2017 RANKING & REVIEWS

TOP RANKING CREDIT UNIONS IN SAN FRANCISCO

Finding the Top Credit Unions in San Francisco, CA

Do you live or work in the San Francisco area? If so, how much money are you paying each month in fees with a San Francisco credit union or bank? Could you be saving a substantial amount of money by reducing those transaction fees?

What about interest yields? Are you earning interest with your San Francisco credit union that are competitive in both your checking and savings accounts?

All of these are essential questions to ask when you’re considering the best credit unions in San Francisco to use and whether or not it’s time to move to another San Francisco credit union.

Award Emblem: Top 8 Best Credit Unions in San Francisco, CA

With literally hundreds of credit unions in the San Francisco Bay Area, it can seem like all San Francisco credit unions are pretty much the same, but the differences can be astounding.

The best credit unions in San Francisco that we selected to be included on our list of the “Top 8 San Francisco Credit Unions” have something very unique in common – decades (if not a century or more!) of experience offering competitive rates and services to their members.

AdvisoryHQ’s List of the Top 8 Best Credit Unions in San Francisco CA

- McKesson Employees Federal Credit Union

- Navy Federal Credit Union

- Northeast Community Federal Credit Union

- Patelco Credit Union

- San Francisco Bay Area Educators Credit Union

- San Francisco Federal Credit Union

- SF Fire Credit Union

- SF Police Credit Union

List is sorted alphabetically (click any of the names above to go directly to the detailed review section for that advisor)

Top 8 Credit Unions in San Francisco

Bank | Location |

| McKesson Employees Federal Credit Union | San Francisco |

| Navy Federal Credit Union | San Francisco |

| Northeast Community Federal Credit Union (NECFCU) | San Francisco |

| Patelco Credit Union | San Francisco |

| San Francisco Bay Area Educators CU | San Francisco |

| San Francisco Federal Credit Union | San Francisco |

| SF Fire Credit Union | San Francisco |

| SF Police Credit Union | San Francisco |

Table: Best Credit Unions in San Francisco | Above list is sorted alphabetically

Methodology for Selecting Credit Unions in San Francisco, CA

What methodology did we use in selecting this list of best credit unions in San Francisco?

Using publicly available sources, AdvisoryHQ identified a wide range of credit unions that provide services in San Francisco and the surrounding areas.

We then applied AdvisoryHQ’s “Breakthrough Selection Methodology” to identify the final list of top credit unions in San Francisco that provide services to communities in and around the San Francisco Bay Area.

Click here for a detailed review of our methodology: Methodology for Ranking Top Banks and Credit Unions in the U.S.

Detailed Review – Top Ranking Credit Unions in San Francisco

Below, please find the detailed review of each firm on our list of top credit unions in San Francisco. We have highlighted some of the factors that allowed these San Francisco credit unions to score so high in our selection ranking.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

McKesson Employees Federal Credit Union Review

McKesson Employees Federal Credit Union began as a credit union to serve dairy employees. Over time, the credit union has seen many changes to its name and location. Membership is currently open to employees of McKesson Corporation or DS Waters, LP or any of its subsidiaries in the U.S. or family members of an existing member. Once a person becomes a member, he/she will always be able to keep an account balance so long as the minimum account balance is maintained.

Key Factors That Enabled This Credit Union to Rank as One of the Best Credit Unions in San Francisco

Below are key factors that enabled McKesson Employees Federal Credit Union to rank as a top credit union in San Francisco.

Image Source: McKesson Employees Federal Credit Union

Savings Account

As displayed on its website as of June 2016, a regular Share (savings) account may be opened by eligible persons with a $25 minimum deposit amount. The account earns dividends. Speak to a McKesson Employees Federal Credit Union to understand the details on the dividends rates and requirements.

Checking Account

Checking accounts may be opened with no minimum deposit and have no monthly service charges. Dividends are paid on the average daily balance for the quarter (as of June 2016).

Some benefits of a checking account include a debit card, online banking, and online bill pay. Overdraft protection may also be activated by opting to link a regular share (savings) account and/or an approved line of credit. Check with a McKesson Employees Federal Credit Union representative to learn all of the details regarding overdraft protection.

Additional Accounts:

Additional accounts available at McKesson EFCU include special purpose “club” accounts (for special purpose savings). Members may open as many club accounts as needed, and fees will apply for each newly opened account.

IRA accounts and certificate accounts are available as well.

Loans

There are several loans available for members to apply for at McKesson Employees Federal Credit Union. Such loans include:

- Auto loans

- RV, boat, and motorcycle loans

- Line of credit

- Home equity

- First mortgages

Credit Cards

Members may apply for a Visa credit card. The Visa Classic card and Visa Gold card are available as of June 2016. Check out the organization’s webpage to learn more about the details of these cards.

To view the schedule of fees for all accounts, click here.

Mobile App

McKesson Educators FCU has both an iPhone and Android mobile app. The apps allow members to conveniently access accounts from a mobile device.

Before opening an account, be sure to check the McKesson Employees Federal Credit Union website and to contact a credit union representative to make certain that you are fully aware of all membership requirements, fees, terms, conditions, and benefits.

Navy Federal Credit Union Review

Navy Federal Credit Union was founded in 1933 with seven members and has grown to over 6 million members. Membership is open to active duty members of the army, marine corps, navy, air force and coast guard, army and air national guard, delayed entry program, DoD officer candidate or ROTC, DoD reservists, retirees and annuitants, DoD civilian employees, U.S. government employees assigned to DoD installation, DoD contractors assigned to U.S. government installations, and DoD civilian retirees and annuitants.

Immediate family members of current member or individuals who are eligible to join are also eligible for membership. Regardless if you retire from the military, move or get married, once a member always a member!

In the first quarter of 2016, Navy Federal Credit Union had $75, 233, 818 in assets and 6, 103, 507 members. It also had $54,731,202 in outstanding loans.

Since 1933, when Navy Federal Credit Union first opened its doors, it has focused on serving the needs of customers and staying true to its vision statement: “Be the most preferred and trusted financial institution serving the military and their families.”

Key Factors That Enabled This Credit Union to Rank as a Top Credit Union in San Francisco

Below are key factors that enabled Navy Federal Credit Union to rank as one of the top 2016 credit unions in the San Francisco Bay Area.

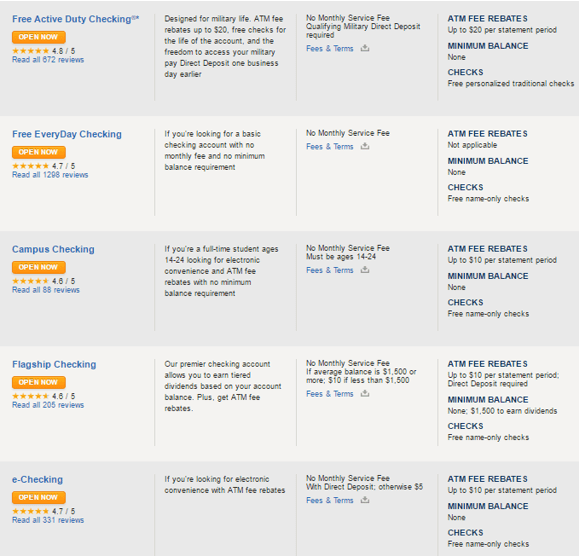

Checking Accounts

Several checking accounts with varied benefits and terms are available at Navy Federal Credit Union. Such accounts include:

Image Source: Navy Federal Credit Union

Each of these accounts is designed for different purposes and needs. Check out the webpage or contact a Navy Federal Credit Union representative to learn more about the accounts.

All of the accounts above offer the following services:

- Checks

- Debit cards

- Bill pay

- Direct deposits

- Online statements

- Mobile checking deposits

- Online banking

- Accounts earn dividends

- ATM access

Savings Accounts

Navy Federal Credit Union has savings accounts to meet your various needs. When you become a member of this credit union, you automatically have access to the Basic Savings account, which has competitive rates and no monthly service charge. Other savings accounts that are offered include the Education Savings, the SaveFirst Account, and the Estate Management account.

Whether you simply want a basic savings account or to save for college, a vacation or start a trust account, Navy Federal Credit Unions has an account to suit your needs. It also offers money market accounts, IRAs, and certificate accounts.

Credit Cards

A number of credit cards are available to apply for at this credit union. As of June 2016, it has both MasterCard and Visa credit cards listed on its website.

All credit cards have no balance transfer fees, no cash advance fees, no foreign transaction fees, and all but one credit card, the Visa Signature Flagship Rewards card, have no annual fees. The credit cards offered by this credit union include:

All credit cards with Navy Federal Credit Union include easy payment options, chip technology, no balance transfer fees, 24-hour online Account Access, protection from unauthorized purchases, and credit card fraud. Along with these great features, you are also given the choice of three different optional Payment Protection Plans.

Online and Mobile Banking

Online banking is available to account holders at Navy Federal. Online banking offers members services, such as 24-hour account access and funds transfers as well as the ability to order checks, view up to 36 months of statements, pay bills, apply for loans, scan deposits, open new accounts, enroll in direct deposit, and more.

Convenient mobile banking is also provided to Navy Federal members. A mobile app is available for Apple, Android, and Kindle Fire devices. With mobile banking, members can manage accounts, view balances and transcripts, make funds transfers, use bill pay, and make mobile deposits. Mobile deposits are done by taking a photo of the check and submitting through the app.

Text banking is also offered. This allows members to receive account alerts via text messages when accounts are low, payments are due or deposits have posted. Members who have activated the service may also text commands to a designated number and receive information about accounts, such as transaction history or account balances.

Loans

Members may also apply for loans at Navy Federal. Such loans include:

- Mortgages

- Equity

- Student loans

- Auto loans

- Motorcycle, boat or collateral

- Personal loans

Additional Services

This credit union also offers business services, investment services, and insurance products.

Before opening an account, be sure to check the Navy Federal Credit Union website and to contact a credit union representative to make certain that you are fully aware of all membership requirements, fees, terms, conditions, and benefits.

Northeast Community Federal Credit Union Review

Northeast Community Federal Credit Union became a self-sufficient institution in 1988 and is a credit union in the bay area. Due to achieving self-sufficiency, this credit union had the ability to develop and expand its initiatives for community economic development, which addressed the credit needs of members wanting to start and cultivate small businesses.

The areas it focused on were printing, graphic design, import-export, general construction, and a variety of other retail businesses. Due to this, NECFCU considers itself to be a “national pioneer in the making of microenterprise loans to small businesses ignored by mainstream financial institutions.”

Membership is open to individuals who live in San Francisco, work within the field of membership or have appropriately associated ties. Such ties may include volunteers, receiver of services, a person who has household members or relatives that are already members or is a contributor or supporter of a nonprofit or church.

Image Source: Top Credit Unions in San Francisco

Key Factors That Enabled This Credit Union to Rank as a Top Credit Union in San Francisco

Below are key factors that enabled Northeast Community Federal Credit Union to rank as one of this year’s top credit unions in San Francisco.

Northeast Community Federal Credit Union Snapshot

This credit union was formed in 1981 and became self-sufficient in 1988. On its website, it explains that it mostly serves the Chinatown, Tenderloin, and SOMA neighborhoods of San Francisco.

Northeast Community CU has been recognized by the Department of the Treasury Community Development Financial Institution for the high impact it’s had on the communities it serves.

Product Development

Initially, NECFCU received its financial support from a Community Services Agency grant. In the beginning, its operations were solely supported by volunteers. Due to the grant and support of volunteers, this credit union was able to grow to $250,000 in assets in a years’ time. NECFCU began making loans, including those made to small businesses in 1983.

Accounts

A savings account may be opened by eligible persons with a $25 minimum deposit. Dividends are paid on accounts with a balance of $500 or more (as of June 2016).

Checking accounts are available as well, with a $25 minimum deposit. The credit union also offers a business checking account with a minimum deposit of $100.

These fees were available on Northeast Community Federal Credit Union’s website as of June 2016.

Loans

Several loans are available for members to apply for at this credit union. Such loans include:

- Secured personal loans

- Unsecured personal loans

- Bank on San Francisco PayDay Advance Loan

- Grace loan

- Tax refund loan

- Special occasion

- Auto loan

- Home mortgages

- Home improvement

- Small business

Contact Northeast Community Federal Credit Union to learn more about its loans.

Membership Stories

Northeast Community Federal CU has posted some membership stories on its website. You can find the stories of several business owners that have utilized loans from Northeast Community online.

The credit union has also posted stories from members that have utilized grace loans, personal loans, and savings accounts. Also available are stories about members who have worked to rebuild credit through membership with the credit union.

Before opening an account, be sure to check the Northeast Community Federal Credit Union website and to contact a credit union representative to be sure that you are fully aware of all membership requirements, fees, terms, conditions, and benefits.

To browse exclusive reviews of all top rated credit unions in San Francisco, please click on any of the links below.

- McKesson Employees Federal Credit Union

- Navy Federal Credit Union

- Northeast Community Federal Credit Union

- Patelco Credit Union

- San Francisco Bay Area Educators Credit Union

- San Francisco Federal Credit Union

- SF Fire Credit Union

- SF Police Credit Union

Free Wealth & Finance Software - Get Yours Now ►

Conclusion – Top 8 Best Credit Unions in San Francisco

Hopefully, this article has served as an educational tool to help you learn more about the top ranked credit unions in San Francisco and what these institutions offer their members. You may dive even deeper and contact the institutions to learn more about specific interest rates and account fees and benefits.

Since individual San Francisco credit unions each have different rules for membership eligibility, anyone researching credit unions will likely want to start with reviewing membership. If you aren’t eligible for membership, there really isn’t any point in continuing to research that particular credit union as you ultimately won’t be able to open an account with that institution.

After you’ve determined that you are eligible for membership at a San Francisco credit union, you can then look into the additional services that it offers. Everyone has different needs and concerns when choosing an institution to bank with, so the best organization for you depends on what services you are looking for.

Be sure to conduct your own research in order to sort out which of these credit unions in San Francisco offers what you’re looking for. The services, prices, and other information regarding these credit unions were available on their websites as of the posting of this article. To be sure that the information has not changed, you can review the websites yourself or contact a credit union representative.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.