2017 RANKING & REVIEWS

TOP MUTUAL BANKS & BUILDING SOCIETIES IN AUSTRALIA

Intro: Understanding Banking in Australia & Finding the Best Australian Mutual Banks

The banking sector in Australia is one that’s diverse and competitive, in large part because of the presence of top Australia mutual banks and top Australia building societies, which provide a unique alternative to conventional banks.

The Customer Owned Banking Association is the governing body of the more than 100 credit unions, building societies, and mutual banks that comprise the cooperative banking industry in Australia. The primary difference between the top Australia mutual banks and conventional banks is the fact that the members own the financial institution in a mutual bank.

When they open accounts with the best Australia mutual banks, they’re essentially buying into the organisation, which gives them the opportunity to guide the decision-making process.

Also included under the umbrella of the best Australia mutual banks are building societies.

Award Emblem: Top 10 Mutual Banks and Building Societies in Australia

There are really very few categorical differences between a top Australia mutual bank and a top Australia building society, as the key feature of both is the customer-owned structure. Any differences are usually the result of history or region, which may lead one to be called a mutual bank and another to be classified as a building society.

A few things to note about the top Australia mutual banks, before delving into the list of the best Australia mutual banks and the list of building societies in Australia that are ranked as the best. The first is that this customer-owned banking sector tends to be highly ranked in terms of customer satisfaction in Australia. These organisations are also guided by values and principles that are carefully defined, including a dedication to ethical, quality banking, as well as competitive rates and pricing.

These are some of the many reasons consumers will often prefer one of the top Australia mutual banks, such as the Victorian Teachers’ Mutual Bank, as opposed to a conventional bank, like one of the Big Four.

See Also: Top Best Banks in Sydney, New South Wales, Australia | Ranking & Reviews

List of the Best Australia Mutual Banks and Top Australia Building Societies

This list is sorted alphabetically (click any of the below names to go directly to the detailed review for that top Australia mutual bank or top building society in Australia).

- Australian Military Bank

- Bank Australia

- BankVic

- Beyond Bank Australia

- Customs Bank

- Greater Bank

- Heritage Bank

- IMB Bank

- Police Bank

- Victoria Teachers Mutual Bank

List of Top Mutual Banks & Building Societies in Australia

Firms | Websites |

| Australian Military Bank | http://www.australianmilitarybank.com.au/ |

| Bank Australia | https://bankaust.com.au/ |

| BankVic | http://bankvic.com.au/ |

| Beyond Bank Australia | http://www.beyondbank.com.au/personal-banking.html |

| Customs Bank | https://www.customsbank.com.au/ |

| Greater Bank | https://www.greater.com.au/ |

| Heritage Bank | https://www.heritage.com.au/ |

| IMB Bank | http://www.imb.com.au/ |

| Police Bank | https://www.policebank.com.au/ |

| Victoria Mutual Teachers Bank | http://www.victeach.com.au/ |

Table: Top 10 Best Mutual Banks & Building Societies in Australia | Above list is sorted alphabetically

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Methodology for Selecting Top Banks and Credit Unions

One of the primary questions received from readers is how AdvisoryHQ creates its in-depth rankings and reviews, such as this list of the top Australia mutual banks and the best Australia building societies.

To begin the comprehensive process, we reviewed all of the mutual banks and building societies in the country and started broadly comparing them using publicly available resources and customer reviews.

Once an initial list of the top Australia mutual banks and the top Australia building societies was created, we then further narrowed it down based on customer-centric criteria such as products and services, fees and charges, transparency, history, stability, and guiding values. Then, the final list of building societies in Australia and top Australia mutual banks was created.

Click here for a detailed explanation of our methodology: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions

Detailed Review—Top Australia Mutual Banks and Top Australia Building Societies

After carefully considering the best Australia building societies and mutual banks, we created the following list of the top 10. As you continue reading, you’ll find detailed reviews for each of our picks, as well as specifics of some of the factors we used in our decision-making process.

Australian Military Bank Review

Australian Military Bank, a top mutual bank in Australia, is the country’s longest-serving defence-related financial institution. Operational since 1959, this top mutual bank in Australia serves personnel from the Australian Defence, as well as their families. The more than 50,000 members are also shareholders, and there are more than 30 in-person branches at all major defence bases in Australia.

This top mutual bank in Australia also offers members access to more than 3,400 Australia-wide ATMs through an affiliation with the NAP and the rediATM network.

Key Factors That Allowed This to Rank as a Top Australia Mutual Bank

Key reasons Australian Military Bank is ranked as a top mutual bank in Australia are listed below.

Capital Guaranteed Superannuation

For members searching for a valuable retirement account that will allow them to maximise their savings, there are the superannuation options from Australian Military Bank, which are low in cost and easily manageable. Two of the primary products available from this top mutual bank in Australia are the Capital Guaranteed Super and the Capital Guaranteed Pension, both of which are guaranteed against negative returns.

Members can select between options that are either a variable or fixed rate, and there are no ongoing fees associated with these retirement accounts.

Additional features include no entry or investment fees, a concessional tax rate, online access, and the option to roll over existing super balances.

Military Rewards Accounts

The Military Rewards Account is an everyday spending account that provides rewards to the defence community as they spend. The primary feature of this account that members of this leader among the top Australia building societies and mutual banks find appealing is 2% cash back on Visa payWave purchases less than $100 when the account holder deposits at least $1,500 each month.

It also includes free rediATM withdrawals, the option to participate in the Cents gifting program so members can donate to their choice of defence charities, and there is no annual fee on the Visa debit card.

There is also no month service fee when members deposit at least $1,500 each month, and there is no minimum balance requirement to start the account.

DHOAS Loans

One of the main ways Australian Military Bank is unique from other top Australia mutual banks and top Australia building societies, including names like the Vic Teachers’ Mutual Bank, are their product offerings specifically geared toward the needs of the defence community.

One category of these defence-specific products is DHOAS Home Loans, which are low-cost and specially tailored to the needs of home buyers who are part of the Australian Defence Force.

With these loans, discounted rates may be available depending on the members’ deposits, and interest rates are significantly lower than comparison rates.

Options include the DHOAS Value home loan, the DHOAS standard variable-rate home loan, and two- and three-year fixed-rate home loans. Other DHOAS loans include the five-year fixed-rate home loan and the Construction loan.

Mobile App

Regardless of where in the world a member of this top mutual bank in Australia is located, they have access to banking services and money management tools thanks to the Australian Military Bank mobile app. This app features the most up-to-date mobile payment technology, as well as the following features and capabilities:

- Lock and cancel debit and credit cards that are lost or may have been stolen

- Let the bank know if you’re traveling overseas for work or otherwise so addition security measures can be put on your account

- 24/7 worldwide banking access

- Secure fingerprint login for compatible mobile devices

- Tap and Pay for purchases under $100

- Quick account balance access

- Bill pay with BPAY

- See transaction history

- Register a card as lost or stolen

- Transfer money between accounts

- Send money to anyone

- Find ATMs and branches of this top Australia mutual bank

Don’t Miss: Top Australia Banks | Ranking | Biggest Australia Banks & Best Banks in Australia

BankVic Review

BankVic, along with names like the Vic Teachers Mutual Bank, is one of Victoria’s most significant and well-known mutual banks. BankVic began in 1974, and like the Victoria Teachers Mutual Bank, was created for a specific community, although instead of teachers, it was originally for Victoria police officers and their families.

Now, membership at this top Australia mutual bank has been extended to health, emergency, and public service sector members. The membership has grown to 100,000, and this top Australia mutual bank has $1.5 billion in assets.

Key Factors Leading Us To Rank This as One of the Top Australia Mutual Banks

When creating this list of building societies in Australia and the best Australia mutual banks, the following are reasons BankVic stood out.

Loans

A big reason BankVic is included on this list of the top Australia building societies and top Australia mutual banks is because of their wide range of lending products, designed to suit diverse needs and provide the funding people need at affordable rates.

The loans available from this top Australia mutual bank include:

- Home loans including options for refinancing and renovation

- Investment loans are designed with competitive interest rates whether a member is an experienced investor or a first-timer

- Car loans with no fees

- Personal loans from this top Australia mutual bank can be used for boats, electronics, or whatever a member wants or needs

Also available from this leader among the best Australia mutual banks and the best Australia building societies are travel loans and overdraft protection loans.

Online Term Deposits

Members of the top Australia mutual banks and building societies are typically looking for a variety of available savings products, including term deposits. One of the signature products available to members of BankVic is the online term deposit, which is beneficial because it pairs competitive rates with online convenience.

For members who don’t want to visit a branch, this term deposit can be opened via online banking.

Other perks include a range of terms to choose from, interest that’s calculated daily, paid annually and on maturity, and there are no management or account keeping fees. The minimum deposit to open this convenient online account is only $2,000.

12 Months Regular Income

Distinctive product offerings were also important in the process to create a list of building societies in Australia and the best Australia mutual banks, and this is an area BankVic performed well. Their 12 Months Regular Income Account is a fixed-term investment, where the interest is paid as regular income.

The competitive interest rates are regularly paid to the account holder or the account of their choosing, and interest can compound annually, or be paid fortnightly, monthly, quarterly, or annually. There are no management or account keeping fees.

Everyday Banking

Bank Vic, a top mutual bank in Australia, offers many different Everyday Banking options. These transaction accounts provide value, as well as ease-of-use and convenience.

One option is the Anywhere S11, which is an account offering instant access to money from anywhere as well as free ATM withdrawals throughout Australia when a minimum of $1,000 per month is deposited.

With the EZPack account, it’s a combination of transaction account and savings account with a competitive interest rate. It also includes four free branch withdrawals per calendar month.

The Multipack account has no minimum balance, and transaction benefits to provide flexibility.

Related: NAB Review—Review of the Largest Bank in Australia—What Is NAB? Complaints, Fees, Reviews

Customs Bank Review

Ranked as a top building society in Australia or a top Australia mutual bank, Customs Bank is a modern financial institution including a community of members, directors, and staff. Customs strives to maintain a set of core values including a caring response to the needs of members, honoring excellence, and a sense of personal honesty and integrity.

Customs Bank always puts the needs of members at the forefront of their initiatives, including in their offering of valuable, competitive products and services. Customs Bank serves the needs of Australian Customs and Border Protection Service employees and is also affiliated with Police Bank.

Key Factors That Led Us to Rank This as a Top Building Society in Australia or a Top Australia Mutual Bank

During the process to compile this list of building societies in Australia and top Australia mutual banks, the following are reasons Customs was included.

Reduced Fees Program

The Reduced Fees Program from this top mutual bank in Australia offers members the opportunity to reduce or even eliminate transaction fees and charges.

The goal is to reward members for their loyalty, and to qualify, a member only needs to maintain a combined monthly balance of $5,000 or more worth of savings, investments, or loans. If they do that, they will receive fee-free ATM and EFTPOS transactions.

Additionally, if they meet those standards, they’ll qualify for fee rebates, and for more free personal cheques and external electronic periodical payments than other members would ordinarily.

Other Ways to Reduce Fees and Charges

In addition to the Reduced Fees Program, Customs Bank highlights many other ways members can reduce what they pay in fees and charges. Some of these include:

- Members without the Reduced Fees Program receive four free rediATM transactions every month

- Members receive 25 free EFTPOS transactions per month

- When a member pays bills with BPAY either through online banking or telephone banking, it’s free

- If a member transfers funds within or across their membership using the Redidial or online banking service, it’s free

- When the number of memberships someone has with Customs are consolidated, they save on transfer fees

- External transfers are available through online banking for free

Edvest

An exclusive service available to members of Customs, one of the best Australia mutual banks, is called Edvest. Edvest offers certain members advisory and financial services to help them secure the lifestyle they want. Edvest members are also eligible to receive discounts on other banking products and services.

For example, Edvest members can receive higher bonus interest rates on investment accounts and special exemptions on certain fees and charges. They receive discounts on insurance, independent financial advice from a Bridges Financial Planner, regular newsletters and invitations to social events.

The Edvest Redifund Plus Account is also exclusively available to Edvest members, and it includes a bonus interest rate above the Market Linked rate.

Customs Bank App

The Customs Bank app offers convenience and banking services on the go. Members can quickly check account balances, transfer funds, make BPay payments, and locate the nearest rediATM.

The app features iOS Touch ID login and the ability to make contactless payments using Visa payWave.

The Customs Bank Visa credit and debit cards can be added to Android Pay, and the mobile app can be used to change a PIN or report a lost or stolen Customs Bank Visa card.

Popular Article: Top Best Banks in New Jersey | Ranking and Reviews

Police Bank Review

When covering the top Australia building societies and the best Australia mutual banks, Police Bank is often at the top of the list in terms of member-owned banking. This top mutual bank in Australia describes itself as being secure and modern, offering access to a wide range of products.

Police Bank was originally established as NSW Police Credit Union in the 1960s by a group of Clarent Street police station officers in Sydney. It officially opened for business in 1964. Today, Police Bank is one of the largest and most successful financial institutions in Australia.

Key Factors That Enabled This to Rank as a Top Building Society in Australia or a Top Australia Mutual Bank

Key reasons Police Bank is part of this ranking of the best Australia building societies and top Australia mutual banks are named below.

Special Purpose Accounts

Sometimes consumers of a top Australia building society or mutual bank want not only a general savings account but also one that can be customised to their needs and suitable for specific purposes. Police Bank offers excellent options.

One such option is the Christmas Club account, which is designed to help people save for holiday spending without accruing large amounts of debt. It features convenient deposit options including salary deductions and maximised interest. Funds become available November 1, and they can be transferred to another Police Bank account, or they can remain in the Christmas Club account.

Also available is the Insurance Saver Account, which deducts a specified amount from the account holder’s salary and puts it into the account automatically until insurance payments are due.

Read More: Top Best Banks in Texas (Ranking & Review)

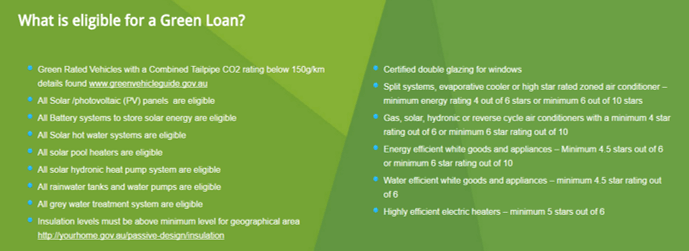

Green Loan

According to Police Bank, part of their mission is to do their part for sustainability, and they like to encourage members to do the same. As part of that mission, this top Australia mutual bank recently launched the Green Loan, which features a special low rate offered to members who borrow for a green initiative.

This can include things like solar hot water systems, rainwater tanks, green vehicles, or top energy-saving white goods.

Along with the discounted rate, the Green Loan is advantageous because it has a fixed rate, it helps members qualify for eligibility in the Reduced Fees Program, and there are no ongoing account-keeping fees.

Image Source: Police Bank

Transaction Accounts

A fundamental offering of a top Australia mutual bank or a top Australia building society is the transaction account.

The signature Easy Access transaction account from Police Bank is a day-to-day savings account that meets most basic banking requirements. Money is accessible via card or cheque, bill payments can be set up, and account holders can use Internet or phone banking.

The Easy Access account also features ATM and EFTPOS access and the option to add Credit Overdraft to the account.

Salary Packaging

Available from this top mutual bank in Australia is an option called Salary Packaging, which aims to help members reduce their income tax, car running costs, and increase the overall value of their pay-packet.

Rather than buying a car outright, the member would instead lease a car and pay the running costs through their salary package. This reduces the FBT liability over time.

Members of this top mutual bank in Australia can also arrange for independent salary packaging advice from a Bridges Financial Planner.

Related: Top Best Banks in Massachusetts | Ranking & Review

Victoria Teachers Mutual Bank Review

Victoria Teachers Mutual Bank, also commonly known as Vic Teachers Mutual Bank is a customer-owned organisation that works to provide members with an alternative to the Big 4. Victoria Teachers Mutual Bank provides strength, security, and constant value to members. Vic Teachers Mutual Bank is an Authorised Deposit-Taking Institution, protected in the same ways as other financial institutions.

Many of the members of the Vic Teachers Mutual Bank community work in education, but membership is ultimately open to anyone. The philosophy of Victoria Teachers Mutual Bank is to provide a fair deal and superior service to customers.

Key Factors That Led to the Ranking of This as a Top Australia Mutual Bank

Victoria Teachers Mutual Bank is part of this list of building societies in Australia and best Australia mutual banks for reasons like the ones listed below.

Savings Accounts

When reviewing and ultimately ranking the best Australia building societies and the top Australia mutual banks, a wide selection of products was important. Vic Teachers Mutual Bank excels in this area, among others. They have an extensive selection of most accounts, and, in particular, savings accounts.

Savings accounts include the Bonus Saver, which rewards regular savings contributions with additional interest, as well as the convenient and easy Online Saver with high returns and accessibility.

Also offered from Vic Teachers Mutual Bank are the First Saver for young people, the Cash Management account which rewards higher deposits with higher interest rates, and the Christmas Club.

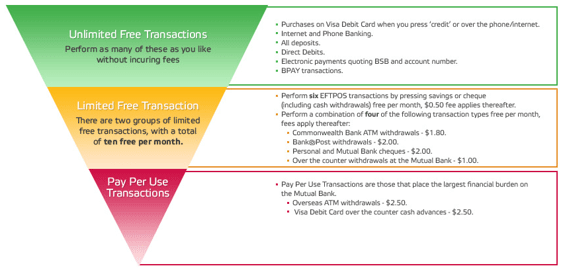

Transparent Transaction Fees

Critical to the philosophy of fairness that’s so essential in all that the Victoria Teachers Mutual Bank does, is a sense of transparency. Vic Teachers Mutual Bank strives not only to offer low, and in some cases no transaction fees, but they also explain all fees in a clear, straightforward way. Members of Vic Teachers Mutual Bank don’t feel blindsided or surprised by transaction fees.

Transactions at Victoria Teachers Mutual Bank are grouped into three categories, which include Unlimited Free Transactions, Limited Free Transactions, and Pay Per Use Transactions.

Vic Teachers Mutual Bank has created a chart outlining all fees, and they also provide transparency as to how members might avoid any fees by meeting certain criteria.

Image Source: Victoria Teachers Mutual Bank

Mobile Lenders

Victoria Teachers Mutual Bank offers a unique and convenient program called Mobile Lenders. Mobile Lenders from Vic Teachers Mutual Bank will go to the borrower, whether that’s at home or work in the metropolitan Melbourne area. Then, they will walk the member through buying or refinancing.

A Mobile Lender from Vic Teachers Mutual Bank can help the member determine which loan is right for their needs, help them with the application, and guide them through the settlement process.

Also available from Victoria Teachers Mutual Bank are Mobile Lenders that work by phone or Skype for regional customers.

Credit Cards

Members of Victoria Teachers Mutual Bank may be eligible to open a credit card account, and there are two main options available. The first credit card offered through Vic Teachers Mutual Bank is the Visa Platinum Card.

The Visa Platinum is convenient, and it features Visa privileges paired with an extremely low purchase interest rate. It also has a low annual fee, complimentary international travel insurance, and 24-hour Visa Concierge Service. The interest rate on purchases is the same as on balance transfers, there are no monthly administration fees, and repayment options are easy and flexible.

Also available from Vic Teachers Mutual Bank is the Visa Classic Card. This Victoria Teachers Mutual Bank credit card is designed to be affordable with a low interest rate, no annual fee, and up to 55 days interest-free. The card can be used with no monthly administration fees, approval time is fast, and it includes Visa payWave contactless features.

Don’t Miss: Top Best Online Banks | Ranking & Comparison Review

Conclusion—Top Australia Mutual Banks and the Best Australia Building Societies

What is so appealing to consumers when they’re considering the top Australia mutual banks like Victoria Teachers Mutual Bank or Heritage Bank? It’s likely a few different things that come into play and continue to draw consumers toward these unique financial institutions.

Image Source: Pexels

Image Source: Pexels

One reason? The freedom and sense of choice that comes with banking with a customer-owned institution.

Each of the names on this list of building societies in Australia and the best Australia mutual banks is not owned by outside shareholders. Instead, the power is in the hands of the account holders.

Also unique about the best Australia building societies and top Australia mutual banks is their dedication to responsible lending, ethical practices, and a commitment to serving the needs of members and the community. All of these things are then paired with benefits like higher interest rates on savings accounts and lower fees on transaction accounts.

These are the reasons top Australia mutual banks and top Australia building societies continue to grow their membership and thrive in the financial sector.

Popular Article: Top Best Banks in Washington ( Ranking & Review)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.