Best Tennessee Mortgage Rates for You | Current Mortgage Rates in TN for Good-Best Credit

If you’re in the market to buy a home in Tennessee or refinance an existing Tennessee mortgage, the time to strike is now.

The housing market in Tennessee has kept a strong pace over the past few years, with low mortgage rates keeping home ownership attainable for both Millennials and Baby Boomers, according to The Tennessean.

While the housing market in Nashville is particularly strong, current mortgage rates in TN provide ample opportunities to refinance or buy a home in Memphis, Knoxville, Gatlinburg, Chattanooga, Franklin, Clarksville, or any other city in Tennessee.

Current Mortgage Rates in New Mexico | Best NM Mortgage Rates for Good-Excellent Credit Borrowers

Current Mortgage Rates in Arkansas | Best AR Mortgages for Good-Excellent Credit Borrowers

Which Tennessee City Are You Located in?

When it comes to finding the best Tennessee mortgage rates, there are plenty of factors to consider.

For many Tennessee mortgage lenders in Nashville, Memphis, Knoxville, Chattanooga, Jackson, Clarksville, and other cities, the location of the home will play a large role in what type of Tennessee mortgage rates are available.

This means that homes across the state could have varying Tennessee mortgage rates based on the individual city, neighborhood, and the condition of the home itself.

While you are searching for the best mortgage rates in Tennessee, it may be worthwhile to check the rates for neighboring cities to explore other Tennessee mortgage rates that could potentially be more affordable over the long run.

See the table below for a list of some of the largest cities in the state offering a wide range of Tennessee mortgages.

| Top Tennessee Cities | Population (2016) |

| Nashville | 684,410 |

| Memphis | 652,717 |

| Knoxville | 186,239 |

| Chattanooga | 177,571 |

| Clarksville | 150,287 |

| Murfreesboro | 131,947 |

| Franklin | 74,794 |

| Jackson | 67,005 |

| Johnson City | 66,677 |

| Bartlett | 58,622 |

| Hendersonville | 57,050 |

| Kingsport | 52,806 |

Source: Google

Factors that Influence Tennessee Mortgage Rates

To maintain good financial health, monthly payments on Tennessee mortgages should not be higher than 28 percent of your monthly income, which should include related expenses like principal, interest, taxes, insurance, and even HOA fees.

While the terms of your Tennessee mortgage will play a role in determining monthly costs, the Tennessee mortgage rate will be the biggest factor in whether your monthly payments are affordable.

See the sections below for common elements that can impact mortgage rates in Tennessee.

Credit Score

Just like any other loan, your credit score is used as a benchmark for reliability. If you have a high credit score, Tennessee mortgage lenders see that as proof of reliability, and will offer lower Tennessee mortgage rates as a result.

A low credit score is problematic for lenders, since it raises doubts on whether they can trust borrowers to pay off Tennessee mortgages.

While you are exploring mortgage rates in Tennessee, you should also take the time to look over your credit score with a fine-toothed comb. Look for ways to boost your score through paying off any old debts or resolving errors before committing to TN mortgage rates.

Location

As mentioned above, the location of your home could make a difference in TN mortgage rates, since lenders may have varying rates depending on the neighborhood or city.

There may be differences when purchasing a home in an urban vs. rural area, so make sure that you take note of the location and use a home affordability calculator that allows for that data.

Down Payment

Putting aside more money for a down payment certainly isn’t fun, but it’s a great way to boost your chances of getting a lower Tennessee mortgage rate. According to Bankrate, most lenders require a payment of at least 3 percent.

Although mortgage lenders in Tennessee may allow for lower down payments, the best way to save yourself from additional long-term costs—like mortgage insurance—is to put 20 percent down.

Nashville, TN

Best Refinance & Purchases Loan Rates Today | Lower Interest Rate Payments

Free Personal Finance and Investing Software

Good, Great, or Excellent Credit Score for a Tennessee Home Loan

Most lenders that provide competitive Tennessee mortgage rates use a FICO score to determine if a Tennessee based borrower is creditworthy or not.

FICO scores range anywhere from 300 to 850, with higher numbers seen as the most creditworthy and lower numbers seen as the biggest financial risk.

FICO scores generally fall into these categories:

- 300 – 629 is considered “Bad”

- 630 – 689 is considered “Fair”

- 690 – 719 is considered “Good”

- 720 – 850 is considered “Excellent”

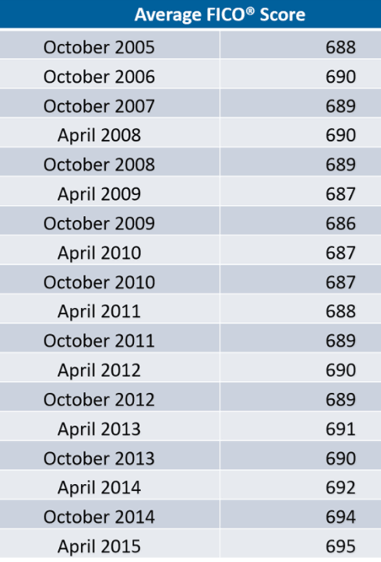

If you’re curious about the average credit score, see the table below for average FICO scores from 2005-2015. According to CNBC, as of this year, the average score is 700.

How Much House Can You Afford Today?

Mortgage Rates & Loans Calculator

Conclusion – Finding a Top Mortgage Loan for a Home in Tennessee

When searching for the best Tennessee mortgage rate for you, there are a few additional pieces of information to keep in mind.

If you have a good, great, or excellent credit history and you are seeking a Tennessee mortgage rate for a loan totaling over $424,100, some lenders may be able to provide different terms than those listed above.

For this reason, it’s important to confirm any Tennessee mortgage rates and terms for specific amounts before making a commitment.

Additionally, it’s also important to keep in mind that the APR and payment info does not include state-specific taxes or required insurance premiums.

As such, you should expect that your monthly Tennessee mortgage payment will be greater when taxes and insurance products are added.

Retirement Calculator Tool | Retirement Income Calculator

Personal Loan Calculator | Calculate Your Loan Payments

Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image sources:

- https://pixabay.com/en/nashville-tennessee-downtown-2290081/

- http://www.fico.com/en/blogs/wp-content/uploads/2015/08/April-2015-Average-FICO-Score.png

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.