Intro – State Employees’ Credit Union Reviews & Ranking

AdvisoryHQ recently published its list and review of the top Credit Union firms in North Carolina a list that included State Employees’ Credit Union.

Below we have highlighted some of the many reasons State Employees’ Credit Union was selected as one of the best banking firms in North Carolina.

Click here for a detailed review of AdvisoryHQ’s selection methodology: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

State Employees’ Credit Union Review

Founded in 1937, State Employees’ Credit Union (SECU) was originally operated part-time from the basement of the Agriculture Building in Raleigh. From those humble beginnings, the credit union has grown to proudly serve more than 2 million customers today and holds over $33 billion in assets.

This Charlotte credit union operates more than 255 banking branch locations throughout North Carolina. With more than 1.8 million members, State Employees’ Credit Union in the largest credit union in North Carolina – by both number of members and size of assets.

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Credit Union Firms

Upon completing our detailed review, State Employees’ Credit Union was included in AdvisoryHQ’s ranking of this year’s best banking firms based on the following factors.

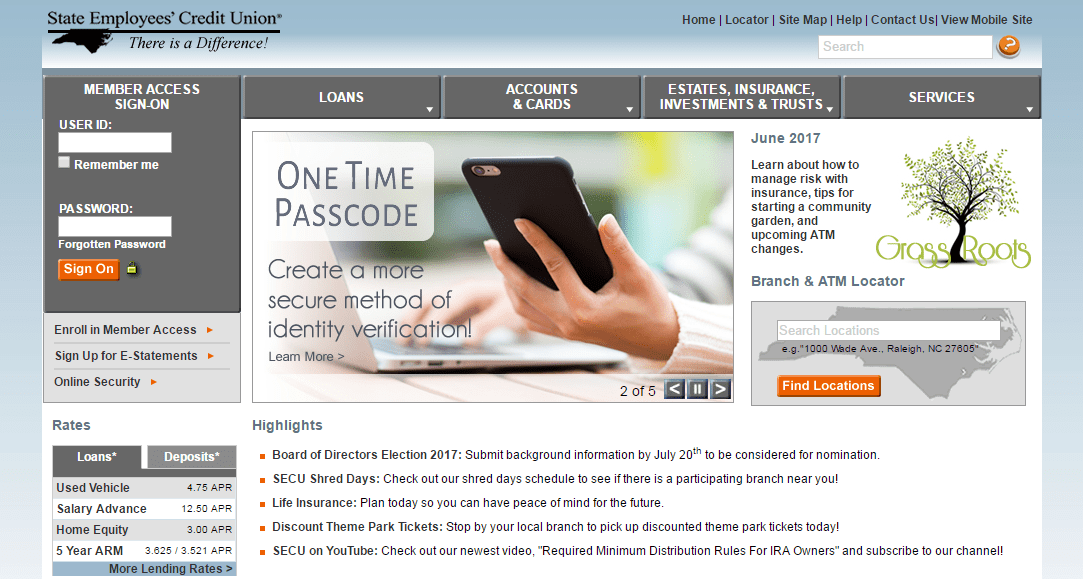

Image Source: State Employees’ Credit Union

Image Source: State Employees’ Credit Union

Related: Top Credit Unions in Jacksonville, Florida

Interest-Bearing Checking

SECU offers an interest-bearing checking account that features a competitive interest rate of 0.25% APY. The account does have a monthly maintenance fee of $1, but it is a fee members can actually feel good about. That’s because at this top credit union in Charlotte, NC, the maintenance fee is automatically donated to the SECU Foundation where it is used to fund community projects in the areas of housing, education, health care, and human services.

Other features of the checking account include:

- No minimum balance requirement

- Dividends compounded daily and credited monthly

- 50 free checks per statement period

- Free bill pay

- Free debit card

High Yield Share Term Certificates

A Share Term Certificate (STC) offers members of this top Charlotte credit union a way to earn a higher rate of interest on their savings. Its STCs offer highly competitive interest rates that are hard to find in a CD at traditional for-profit banks.

As with most share certificates or certificates of deposit, accounts offer a guaranteed rate of return over a specified term. The longer the term, the higher the rate of return.

With a low minimum opening deposit of just $250, it is easy for all members of this best credit union in Charlotte, NC to open an STC account and begin earning.

Current terms and interest rates for STC accounts at this popular credit union in Charlotte are:

- 6-month term: 1.00% APY

- 12-month term: 1.00% APY

- 18-month term: 1.25% APY

- 24-month term: 1.25% APY

- 30-month term: 1.25% APY

- 36-month term: 1.50% APY

- 48-month term: 1.75% APY

- 60-month term: 1.75% APY

This credit union in Charlotte, NC also offers the option of laddered STCs for those members who wish for a more stable flow of interest income. Laddering STCs means opening several STCs with staggered maturity dates over the course of several years so that they regularly mature and renew each year.

Don’t Miss: Top Credit Unions in Sacramento, California

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Special Mortgage Programs

Besides traditional mortgage products, State Employees’ Credit Union also offers several special mortgage programs to assist members in achieving their dream of homeownership. The top Charlotte credit union has partnerships with the North Carolina Housing Finance Agency and Federal Home Loan Bank of Atlanta in order to offer additional programs to assist those members that are first-time homebuyers.

Most of these lending programs are available to members who reside in North Carolina, South Carolina, Virginia, Georgia, and Tennessee.

Special mortgage programs offered by this best credit union in Charlotte are:

- First Time Homebuyer’s Mortgage: designed to help members that are purchasing their first home. Up to 100% financing is available with this program under the 5-year ARM program.

- Manufactured Home Loans: for purchase of a single or double wide manufactured homes. Financing can be accomplished through the 5-year ARM program, 10 or 15-year fixed-rate mortgage program or through the First Time Homebuyers Program.

- Construction-Permanent Mortgage: designed for members building a new home or making a major addition to their existing home. The purchase of land can be folded into the original construction loan.

- Mortgage Credit Certificates: issued through the NC Housing Finance Agency for mortgages used to purchase a home for the first time. A 30% federal tax credit of the mortgage interest payment is provided each year up to $2,000.

- FHLA Grant Program: first-time homebuyers program offered by the Federal Home Loan Bank of Atlanta. Offers members forgivable second mortgages up to $5,000 to assist with down payment and closing costs on the purchase of their first home.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.