Getting Great Chicago CD Rates for Consumers with Good-to-Great Credit Scores

Are you in the market for the best certificate of deposit (CD) account rates? If you live in Chicago or near the Chicago area, you’ve come to the right place.

At AdvisoryHQ, we understand the importance of conducting smart, thorough research on CD rates in the Chicago area.

Below, please find expert tips on how to get the best rate of return on your hard-earned savings.

Are you in the market for a high yield account and searching for the best CD rates in Chicago?

Or, are you looking for the highest Chicago CD rates for 1-month, 3-month, 6-month, 9-month, 1-year, 2-year, 3-year, or 5-year jumbo CDs?

Luckily, Chicago residents have plenty of savings products to choose from to meet a variety of savings needs. No matter what type of financial product you are interested in, it’s important to find the best rates to ensure that your savings can grow.

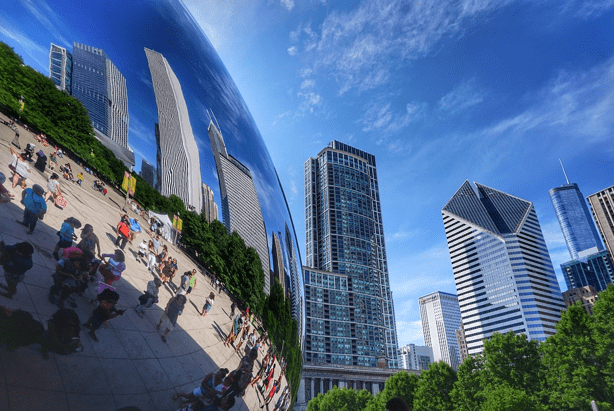

Chicago, IL

First Time Home Buyers in Ohio | Best Rates & Programs for Ohio First Time Home Buyers

First Time Home Buyers in Wyoming | Best Rates for Wyoming First Time Home Buyers

Largest City in Illinois

With an estimated population of 2.7 million, Chicago is the single largest city in Illinois. In fact, its high population makes Chicago the third-largest city across the entire United States after New York City and Los Angeles.

With so many people living in the same area, there are plenty of financial services firms competing to provide the best CD rates in the Chicago area.

For this reason, it’s extremely important to compare multiple offers for Chicago CDs rather than choosing the first one you find. Not only is there plenty of competition for the best CD rates in Chicago, but rates for Chicago CDs are constantly in a state of flux.

In fact, interest rates change so often that the current CD rates in Chicago could easily change by tomorrow or the following week.

First Time Home Buyers in Delaware | Best Loans for Delaware First Time Home Buyers

First Time Home Buyers in Montana | Best Loans for Montana First Time Home Buyers

Tips for Getting the Best CD Rates in Chicago

Across the nation and in Chicago, CD rates are increasing, especially those that are offered by online banks.

Often providing more in returns than a savings account, certificates of deposit are popular savings products for Chicago residents, but it’s important to choose the right savings products and rates for your unique financial needs.

Read on to find tips for getting the best CD rates in Chicago to help your savings grow.

Know Your Finances

Before taking out Chicago CDs, you’ll want to know exactly how much you can afford to set aside.

Some savings products and CD rates in Chicago will have minimum balance requirements, so the amount of cash you can set aside may play a large role in which CD you choose.

Keep in mind that any money put into a CD won’t be liquid for at least one year—or more—so you’ll want to have a good handle on your finances before adding Chicago CDs to your savings.

Compare Multiple Products

When looking for the best CD rates in Chicago, your local bank is a good place to start, but it should not be an end-all solution.

With the rise of online banking, there are plenty of online banks offering competitive Chicago CD rates, often providing better rates than brick-and-mortar banks.

Credit unions are also great resources for CD rates in Chicago, since they operate as not-for-profit organizations and can often offer better rates as a result.

Look for Promotional Chicago CD Rates

The benefit to having local banks and credit unions to choose from is that these financial institutions often have promotions or special rates on CDs.

Some examples of potential discounts on Chicago CD rates include:

- Larger deposits

- Switching to electronic statements

- Senior citizens

- Veterans

- Residents of a specific county or city

First Time Home Buyers in Rhode Island | Best Loans for RI First Time Home Buyers

First Time Home Buyers in NH | Best Loans for New Hampshire First Time Home Buyers

Conclusion: Finding the Top CD Rates that Chicago Has to Offer

Keep in mind that, in most cases, you won’t be able to withdraw funds from a CD until the account has matured, which may cause a problem for consumers that want liquidity.

At the same time, however, a CD is an ideal option for those who struggle with depleting their savings accounts before they have a chance to grow it.

Consider your financial goals, your current savings plan, and the best Chicago rates on financial products to determine whether investing in Chicago CDs is the right decision for your financial goals.

First Time Home Buyers in New Jersey | Best Rates for New Jersey First Time Home Buyers

Current Mortgage Rates in Kansas | Best KS Mortgage Rates for Good-Excellent Credit Borrowers

CD, Savings and MMA Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the rate table(s) displayed on this page.

Image source:

https://pixabay.com/en/chicago-mirror-image-bean-cloud-2756595/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.