RANKING & REVIEWS

BEST FINANCIAL ADVISORS IN SAN ANTONIO & NEW BRAUNFELS

Best Financial Advisors in San Antonio and New Braunfels, Texas for 2021-2022

San Antonio, Texas and the nearby town of New Braunfels not only have a rich heritage, but are also considered to be one of the fastest-growing areas in the country.

With so many people gravitating to these popular Texas locations, there’s a growing need for top financial advisors to serve San Antonio and New Braunfels residents.

Financial planning and wealth management firms help people manage their money, invest wisely, and create a game plan to reach multiple future goals. These goals could include anything from a happy retirement to sending a child to college or growing a business/non-profit organization.

However, when it comes to actually choosing a top-rated San Antonio wealth management firm, many people aren’t sure exactly where to start. There are terms to understand like “fee-only” or “fee-based,” multiple firms to sort through, and the task of finding a firm you can trust.

AdvisoryHQ’s 2021-2022 ranking of the best financial advisory firms in the San Antonio and New Braunfels area is designed to make your search much easier. We’ve thoroughly reviewed multiple firms in the area in order to bring you the best of the best in our top 9 ranking.

Below, you’ll find a summary of each San Antonio or New Braunfels-based financial planner that we’ve decided to include. Our summaries include their fee structure, key specialties, and the highlights that made them stand out on our list.

We’ll also give you a cheat sheet that will help you better understand each of the fee structures.

By the end of this review, you should have a much better idea of which wealth management firms in the San Antonio area you’d like to partner with to help grow your money and meet your goals for the future.

Award Emblem: 9 Best Financial Advisors in San Antonio and New Braunfels, Texas

Top 9 Best Financial Advisors in San Antonio & New Braunfels, Texas | Brief Comparison & Ranking

| Financial Advisors in San Antonio & New Braunfels | 2021-2022 Ratings |

| Christian Financial Advisors (previously known as CIS Wealth Management) | 5 |

| Exencial Wealth Advisors | 5 |

| Financial Life Advisors | 5 |

| Intercontinental Wealth Advisors | 5 |

| M Capital Advisors | 5 |

| PAX Financial Group | 5 |

| Sendero Wealth Management | 5 |

| Strategic Financial Concepts (SFC) | 5 |

| Cypress Wealth Advisors | 3 |

Table: 9 Best Financial Advisors in San Antonio & New Braunfels | Above list is sorted by rating

See Also: Best Financial Advisors in Cincinnati, OH

Fee-Based, Fee-Only, & Fiduciary Financial Advisors in San Antonio & New Braunfels

When you start researching the best financial advisors in San Antonio and New Braunfels, there are three important terms that you need to familiarize yourself with.

- Fee-Only

- Fee-Based

- Fiduciary

These terms tell you the compensation structure a financial planning firm works under, as well as the level of commitment they make to their clients.

Below is a brief summary of each term:

Fee-Only Financial Advisors

When an investment firm or a financial advisor in San Antonio says that they are “fee-only,” this means that they do not accept any commissions or third-party referral payments.

When a firm’s only source of income comes from client fees, this greatly minimizes the inherent conflicts of interest that come with recommending and selling investment products. This means these advisors are in a better position to act solely in their client’s best interests.

Fee-Based Financial Advisors

On the other hand, fee-based financial advisory firms are free to accept commissions and incentives from companies that sell financial products, in addition to direct compensation from clients.

A fee-based structure creates the potential for conflicts of interest, which is why many fee-based investment firms are also established as fiduciaries, which can help counteract the potential for conflict.

2021-2022 Ranking of the Best Financial Advisors in San Antonio & New Braunfels, TX

Fiduciary

Both fee-only and fee-based firms can be set up as fiduciary. A fiduciary is a financial advisor that has taken on a legal responsibility to fully disclose any conflicts of interest, and keep the interests of their clients ahead of their own at all times.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

2021-2022 AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the financial products, firms, and services that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies.

Detailed Review – Best Wealth Management Firms in San Antonio & New Braunfels, Tx

Below, please find the detailed review of each firm on our list of 2021-2022 best wealth management firms in San Antonio and New Braunfels, TX.

We have highlighted some of the factors that allowed these top financial advisors in Texas to score so high in our selection rankings.

Click on any of the names below to go directly to the review section for that firm.

- Christian Financial Advisors

- Exencial Wealth Advisors

- Financial Life Advisors

- Intercontinental Wealth Advisors

- M Capital Advisors

- PAX Financial Group

- Sendero Wealth Management

- Strategic Financial Concepts (SFC)

- Cypress Wealth Advisors

Click below for previous years’ rankings:

- 2019 Review: 10 Best Financial Advisors in San Antonio and New Braunfels, TX

- 2018 Review: Top 9 Best Financial Advisors in San Antonio and New Braunfels, TX

- 2017 Review: Top 8 Best Wealth Managers in San Antonio & New Braunfels

- 2016 Review: Top 9 Best Financial Advisors in San Antonio & New Braunfels

Don’t Miss: Top Wealth Management Firms in Boston, MA

Christian Financial Advisors Review

Originally founded in 1993 under the name “Christian Investment Services”, Christian Financial Advisors (previously known as CIS Wealth Management), is a value-based and fiduciary-driven financial advisor. The firm is headquartered in New Braunfels with an additional office in Boerne, Texas.

Even though CFA is a fee-based financial advisory firm, we have included them on our list of top New Braunfels and San Antonio financial planners due to the firm’s wide range of services, commitment to fee transparency, and unique status as a faith-based financial firm.

Key Factors That Enabled Christian Financial Advisors to Rank as a Top Wealth Management Firm in San Antonio and New Braunfels, TX

Biblically Responsible Investing

The firm’s philosophy is based on a steadfast belief in adhering to Christian values in every aspect of life. The team at CFA uses its experience in financial planning and investment management to help its clients engage in Biblically responsible investing.

This New Braunfels financial advisor offers value-based investing, which refers to investing in a way that supports businesses making positive changes in society.

As a result, CFA can help its clients make well-informed decisions that match their values for all their current and future investments. These top wealth managers in New Braunfels will sit down with clients to align their financial needs with good stewardship practices and discuss investing in a way that aligns with their Christian faith.

Technology Driven, Interactive Financial Planning Services

CFA offers a wide array of services for its clients. This top Texas wealth management firm believes that a good financial plan should be living, breathing, and changing just as each individual is. This gives clients the full control to choose and pay exactly what they want.

Clients can choose between the following financial planning items:

- Retirement Planning

- Social Security Planning

- Company Retirement Plan Review

- Values-Based Investment Planning

- Investment Risk Assessment

- Tax Planning

- Educational Funding

- Life Insurance Planning

- Estate Planning

- Long Term Care Planning

- Investment Real Estate Analysis

- Major Purchases & Planning for Future Expenditures

- Creative & Deferred Gifting Strategies

- Planning for Sales of Major Assets

- Planning for Possible Incapacity

- Proper Titling & Beneficiary Designations

- CPA & Attorney Collaboration

- Multigenerational Family Planning

- Personal Document Digitization

- Asset Protection Planning

- Cash Flow & Debt Planning

- Net Worth Statement

- Ongoing Financial Guidance

The firm’s offerings are designed to allow clients to choose various areas of focus, depending on what services are most important to them. Based on each clients’ preferences, these New Braunfels financial planners will generate a proposal to meet their specific needs.

Rating Summary

If you’re looking for a firm that supports a faith-based approach to investing, then Christian Financial Advisors will be a top choice for you among New Braunfels financial advisors.

The firm’s experienced advisors and effective financial planning methods are entirely client-focused, allowing for a great deal of flexibility in how your money is managed.

With a team-based philosophy and a wide range of value-based financial services, Christian Financial Advisors once again solidifies its 5-star rating as one of the top financial advisory firms to consider partnering with in 2021-2022.

Related: Best Financial Advisors in Dallas, TX

Exencial Wealth Advisors Review

Exencial Wealth Advisors takes an integrated approach to wealth management in order to best serve their clients’ needs. In addition to their office in San Antonio, this financial advisor has 9 other offices across the United States.

The firm is an independent, fee-only financial advisor in San Antonio that assists clients with making better financial decisions via a strategic approach and customized portfolios.

Key Factors That Enabled Exencial Wealth Advisors to Rank as a Top San Antonio Financial Advisor

Personal & Executive Wealth Management

Whether you’re receiving personal or executive wealth management services, these financial planners in San Antonio believe that the more they know about you, the better plan they can create. Therefore, they take the time to understand your short-term and long-term goals before creating a plan of action.

No matter who you are, an important component of any financial plan is a smart investment strategy. As such, your financial advisor at Exencial will consider:

- Growth opportunities and risks posed by the securities market

- Methods to minimize risk

- Ways to reduce investment costs

- Your current investment allocation and costs

- Your specific goals

Comprehensive Process

The innovative process used by Exencial Wealth Advisors prioritizes giving clients all the information they need to be active participants in their wealth management plan.

During the analysis of a client’s current financial positions, these San Antonio financial advisors compile a personal financial statement that includes:

- Net Worth

- Cash Flow

- Insurance Coverage (including death, disability, and long-term care needs)

- Estate Valuation

- Income Tax Projections

- Withholding Analysis

- Investment Allocation

- Stock Option Analysis

This financial advisor in San Antonio then designs a completely customized financial plan that incorporates:

- Cash Flow & Retirement Planning

- Insurance Needs

- Estate Planning

- Tax Planning & Preparation

- Recommended Investment Allocation

- Charitable Giving

- Gifting to Family

- Company-Provided Benefits

Best Wealth Management Firms in San Antonio

Rating Summary

Exencial Wealth Advisors offers clients a comprehensive process that is completely customized and client-focused. The fee-only, independent structure of these San Antonio financial planners also creates a base of trust and transparency.

With an expert team providing both investment management and financial planning through a holistic approach, Exencial Wealth Advisors earns a 5-star rating as one of the best financial planners in San Antonio to consider partnering with this year.

Popular Article: Best Financial Advisors in Los Angeles, CA

Financial Life Advisors Review

With a culture based on “Cowboy Ethics”, Financial Life Advisors is a wealth management firm in San Antonio that believes in following a set of principles that result in doing the right thing for the client at all times.

This fee-only San Antonio financial planner works with transitioning retirees, busy professionals, and generational wealth transfer clients.

Key Factors That Enabled Financial Life Advisors to Rank as One of the Best Wealth Management Firms in San Antonio and New Braunfels

Cowboy Ethics

The team at Financial Life Advisors is inspired by a philosophy that’s reflected in everything they do. Cowboy Ethics, inspired by James P. Owen’s book of the same name, brings an unusual but effective approach to business ethics with its core “cowboy” principles to live by.

As a result, this popular San Antonio wealth management firm finds the following 10 principles critical to always doing what’s right for the client:

1. Live Each Day with Courage: They challenge themselves to be better tomorrow than they were today.

2. Take Pride in Your Work: They firmly believe in being masters of their craft.

3. Always Finish What You Start: They get help if they need it, but they always finish what they start.

4. Do What Has to Be Done: They always take care of the client first, then solve the problem or handle the situation.

5. Be Tough, But Fair: They are tough enough to stand up for their principles, convictions, the client, the firm, or themselves.

6. When You Make A Promise, Keep It: They believe a person (or company) is only as good as their word.

7. Ride for the Brand: They pride themselves on making a difference in their clients’ lives.

8. Talk Less and Say More: They try to keep it simple but also always keep it true.

9. Remember That Some Things Aren’t for Sale: They honor the principles they’re guided by, take care of the client, and honor the outfit.

10. Know Where to Draw the Line: They abide by the rules and laws, but they are not afraid to raise the bar to a higher standard and do the right thing.

This code of conduct means instilling a company-wide commitment to doing the right thing at all times – yesterday, today, and tomorrow.

Risk Analysis

Financial Life Advisors believes that timing is often the most important component of a successful retirement plan.

This San Antonio wealth management firm’s software modeling not only mimics stock portfolio outcomes, but also tracks 10,000 simulations with each client’s specific goals.

This gives clients a great opportunity to understand a variety of scenarios including the resultant average returns, strongest returns, and catastrophic market returns as well as how each outcome influences their financial future.

Rating Summary

As a top-rated financial advisor in San Antonio, Financial Life Advisors offers in-depth research and data-driven modeling to help clients make the best financial choices for a successful future.

With an experienced and credentialed team, a full range of financial services under one roof, and an honorable code of conduct, Financial Life Advisors scores a 5-star rating as a top San Antonio financial advisor to consider partnering with this year.

Popular Article: Best Wealth Management Firms in Pittsburgh, PA

Intercontinental Wealth Advisors Review

Founded in 1981, Intercontinental Wealth Advisors is a San Antonio financial planning with an additional office in Ft. Lauderdale. This firm stands out with its global perspective, innovative thinking, and unique approach to financial planning.

Intercontinental Wealth Advisors’ website does not clearly state whether it’s a fee-based or fee-only firm. However, the firm’s ADV does state that IWA receives a financial incentive to place advisory clients in mutual fund classes, which points to a fee-based structure.

As always, we recommend verifying fee structure before partnering with any San Antonio financial advisor.

Key Factors That Enabled Intercontinental Wealth Advisors to Rank as One of the Best Financial Advisors in San Antonio

Financial Planning & Investment Management

While Intercontinental Wealth Advisors may be considered a boutique firm, these San Antonio financial advisors offer a complete range of services, comparable to even the largest wealth management firms. These services include:

- Wealth Management: Asset management, investment philosophy, investment advice, family governance, foundations, private investments, and more.

- Financial Planning & Estate Planning: Uses behavioral finance principles to help clients comprehend and anticipate money-related emotions and actions.

- Insurance Services: Personal and business-related insurance to minimize risk.

- Alternative Investments: Private equity, art advisory, managed futures, and master limited partnerships.

- Concierge Services: Services that go “above and beyond” and can include things such as scheduling doctor’s appointments, buying an art collection, or even selling a corporate jet.

- Lending Solutions: Investment credit line and mortgage solutions through a partnership with BNY Mellon.

San Antonio’s Top Financial Planning Firms

Behavioral Finance Approach

Part of what makes Intercontinental Wealth Advisors stand out as one of the best financial advisors in San Antonio is their behavior-based approach to financial planning. They work to help clients understand the emotions and feelings tied to money management.

Discussing money is often an emotional experience, which can lead to decisions based on panic or fear. Other components added to the mix include behavioral patterns and past upbringing, which often significantly impact how each client handles their finances.

Using an approach based on behavioral finance can address these influences, emotions, and fears revolving around money to improve financial health on a fundamental level.

Rating Summary

As a globally-minded San Antonio financial advisor with offices in both San Antonio and Miami, Intercontinental Wealth Advisors offers a unique perspective to successful financial management. They also specialize in working with tax professionals to assist in non-US tax considerations.

With a unique behavioral approach, a long history of expert financial guidance, and a global perspective, Intercontinental Wealth Advisors easily earns 5 stars as one of the best San Antonio wealth management firms to consider partnering with in 2021-2022.

M Capital Advisors Review

M Capital Advisors is a nationally recognized San Antonio financial advisory firm with a history dating back to 1993. In addition to San Antonio, the firm also has an office in Nashville, TN.

The firm is an independent, fee-only financial advisor in San Antonio that is focused on providing custom-tailored solutions for both personal wealth management and institutional asset management.

Key Factors That Enabled M Capital Advisors to Rank as One of the Best Financial Advisors in San Antonio

Unbiased, Objective Viewpoint

As an independent, fee-only firm that also upholds a fiduciary commitment, M Capital Advisors provides clients with completely conflict-free financial advice.

Rather than earning commissions from financial products, a fee-only pricing schedule ensures that the firm’s interests are directly matched up with that of their clients.

Additionally, a completely independent structure ensures clients can trust that all advice is unbiased and objective. All of the top Texas financial advisors at M Capital Advisors are free from the pressure to “sell” certain financial products.

Not only does this encourage trust within the client/advisor relationship, but it also fosters positive, long-term relationships – a key element in any successful wealth management relationship.

Integrated Wealth Management & Financial Planning

M Capital Advisors believes that to be truly successful, clients should have access to a wide range of fully integrated financial planning and wealth management services. To that end, the San Antonio wealth managers at M Capital Advisors provide some of the following financial planning services:

- Investment Management: Provides personalized and comprehensive investment strategies.

- Retirement Planning: Ensures that clients are well-prepared for retirement through things like pension planning and social security analysis.

- Risk Management: Reviews assets and liabilities, developing strategies to minimize exposure and risk.

- College Planning: Maximizes savings to fund future education goals without sacrificing other long-term objectives.

- Trust & Estate Planning: Ensures you leave a lasting impact through a comprehensive estate plan.

- Cash Flow Management: Manages your personal wealth to support future goals both in the short-term and the long-term.

Rating Summary

M Capital Advisors believes in a client-first philosophy that guides every step of their financial planning and wealth management services in San Antonio. Their goal is to create a better plan for a better future for their clients.

Their fee-only structure, experienced team, and wide range of integrated services earn them a solid 5-star rating, making M Capital Advisors one of the top San Antonio financial planners to consider partnering with this year.

Read More: Ranking of Top Financial Advisors in Minneapolis, MN

PAX Financial Group Review

PAX Financial Group is a San Antonio-based financial advisor that believes everyone is entitled to quality, unbiased financial advice. They serve clients from their offices in San Antonio, New Braunfels, and Asheville, NC.

The firm is set up as a fee-based financial advisor that is also a fiduciary. They commit to putting their clients’ interests first and also state that their financial professionals aren’t paid on a commission basis.

Key Factors That Enabled PAX Financial Group to Rank as One of the Top Wealth Management Firms in San Antonio

Comprehensive Services

PAX Financial Group works to maintain an informative environment and to create completely personalized and efficient financial solutions.

Once a financial plan is executed, this San Antonio wealth management firm works together with clients to consistently maintain goal projections and regularly consults with clients to ensure that the plan remains consistent with the client’s objectives.

For individual clients, these solutions include:

- Financial Planning

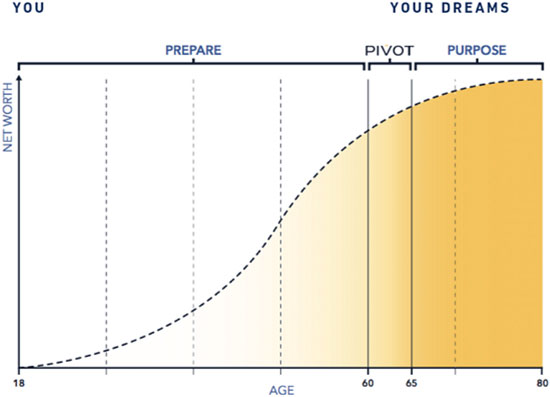

- PIVOT™ Retirement Planning

- Individual Retirement Accounts (IRAs & Roth IRAs)

- Non-Qualified Retirement Programs

- Life & Disability Income Insurance Needs

- Retirement Needs Analysis

- Health Insurance

- Long Term Care Insurance

- Tuition Funding Programs

- College Costs Analysis

- Charitable Giving

- Estate Planning

Best Wealth Management Firms San Antonio

Strong Value Proposition

As a top-rated San Antonio and New Braunfels financial advisor, PAX Financial Group offers new and existing clients a strong value proposition, including:

- Experience: The team of San Antonio financial planners at PAX boasts over 130 years of combined financial industry experience.

- Fiduciary: With a fiduciary commitment, clients can trust that their best interests will always come first.

- Independent: As an independent firm, the Texas financial advisors at PAX are not obligated to sell any specific financial products, ensuring an unbiased viewpoint.

- Compensation: Advisors are paid via salary, avoiding conflicts of interest that come with a commission-based model.

- Credentials: The team of Texas financial advisors at PAX includes multiple CFP® and AIF® professionals.

- Minimums: There are no account minimums to become a client of PAX, as the firm believes that expert financial and wealth management should be open to all.

With a welcoming philosophy and a wide range of value-added services, PAX Financial Group is an excellent option for those new to investing and wealth management.

With a dedicated retirement system, a talented team, and an all-inclusive approach, PAX Financial Group easily solidifies its 5-star rating as one of the best wealth management firms in San Antonio to consider partnering with this year.

Sendero Wealth Management Review

Founded in 2008, Sendero Wealth Management is a private, boutique San Antonio-based wealth management firm with deep family values and a passion for personalized service.

This fee-only San Antonio wealth advisor generally focuses on clients with $5,000,000 or more in investable assets. SWM’s expert team of advisors develops and implements investment strategies based on a client’s entire financial situation, not just their managed assets.

Key Factors That Enabled Sendero Wealth Management to Rank as a Top Texas Financial Advisor in San Antonio

The Pathway of Stewardship™

As a privately-owned boutique San Antonio wealth advisor, Sendero Wealth Management offers unbiased financial advice and personalized investment strategies that are meant to help their clients preserve and grow their wealth responsibly.

Sendero defines its Pathway of Stewardship™ as “an ethic that embodies the careful, responsible planning and management entrusted to one’s care; the acceptance or assignment to shepherd and safeguard the valuables of others; choosing service over self-interest”.

Designing the Right Mix

Understanding their clients’ unique investment goals and challenges is at the core of Sendero Wealth Management’s services. This San Antonio wealth management team wants to ensure that they’re utilizing the comprehensive view that allows them to best customize a blend of investment strategies in order to diversify exposure. This includes:

Stability Assets: May include asset classes such as cash, bonds, multi-strategy, and market-neutral hedge funds.

Growth Assets: Assets such as domestic stocks, international stocks, and REITs.

Diversifier Assets: This category will include asset classes such as long/short and hedged equity strategies, managed futures, and other illiquid investments.

This team of San Antonio wealth managers will take a good look at and become familiar with each client’s investment goals and risk tolerance through multiple meetings before making their recommendation.

Rating Summary

Sandero’s boutique approach to investing, determination to provide holistic investment strategies and advice, and family values that are rooted in everything they do, have earned this San Antonio wealth manager a 5-star rating. This makes the firm one of the top ones to consider partnering with in 2021-2022.

Related: Reviews of Best Financial Advisors in New York, NY

Strategic Financial Concepts (SFC) Review

Founded with a goal to protect, preserve, and accumulate wealth for their clients, Strategic Financial Concepts (SFC) is a San Antonio-based wealth management firm that serves families, individuals, and businesses throughout 40 U.S. states.

The firm operates with a fee-based structure and is also a fiduciary, which obligates them to always put their clients’ best interests first and to be completely open and transparent about all fees.

Key Factors That Enabled Strategic Financial Concepts to Rank as a Top Texas Financial Advisor in San Antonio

Team-Based Planning

Strategic Financial Concepts promotes a team-based approach. Comprehensive financial plans are put together by multiple advisors who provide second and third opinions to help determine what is best for each client’s individual needs. As a result, clients receive a much more robust plan than if the process were less collaborative.

These San Antonio financial advisors look at the total financial picture of each individual, combining personal and business factors and integrating specialists into the process when needed, in order to provide truly comprehensive financial planning.

The team at Strategic Financial Concepts believes that a holistic financial plan leads to solutions that are comprehensive and thus more effective.

Suite of Financial Services

Strategic Financial Concepts gives clients access to a wide range of services and products aimed to help them achieve their goals.

Financial Planning Firm in San Antonio

Available services from this San Antonio financial planner include:

- Business Planning: Entity planning, business continuity/transition, CFO program for businesses, tax planning, and more.

- Wealth Management: Goal planning, estate planning, financial planning, insurance management, and more.

- Individual Planning: Goal planning, investment management, insurance management, and budgeting.

- Asset Protection: Investment management and legal coordination.

The firm then works with various financial services and insurance companies to ensure that clients have access to everything they need to reach their financial objectives.

Rating Summary

Strategic Financial Concepts takes a straight-forward approach to wealth management and financial planning that puts the needs of the client front and center. Their team-based philosophy is a stand-out which adds exceptional value to each client portfolio.

With a comprehensive mindset and collaborative spirit, Strategic Financial Concepts also earns a 5-star rating as one of the best financial advisors in San Antonio to consider partnering with this year.

Cypress Wealth Advisors Review

With a mission to act as an independent voice for clients, Cypress Wealth Advisors is a San Antonio financial advisory firm that provides an objective and flexible range of services.

The firm is a fee-only wealth management firm in Texas that services clients throughout the region including San Antonio, Dallas, Houston, Austin, and several surrounding states. They believe in providing custom-tailored solutions that are easy to understand.

Key Factors That Enabled Cypress Wealth Advisors to Rank as a Top Financial Advisor in San Antonio

Wide Range of Services

As one of the top-rated San Antonio financial advisors, Cypress offers clients a wide array of financial planning and investment management services to choose from, including:

- 401k & IRAs

- Cash Flow & Debt Reduction

- 529 Tuition Plans

- Annuities

- Mutual Funds, ETFs & Individual Equities

- Fixed Income (inc. Treasuries & Bonds)

- Group Retirement & Savings Plans

- Qualified Retirement Plans

- Life, Long-Term Care & Disability Insurance

- Social Security & Medicare

- Insurance, Estate Planning & Taxes

Talented Team

While Cypress Wealth Advisors may have a smaller team than other competing financial advisors in San Antonio, the expert advisors at Cypress hold a wealth of industry knowledge and experience.

These industry accreditations include:

- CFA

- CFP®

- CRPS®

- AIF®

Many of these accreditations come with strict requirements for ethical behavior and ongoing yearly education, increasing the value that each certification brings.

Additionally, advisors hold membership in industry associations like the Financial Planning Association (FPA) and the National Association of Personal Financial Advisors (NAPFA).

San Antonio’s Top Financial Planning Firms

Rating Summary

With a comprehensive approach that helps simplify the wealth management process and a highly customer-centric philosophy, Cypress Wealth Advisors is one of the top San Antonio wealth management firms to consider working with this year.

However, it is worth noting that compared to other top-rated San Antonio financial advisors, Cypress could benefit from a website update. The current site doesn’t have a secure encrypted connection, looks outdated, and doesn’t fully illustrate the firm’s value, making it difficult for first-time clients to fully evaluate the firm.

For the above-mentioned reasons, we’ve scored the firm with 3-stars.

By updating its website to be more secure, user-friendly, and visually appealing, Cypress Wealth Advisors could easily improve both its value proposition to new clients and its rating as one of the best financial advisors in San Antonio.

Don’t Miss: Top Wealth Management Firms in Phoenix & Scottsdale, AZ

Free Wealth & Finance Software - Get Yours Now ►

Conclusion – 2021-2022 Best Financial Advisors in San Antonio & New Braunfels, Texas

Financial planning and wealth management services aren’t just for the wealthy. Everyone can benefit from expert advice and a strategic plan to manage existing wealth and help it grow to reach future goals.

An experienced San Antonio financial advisor can help you manage both risk and growth expectations, take a clear look at your current financial situation, and give you a customized path to financial success.

Now that you know the top 9 financial advisory firms in San Antonio to work with, you’ll want to narrow down the list further to a few that you’re most excited about.

Most firms offer a free complimentary meeting to get to know them and see if they’re a good fit. So, take advantage of these offerings and be sure to bring your financial information along for a productive face-t0-face visit.

While the process of choosing the best wealth management firm in San Antonio can take a little time, it’s well worth it to find the perfect partnership with a firm that you can work with for the long haul.

Image sources:

- https://www.pexels.com/photo/buildings-under-cloudy-sky-during-sunset-462331/

- https://paxfinancialgroup.com/are-we-right-for-you/

- https://exencialwealth.com/services

- https://intercontl.com/services/financial-planning

- https://pixabay.com/photos/san-antonio-city-cityscape-347429/

- www.cypresswealthadvisors.com/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.