Intro: Review & Ranking of Blankinship & Foster

Blankinship & Foster has been reviewed by AdvisoryHQ News and was ranked as one of the top financial advisory and wealth management firms in San Diego, California.

In the sections below, we provide a detailed overview, including some of the key factors that enabled Blankinship & Foster to rank as a top wealth management firm and financial advisor in San Diego, California four years in a row.

Financial advisors and wealth management firms on our top rated lists are selected after they have successfully passed AdvisoryHQ’s ground-breaking “Top-Down Advisor Selection Methodology” that is based on a wide range of filters, including fiduciary duty, independence, transparency, level of customized service, history of innovation, fee structure, quality of services provided, team excellence, and wealth of experience.

About AdvisoryHQ News

Searching for top rated financial firms and services can be a daunting undertaking, especially if you are unfamiliar with the landscape. AdvisoryHQ is committed to simplifying the research that consumers conduct before choosing a top financial advisor or product.

Our goal is to give consumers, investors, high-net-worth individuals, and business owners exactly the information they need, without any hype or jargon. This allows them to make their own decisions effectively.

AdvisoryHQ’s reviews and rankings are always 100% independently researched and written.

Overview of Blankinship & Foster

Blankinship & Foster is a fee-only wealth management firm in Solana Beach, California, where it has been serving clients since 1974. Solana Beach is an affluent city in San Diego County, California.

The team at Blankinship & Foster is experienced in bringing financial planning and investment management services with a special focus on helping retirees, soon-to-be retirees, financially independent women, and women in transition.

Review and Selection Highlights

Below are some key selection factors that enabled Blankinship & Foster to be ranked a 2017 top-rated wealth management and financial planning firm in the San Diego area.

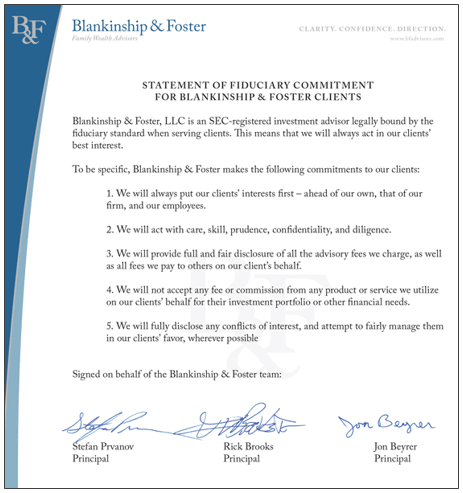

A Statement of Fiduciary Commitment

Perhaps the most important thing the Blankinship & Foster team offers their clients is the promise of fee-only, independent, and fiduciary services.

Recommendations are based solely on the best interests of the clients and never involve third-party, commission-based sales.

The Financially Independent Woman

Blankinship & Foster has a long history of serving financially independent women. As women are more likely to undergo significant life changes, both planned and unexpected, the firm has developed a strategic approach to properly guide the sensitive needs of these unique clients.

The Financial Independence Plan

As a pre-retiree, it’s never too early to start planning for your golden years. In fact, the sooner you get a handle on your financial future, the more successful your plan will ultimately be. The firm’s “Financial Independence Plan” encompasses the following variables:

- Income planning

- Investment planning

- Estate/charitable/legacy planning

- Tax planning

Retirement Planning

Retirement is a beginning, not an end. While this can be an exciting time in a person’s life, it can also leave a lot of unanswered questions. With over 25 years of retirement expertise, Blankinship & Foster has implemented a variety of sound retirement strategies. Transitioning into retirement involves the following:

- Maximizing benefits

- Planning for income and assets

- Maintaining your plan through retirement

- Anticipating changes

A Team-Centered Approach

To provide the best quality of service, each client is assigned to a team of two financial advisors who are supported by the entire Blankinship & Foster firm. This team-focused approach allows your advisors to remain highly attuned to your specific financial goals.

Wealth Management Services

An integrated wealth management plan allows you to stay focused on all aspects of your financial future. Customizable objectives take into account finances, cash flow, taxes, risk management, and investment strategies. Along with the following options, you have the opportunity to create a distinct and comprehensive portfolio:

- Goal planning

- Retirement planning

- Income and expense planning

- Tax planning

- Estate planning

- Risk management and insurance planning

- Philanthropic and legacy planning

- Executive benefits

- Social Security and Medicare planning

- Mortgage planning

Small, but Large Enough

One key factor about Blankinship & Foster is that the firm is small enough to deliver personalized service to its clients, but large enough to deliver a full suite of services through a team of experienced advisors.

In addition, the firm uses its collective knowledge and education, including professional qualifications, which include CFA®, CFP®, and EA®, to deliver a higher level of individualized services to its clients.

Clients are served by a team of at least two advisors, a strategy that offers continuity of service through assured advice from a professional who knows the client’s circumstances intimately.

Additionally, where required, the firm taps into its extensive professional network to put clients in touch with other service providers, like attorneys, accountants, trustees, insurance agents, business advisors, private bankers, etc., to ensure every aspect of a client’s financial life receives appropriate professional attention.

Fee Structure

The firm has a fee-only structure, which means that they do not sell products for commission, nor do they receive referral fees of any kind.

Fee-only financial advisors do not accept any commission for recommending a product or service that is provided by a bank, broker dealer, investment firm, mutual fund, insurance company, or from any other source other than the fees they receive from you, the client.

Being that the sole compensation for fee-only financial advisors, financial planners, and asset managers comes directly from clients, their only loyalty is to clients and making sure the advice provided is the best for each client’s unique financial situation.

Blankinship Contact & Key Team Info

Readers can contact Blankinship & Foster via the contact information below. To contact AdvisoryHQ directly about Blankinship & Foster, see the “Contact AdvisoryHQ News” section below.

Key Blankinship & Foster Team Members:

- Stefan Prvanov, CFP® | President/CEO

- Rick Brooks, CFA®, CFP® | Director/Chief Investment Officer

- Jon Beyrer, CFP®, EA® | Director/Wealth Management

- Teresa Kakadelas, CFP®, CDFA™ | Director/Financial Planning

- Monica Ma, CFA®, CFP®, CSA® | Chief Investment Officer

Click here for the firm’s most updated team member information: http://www.bfadvisors.com/about/team/

Blankinship & Foster Contact Information:

AdvisoryHQ’s Objective Standards & Our Personalized Page Service

This Blankinship & Foster review was independently conducted by AdvisoryHQ. Firms do not pay for their ranking. In fact, most firms do not even realize that they are being reviewed and ranked by AdvisoryHQ until after our ranking publication has been completed and published to the public.

Our focus is on the everyday consumer. All of our research and publications are conducted from the end-user consumer’s perspective, and we publish our top ranking reviews for anyone to view for free.

However, after we’ve published our top ranking publications to the general public, firms can request to have a separate personalized profile, like the one above, which incurs a charge. Click here for more information on AdvisoryHQ’s Personalized Page service.

Click below for information on AdvisoryHQ’s objective and independent standards:

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.