Getting the Best Mortgage Rates in Wisconsin (10-15-30-Year Fixed, 5/1, 7/1 ARM)

The Wisconsin housing market is on the upturn, capping off a stellar summer season for WI mortgages in 2017.

As reported by Journal Sentinel, the Wisconsin Realtors Association closed on over 8,500 homes in August, marking the highest number of sales since August 2005.

Interestingly, despite an increase in new home sales, the median Wisconsin mortgage rose from $170,000 to $182,000 in Milwaukee, Racine, Madison, Green Bay, Oshkosh, and other cities across the state.

Sales are undoubtedly strong for the Wisconsin real estate market, but rising home costs stress the importance of finding great Wisconsin mortgage rates.

If you’re looking to purchase a home in Wisconsin or refinance an existing Wisconsin mortgage loan, knowing the current mortgage rates for WI and finding competitive mortgage rates in Wisconsin can be instrumental in off-setting the long-term costs of home ownership.

Current Mortgage Rates in North Dakota | Mortgage Rates in ND for Good-Excellent Credit Borrowers

Best Mortgage Rates in Puerto Rico | Home Loans in Puerto Rico for Good-Excellent Credit Borrowers

Which Wisconsin City Are You Located in?

When it comes to finding the best WI mortgages, there are plenty of factors to consider.

For many lenders in Milwaukee, Madison, Green Bay, Racine, Kenosha, Appleton, Waukesha, and other cities across the state, the location of the home will play a large role in what type of Wisconsin mortgage rates are available.

This means that homes across the state could have varying Wisconsin mortgage rates based on the individual city, neighborhood, and the condition of the home itself.

While you are searching for competitive Wisconsin mortgage rates, it may be worthwhile to check the rates for neighboring cities to explore other mortgage rates in Wisconsin that could potentially be more affordable over the long run.

See the table below for a list of some of the largest cities in the state offering a wide range of mortgage rates in Wisconsin.

| Top Wisconsin Cities | Population (2016) |

| Milwaukee | 595,047 |

| Madison | 252,551 |

| Green Bay | 105,139 |

| Kenosha | 95,631 |

| Racine | 77,571 |

| Appleton | 74,370 |

| Waukesha | 72,363 |

| Eau Claire | 68,339 |

| Oshkosh | 66,579 |

| Janesville | 64,159 |

| West Allis | 60,087 |

| La Crosse | 52,109 |

Source: Google

Key Requirements for Buying a House in Wisconsin

Before you apply for a WI mortgage loan, you’ll want to ensure that you complete the below list of requirements.

- Get your down payment ready (~20% of the loan amount)

- Maintain good to excellent credit

- Save some extra funds for your closing cost (there might be additional expenses that you’ll need to pay)

- Maintain a low debt balance

- Demonstrate sufficient income

- Gather your financial documents

- Get a home appraisal on the home

You’ll also need to examine your options for WI mortgage products from multiple Wisconsin mortgage lenders before choosing the best mortgage rates in Wisconsin for you.

Summer Field in Wisconsin

Current Mortgage Rates in New Hampshire | NH Mortgage Rates for Good-Excellent Credit Borrowers

Good, Great, or Excellent Credit Score for a WI Mortgage

Most Wisconsin mortgage lenders offering competitive Wisconsin mortgage rates use a FICO score to determine if a Wisconsin based borrower is creditworthy or not.

FICO scores range anywhere from 300 to 850, with higher numbers seen as the most creditworthy and lower numbers seen as the biggest financial risk.

FICO scores for WI mortgage applicants generally fall into these categories:

- 300 – 629 is considered “Bad”

- 630 – 689 is considered “Fair”

- 690 – 719 is considered “Good”

- 720 – 850 is considered “Excellent”

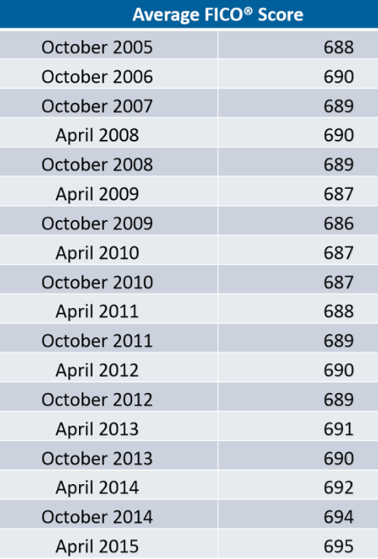

For an overview of the average FICO scores from 2005-2015, see the below table. According to CNBC, as of this year, the new average score is 700.

Current Mortgage Rates in Kansas | Best KS Mortgage Rates for Good-Excellent Credit Borrowers

Current Mortgage Rates in Hawaii | Best Hawaii Mortgage Rates for Good-Excellent Credit Borrowers

Conclusion – Finding a Top Mortgage Loan for a Home in Wisconsin

Purchasing a home in Wisconsin can be an exciting time. For many homeowners, the process of buying a home represents spreading roots, change, renewal, progress, and the pride of ownership.

Not surprisingly, purchasing or refinancing a WI mortgage can also be an expensive time, particularly when it comes to Wisconsin mortgage rates.

Understanding your options for Wisconsin mortgage rates and Wisconsin refinance rates is crucial—no matter what mortgage rates in Wisconsin you choose, you’ll want to ensure that a WI mortgage or refinance sets you up for financial success over the long run.

After all, your Wisconsin mortgage rate will stick with you for the next few decades, making it crucial for each potential homeowner to find the best Wisconsin mortgage rates for their personal finances.

Current Mortgage Rates in Idaho | ID Mortgage Rates for Good-Excellent Credit Borrowers

Current Mortgage Rates in Delaware | DE Mortgages for Good-Excellent Credit Borrowers

Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image sources:

- https://pixabay.com/en/wisconsin-fields-meadow-cattle-1826834/

- http://www.fico.com/en/blogs/wp-content/uploads/2015/08/April-2015-Average-FICO-Score.png

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.