Getting the Best Mortgage Rates in San Diego (10-15-30-Year Fixed, 5/1, 7/1 ARM)

With a nickname like “America’s Finest City,” it’s no wonder that there are plenty of potential homeowners looking to purchase a house in San Diego.

Although San Diego real estate may be desirable, home buyers will almost certainly face high mortgage rates and even higher home prices.

According to the San Diego Union-Tribune, San Diego was ranked as one of the top five least affordable cities by HSH, a national mortgage research company.

With the median home price coming in at $483,000, finding the best mortgage rates in San Diego is crucial to ensure that homeownership remains affordable and manageable over the long run.

Current Mortgage Rates in San Francisco | Best Rates & Offers for San Francisco Mortgages

Current Mortgage Rates in San Jose | Best Offers & Rates for San Jose Home Loans

What Influences Your Interest Rate?

There are plenty of factors that could make a difference in the rates you receive from San Diego mortgage lenders. For example, San Diego mortgage rates could be impacted by any of the following:

- Type of loan and term length

- Your credit score and history

- The overall amount of the loan

- The initial down payment amount

Generally speaking, San Diego mortgage rates will be primarily based on your credit score, since lenders use this to gage their level of risk, or whether a borrower will default on a loan.

In addition to the factors listed above, mortgage rates in San Diego are constantly in a state of flux, meaning that the current financial market could also impact San Diego mortgage rates from one day to the next.

Best CD Rates in Puerto Rico | 1-Month to 5-Year Puerto Rico CDs

Best CD Rates in Washington, DC | 1-Month to 5-Year DC CDs

Good, Great, or Excellent Credit Score for San Diego Home Loans

Most lenders that provide competitive San Diego mortgage rates use a FICO score to determine if a borrower is creditworthy or not.

FICO scores range anywhere from 300 to 850, with higher numbers seen as the most creditworthy and lower numbers seen as the biggest financial risk.

FICO scores for San Diego mortgage rates generally fall into these categories:

- 300 – 629 is considered “Bad”

- 630 – 689 is considered “Fair”

- 690 – 719 is considered “Good”

- 720 – 850 is considered “Excellent”

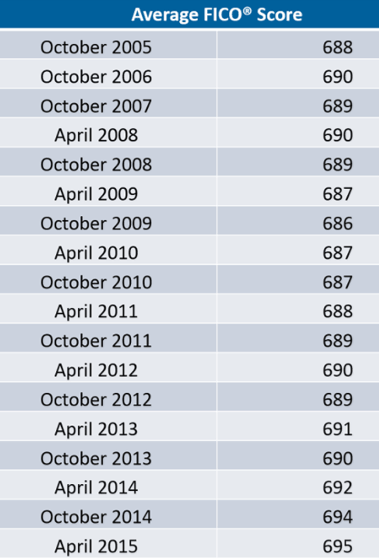

If you’re curious about the average credit score, see the table below for average FICO scores from 2005-2015. According to CNBC, as of this year, the average score is 700.

Tips to Save for a Down Payments on San Diego Mortgages

Along with finding the best mortgage rates in San Diego, many new homeowners struggle with saving enough money for a sizable down payment.

If you don’t have an already established savings, the thought of putting aside thousands of dollars to get the best mortgage rates in San Diego can be daunting.

Below, we’ve compiled a few tips to help you save for a down payment and get the best San Diego mortgage rate:

Re-Examine Your Budget

While some expenses are non-negotiable, creating a monthly budget can help you identify and fix overspending in non-essential categories.

Free budgeting tools—like those from Mint and Personal Capital—will take your monthly expenditures and sort them into categories like food, restaurants, bars, and entertainment.

You can use budgeting tools to decrease spending and allocate those savings towards San Diego mortgage rates.

Pick Up Additional Income

Earning additional income is a great way to increase your financial stability and build your down payment savings to lock in great mortgage rates in San Diego.

There are plenty of options for stay-at-home jobs to consider, or you can pick up a part-time job to supplement full-time income.

Make a commitment to apply any additional income towards San Diego mortgage rates, and you will be in good shape to contribute a 20 percent down payment.

San Diego, CA

Best CD Rates in Wyoming | Cheyenne, Casper, Laramie, & Other Cities

Best CD Rates in Vermont (1-Month to 5-Year CDs)

Conclusion – Getting the Best Mortgage Rates in San Diego

Once you know what type of San Diego mortgage you are interested in, your next step is to start evaluating lenders to find the best mortgage rates in San Diego.

Just as with any other shopping experience, it’s important to weigh your options and compare offers from multiple San Diego mortgage lenders to ensure that you are getting the best deal possible.

Ultimately, affordable and manageable San Diego mortgage rates are determined not just by monthly payments, but also by San Diego mortgage terms.

As such, don’t be afraid to shop around until you find the best mortgage rates in San Diego for your financial needs.

Best CD Rates in North Dakota for 1-9-Month & 1-5-Year CDs

First Time Home Buyers in Kentucky | Best Loans for Kentucky First Time Home Buyers

Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image sources:

- http://www.fico.com/en/blogs/wp-content/uploads/2015/08/April-2015-Average-FICO-Score.png

- https://pixabay.com/en/san-diego-city-coastline-skyline-2084674/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.