Intro: Digit Savings App

Having a healthy savings account is an important piece of financial health. Putting money towards savings can bolster financial stability and lessen financial stress from life events like repairing your car, purchasing a home, and making debt payments.

With the right amount of discipline, your savings account can even be a place to set aside money for fun events, like a rainy day or an opportunity to travel the world.

Of course, the biggest challenge when establishing a saving account is figuring out where to begin. Luckily, the best money saving apps make it easy to put away small amounts of money to let your savings grow over time.

One such money saving app is Digit, an automatic savings app that seeks to make saving into a painless and effortless process.

In this Digit savings review, we’ll take a close look at the Digit app to answer the following consumer questions:

- What is Digit?

- How does Digit work?

- Is Digit safe?

- Is a Digit savings account worth it?

If you’re looking for the best money saving apps to use this year, stay tuned. Our Digit savings review will tell you everything that you need to know about the Digit app.

See Also: Best Financial Apps | Financial Planning Software Reviews

Digit Savings Review | What is Digit?

Founded in 2013, Digit is a California-based startup that is poised to become one of the best money saving apps.

The Digit money saving app was created to bridge the gap between consumers and their money, improving financial habits through an automatic money saving app.

Rather than consciously setting aside savings each month, the Digit app is continuously working in the background, combining expert saving strategies from both behavioral psychology and technology.

Since its inception, the Digit app has attracted a wide amount of publicity from financial experts, with featured Digit reviews in Forbes, Fortune, and Fast Company, among others.

With over $36 million in funding and over half a billion in savings from users, this automatic savings app is well on its way to becoming one of the top apps to save money.

Don’t Miss: Acorns vs. Robinhood – Stock & Trading Review (Safety & Fees)

Digit Savings Review | How Does Digit Work?

The basic goal of the Digit savings app is simple. After your checking account is connected, the automatic savings app will analyze your income and your spending habits to choose what amount of money to transfer.

After your bank account is linked, the Digit app will transfer small increments into a separate Digit savings account. It only transfers dollar amounts that you won’t miss, making it easy for even the most budget-challenged of users to establish a savings account.

The Digit app is available free of charge for the first 100 days, and will cost users $2.99 each month to use afterwards.

Our Digit savings review found a few other notable aspects of how this automatic savings app works, listed below.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Personalized, Incremental Savings

Perhaps the biggest draw to the Digit app is a keen focus on providing a personalized savings system.

Instead of choosing an arbitrary amount to save each week, the Digit savings algorithm considers each user’s unique financial situation—including daily expenses and bills—to choose the best savings amount.

According to the Digit Help Center,

For your Rainy Day Fund, most folks see 2-3 savings transfers per week on average. The average savings transfer is $18 but is typically between $5-$30…the minimum Digit will ever save is $0.05 and the maximum is $150 (extremely rare).

Depending on your unique financial goals, income, and outgoing bills, these numbers can vary.

Related: Best Business Management Software | Ranking & Reviews

Transfers & Withdrawals

One benefit of using the Digit app is that there are unlimited transfers and unlimited withdrawals, encouraging regular use of a Digit savings account.

Withdrawals from your Digit savings account typically take 1 business day, though this can vary depending on the time of day that the transfer request is received.

The is also no minimum balance requirement for Digit savings, making this one of the best apps to save money for newbies to consider.

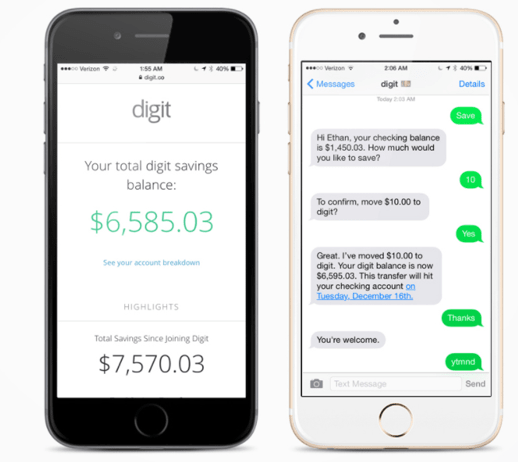

Text-Based System

This money saving app relies heavily on text notifications, and comes with a comprehensive list of text commands for users to manage their account.

In fact, all Digit app features are accessible through these text-based commands, which is great for users that don’t want to use up their data or keep logging in and out of apps.

Using a text-based system means that all aspects of the automatic savings app are available 24/7, making Digit one of the best money saving apps for users that want convenient, reliable access.

Save for Goals & Bills

Digit savings can be divided between goals (like a rainy day fund or a vacation) and bills (like a car payment or electric bill).

Users can create and monitor their separate savings accounts through the new Goalmoji feature—assign an emoji of choice to a goal and text Digit with that emoji for an update on the savings balance.

The Goalmoji feature can be used to add, withdraw, change, or cancel your savings account, making it easy—and fun—to manage savings through your phone.

Savings Bonus

Every three months, the Digit savings app generates a Savings Bonus, based on 1 percent of your average daily balance.

This 1 percent bonus is an annual percentage, meaning that each quarterly payment will be 0.25 percent.

Popular Article: Best Small Business Accounting Software | Ranking | Online and Business Accounting Tools

Digit Savings Review | Is Digit Safe?

The best money saving apps should come with high security and safety features to ensure users that their savings are safe.

Those wondering, “Is Digit safe?” can rest assured that yes, Digit is safe to use. Any funds held within the money saving app are FDIC insured up to $250,000, meaning that users won’t have to worry about their funds disappearing.

What about the Digit money saving app? Is it safe to use?

Our Digit savings review found that any transmitted data is protected by 128-bit encryption, putting Digit app security on par with many national banks.

Conclusion: Is a Digit Savings Account Worth It?

Is Digit safe? With FDIC insured accounts and strong security measures, the Digit app is certainly safe to use.

Can you grow your savings with the Digit money saving app? Absolutely—some have successfully saved almost $2,000 in less than a year.

Is a Digit savings account worth it? Well, each money saving app is different—and there is no one-size-fits-all solution.

The ability to assign emojis to specific goals and access their account via text messaging could make Digit one of the best money saving apps, but other users may find the process cumbersome.

Because Digit relies on text-based account maintenance, users should be prepared to access their account primarily through text commands.

If you’re considering Digit as one of the top apps to save money, you should also evaluate whether the $2.99 monthly fee will fit into your personal finance goals. With similar money saving apps available for free (like Qapital), the cost may be hard to justify.

Despite the monthly fee, there’s no doubt that Digit holds a lot of appeal for new, inexperienced savers.

If you’re new to the process and want to try an automatic savings app, Digit is certainly worth a try. With a free 100-day trial, you have nothing to lose and everything to gain.

Read More: Best Tax Software for Small Businesses

Image sources:

- https://cdn.digit.co/images/press/digit-logo-branded.1d3ced56.png

- https://cdn.digit.co/images/press/yolo2.d19e51b4.jpg

- https://cdn.digit.co/images/press/dashboard-and-convo.db56a012.jpg

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.