2017 RANKING & REVIEWS

TOP RANKING BEST BANKS IN TENNESSEE

Intro: Finding the Top Banks in Tennessee, U.S.

According to the Federal Deposit Insurance Corporation (FDIC) there are 157 active FDIC-insured banks operating in the State of Tennessee.

Our comprehensive list of the 20 best banks in Tennessee represents the top institutions in the state and includes banks in Memphis, TN, banks in Nashville, TN, banks in Knoxville TN, and banks in Chattanooga, TN, as well as in other areas statewide.

Award Emblem: Top 20 Best Banks in Tennessee

Financial institutions on our best banks in Tennessee list represent both smaller farming communities as well as large metropolitan areas; some banks have a very local focus while others have a statewide or multi-state market footprint.

They have all exceled at providing quality financial services to their communities and possess stable company financials.

To become a best bank in Tennessee, these organizations scored highly on AdvisoryHQ’s proprietary methodology, which recognizes several financial and business factors to compile the final list of top Tennessee banks.

AdvisoryHQ’s List of the Top 20 Best Banks in Tennessee

List is sorted alphabetically (click any of the bank names below to go directly to the detailed review section for that bank in Tennessee):

- Atlantic Capital Bank

- BancorpSouth Bank

- Bank of America

- Bank of Tennessee

- Branch Banking and Trust Company

- Capital Bank Corporation

- CB&S Bank, Inc.

- Citizens Bank

- Citizens Bank of Lafayette

- Fifth Third Bank

- First Tennessee Bank

- First Volunteer Bank

- FirstBank

- Home Federal Bank of Tennessee

- Pinnacle Bank

- Regions Bank

- Simmons First National Bank

- SunTrust Bank

- U.S. Bank

- Wilson Bank & Trust

Click here for 2016’s ranking of the Top 20 Best Banks in Tennessee

Top 20 Best Banks in Tennessee | Brief Comparison & Ranking

Best Banks in Tennessee | Highlighted Features |

| Atlantic Capital Bank | Comprehensive private banking services |

| BancorpSouth Bank | Financial Answer Center |

| Bank of America | Keep the Change Savings Program |

| Bank of Tennessee | Dynamic business online banking tools |

| Branch Banking and Trust Company | Varied lending options |

| Capital Bank Corporation | Strong focus on supporting low-income communities & households |

| CB&S Bank, Inc. | Business & commercial lending products |

| Citizens Bank | Multiple overdraft options |

| Citizens Bank of Lafayette | Commitment to supporting financial literacy |

| Fifth Third Bank | Comprehensive identity protection solutions |

| First Tennessee Bank | Skilled Private Client services |

| First Volunteer Bank | Dedication to participating in community events & fundraisers |

| FirstBank | Dynamic online banking tools |

| Home Federal Bank of Tennessee | Wide selection of commercial lending products |

| Pinnacle Bank | Provides volunteer & financial assistance towards constructing Habitat for Humanity homes in the local community |

| Regions Bank | Money management & savings tools |

| Simmons First National Bank | Foreign currency delivery & card services |

| SunTrust Bank | Balanced banking helps account holders manage their money effectively |

| U.S. Bank | Powerful online investing tools |

| Wilson Bank & Trust | Six free checking account options |

Table: Top 20 Best Banks in Tennessee | Above list is sorted alphabetically

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review—Top Ranking Best Banks in Tennessee

Below, please find a detailed review of each bank on our list of top banks in Tennessee. We have highlighted some of the factors that allowed these Tennessee banks to score so high in our selection ranking.

See Also: Best Banks to Bank With | Review | Best Banks in America for Businesses, Students, Online Banking, Free Checking, etc.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Atlantic Capital Bank Review

Atlantic Capital Bank was founded in 2007 through the then-largest equity capital issuance in U.S. history by a stand-alone bank holding company.

Prior to its 2015 merger with Chattanooga’s First Security Group, this top 20 best bank in Tennessee had grown to $1.3 billion in assets.

After the merger, the combined company, operating as Atlantic Capital Bank and headquartered in Atlanta, Georgia, reported total assets of $2.8 billion.

As one of the top banks in Chattanooga, TN, Atlantic Capital Bank currently has 16 branches throughout the state.

This Tennesee bank has expertise assisting small- and mid‐size companies and non-profit organizations, as well as institutional commercial real estate developers and investors.

This best bank in Tennessee also provides retail and small-business banking services, trust and investment management, mortgage banking, financial planning, and internet banking.

Key Factors That Enabled This Bank to Rank as One of the Top Banks in Tennessee

Below are key factors that enabled Atlantic Capital Bank to be rated as one of this year’s best banks in Tennessee and one of the top banks in Chattanooga, TN.

Private Banking

Atlantic Capital Bank, as one of the best banks in Tennessee, offers private banking clients numerous services and strives to “provide excellent solutions and advice, respond quickly, be proactive, and always put clients first.”

Wealth management clients and business owners will find a wide breadth of services tailored to their needs, including:

Trust Services

When it comes to wealth management, it is not only about building wealth, but also about ensuring the right financial planning is in place when the time comes to transfer your wealth to loved ones.

Atlantic Bank’s services, provided through Southeastern Trust Company’s trust and estate services, helps to ensure smooth transitions by financial planning for wealth transfer to reduce stress during the hardest times.

Medical Banking

This Tennessee bank offers personalized service, expert advice, and innovative banking solutions to help physicians, their partners, and their practices prosper.

Atlantic can also assist medical clients in gaining access to the financing, cash management, and other banking services they need to succeed in today’s market.

Legal Banking

The legal banking group at Atlantic Capital Bank is designed to meet the specialized retail and business banking needs of attorneys and their legal practices.

Atlantic takes a personalized approach to help clients meet specific needs and gain access to the correct financial resources.

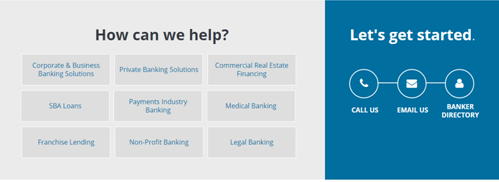

Image Source: Atlantic Capital Bank

Corporate, Business, and Non-Profit Banking

Atlantic Capital Bank is among the Tennessee banks with a wide range of banking services dedicated specifically to supporting small- and mid-sized businesses in addition to larger companies.

Professional business and corporate banking managers at Atlantic help clients in specialized company needs like fulfilling capital, cash flow, and growth objectives. Some examples of business products and services are shown below:

Franchise Lending

The Franchise Lending Group provides customized lending programs to franchises and customers of industry-leading franchise concepts and distribution companies.

Atlantic Capital associates collaborate with franchisors and distribution companies to tailor financing programs that will directly benefit the client, and associates aim to assist with other strategies including acquisition financing, ownership/partnership transfers, and equipment, real estate, and working capital financing.

Non-Profit Banking

The Non-Profit Banking Group specializes in serving the unique financial needs of local, regional, and national organizations.

Recognizing that non-profits operate differently than for-profit companies, this Tennessee bank can customize underwriting and treasury services to meet the unique needs of the client.

Atlantic Capital serves many types of non-profit organizations including schools and universities, religious organizations, art and cultural institutions, social service organizations, and membership organizations.

Don’t Miss: Best Banks in Texas | Ranking | Best Texas Banks in Austin, Dallas, and Houston

BancorpSouth Bank Review

BancorpSouth Bank began operations in 1877 in Verona, Mississippi. What started as a single-office mercantile bank established by the Raymond Trice Company in 1886, evolved into the Bank of Lee County.

As this best bank in Tennessee grew, other name changes followed to reflect the bank’s new and expanding territory. After becoming the Bank of Tupelo, the company shifted to the Bank of Mississippi in 1966.

In 1997, Bank of Mississippi officially changed its name to BancorpSouth, signaling an intention to expand to surrounding states.

Acquisitions and mergers followed, and in 2004, this member of the top 20 best Tennessee banks completed its entry into the Tennessee market by merging with Premier Bank of Brentwood, Tennessee.

Key Factors That Enabled This Bank to Rank as One of the Top Banks in Tennessee

Below are key factors that enabled BancorpSouth to be rated as one of this year’s best banks in Tennessee and top banks in Memphis, TN.

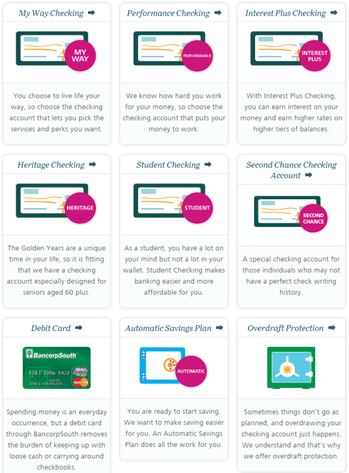

Checking Services

BancorpSouth has the deposit products and customer service that consumers expect and deserve.

This best bank in Tennessee offers a variety of checking product options that include standard checking, premium-interest accounts, and student accounts.

BancorpSouth also offers a second-chance account for those who may have had accounts in the past, but need a second chance on using a bank.

Image Source: BancorpSouth Bank

BancorpSouth Financial Answer Center

The name says it all. The bank provides a wealth of information, learning tools, and resources for consumers and businesses through its Financial Answer Center.

The content is rich, and there are numerous topics to choose from—all at no cost to anyone with an internet connection. BancorpSouth’s answer center includes information on:

- Paying for college

- Getting ready for retirement

- Buying insurance

- Benefits at work

- Cash and debt management

- Investing and investments

- Buying and selling a home

- Running your business

- Major life events

- Planning estates

- Career transition

- Staying safe online

- Avoiding identity theft

Small-Business Merchant Solutions

Through a venture with FirstData, Bancorp is able to offer its customers a complete small-business merchant-services solution.

The products provided through this program allow merchants to utilize the latest technology and better understand their business information. These options include:

- In-store solutions: Improve cash flow by linking a business checking account directly to a sales system.

- Online solutions: Make goods and services accessible to more customers with fast and secure online payment solutions.

- Mobile solutions: Accept payments quickly, easily, and securely on Android®, iPhone®, or iPad® with affordable mobile solutions.

Related: Best Banks in Florida | Ranking | Best Florida Banks in Jacksonville, Orlando, Miami, & Tampa

Bank of Tennessee Review

Bank of Tennessee began operations in 1973. This best bank in Tennessee operates 21 full-service offices throughout Central and Eastern Tennessee, as well as 1 office in Western North Carolina.

Banking markets include the Johnson City and Nashville metropolitan areas, making this Tennessee bank into one of the top banks in Nashville, TN.

Offering a wide variety of loan products, Bank of Tennessee is prepared to meet its clients’ needs, with services and products including mortgage, construction, commercial, agricultural, home equity, credit cards, vehicle, and other personal loans to meet local area credit needs.

This Tennessee bank also provides a variety of deposit services including checking, savings, and time deposits. Other account products and services include safe deposit boxes and e-statements as well as investment advisory services.

Image Source: Top Banks in Tennessee

Key Factors That Enabled This Bank to Rank as One of the Top Banks in Tennessee

Below are key factors that enabled Bank of Tennessee to be rated as one of this year’s best banks in Tennessee and top banks in Nashville, TN.

Treasury Management

Bank of Tennessee offers a responsive set of treasury management services that are specialized for small- and mid-sized companies. Receivables, disbursements, sweep products, and lockbox services are just a few of the services available.

Business Online Banking

Bank of Tennessee’s business online banking is an effective tool to help customers stay on top of their business’s needs.

With timeliness more critical than ever, this best bank in Tennessee has created an online experience made keep the customer moving and keep track of finances immediately wherever they go.

With functionality specifically designed for the business owner, this service enables customers to:

- Access critical checking and savings account as well as detailed transaction information online

- Access time-sensitive information

- Access transaction origination modules to initiate ACH items, wire transfers, account transfers, and stop payments

- Access online images of paper items that have posted to accounts

- Review Positive Pay exception items and submit disposition instructions

- Compatible with accounting software, such as QuickBooks and Microsoft Money

- Exporting features available to help with reporting

Loans Supporting Lower-Income Communities

Bank of Tennessee provides financing to home buyers and small businesses. In addition, it provides, to these groups, a significant portion of consumer and business lending resources, specifically in support of lower-income consumers and communities.

Below is information from the FDIC on Bank of Tennessee loans that directly impacted lower-income neighborhoods.

Home Mortgage Loans:

- 2013: 407 loans totaling $65,493,000

- 2014: 566 loans totaling $97,003,000

- 2015: 277 loans totaling $42,471,000 (YTD January–September)

Small Business Loans:

- 2013: 379 loans totaling $80,125,000

- 2014: 478 loans totaling $56,458,000

- 2015: 476 loans totaling $109,489,000 (YTD January-September)

Small Farm Loans:

- 2013: 6 loans totaling $907,000

- 2014: 1 loan totaling $250,000

- 2015: 5 loans totaling $1,970,000

Popular Article: Top Banks in Pennsylvania | Ranking | Best Banks in Pennsylvania, Philadelphia, Pittsburgh, etc.

Citizens Bank of Lafayette Review

Citizens Bank of Lafayette first opened for business in 1909. Headquartered in Lafayette, Tennessee (about 70 miles northeast of Nashville), this member of the top Tennessee banks operates in the Central Tennessee region in areas such as Bedford, Clay, Coffee, DeKalb, Franklin, Jackson, Macon, Smith, Sumner, and Wilson counties.

The bank is fully owned by Citizens Bancorp Investment, Inc., a one-bank holding company also headquartered in Lafayette, Tennessee.

The holding company also owns Town and Country Finance Company, Citizens Insurance Services, and Liberty Insurance Company.

Over time, numerous mergers and acquisitions have helped to form the organization that exists today, and the company has maintained personal connections with both its old markets as well as the new ones it has entered.

Below are details of Citizens Bank’s most recent acquisitions:

- In 2013, Citizens Bancorp bought out the remaining Liberty stock and merged into Citizens Bank, adding five branches in DeKalb and Wilson counties in Tennessee.

- In 2015, Citizens Bancorp acquired Traders Bank’s holding company, and merged it into Citizens Bank. Traders Bank still operates under its historic name, but now has branch locations in Tullahoma, Shelbyville, Winchester, and Manchester, Tennessee.

Key Factors That Enabled This Bank to Rank as One of the Top Banks in Tennessee

Below are key factors that enabled Citizens Bank of Lafayette to be rated as one of this year’s best banks in Tennessee.

Literacy in Financial Education

Citizens Bank of Lafayette has partnered with EverFi to sponsor local area high schools with the new LiFE Program.

This financial literacy program is a new learning platform that uses the latest technology, video, animations, 3-D gaming, avatars, and social networking to bring complex financial concepts to life for today’s digital generation to enable their understanding of these important concepts.

According to Citizens Bank of Lafayette’s website, “Since 2013, students have completed over 7,800 modules and spent over 5,000 hours learning critical Personal Finance skills through the Citizens Bank LiFE Program (as of January 2015).”

EverFi topics covered include:

- Credit scores and reports

- Insurance

- Credit cards and pitfalls

- Taxes

- Investing

- Savings

- 401(K)s and retirement

- Mortgages and loans

Support for Agriculture

Agriculture has long been a thriving segment in this best bank in Tennessee’s market area. Citizens Bank of Lafayette is an active lender and financial assister in land purchase and crop production, as well as in equipment and livestock acquisition.

Consistent with the small-business needs and nature of the farming business, the bank offers borrowers the option of monthly payments or seasonal payments.

According to the FDIC, Citizens Bank of Lafayette displayed “excellent performance” in its provision of small-farm loans within the communities where this best bank in Tennessee operates.

In 2013, the bank originated 210 qualified small-farm loans, totaling $7,894,000. The FDIC ranked Citizens of Lafayette first in terms of percent of total small-farm loans in its market.

With 13 reporting financial institutions, Citizens Bank of Lafayette had originated 62.5% of all small-farm loans in 2013 across all banks, with 65.8% of the loan dollar volume.

To browse exclusive reviews of all top rated banks in Tennessee, please click on any of the links below:

- Atlantic Capital Bank

- BancorpSouth Bank

- Bank of America

- Bank of Tennessee

- Branch Banking and Trust Company

- Capital Bank Corporation

- CB&S Bank, Inc.

- Citizens Bank

- Citizens Bank of Lafayette

- Fifth Third Bank

- First Tennessee Bank

- First Volunteer Bank

- FirstBank

- Home Federal Bank of Tennessee

- Pinnacle Bank

- Regions Bank

- Simmons First National Bank

- SunTrust Bank

- U.S. Bank

- Wilson Bank & Trust

Conclusion: Top 20 Best Banks in Tennessee

We hope that by providing you with a list of banks that objectively rose to the top of our analysis of the best banks in Tennessee, we have given you the information and resources that lead to a solid starting point for your own research and analysis.

Our final list of top Tennessee banks offers a variety of institutions and product sets, as well as different approaches to customer service and community involvement. Each possesses a stable financial history and a forward-looking approach to banking in the new millennium.

At AdvisoryHQ, we want to help make your financial journey just a little bit easier, whether you’re looking for banks in Memphis, TN, banks in Nashville, TN, or anywhere throughout the state.

Recognizing the importance of financial well-being and selecting a bank that delivers is more than just a brand choice—it is a matter of planning your future and your family’s future.

We recommend you ask the hard questions before you make the commitment to any bank, even one of our top 20 best banks in Tennessee.

Think about where the branches and ATMs are located for each Tennessee bank, and take the time to consider which banking products will fit your needs, both current and future.

By taking a close look at the features, locations, values, and community involvement for bank in Tennessee, you will be one step closer to finding the best Tennessee bank for your needs.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.