If you live in Australia, chances are you are quite familiar with the National Australia Bank (NAB). NAB is the largest bank in Australia; however, when determining whether or not you should use this bank, you can’t rely solely on size.

We’ve conducted a number of NAB reviews and examined their products in detail to help you make an informed decision.

About NAB

As previously stated, National Australia Bank (NAB) is the largest bank in Australia. In fact, given its 1,700 branches and service centers and 3,400 ATMs, NAB was ranked the 47th largest bank in the world by total assets. The financial institution currently serves an impressive 12.7 million customers with personal and business services.

The bank’s mission is provide “customers with quality products and services, fair fees and charges, and relationships built on the principles of help, guidance and advice.”

Image Source: National Australia Bank (NAB)

NAB Reviews & NAB Complaints

NAB reviews are freely available on a number of review sites, with a mix of both positive NAB reviews and NAB complaints. This can make it difficult when deciding if NAB is the best bank for you.

Happy customers note on Mozo that they appreciate the excellent security provided and exemplary customer support. They also note being extremely satisfied with the great interest on savings accounts and convenience of having many ATM’s available.

Other customers note a different experience – especially with the home loan process.

In an effort to help you with your research, we’ve provided you a detailed breakdown of what you should consider before banking with the largest bank in Australia.

See Also: Chase vs Bank of America | Bank Ranking and Comparisons

Personal Banking

You may be wondering what NAB’s range of personal products are. NAB offers a wide range of products for personal customers, including:

- Checking accounts

- Saving accounts

- Credit Cards

- Home & Personal Loans

- Transaction Accounts

Checking Accounts

NAB offers two different transactional accounts: NAB Classic Banking and NAB Retirement Accounts.

What Is NAB Classic Banking?

NAB Classic Banking is for those looking for an everyday account with no monthly fees (ever!). NAB notes that you can enjoy convenient, unlimited access to your money wherever you are. With NAB’s Classic Banking choice, you’ll also enjoy:

Image Source: National Australia Bank (NAB)

Don’t Miss: USAA Bank Reviews – Is USAA a Good Bank? (Online Checking, Savings, & Military Banking)

- No minimum or ongoing deposits required

- No monthly NAB fees or overdrawn fees

- 24/7 online access with NAB Internet Banking and the NAB app

- A convenient NAB Visa Debit card for all your transactions: online, in person, and over the phone

- No ATM fees at NAB ATMs or RediATMs

- Use Visa payWave or Tap and Pay to pay for smaller purchases under $100 – quickly and securely

- Protecting from fraud with NAB Defence

Is NAB’s Classic Checking Right for You?

Of the four big banks in Australia, NAB, the largest bank in Australia, is the only institution that offers no monthly fee without conditions. Therefore, if you are looking for a free option, the Classic Banking Account by NAB is a great option.

Mozo, a website that compares and rates financial products, recently ranked NAB’s Classical Checking as Austalia’s Best Bank Account. NAB was named Winner of Mozo’s Experts Choice Awards for 2016, and Mozo noted that the lack of monthly account fees and full range of advantages, such as a network of branches and ATMs, makes this classic banking option highly appealing and a best value bank account for Australians.

Through our research, we’ve noticed more positive NAB reviews than NAB complaints, solidifying Mozo’s findings.

Bottom Line: The NAB Classic Banking account is a good option for anyone looking to open an everyday bank account that has no fees and flexible access options.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

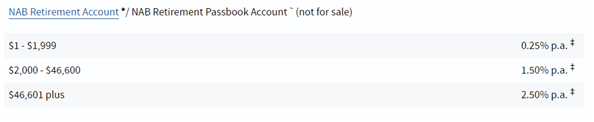

What Is the NAB Retirement Account?

In addition to NAB’s Classic Banking option, there is the option to get more from your money in retirement with NAB’s Retirement Accounts. With NAB’s Retirement Account, you’ll enjoy easy access to your money while earning a competitive interest rate. Those who are over 55 and retired and receiving a government pension or Centrelink payments will receive:

- No monthly NAB fees or overdrawn fees

- 24/7 online access with NAB Internet Banking and the NAB app

- Unlimited access to your money

- Protection against fraud with NAB Defence

- Overdraft protection

- Competitive tiered interest rates:

Image Source: National Australia Bank (NAB)

Interest-Bearing Savings Accounts

In addition to offering personal checking accounts, NAB offers three interest-bearing savings accounts to help you reach your goals sooner: NAB Reward Saver, NAB iSaver, and NAB Cash Manager.

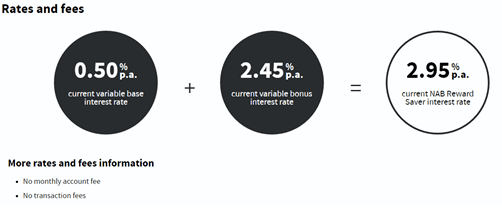

What Is NAB Reward Saver?

NAB Reward Saver is an interest-bearing savings account with no monthly account fee and no transaction fees. With this type of account, you can earn bonus interest if you make at least one deposit and no withdrawals in a given month. You can earn interest on every dollar. In fact, interest is calculated daily and paid monthly.

Here is how NAB Reward Saver’s Rates and NAB fees stack up:

Image Source: National Australia Bank (NAB)

- 0.50% current variable base interest rate

- 2.45% current variable bonus interest rate

- Total of 2.95% NAB Reward Saver interest rate

- NAB Fees: No monthly account fee and no transaction fee

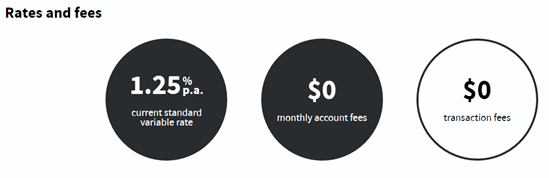

What is NAB iSaver?

You can also opt in for the NAB iSaver account, which also offers no transaction fees and no monthly account fee. The bonus interest rate applies for the first four months on balances up to $1 million.

About NAB fees and rates for NAB iSaver:

Image Source: National Australia Bank (NAB)

- 1.55% current standard variable interest rate

- 0.70% 4 months fixed bonus interest on new account

- Total of 2.25% current NAB iSaver rate on new accounts

You’ll also enjoy access to savings when you need them with unlimited transfers between your NAB iSaver and your linked everyday banking account (NAB Classic Banking) without affecting your interest rank. No minimum deposit or ongoing balance is required for this NAB iSaver account.

Related: Best Savings Accounts for Kids | Ranking & Review

What Is NAB Cash Manager?

According to NAB, the NAB Cash Manager account is ideal for managing your investment cash flow or holding your funds while you wait for the next opportunity. With NAB Cash Manager, you’ll have quick and easy access to your money when you need it. Plus, the interest is calculated daily and paid monthly, so your cash is always working for you.

In order to open an NAB Cash Manager account, you’ll need at least $5,000. Once your account is open, there’s no minimum balance.

About NAB fees and rates for the Cash Manager account:

Image Source: National Australia Bank (NAB)

- 1.25% current standard variable rate applies

- No NAB fees or transaction fees

Loans from NAB

The largest bank in Australia offers a range of consumer loan products, including:

- Home Loans

- Travel Loans

- Wedding Loans

- Home Renovation Loans

- Car Loans

- Debt Consolidation Loans

Home Loans by NAB

NAB offers a variety of home loans to fit consumers’ needs. Many of the NAB complaints we found centered on mortgage servicing: customers experienced poor customer service and claimed being forced to use a broker rather than servicing directly with NAB.

We’ve conducted NAB reviews of some of these products to help you make an informed decision, but make sure to look at reviews from various sources to get the perspective of clients as well.

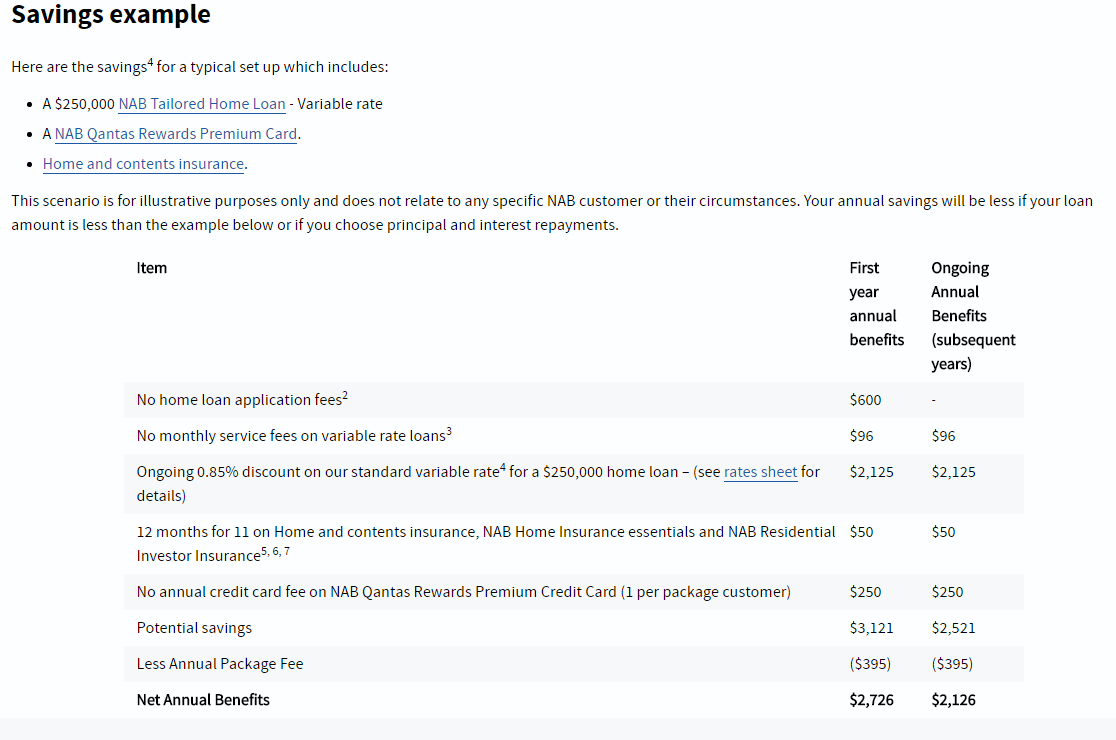

NAB Review: NAB Choice Package

The NAB Choice Package is available to consumers for an annual package fee of $395; however, it offers potential saving benefits of up to $2,726 in your first year. Learn about NAB savings:

Image Source: National Australia Bank (NAB)

Popular Article: Huntington Bank Reviews – What You Need to Know Before Using Huntington Bancshares

With this package, you can get preferential interest rate discounts on home lending products, with no applicant, annual card, or monthly service fees.

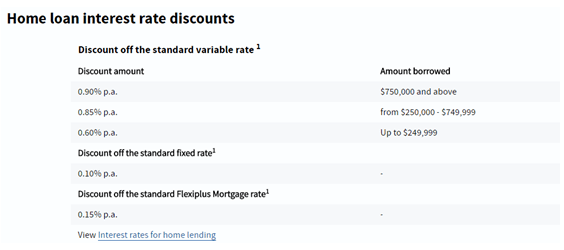

Here we’ve outlines NAB fees and interest rates for the NAB Choice Package:

Image Source: National Australia Bank (NAB)

- 0.85% discount for variable rate home loans from $250,000

- No application or service fees

- No annual credit card fees

Here are the home loan interest rate discounts for your consideration for the NAB Choice Package:

Who is the NAB Choice Package for?

The NAB Choice package is for anyone looking to receive an interest rate discount and extra features. This includes a discount on the standard fixed interest rate in addition to waiving ongoing and application fees. The NAB Choice Package is for investors, refinancers, and first time homebuyers. It cannot be used for construction purposes. If you’re not interested in a fixed rate home loan, you may want to consider the NAB Tailored Home Loan Variable Rate, which we will discuss later on.

NAB Review: NAB Base Variable Rate Home Loan

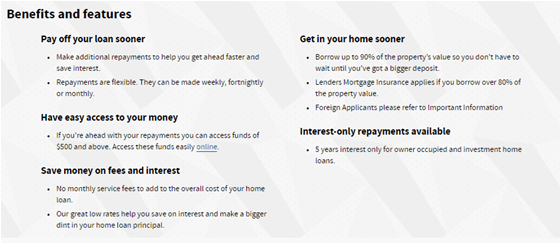

The NAB Base Variable Rate Home Loan boasts that it can “get you into your home sooner with a simpler, low-cost home loan.” The plan is a basic home loan that offers low rates and NAB fees:

Image Source: National Australia Bank (NAB)

The NAB Base Variable Rate Home Loan allows you to borrow up to 90% of the property’s value, so you don’t have to wait until you’ve got a bigger deposit, along with a host of other benefits and features:

Image Source: National Australia Bank (NAB)

Who is the NAB Variable Rate Home Loan for?

This loan is a great option for anyone looking for a low-interest rate and minimal fees. Consumers will also enjoy useful features with the NAB Variable Rate Home Loan. It’s suitable for first time home buyers, owner occupiers, and investors.

Is National Australia Bank Right for Me?

NAB reviews show that the largest bank in Australia is well-known and boasts plenty of service centres, branches, and ATM’s for your convenience. In addition, since there are minimal NAB fees, in fact, it is the only bank in Australia offering a no-fee checking account, it is a great option for those looking to dispel banking fees.

With minimal NAB complaints, happy customers note that they love the bank’s customer service support, interest on savings, large number of ATM’s and no-fee checking accounts.

As with any banking decision, it is important to do your research and find a product with benefits that are unique to your situation. We hope that you found this review to be helpful in your search for the best bank in Australia.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.