2017 RANKING & REVIEW

TOP RANKING BEST BANKS IN MELBOURNE

2017 Ranking and Review of the Best Melbourne Banks | Are You Maximising Your Banking Experience?

Whether you already work with a bank in Melbourne, you’re searching for a new Melbourne bank, or you are an expat planning your move to the area, there is one big question you should ask yourself:

Are you doing everything you can to avoid unnecessary fees?

Some of the fees banks in Melbourne may charge include monthly service charges, minimum monthly balance or deposit requirements, and EFTPOS and ATM fees.

Your Melbourne bank may also charge you to bank online or by phone, have high debit or credit card fees, transfer fees, and more.

While fees and the cost of doing business are essential information when comparing Melbourne banks, so is determining whether or not you’re maximising your earnings on your savings and deposit accounts.

Award Emblem: Best Banks in Melbourne Victoria, Australia

The best banks in Melbourne are going to be the ones that offer excellent and competitive interest rates on savings. Consumers will find it advantageous to continuously shop around for Melbourne banks with the best interest rates to make sure they’re putting their idle cash to good use.

Of course, fees and interest rates are only two of the criteria used to develop this list of banks in Melbourne that excel, although they are two of the most important factors.

The following list of the best banks in Melbourne also considers the availability and diversity of products, reputation for service, and whether a given Melbourne bank embraces financial technology and accessibility, such as offering mobile and Internet banking.

See Also: Investing Basics—Are Robo Advisors Right for You? (Robo Investing Guide)

AdvisoryHQ’s List of the Top Banks in Melbourne

List is sorted alphabetically (click any of the bank names below to go directly to the detailed review for that bank).

- ANZ

- Bank Australia

- Bank of Melbourne

- Bendigo Bank

- Commonwealth Bank of Australia

- HSBC Bank Australia

- Macquarie

- ME (Members Equity Bank)

- NAB

- Westpac

AdvisoryHQ’s List of the Top 10 Best Banks in Melbourne

Melbourne Banks | Highlighted Product |

| ANZ | ANZ Progress Saver |

| Bank Australia | Basic Access Account |

| Bank of Melbourne | Get Set Loan |

| Bendigo | Protect+Pay |

| Commonwealth Bank of Australia | GoalSaver |

| HSBC Australia | Home&Away |

| Macquarie | Android Pay |

| ME Bank | Ed School of Money |

| NAB | Velocity Rewards Card |

| Westpac | Cardless Cash |

Table: Top 10 Best Banks in Melbourne, Victoria, Australia | Above list is sorted alphabetically

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Banks in Melbourne

Below, please find the detailed review of each Melbourne bank on our list of the best banks in Melbourne. We have highlighted some of the factors that allowed these Melbourne banks to score so high in our selection ranking.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

ANZ Review

A leading bank in Melbourne, ANZ operates in 34 global markets with representation in not only Australia but also New Zealand, Asia, the Pacific, Europe, America, and the Middle East. It’s ranked as one of the top four banks in Australia, and among the top 50 banks in the world.

ANZ’s world headquarters are in Melbourne, and it was originally established as the Bank of Australasia in Sydney in 1835. It expanded to Melbourne in 1838. In total, this bank in Melbourne has a history spanning more than 180 years. It’s also the largest banking group in New Zealand and Pacific.

Key Factors That Enabled This to Rank as a Top Bank in Melbourne

When comparing Melbourne banks, the following are some of the primary reasons ANZ is on this list of banks in Melbourne.

Expat Services

One of many reasons consumers might be in search of the best bank in Melbourne is if they’re an expat planning a move to the country. Setting up a bank account at a Melbourne bank is one of the first and most important things a person does when planning a move to the area, but doing so in a foreign country can be overwhelming and confusing.

One of the reasons ANZ excels in terms of banks in Melbourne is because they understand this process, and offer services specifically geared toward expats who will be moving to the country. This is a bank in Melbourne that makes it fast, easy, and straightforward to open an account with them as an expat.

The ANZ team can work with new banking customers to help them transfer their funds when the exchange rate is favourable. With Internet banking, expats can track everything and make sure their money has safely arrived. New banking customers to this top bank in Melbourne can start earning interest on their money right away with the Online Saver Account, and the ANZ bank statement consumers receive can be used as proof of address immediately upon arrival in Australia.

ANZ Access Advantage

The availability of inexpensive account options was an important factor under consideration when selecting Melbourne banks for our list of the best banks in Melbourne. One of the signature account options consumers may find appealing from this bank in Melbourne is the ANZ Access Advantage Account. This account has all the fundamentals needed for secure everyday banking, and consumers can apply for it online.

Some of the features of this account include an ANZ Access Visa Debit Card and secure unlimited transactions. There is no maintenance fee if you deposit at least $2,000 a month into this account or you are under 25 years old.

It can also be paired with innovative digital banking tools including mobile payment services and ANZ online banking.

Image Source: ANZ Access Advantage

ANZ goMoney®

When comparing and ranking Melbourne banks, critical in the process was determining whether a financial institution offered mobile banking. Mobile banking is offered by many of the top banks in Melbourne, and it provides consumers many benefits including increased control over their money and spending and more accessibility to their accounts.

At this bank in Melbourne, the mobile banking app is called ANZ goMoney®, and the tagline is: “Your bank in your pocket.”

Features of ANZ goMoney® include:

- Transfer funds with a few taps and easily view account balances

- View credit card statement summary

- View linked business and personal accounts using a four-digit PIN

- Pay bills with the BPAY feature

- Send money to anyone with their BSB and account number or their mobile phone number

- Find ANZ ATMs and branch locations

- Access and edit Biller and Pay Anyone lists that are set up in ANZ online banking

Savings Accounts

As mentioned in the introduction of this review of the top banks in Melbourne, when comparing banks in Melbourne, along with checking account options, value-creating savings accounts were also a key consideration.

At ANZ, there are several different savings accounts available, all of which played a significant role in its ranking as a best bank in Melbourne.

One of the simplest and most popular options from this top bank in Melbourne is the ANZ Online Saver, which is a flexible, interest-earning account with access to savings through a linked ANZ everyday banking account.

Also available from this top bank in Melbourne is the ANZ Progress Saver, which rewards consumers for saving money. It includes bonus interest when a single deposit of $10 or more is made in a month and no withdrawals take place in that month.

The Premium Cash Management Account is designed to help customers manage their investment cash flow or maintain funds until they make their next investment. It earns tiered interest, and access to money in this account is flexible.

Don’t Miss: WiseBanyan Review | Robo Comparison (WiseBanyan vs. Betterment)

Bank Australia Review

Bank Australia is a top bank in Melbourne that defines itself as both customer-owned and responsible. Bank Australia is actually unique among other Melbourne banks because it’s a completely customer-owned financial institution. This allows them to operate with a focus on the long-term interests of the customer, rather than investors.

Bank Australia has a history that goes back to 1957, and currently, there are about 130,000 people and community sector organisations that work with this bank in Melbourne. The goal of their unique business model is to provide reasonable fees, competitive interest rates, and a general selection of responsible products.

Key Factors That Led Us to Rank This as a Top 10 Bank in Melbourne

Distinctive features of Bank Australia that led to its inclusion on this list of the best banks in Melbourne are named below.

Responsible Banking

As mentioned above, one of the number one reasons Bank Australia is ranked as a top bank in Melbourne and was included on this list of banks in Melbourne is because of their business model of responsible banking. The objective is to create mutual prosperity for customers, their communities, and the environment.

Bank Australia believes in making a profit, but then putting it to good use to create what they call positive “social, environmental, and cultural outcomes.”

Mutual prosperity is created through the implementation of the customer-owned model, investing up to 4% of profits through the Bank Australia Impact Fund, staying carbon neutral and contributing to a healthier planet, and creating and keeping jobs in Australia.

Basic Access Account

Along with transaction accounts featuring interest-bearing perks, this best bank in Melbourne also features the Basic Access Account, which is designed to offer all the essential features a consumer would need for daily banking, and there is no fee for eligible customers that are living on a low income.

Eligible customers can receive their government benefit payment directly into the Basic Access Account and access free banking transactions at more than 3,000 rediATMs, every EFTPOS outlet, and at branches. It also includes a VISA debit card.

Other account features offered by this Melbourne bank include no account keeping fees, no minimum deposit amounts, the option to set up and cancel direct debits, and this account has no overdraft fees.

Home Loans

Bank Australia was selected as one of the best banks in Melbourne, Australia not only because of transaction and savings account options, but also their lending products. Consumers can come to Bank Australia to obtain a home loan.

One of the most popular options is the Basic Home Loan, with a competitive interest rate and a suite of features specifically designed to make the loan more affordable for consumers.

Also available is the Premium Home Loan Package, which includes a fully featured home loan, discounted interest rates, fee waivers, and discounts on other products. It also includes a free consultation with an independent financial advisor.

Other similar products from this bank in Melbourne include the Premium Package 2-Year Fixed home loan, a bridging home loan, and a line of credit to utilise equity.

Bonus Saver

As a top bank in Melbourne, Bank Australia offers many savings account options, and one of the most popular is the Bonus Saver. This provides the account holder with a monthly interest bonus. Customers simply have to deposit $100 or more into their account, and not make any withdrawals during the month to take advantage of the Bonus Saver perks.

So, currently the interest rate is 0.15% p.a. and the bonus rate is 2.45% p.a. making the total Bonus Saver rate 2.60% p.a. for eligible customers of this best bank in Melbourne.

This account also features flexible access to funds, and it can be used with telephone and Internet banking.

Related: What Is a Robo Advisor? Everything You Should Know about Robo Advisors (Definition)

Bank of Melbourne Review

One of the best banks in Melbourne is the Bank of Melbourne, which is nicknamed “Victoria’s local bank.” This Melbourne bank has 106 branches throughout Victoria, while the headquarters and call centre are located in Melbourne’s CBD. All branches are operated by local residents, and this bank runs with a passion for Victoria.

This best bank in Melbourne has been the recipient of many awards over the years, including being named the best local bank in Australia at the Financial Review Smart Investor Blue Ribbon Awards. It also won an Australian Private Banking and Wealth Award, and an Australian Banking & Finance Corporate and Business Banking Award for Best Cash Management in the Business Bank Category.

Key Factors That Enabled This to Rank as One of the Top Banks in Melbourne

Among the many banks in Melbourne the following are some reasons this Melbourne bank is one of the best.

Get Set Loan

This bank in Melbourne is frequently recognised as being among the best because of the availability of valuable, low-cost lending solutions. One of the signature loans available from this best bank in Melbourne is called the “Get Set Loan.”

This is a personal loan that’s convenient, reusable, and carries no expiration date that requires the recipient to reapply.

Features and benefits of this loan include the following:

- Funds are accessible whenever they’re needed up to an approved limit

- Borrowers pay interest only on their outstanding balance, not on the approved limit

- Credit limits range from $5,000 to $50,000

- Funds are accessible anytime through online and mobile banking

- Payments can be made above the minimum monthly repayment amount

- There are no fees for additional withdrawals

Maxi Saver

When comparing Melbourne banks, one of the first things to consider is the availability of savings accounts with excellent rates. Bank of Melbourne features the Maxi Saver, which earns a competitive interest rate. The introductory rate is 2.75% p.a., which is a combination of the usual rate (1.00% p.a.) and the fixed bonus rate (1.75% p.a.).

There is no monthly service fee to use this account available from this bank in Melbourne. Regular transfers can be set up to make saving money effortless, and the account can be linked to an eligible Bank of Melbourne Transaction account.

Funds can be managed through online and mobile banking as well.

Complete Freedom Account

As one of the leading banks in Melbourne, Bank of Melbourne features many different transactions accounts that include things like debit cards for simplified everyday purchases.

A signature account from this bank in Melbourne is the Complete Freedom Account. This account has no monthly service fee when at least $2,000 is deposited by the last business day of the month, which is one of the big reasons it’s such a valuable account.

This account can also be activated online, and balances can be checked on the go using the Quick Balances feature available from this leader among Melbourne banks.

Popular Article: Vanguard Robo Advisor—Ranking | Vanguard Personal Advisor Services Review

Bendigo Bank Review

Among banks in Melbourne, Bendigo is often rated among the best. Bendigo began more than 150 years ago, as Bendigo Bank in Victoria and Adelaide Bank in South Australia, both of which were originally building societies. Now, through many years of growth and expansion this top bank in Melbourne has become an ASX-listed company with more than 6,500 employees.

This leader among Melbourne banks also has around 1.5 million customers in more than 500 communities throughout Australia. Bendigo Bank operates many other brands as well, including Sandhurst Trusties, Rural Bank, and Homesafe Solutions.

Image Source: Top Banks in Melbourne

Key Factors That Allowed This to Rank as One of The Best Banks in Melbourne

When reviewing and ranking Melbourne banks to include on this list of banks in Melbourne, the below criteria were important for Bendigo Bank.

Premium Rewards Credit Cards

As one of the premier banks in Melbourne, Bendigo offers quite a few different credit card options to customers, all of which are designed to bring benefits, carry fair interest rates, and be delivered with the utmost care in customer service.

One of the best credit cards offered by this top bank in Melbourne is the Platinum Rewards Visa, which is a card that is the highest level in terms of the Bendigo rewards program.

The rewards program from this leader among banks in Melbourne, Australia includes 1.5 rewards points for every $1 spent on purchases and one reward point for every $1 of balance transfers. New account holders with the Platinum Rewards card also receive 10,000 bonus rewards points as a new account holder, and there are up to 55 days interest-free offered on all purchases.

Protect+Pay

As an innovative and technologically advanced bank in Melbourne Bendigo provides the Protect+Pay mobile app, which is designed to provide the utmost control over Bendigo credit, debit, and Easy Money cards.

With this app, customers of this best bank in Melbourne can temporarily block a lost card, and, if it’s found, they can use the app to unblock it. Online transactions can be blocked until the customer wants to make an online purchase, and overseas transactions can be blocked while the customer is in Australia.

This mobile app from this bank in Melbourne can also be used to cancel lost cards and order replacements, view PINs, and see quick balances.

Easy Switching

Among Melbourne banks, Bendigo tends to rank highly not only because of their products, but for their services as well. One such service that is popular at this top bank in Melbourne is called Easy Switching. When a consumer decides to move from other banks in Melbourne to Bendigo, they make sure it’s as simple as possible.

With Easy Switching of personal accounts, customers of this top bank in Melbourne can let the bank do everything for them, including identifying regular payments, notifying suppliers and paying direct debits.

Another option is to do it yourself using the letters provided by Bendigo, and this can be used for both personal and business accounts.

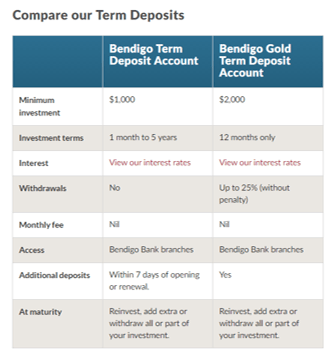

Term Deposits

Often, consumers are seeking banks in Melbourne that offer not only conventional savings and transaction accounts but also investment products. As a full-service bank in Melbourne, Bendigo offers many investment accounts and products including term deposits, which can be customised for short- or long-term investment strategies.

Image Source: Bendigo – Term Deposits

Bendigo Term Deposits are designed for consumers who want regular income from their investment but don’t require immediate access to funds.

These accounts include a fixed rate for the duration of the investment, and there are no set-up or ongoing fees. Interest is calculated daily and paid monthly, annually or on maturity, depending on the preferences of the customer.

Commonwealth Bank of Australia Review

Among banks in Melbourne, Commonwealth Bank excels because they offer a full suite of products and services including not only retail banking but also premium, institutional, and business banking. CommBank is one of the leading providers of integrated financial products and services.

Some of the general strengths of this leader among Melbourne banks include the brand and established reputation of the company, the scale, and the diversity of offerings. Other brands that are affiliated with CommBank include Colonial First State, CommSec, and Bankwest.

Key Factors That Enabled Us to Rank This as One of the Top Melbourne Banks

When comparing Melbourne banks, below are some reasons Commonwealth Bank was ranked as a best bank in Melbourne.

International Products and Services

In an increasingly globalised marketplace, it’s important that Melbourne banks offer products and services with an international focus, and this is an area of specialisation offered by CommBank.

Their international products and services include:

- International Money Transfers: Customers can quickly and securely send money to more than 200 countries in 30 currencies.

- Foreign Currency Account: This is a customised solution for people who often send money overseas or who want to save money in a different currency. Account holders can choose from global currencies and convert them when they choose.

- Foreign Cheques and Drafts: This is a safe, convenient way to pay for things purchased overseas.

- Tools and Calculators: Some of the international tools and calculators customers of this top bank in Melbourne can take advantage of include an FX calculator, as well as an FX mobile app providing real-time currency updates.

Smart Access

Smart Access is a comprehensive all-in-one bank account offering flexibility, as well as unlimited electronic transactions. Customers of this top pick among Melbourne banks can use the Smart Access account to get to their money at more than 4,000 ATMs and 950 branches.

The $4 fee is waived for new Everyday Account Smart Access if at least $2,000 in deposits are made each month.

This account can also be completed quickly with four steps that typically take less than five minutes including a straightforward application, online identity verification for new CommBank customers, and downloading the CommBank mobile app.

Tap & Pay

When asked, one of the top things consumers say they’re looking for in their search for banks in Melbourne is convenience. CommBank understands this need, which is why they offer features like Tap & Pay.

Tap & Pay lets customers of this top bank in Melbourne use their compatible smartphone to make contactless purchases at participating merchants. They can simply use their phone to access funds in their Everyday Account or their credit card.

Purchases are also covered by this Melbourne bank’s 100% Money Back Guarantee.

Savings Accounts

All of the well-ranked banks in Melbourne feature excellent savings account options, and CommBank is no exception. The primary savings account options available from this best bank in Melbourne include the NetBank Saver with unlimited transfers to and from CommBank transaction accounts and a competitive introductory rate, as well as the GoalSaver.

With the GoalSaver, customers of this bank in Melbourne are rewarded when they make regular contributions to their account. This top Melbourne bank also offers a competitive variable interest rate to those who contribute to this savings account regularly.

Another option popular among consumers of Melbourne banks is the Term Deposit product. This features fixed rates of return, so customers know exactly what their investment total will be.

Universal features of all of the savings accounts offered by this top bank in Melbourne include flexibility, no monthly account fees, simplified online banking access, and award-winning mobile banking.

Read More: Top Robo-Advisors (Reviews) | A Changing Trend in the Robo-Investment Field

HSBC Bank Australia Review

As one of the top-ranked Melbourne banks, HSBC is also known for having a global presence as a leading worldwide financial institution. HSBC is not only one of the most well-known financial services providers in the world but also one of the largest. More than 45 million customers are served by HSBC, and they have four core components to their business including retail banking and wealth management, commercial banking, global banking and markets, and global private banking.

HSBC is not just one of the most prominent banks in Melbourne, but it also has about 4,400 offices around the world, and is listed on the New York, London, and Hong Kong stock exchanges, among others.

Key Factors Leading Us to Rank This as One of the Top Melbourne Banks

During the comprehensive process of researching Melbourne banks, the following are key reasons HSBC is included in this ranking of leading banks in Melbourne.

Day-to-Day Account

As one of the best banks in Melbourne, HSBC certainly offers diversity in its products and services. One of the signature accounts available from this top bank in Melbourne is the Day-to-Day Account.

The biggest perk of this account? It has no monthly account fee and no minimum deposit requirement.

It also features access to more than 3,000 ATMs including HSBC, Westpac Bank, St. George, Bank of Melbourne, and BankSA, all with no ATM fee. It comes with an HSBC Visa Debit Card and features like Visa Zero Liability to protect against fraudulent purchases.

Home&Away Program

When comparing Melbourne banks to create this list of banks in Melbourne, unique programs were important. The ranking team looked for those Melbourne banks that offered things no other bank did, and one of these programs from HSBC is called Home&Away.

This is an exclusive offering for HSBC debit and credit card holders, and it features both local and global offers.

For example, HSBC customers receive perks and discounts for both local and global travel when they use their credit or debit card during a particular period of time. Some of the deals are not only in travel categories but are also available from popular local and international retailers, restaurants, and health and beauty businesses.

Image Source: HSBC – HomeAway

HSBC Safeguard

A top concern for many customers of banks in Melbourne is safety and security, particularly in the midst of so much fraud and financial crime that takes place around the world. Essential to being ranked as one of the best banks in Melbourne is having resources in place to protect customers, and HSBC delivers this through their signature Safeguard program.

The Safeguard program is based on a set of processes and systems with up-to-date customer information.

The bank will regularly and proactively contact customers to make sure they have all necessary information. The data and security standards utilised by HSBC are among the most rigorous in the world.

Internet Banking

Internet banking is offered by most banks in Melbourne, and it’s not just having this service that was important in this ranking but also how robust, convenient, and user-friendly this service is.

HSBC is a leader in the world of online banking, and the platform is pretty packed with features. Users can do more than just simple things like check their account balances and transactions—they can also pay bills using the BPAY service to more than 15,000 linked organisations.

It’s also possible to use online banking from this top bank in Melbourne to transfer funds to almost any account not only in Australia but also overseas.

HSBC also issues all Internet banking customers an Online Security Device, which is complimentary and is designed to provide the highest level of protection for online accounts.

Related: Betterment Investment Review | Is Betterment a Good Investment Firm?

Free Wealth & Finance Software - Get Yours Now ►

Macquarie Review

Macquarie is one of the most well-respected and reputable banks in Melbourne, with offices not only in Australia and around the world. Macquarie has a history that spans many decades, and while they are an integrated advisory and financial services company, personal banking is offered under their Banking and Financial Services Group.

Macquarie’s banking division has more than 1,959 staff members, most of whom are in Australia, and as of June 2016, the group had total BFS deposits of $41.4 billion. Retail financial products available to customers of this selection for one of the top banks in Melbourne include mortgages, deposit accounts, and credit cards.

Key Factors That Enabled This to Rank as One of the Top Banks in Melbourne

When comparing Macquarie to other banks in Melbourne, the following highlights some reasons it was included in this ranking of the best banks in Melbourne.

Android Pay

This leader among Melbourne banks recently announced the availability of Android Pay for debit and credit cards. Android Pay is a convenient and secure contactless method of payment that can be used to make purchases at participating retailers.

When a customer of this bank in Melbourne is ready to make a purchase, they can place their phone near the contactless terminal, and that’s it. This service doesn’t even require the customer to open an app.

Android Pay can also be used to speed up and simplify how in-app purchases are made.

Transaction Accounts

Transaction accounts are one of the primary offerings of most banks in Melbourne, Australia, and Macquarie is no exception. What is unique about their transaction accounts as compared to other banks in Melbourne is the benefits and rewards they include for the customer.

With transaction accounts from this best bank in Melbourne, customers receive free access to any ATM in Australia, which includes the rediATM network. There are no international fees when using a Macquarie Debit MasterCard overseas or online, and there are no monthly account fees.

Interest can be earned on balances more than $5,000 and there is a 50c rewards for cash out in stores when $100 or more is withdrawn.

Savings Accounts

Another thing that should be and is often very important to consumers when selecting from Melbourne banks is their availability of value-creating savings accounts. As mentioned in the introduction to this review of banks in Melbourne, consumers want to feel like they are earning the most possible money on the unused money kept in savings, and Macquarie is a top bank in Melbourne because they strive to make this happen.

This top bank in Melbourne offers a welcome variable rate of 2.65% currently, and the standard stepped variable rates start at 1.30%.

Other benefits of savings accounts offered by this top bank in Melbourne include no monthly account fees, instant access to funds, a government guarantee, and 24/7 customer service availability.

Mobile Banking App

Among top banks in Melbourne, Macquarie is often ranked as having one of the very best mobile banking platforms. The mobile app offers access to everything a customer could need including their Macquarie transaction and savings accounts, credit cards, home loans, and cash management accounts.

TouchID accessibility is available, and account balances can be checked without logging in.

Immediate payments can be set up and sent to BPAY billers, and account information including interest earned and credit card reward points can also be accessed using the mobile app offered by this bank in Melbourne.

Security features include the ability to temporarily block cards if they’re lost or stolen, and PINs can be activated and changed for debit and credit cards within the mobile platform.

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

ME Bank (Members Equity) Review

Among Melbourne banks, ME is frequently rated among the best not only by this ranking and review but by many outlets and professional organisations. For example, Mozo named it Australia’s Best Bank in the Experts Choice Category for 2016. ME was created in 1994 with the initial purpose of helping Australians achieve homeownership.

Now, ME is a full-service top bank in Melbourne and throughout Australia. The principle that guides their financial products and services is based on helping Australians get the most out of their money.

Key Factors That Led Us to Rank This as One of The Top Banks in Melbourne

Essential reasons ME is ranked as one of the best banks in Melbourne are covered in the following list.

Discount Home Loan Rates

ME is a top bank in Melbourne offering not only deposit accounts but also home loans. They feature options that allow customers to receive discounted interest rates on their loans with the Flexible Home Loan with Member Package.

This package has a low interest rate of 3.94% p.a. as compared to 4.35% p.a. There’s also a 0.89% “Loveable” discount off the variable reference rate for the life of a loan as long as a Member Package is maintained.

The fees are reduced, and this home loan includes no solicitor fee, no fix or split loan fee, no top-up fee, and no valuation fee.

There is a 100% offset on the variable loan component with an ME Everyday Transaction Account, and cash can be redrawn from available funds at no charge.

Online Savings Account

Also available from ME, one of the top banks in Melbourne, is the Online Savings Account, which is simple and is constantly earning the account holder interest. It’s also unique when compared to many other savings accounts from banks in Melbourne, Australia, because it features flexible funds access.

The variable base interest rate is currently 1.30%, which is calculated daily and paid monthly. On balances up to $250,000, there is a possible variable bonus rate of 1.75% p.a.

There is no commitment, no account-keeping fees, and no penalties for accessing cash when it’s needed.

Customers can apply online in a matter of minutes, and if they’re a new ME customer, they’ll just need a driver’s license or passport for identity verification.

Financial Education

As one of not only the best banks in Melbourne, but an integrated, well-rounded, and full-service financial institution, ME offers the Ed School of Money, which is an online program. Through this program, consumers can start learning more about finances, and in the process, become more financially fit.

Some of the topics covered in this online education portal offered by this top bank in Melbourne include:

- Home buying

- Budgeting

- Money basics

- Managing debt

- Moving out

- Kids and money

- Investing

- Your credit history

- Living with a home loan

Don’t Miss: Wealthfront vs. Vanguard—Rankings & Review

Free Wealth Management for AdvisoryHQ Readers

NAB Review

NAB is a leader among the banks in Melbourne and is led by Chairman Ken Henry AC. NAB is included on this list of banks in Melbourne for many reasons, including their unique perspective on being part of the financial services industry. They define their responsibility as a special one, and their commitment is to create more of what matters for individuals, the economy, and communities.

This top bank in Melbourne’s main base of operations is throughout Australia and New Zealand, but there’s also a presence in Asia, the UK, and the United States. NAB serves both retail and business customers.

Key Factors Considered When Ranking This as One of the Top Banks in Melbourne

The details below highlight reasons NAB is part of this list of banks in Melbourne.

Velocity Rewards Cards

Vital to being one of the top banks in Melbourne and being included on this list of banks in Melbourne is offering the best credit card options. NAB features several different cards for different consumers, but one of their most benefit-packed is the Velocity Rewards Premium Card.

Cardholders have the opportunity to earn Velocity Points on their typical purchase, and there are two cards on one account for even more advantages. The NAB Velocity Rewards Premium American Express is included to maximise possible points earnings, while the Premium Visa Card offers flexibility and acceptance around the world.

This card also includes complimentary insurance and Platinum Concierge Service to eligible account holders.

Financial Hardship

People’s lives can be rocked by unexpected situations that leave them in a financially difficult spot. Some of the reasons a person might be experiencing a financial hardship include injury or illness, unemployment, domestic violence, natural disaster, or reduction in income.

This can leave one unable to make their loan or credit card payments, even if they want to.

NAB was included on this list of banks in Melbourne because they operate with compassion and offer possible solutions to customers if they’re in a challenging situation.

This top bank in Melbourne has a dedicated Customer Care team, and their focus is on working with customers who are in a tough financial spot. They will talk through the situation with the customer, and then help them identify the right possible solution for their needs.

Account Features

Available accounts offered through this bank in Melbourne include transaction and savings options, and regardless of the account a member selects, they all have some universal perks that make them appealing.

One of the big ones is that NAB doesn’t charge any monthly account fees. They also don’t require minimum deposits or ongoing balance totals.

NAB Defence is cutting-edge fraud protection that comes with accounts, and this bank in Melbourne also offers payWave on NAB Visa Debit Cards at no additional cost.

NAB Classic Banking

The signature account option from this leader among banks in Melbourne, Australia is called Classic Banking.

Along with the benefits mentioned above including no monthly account fees, Classic Banking also features convenient and unlimited access to funds. There are also no overdraft fees and no direct charge at NAB ATMs or RediATMs.

Smaller purchases can be made using Visa payWave or Tap and Pay, and NAB Visa Debit Cards also include Visa Zero Liability and Verified by Visa protection.

The account can be opened online and managed through NAB Internet banking and the NAB app.

Free Money Management Software

Westpac Review

A well-known name among Melbourne banks, Westpac is part of the Westpac Group, which has a history that goes back to 1817. Westpac was Australia’s first bank, established as the Bank of New South Wales. It took its current name in 1982.

Along with Westpac bank, the portfolio of brands that are part of the Westpac Group includes St. George, Bank of Melbourne, BankSA, and RAMS. Westpac Group offers not only consumer banking, but also financial and wealth management, institutional banking, and business banking.

Key Factors That Led to Our Ranking of This as One of the Best Banks in Melbourne

Notable reasons Westpac was included on this list of banks in Melbourne and ranked as a best bank in Melbourne are detailed below.

Travel Money Card

Offered by this top bank in Melbourne, the Global Currency Card is perfect for customers who are planning to travel and want to make convenient, seamless payments.

The Westpac Global Currency Card is a reloadable prepaid Visa money card, so it will be accepted anywhere Visa is. It can be used to make payments in multiple currencies, and online in different currencies as well.

The Global Currency Card app can be used to check balances and move between currencies, and it can be topped up through Westpac Online Banking or BPAY. Users can load up to 5 of the 11 available currencies, and there are no ATM withdrawal fees at more than 50,000 worldwide ATMs that are part of the Global ATM Alliance.

This card also helps users avoid the 3% foreign transaction fee.

Reward Saver

One of the savings account options available to customers of this top bank in Melbourne is the Reward Saver. This account is designed for customers who are serious about saving.

There is the potential to earn bonus interest when no withdrawals are made, and the account holder makes a deposit of at least $50 a month. There is no monthly service fee or minimum balance requirement either.

Additionally, the account can be opened online in less than three minutes.

Also available from this selection for one of the top banks in Melbourne, Australia is the eSaver account, with constant access to funds via a linked everyday account, no monthly service fee, and no minimum balance.

Under 21 and Students

As a best bank in Melbourne, Westpac creates and offers accounts that are designed to suit a wide a variety of financial needs, including those consumers who are students or under 21 years of age.

The Westpac Choice account is an everyday banking option with no monthly account keeping fees for full-time tertiary students and account holders under 21. Also available is the Reward Saver, with features specifically for young people under the age of 21.

Cash Accessibility without a Card

One of the most unique features offered by this best bank in Melbourne is the ability to get cash even without a debit card. To use this option, account holders open the Westpac Mobile Banking App. There’s a feature called “Get Cash.”

Account holders set this up one time and accept the terms and conditions. They can then choose an eligible transaction account where they’ll withdraw money from, and simply hit “Go” right in the app.

Then, they can visit a Westpac ATM or send the cash code to friends and family. They visit the ATM, enter the cash code and how much they want to withdraw, and they have cash. This is perfect if a debit card is lost or stolen, or an account holder simply doesn’t have it with them.

Popular Article: Top Robo-Advisors (Reviews) | A Changing Trend in the Robo-Investment Field

Conclusion—The Top 10 Best Banks in Melbourne

Can a bank be more than somewhere to store your money or complete daily transactions? Can a bank become a partner to its customers and provide them with valuable account options, features, and services?

When it comes to the best Melbourne banks, the answer is yes.

Each of the names on this list of banks in Melbourne was reviewed and ranked based on an extensive set of criteria, all of which was designed for the people who matter most: the consumers.

These Melbourne banks excel in many areas, like offering the lowest fees and highest rates on savings. But these top banks in Melbourne also ranked so highly because they are innovators. They lead the way in offering the most distinctive services and digital platforms to improve the lives of customers and encourage them to form a long-term relationship with their bank.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.