Getting the Best Mortgage Rates in Kentucky (10-15-30-Year Fixed, 5/1, 7/1 ARM)

For potential homeowners looking for great Kentucky mortgage rates or Kentucky refinance rates, a stable economy can be a double-edged sword.

According to Investopedia, while employment has been steadily growing in the state of Kentucky, housing prices have been experiencing a similar growth pattern.

Although closing costs in Kentucky are among the lowest in the country, new homeowners will want to consider shopping around for the best Kentucky mortgage rates to ensure that their investment continues to remain manageable over the long-term.

Today’s Oregon Mortgage Rates | Oregon Home Loans for Good-Excellent Credit Borrowers

Current Mortgage Rates in Alabama | Best Alabama Home Loans & Refinance Rates

Hidden Costs of Purchasing a Home in Kentucky

While selecting from Kentucky mortgage rates, you’ll also want to consider the additional costs that come within the first stages of homeownership.

Before you even start the Kentucky mortgage rate confirmation process, you’ll want to consider the following costs:

- Mortgage application fees (typically 1-2 percent of the total purchase price)

- “Good faith deposit” (helps the seller know that you intend to buy)

- Down payment (20 percent of the total mortgage)

Along with Kentucky mortgage rates, there are also closing costs to consider, which can include:

- Mortgage points

- Attorney’s fees

- Inspections or surveys

- Title insurance

- Escrow deposit

- City recording fees

Louisville, KY

Luckily, Kentucky residents are much better off than the rest of the country when it comes to the closing costs associated with obtaining a great Kentucky mortgage rate.

According to Investopedia, the average closing costs for Kentucky mortgages come to $1,797, making it the 12th lowest average of all the states.

Here’s a quick breakdown of the fees and costs typically required by Kentucky mortgage lenders:

- $1,109—Origination fees

- $469—Settlement fees

- $425—Survey

- $125—Home inspection

- $100—Courier and postage services

It’s worth mentioning that Kentucky home loans may also require title insurance, which could add up to $1,000 in additional costs for homebuyers.

Current South Carolina Mortgage Rates | Good-Best Credit Mortgage Rates in South Carolina

Current Mortgage Rates in Missouri | Good – Best Credit Missouri Mortgage Rates

Key Requirements for Getting a Kentucky Home Loan

Before you apply for a Kentucky home loan, you’ll want to ensure that you complete the below list of requirements.

- Get your down payment ready (~20% of the loan amount)

- Maintain good to excellent credit

- Save some extra funds for your closing cost (there might be additional expenses that you’ll need to pay)

- Maintain a low debt balance

- Demonstrate sufficient income

- Gather your financial documents

- Get a home appraisal on the home

You’ll also need to examine your options for Kentucky mortgages before choosing the best mortgage rates in Kentucky for you.

Good, Great, or Excellent Credit Score for a Kentucky Home Loan

FICO scores range anywhere from 300 to 850, with higher numbers seen as the most creditworthy and lower numbers seen as the biggest financial risk.

When applying for Kentucky mortgages, a borrower’s FICO score generally falls into one of these categories:

- 300 – 629 is considered “Bad”

- 630 – 689 is considered “Fair”

- 690 – 719 is considered “Good”

- 720 – 850 is considered “Excellent”

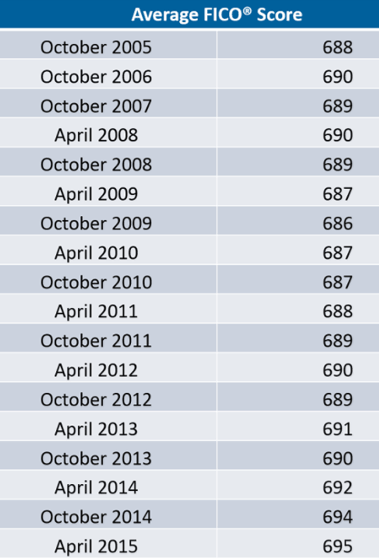

For an overview of the average FICO score from 2005-2015, see the table below. According to CNBC, the average score for 2017 is 700.

Current Louisiana Mortgage Rates | Best Louisiana Mortgages for Good-Excellent Credit Borrowers

Conclusion – Finding a Top Mortgage Loan for a Home in Kentucky

When it comes to purchasing a home in Kentucky, browsing through floor plans and amenities is only one part of the equation. The real work comes from evaluating Kentucky mortgage rates and terms from the top Kentucky mortgage lenders.

It might be tempting to sign up for the first affordable Kentucky mortgage rate that you find, but it’s important to look at multiple mortgage rates in Kentucky to ensure that you are getting the best deal.

Having an affordable, manageable Kentucky mortgage rate is determined not just by your monthly payments but also by interest rates and terms, so don’t be afraid to shop around until you find the best Kentucky mortgage for your financial needs.

Current Mortgage Rates in Colorado for Good – Excellent Credit Borrowers

Current Mortgage Rates for WI | Top Wisconsin Mortgage Rates for Good-Best Credit

Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image sources:

- https://pixabay.com/en/beach-summer-south-carolina-2405600/

- http://www.fico.com/en/blogs/wp-content/uploads/2015/08/April-2015-Average-FICO-Score.png

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.