples from Review Centre.

Aldermore Mortgages Reviews

One person’s Aldermore mortgages review states that even after a week, they were not contacted back after putting in a new mortgage inquiry.

A more positive reviewer said their mortgage experience with Aldermore was “fantastic,” as seen in the above image.

Aldermore Reviews for Residential Accounts

The following are some of the experiences of Aldermore residential account customers.

Aldermore Savings Reviews | Personal Savings Accounts

Aldermore ISAs have been streamlined to make things easy for its customers. The bank offers one personal savings account called Easy Access.

Account benefits include:

- No account fees for standard services

- Transparent interest rate

- Open an account with a minimum of ₤1,000

- Unlimited withdrawals

Reviews of Aldermore’s personal savings accounts are generally positive; however, there are some complaints about Aldermore as well from account holders.

Aldermore Reviews | Personal Savings Accounts

On the site, SmartMoneyPeople, four Aldermore reviews about the Easy Access Aldermore ISA, all scored the bank between 4 and 5 stars.

- One of the positive Aldermore reviews was pleased with how fast and easy the account setup was, stated: “I completed the online application, and the process was complete in lightning time. Thank you. Others could learn from Aldermore.”

- Another customer praised the ease of use and interest rate of the account. In their Aldermore bank review, they stated: “The best interest rate at the time of needing the savings account. Easy to set up and manage online. Kept informed at all times.”

But not all Aldermore ISA customers find banking with this financial institution so easy.

In Aldermore reviews that are not as positive, reviewers complain about tedious login and identity verification procedures. Some mention waiting weeks before getting into their online account. When people ask, “How safe is Aldermore Bank?” it is exactly this type of online issue that they are anxious about.

- In one of the Aldermore bank reviews on Trustpilot, the reviewer stated: “I lodged money to open account, about a month later I STILL have no access to my account to even check if the funds are there.”

There are 69 more Aldermore Bank reviews on the Review Centre website. The average rating of Aldermore from all of those reviews is just 2.0 stars out of 5. Of the users who wrote an Aldermore review, 28 percent said they would recommend the bank to others.

The two most frequent complaints were (1) the bank was extremely difficult to reach by phone, and (2) the process of opening an account was fraught with unexplained delays.

- One Aldermore review gave the bank just one star, summing up the problems this way: “Once they’ve got your money in their holding account, they seem to go very quiet.” As other reviews have stated, getting through to talk to anyone is not an easy task. Even when I did get through, it wasn’t easy to find out what was happening to my account & their explanations for the delay in opening it were vague.”

Aldermore Mortgages Reviews | Residential

Per Aldermore’s annual report, it has a lending portfolio of approximately ₤9.0 billion, with residential mortgages accounting for 16% of that total.

The bank offers the following types of Aldermore mortgages for individuals:

- Self-employed mortgages

- Low deposit mortgages

- Less than perfect credit mortgages

- First-time buyer mortgages

- Remortgage

- Buy-t0-Let mortgages

The bank offers mortgages for first-time buyers with up to 100% loan to value, which means you don’t need a deposit. It also provides remortgaging services for customers who may gain advantages from refinancing a current holding. There are several Aldermore mortgages reviews on the bank’s website.

Both fixed and variable rate mortgage loans are available. A fixed-rate is where the interest is stable for the life of the loan. Variable-rate is where the interest charged is tied to the prevailing cost in the external market.

Aldermore customer reviews are mixed when it comes to the bank’s residential mortgage services.

A 1-star Aldermore review on Review Centre called the company “loan sharks,” and noted that their fixed rate penalties were “way above any other lender.”

Another reviewer on the same website said they could not be happier. They had trouble getting a mortgage at other banks and stated: “Aldermore were very quick and professional throughout; correspondence was excellent and I was updated sufficiently.”

A first-time buyer wrote one of the 5-star Aldermore mortgages reviews. They were initially a little intimidated by the home buying process but were very pleased with how they were treated. They said: “From beginning to end our broker at Aldermore was fantastic. The whole process was so much easier than I thought and everything was explained so clearly.”

While Aldermore customer reviews about savings accounts seemed to weigh much more heavily on the positive, the Aldermore reviews about mortgages were more mixed as far as the customer experience.

Read More: Best Banks to Open a Business Account With

Aldermore Bank Customer Reviews | On Website

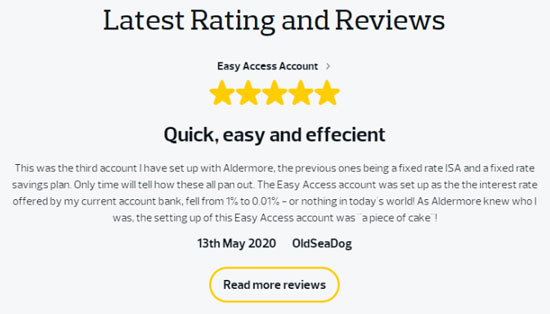

A unique feature that you don’t often find on banking websites is the addition of Aldermore Bank customer reviews on the bank’s site.

While one is generally suspicious of an organisation’s own reviews, our Aldermore bank review found that the company does not only post the positive reviews. You’ll also find negative Aldermore reviews there too.

This kind of transparency is welcome, and is another reason to answer “yes” to the question, “Is Aldermore Bank Safe?”

The site currently lists 340 total Aldermore reviews for their Easy Access savings accounts and an overall aggregated rating of 4.5 out of 5 stars.

Example of Aldermore Bank Reviews

Example of Aldermore Bank ReviewsAldermore Reviews | Resources to Help Consumers

One of the mantras of Aldermore bank has always been to keep banking simple and easy for its customers.

To that end, our Aldermore review found that the bank provides several helpful resources for both business and individual customers in its Help Centre (accessible from the main website menu).

After researching customer experience, Aldermore reviewers found that savings customers were often confused by bank jargon. In response to this issue, the bank developed a Savings Glossary to help.

In addition to the glossary, Aldermore Bank customer reviews have cited various financial education articles in the bank’s Resource Centre as particularly helpful.

Don’t Miss: Synchrony Bank Reviews – High Yield Rates

Aldermore Bank Reviews Conclusion | Is Aldermore Bank Safe?

Aldermore Bank has continued to serve its customers with simple, no-nonsense online banking for over a decade. The numerous awards the bank continues to earn, and its many positive Aldermore reviews point to a bank that is very safe to use for savings, business services, mortgages, and more.

Overall, Aldermore reviews are positive. However, according to some Aldermore reviewers, it does seem there is room for improvement in the mortgage division and customer service department.

We’ve found that while there are some negative Aldermore Bank reviews, more customers have said they are pleased with the bank and its services. We’ve rated Aldermore with a high 4 stars out of 5.

Image Sources:

- https://www.aldermore.co.uk/business/

- https://www.aldermore.co.uk/help-centre/literature-and-downloads/

- https://www.aldermore.co.uk/personal/personal-savings-accounts/easy-access-account/

- https://www.reviewcentre.com/bank_accounts/aldermore_wwwaldermorecouk-review_6606515

- https://www.pexels.com/photo/person-holding-coin-1602726/

- https://www.aldermore.co.uk/personal/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.