Getting the Best Mortgage as a First Time Home Buyer in Louisiana

Purchasing a home is no short-term commitment. With payment terms ranging from 15-30 years, it’s likely that first time home buyers in Louisiana will be working a mortgage into their budget for decades to come.

Many first time home buyers in Louisiana find that Louisiana first time home buyer programs and first time home buyer grants in Louisiana are great tools to make home ownership convenient and affordable through the long-term.

No matter whether you’re ready to start house hunting or you’re simply exploring possibilities, understanding your options as a first time home buyer in Louisiana can make a world of difference while searching for your first house.

First Time Home Buyers in West Virginia | Best Loans for WV First Time Home Buyers

First Time Home Buyers in Vermont | Best Rates for Vermont First Time Home Buyers

Louisiana First Time Home Buyer Programs

Aside from the mountains of paperwork and lists of financial jargon, many first time home buyers in Louisiana find that coming up with the funds for a down payment is the biggest challenge.

Thankfully, there are plenty of Louisiana first time home buyer programs that are meant to ease the financial stress for Louisiana first time home buyers.

Below, you can find a list of the most common Louisiana first time home buyer programs and first time home buyer grants in Louisiana.

- Expand to Homeownership—Provides down payment and closing costs assistance for first time home buyers in New Orleans

- First Time Homebuyers Assistance Program—These first time home buyer grants in Louisiana are available to those purchasing a home in the city of Kenner

- Home Buyers Assistance Program Participation Initiative (HAPPI)—Creates partnerships between local lenders and first time home buyers in Shreveport

- Homebuyer Assistance Program (HAP)—Provides 3 percent down payment assistance for first time home buyers in Baton Rouge

- Southern Mortgage Assistance Program—Gives 3 to 4 percent in down payment assistance for a first time home buyer in Louisiana

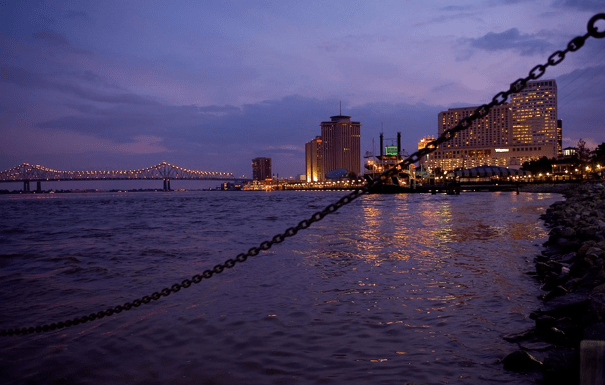

New Orleans, LA

First Time Home Buyers in North Dakota | Best Loans for ND First Time Home Buyers

First Time Home Buyers in Alaska | Best Mortgage Rates for Alaska First Time Home Buyers

Finding the Right Home for Louisiana First Time Home Buyers

As a Louisiana first time home buyer, house hunting can be an exciting process. You get the opportunity to look for the home qualities that you have always dreamt of.

When it comes to choosing the right home for Louisiana first time home buyers, however, there are plenty of factors to consider.

While looking for their ideal home, first time home buyers in Louisiana should think about the following features:

Location

The location of a home for a first time home buyer in Louisiana is incredibly important, since it will determine whether you live in a neighborhood that is quiet, busy, young, old, family-oriented, or business-oriented.

As a Louisiana first time home buyer, you’ll want to make sure that you thoroughly research the neighborhood before committing to a Louisiana first time home buyer mortgage.

Depending on the neighborhood or county, the location of a home could also impact the type of mortgage rate that first time home buyers in Louisiana receive, which is also something that Louisiana first time home buyers should strongly consider.

Age of the Home

There’s no denying that older homes have character, but as a first time home buyer in Louisiana, you’ll want to make sure that you are prepared for the upkeep and repairs on an older home.

If you prefer to buy an older home, make sure that you have the right expectations—and budget—to make the necessary repairs or renovations.

Space Inside the Home

This might sound like an obvious consideration to take, but many first time home buyers in Louisiana forget to consider how the space inside the home will fit into their plans.

If you like entertaining or having guests for the weekend, you’ll want to make sure that your home is spacious enough to accommodate them.

First time home buyers in Louisiana that plan on having children will want to choose a house that has enough space, rather than having to go through the listing and selling process a few years after purchasing a home.

Additionally, first time home buyers in Louisiana will also want to consider factors like their daily commute to work, the local school district, and whether the property values in the neighborhood are projected to change.

First Time Home Buyers in New Mexico | Best Loans for New Mexico 1st Time Home Buyers

First Time Home Buyers in South Dakota | Best Loans for South Dakota First Time Home Buyers

Conclusion – Getting the Best Mortgages for Louisiana First Time Home Buyers

Buying a home will not be a quick shopping experience for first time home buyers in Louisiana. The average processing time for a mortgage takes between 30-45 days, including the start of application to the closing.

Given this, first time home buyers in Louisiana should create a plan to avoid unnecessary delays or extra expenses when getting a Louisiana first time home buyer mortgage.

It’s also important to explore all possibilities for first time home buyer programs in Louisiana and first time home buyer grants in Louisiana to ensure that your first mortgage is as affordable as possible.

First Time Home Buyers in Nevada | Best Rates & Programs for Nevada First Time Home Buyers

Current Mortgage Rates in New Mexico | Best NM Mortgage Rates for Good-Excellent Credit Borrowers

Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image source:

- https://pixabay.com/en/new-orleans-louisiana-city-cities-221301/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.