2020-2021 RANKING & REVIEWS

BEST FINANCIAL ADVISORS IN LOS ANGELES

Intro: How to Find the Best Financial Advisors in Los Angeles, CA

One thing that people from all walks of life have in common is the need for a solid financial foundation from which you can chart a successful future. If you live in Southern California, that likely means seeking out the top wealth managers and investment firms in Los Angeles for assistance.

Whether you’re saving to open your own restaurant, or trying to plan for an active and comfortable retirement, a good financial advisor in Los Angeles is a key ally to have on your side.

The best asset management firms in Los Angeles can help you create savings and investment strategies that will help you reach your future goals. For many firms, it’s all about helping you build the life you want and mitigating risk along the way.

However, the firm you choose is important. You don’t want to just pick the first Los Angeles wealth manager that comes up in a Google search. Finding the best LA financial planner for your needs takes some in-depth research.

As you begin looking at wealth management firms in Los Angeles, California, you’ll find several key differences between them. Those differences can determine whether a firm is a good match for your needs.

Differentiating factors to look at when choosing a financial planner in Los Angeles are:

- The minimum investible asset level they work with

- Clientele specialties (retirees, executives, etc.)

- What their fee structure is

- The range of services they offer

Learning the most you can about a potential Los Angeles investment management firm will help you make a more informed choice. But doing all the research yourself can take a lot of time. That’s why we made your search for the perfect financial advisor in Los Angeles easier.

The AdvisoryHQ Team researches the top financial advisors and wealth management firms in Los Angeles (as well as other cities in the US and UK) every year and puts together comprehensive lists just for you.

We highlight the reasons they’ve been chosen as top-rated wealth management firms, what makes each firm stand out, the type of clients they serve, and much more.

If you’ve been meaning to look into financial management and are interested in the best financial advisors in Los Angeles, you’ll find a detailed review of several top-rated firms that are worth considering in 2020-2021.

Award Emblem: Top 12 Best Financial Advisors in Los Angeles, CA

Award Emblem: Top 12 Best Financial Advisors in Los Angeles, CA

Top 12 Financial Advisors and Wealth Managers in Los Angeles, CA | Brief Comparison & Ranking

| Best Financial Advisors in Los Angeles | 2020-2021 Ratings |

| Abacus Wealth Partners | 5 |

| ACap Advisors & Accountants | 5 |

| AdvicePeriod | 5 |

| Aspiriant | 5 |

| EP Wealth Advisors | 5 |

| Harris Financial Advisors | 5 |

| HCR Wealth Advisors | 5 |

| Miracle Mile Advisors | 5 |

| Navigoe | 5 |

| Westmount Asset Management | 5 |

| Your Wealth Effect | 5 |

| L&S Advisors | 3 |

Table: Top 12 Best Financial Advisors in Los Angeles | Above list is sorted by rating

See Also: Top Wealth Management Firms in Florida

Should I Choose Fee-Based or Fee-Only Financial Management Firms in Los Angeles?

When looking over fees and compensation for financial advisors in Los Angeles, you’ll come across two main operating methods: “fee-only,” or “fee-based.”

Unless you’re familiar with those two terms, it can be confusing to know exactly what the difference is. They sound similar, but there is a very important distinction between them. It could make all the difference in choosing a wealth management firm in Los Angeles, CA.

Fee-Only Financial Advisors

If an LA financial advisor says they are fee-only, that means that they are only compensated by client fees and do not accept any commissions from third parties for selling or recommending financial products.

Operating on a fee-only payment structure adds an additional layer of trust to the financial advisor and client relationship. It minimizes any potential conflicts of interest that could come from earning commissions on financial products.

If you’re working with a fee-only financial planner in Los Angeles, you won’t have to wonder if they’re recommending a particular investment because of a potential commission.

Fee-Based Financial Advisors

Financial firms that are fee-based receive some of their compensation from client fees but also are free to accept third-party commissions from companies providing financial products.

Being fee-based can create a potential conflict of interest, or at the very least, the perception of such a conflict. For that reason, many fee-based firms are also fiduciaries.

A Los Angeles financial planner that is a fiduciary is legally obligated to fully disclose any conflicts of interest, to be completely transparent, and to put the interests of their clients ahead of their own. This legal commitment helps counteract any potential conflicts of interest.

Both fee-only and fee-based asset management firms in Los Angeles can be fiduciaries.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

2020-2021 AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review — Top Ranking Financial Advisors in Los Angeles

Below, please find the detailed review of each firm on our 2020-2021 list of the best financial planners in Los Angeles. We have highlighted some of the factors that allowed these Los Angeles wealth management firms to score so high in our selection ranking.

Click any of the names below to go directly to the review section for that firm.

- Abacus Wealth Partners

- ACap Advisors & Accountants

- AdvicePeriod

- Aspiriant

- EP Wealth Advisors

- Harris Financial Advisors

- HCR Wealth Advisors

- Miracle Mile Advisors

- Navigoe

- Westmount Asset Management, LLC

- Your Wealth Effect

- L&S Advisors

Click below for previous years’ rankings:

- 2019 Review: Top 11 Best Financial Advisors & Wealth Management Firms in Los Angeles, CA

- 2018 Review: Top 10 Best Financial Advisors & Wealth Management Firms in Los Angeles, CA

- 2017 Review: Top 9 Best Financial Advisors in Los Angeles

- 2016 Review: Top 9 Best Financial Advisors in Los Angeles

Don’t Miss: Best Financial Advisors in San Francisco

Abacus Wealth Partners Review

With the stated goal of expanding what’s possible with money, Abacus Wealth Partners is a top Los Angeles wealth manager that focuses on aligning a client’s finances with their values so that they can lead a more fulfilling life.

The firm has four locations in Southern California, two in Northern California, and one in Philadelphia. It serves clients in 42 states.

This top Los Angeles financial advisor is fee-only and is also a fiduciary. Abacus is a founding B Corp member, which means it meets the highest standards of verified social and environmental performance, transparency, and that it balances profit and purpose.

This Los Angeles wealth management firm serves all types of financial needs, helping clients budget for college, plan for retirement, or even navigate an intergenerational wealth or business ownership transfer.

Key Factors That Enabled Abacus Wealth Partners to Rank as One of the Top Los Angeles Financial Advisors

Caring Team with Their Own Stories

One constant on the Abacus team is that each member truly cares about building relationships with their clients and getting to know them so they can better facilitate their financial aspirations.

Abacus is comprised of 39 financial advisors and team members with diverse backgrounds and experience. Each is an innovator and focused on expanding the potential of its clients.

If you enjoy getting to know the wealth manager that you’re working with a bit better, you’ll appreciate the approach of the Abacus team.

Each member of this team of dedicated Los Angeles financial advisors has their own personal story and reason they decided to pursue a career in this area. You can read through them all on their website and get an up-close and personal look at each advisor.

2020-2021 Ranking: Top Financial Advisors in Los Angeles

Comprehensive Financial Planning

Abacus takes a flexible and uncomplicated approach to wealth management. The firm’s advisors believe that financial plans need to be able to handle all of life’s expected and unexpected changes.

This wealth management firm in Los Angeles uses a financial planning process that prioritizes a client’s life events, taking into account all of life’s changes when creating a client’s roadmap to financial success.

Whether life brings new risks or opportunities, this Los Angeles investment management firm ensures your plan can evolve and will be there to support -your ever-changing financial situations.

Abacus Wealth Partners will draft a plan that encompasses the six key areas of financial planning:

- Death

- Goals

- Impact

- Money

- Safety

- Taxes

Rating Summary

Abacus Wealth Partners offers clients of all types and income levels a simple and effective wealth management process. These Los Angeles financial planners also put a premium on truly getting to know their clients and building long-term relationships.

This fee-only Los Angeles wealth management firm also emphasizes financial education that helps clients alleviate the stress normally associated with finances. The firm offers audio Money Meditations and informative blog articles on multiple financial subjects.

Abacus Wealth Partners is not only dedicated to serving its clients but also to sustainability and making a positive difference. It is one of the top-rated Los Angeles financial advisors to consider working with, and has earned a 5-star rating.

ACap Advisors & Accountants Review

Taking a holistic approach to wealth management, ACap Advisors & Accountants is a boutique wealth management firm in Los Angeles that also provides accounting services.

The firm was founded in 2009 and is both fee-only and a fiduciary. The advisors at this top Los Angeles investment management and accounting firm also specialize in working with medical professionals.

The team of advisors at ACap is committed to providing the unbiased and comprehensive financial guidance, eliminating financial anxiety, and giving personalized service.

Key Factors That Enabled ACap Advisors & Accountants to Rank as One of the Top Los Angeles Financial Advisors

Socially Responsible Investing

Some investors appreciate the opportunity to invest in a way that is both socially conscious and financially sound. ACap is a Los Angeles financial advisory firm that facilitates socially responsible investing and keeps a client’s core values in mind while doing so.

Clients who wish to use their wealth and investment strategies to better their community and the world at large can work with ACap’s top-rated financial advisors in Los Angeles to create a customized portfolio that accomplishes both their financial and social goals.

Personalized Bookkeeping & Payroll

Accounting is a large part of managing finances, so working with a financial advisory firm in Los Angeles that can also handle your bookkeeping is a real benefit. It’s an advantage that makes ACap stand out among other investment firms in Los Angeles.

ACap’s advisors & accountants can set up, manage, and maintain your QuickBooks Online file, handling all entries and monthly reconciliations for both your bank and credit card statements.

If you have employees on the payroll, this Los Angeles wealth management firm can also help with payroll services. This includes processing and tracking all relevant payroll data and submitting federal and state tax payments.

Top-Rated Wealth Management, Los Angeles

Rating Summary

ACap takes a methodical approach to investment planning that doesn’t rely on speculation. With the combination of both accounting and wealth management in Los Angeles, this full-service firm has a lot to offer everyone (and especially those in the healthcare industry.)

With a commitment to personalized service, social responsibility, and providing unbiased, comprehensive advice, ACap Advisors & Accountants is awarded a 5-star rating as a top Los Angeles financial advisor to consider partnering with in 2020-2021.

Popular Article: Top Financial Advisors in Charlotte & Asheville, NC

AdvicePeriod Review

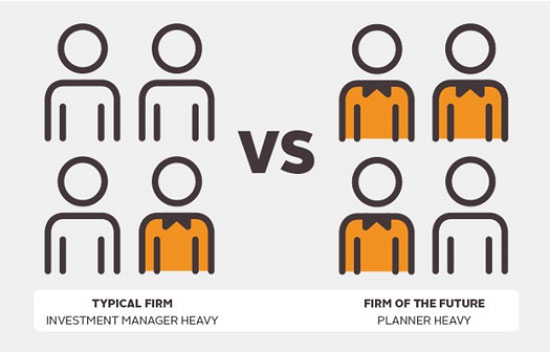

AdvicePeriod has a proud history of disrupting the Los Angeles wealth management and financial service industry. Many of the firm’s team members developed the “gold standard” practices used widely in the financial industry today.

These Los Angeles financial planners boast 27 advisors and 13 offices spread across 10 states. The firm focuses on providing value and helping its clients sleep easier at night.

AdvicePeriod is a fee-only wealth management firm in Los Angeles. It is also a fiduciary, upholding values of transparency and always putting the client’s needs before those of the firm or its advisors.

Key Factors That Enabled AdvicePeriod to Rank as a Top Wealth Management Firm in Los Angeles

Innovating Fiduciary Financial Advisors

As a self-described team of “mavericks,” the advisors at this Los Angeles wealth management firm are always innovating. They have a history of being change-makers and continuing to push boundaries to achieve the next big breakthrough.

This Los Angeles financial planning firm is a fiduciary that has always adopted a stance of putting its client’s interests first. The firm’s team also takes a proactive approach with financial planning that simplifies the process.

Its team of financial advisors in Los Angeles holds itself to a standard of conduct that is centered on trust, ensuring that their clients are happy to have AdvicePeriod as their financial advisor.

Comprehensive Wealth Planning

With a unique mix of experience and expertise, AdvicePeriod says clients will see the difference from their first meeting.

These Los Angeles financial advisors tailor their solutions to each client’s unique needs and take a value-based approach. The advisors at AdvicePeriod work to deliver institutional-quality advice to high-net-worth families.

Here is an overview of general services you can expect from this Los Angeles wealth management firm:

- Trust and estate planning

- Bill pay and financial reporting

- Retirement planning

- Portfolio tax minimization

- Guidance on philanthropy

- Risk management

Best Financial Advisors in Los Angeles, CA

Rating Summary

As one of the top financial advisors in Los Angeles, the firm has always charted its own path and blazed a trail for others in the industry.

You’ll immediately see the difference between this firm and other Los Angeles wealth management firms when you visit its website, which is a combination of bold, comprehensive, and inviting.

With a trailblazing reputation and a client-centric team that’s heavy on experience, AdvicePeriod scores a 5-star rating as a top choice for wealth management in Los Angeles in 2020-2021.

Aspiriant Review

Aspiriant is a top-rated financial advisor in Los Angeles, delivering an innovative business model and consistent wealth management experience.

The firm is a fee-only financial advisor planner in Los Angeles with a team of experts in 11 offices that span coast to coast.

As a top-rated financial advisor in Los Angeles, Aspiriant creates a unique experience for its clients. Its model is designed to make them feel loved, powerful, far-sighted, and, above all, rich.

Key Factors That Enabled Aspiriant to Rank as One of the Top Financial Advisors in Los Angeles

Investing & Wealth Planning

Aspiriant is a financial planner in Los Angeles that knows that offering the best financial guidance to its clients involves robust in-house research, serious rigor, heavy analytical firepower, and a complete commitment to innovation.

The Los Angeles financial advisors at Aspiriant help clients craft a financial strategy that puts them on a successful path toward their future goals. Whether that means early retirement or loan-free education funding, it’s done in a way that doesn’t risk your financial present.

This Los Angeles investment management firm will help you answer questions like:

- Is it feasible for me to leave a lucrative career and pursue my passions?

- If I live to be 100 (or older!) will I have enough income for my long life?

- Would my family be okay if something happened to me?

- Will I have enough money if the market takes a serious downturn?

Exclusive Family Office

Aspiriant’s exclusive family office services are designed to make what can be an overwhelming experience feel simple and streamlined to provide their clients with a feeling of calm and control.

The Los Angeles financial advisors at Aspiriant working in the family office area number 35, and are experts in all areas of financial planning, such as taxes, estate planning, retirement, investments, bill pay, real estate, philanthropy, and budgeting.

This top-rated wealth management firm in Los Angeles helps clients handle a variety of life situations, such as:

- Buying a house: Getting a mortgage, weighing insurance options

- Remodeling a home: Running the project, managing the renovation expenses, finding insurance, and monitoring cash flow

- Prepping children for college: Training them to manage a portion of their own investment portfolio, teaching them to maintain a checking account, and helping them select health insurance

- Philanthropic planning: Aligning client giving with their values, helping them choose between a simple structure or a private foundation

2020-2021’s Ranking of Top Financial Planners in Los Angeles, CA

Rating Summary

As top-rated Los Angeles financial planners, Aspiriant takes a completely unique approach to financial management. The firm’s advisors believe in empowering their clients to make them feel not only more financially secure, but also appreciated and in control.

For those looking for family office services, this is one of the best asset management firms in Los Angeles to consider. The team’s entire goal is to make their clients feel completely comforted and at peace, confident that everything is being expertly handled.

With a client-first focus and a talented team of innovators, Aspiriant is awarded a 5-star rating as a top Los Angeles financial advisor to consider partnering with in 2020-2021.

Read More: Financial Advisors in Boston, MA | Rankings

EP Wealth Advisors Review

A desire to create a better financial model than the one used by Wall Street led to the founding of EP Wealth Advisors. The firm provides financial planning and wealth management in Los Angeles and has 14 offices in total throughout the country.

EP Wealth Advisors is a fee-only firm that is also a fiduciary. Its advisors take a holistic approach to wealth management, understanding that portfolio performance is only one part of a successful financial strategy.

This is one of the top investment firms in Los Angeles to work with if you believe in financial literacy. This is one of the key areas of focus for EP Wealth Advisors.

Key Factors That Enabled EP Wealth Advisors to Rank as One of the Top Financial Advisors in Los Angeles

“Investing in Women” Initiative

Championing a formerly underserved segment when it comes to financial planning, EP Wealth Advisors started its “Investing in Women” initiative to give women the right tools and pathways to grow their careers.

Women often outlive their male counterparts and have other unique situations that make their financial planning needs distinct.

This Los Angeles financial planner’s mission is to empower women and help them plan for a successful financial future. The strategy is summarized in their “Three C’s”:

- Colleagues: Promoting a workplace culture where women can participate and contribute thoughts and ideas openly

- Clients: Using an inclusive approach to financial management, the firm’s advisors help clients truly understand their portfolio

- Community: The firm’s focus on Community includes speaking at national conferences and educating younger generations on the importance of financial literacy

202o Ranking: Best Financial Planners in Los Angeles, CA

Financial Planning Made Easy

When you first begin working with a financial advisory firm in Los Angeles, it can be overwhelming. Searching “wealth management Los Angeles” is just the first step in a long process.

New investors, or anyone else who wants to have a less complex experience, will appreciate the financial planning approach of EP Wealth Advisors.

The firm works to simplify the entire process into four steps that are easy for clients to digest:

- Simplify comes first, which is the consolidation of all your financial documentation into one place.

- Next is Integrate, where the firm’s advisors evaluate your current financial situation from a big-picture perspective.

- Forecast is the next step, where you’ll receive a financial probability analysis in relation to your goals.

- The last step is Prioritize, at which point you’ll be given a recommendation on how to best achieve your financial goals.

Rating Summary

EP Wealth Advisors offers an integrated approach to financial planning that includes looking at your unique financial situation and planning for potential changes. This large team is also well-credentialed and experienced.

As a top financial advisor in Los Angeles, the firm’s “Investing in Women” initiative and focus on financial literacy are both features that make it stand out from the competition.

With an uncomplicated, straight-forward approach and a fiduciary commitment to always put its clients’ best interests first, EP Wealth Advisors earns a 5-star rating as one of the best Los Angeles wealth management firms to consider in 2020-2021.

Harris Financial Advisors Review

Founded in 1992, Harris Financial Advisors is centered on fulfilling its clients’ aspirations and providing advanced financial planning and wealth management in Los Angeles.

Harris Financial is an independent, fee-based Los Angeles wealth manager that is based in Torrance, California. The firm is also a fiduciary, which means it upholds a legal obligation of complete transparency to put its client’s best interests first.

As one of the top financial planners in Los Angeles, the firm was founded with the goal of bringing integrity to the financial lives of its clients. The firm’s advisors work to help clients create security and financial independence.

Key Factors That Enabled Harris Financial Advisors to Rank as One of the Top Financial Advisors in Los Angeles

Financial Planning for Women in Transition

As times have changed, so have the financial management needs of women. Today’s women are accomplishing more than ever, earning higher salaries, and becoming household breadwinners. Unexpected situations can often come up and upend even the best-laid plans.

As a top wealth manager in Los Angeles, Harris Financial Advisors provides support and guidance to women in transition going through any number of financial challenges, including:

- Inheritance

- Retirement

- Loss of a loved one

- Career change

- Divorce

- Relocation

It is worth noting that this focus on providing expert financial services for women is by design. This top financial planner in Los Angeles was founded by Mary Harris, CFP®, a single mom of two children, who recognized the need for the financial empowerment of women decades ago.

Best Wealth Management Firms in Los Angeles 2020-2021

Structured Financial Planning Process

The team at Harris Financial Advisors uses an organized and structured financial management process to ensure the most productive and personalized financial plan for their clients.

The firm refers to its process as a sophisticated wealth management strategy. It’s designed to include the elements needed to build confidence and security about your financial path forward.

While partnering with this top wealth management firm in Los Angeles, you can benefit from:

- Organization — Bringing order to your financial life and taking care of everything

- Accountability — The help you need to follow through on financial goals

- Objectivity — A fresh, third-party point of view to help you avoid emotionally-driven decisions

- Proactivity — Anticipating transitions and ensuring you’re prepared to navigate whatever comes your way

- Education — Providing clients with the knowledge they need to make smart decisions

- Partnership — Not just working for you, but with you, to help you accomplish your goals

Rating Summary

With a focus on women in transition, retirees, executives, business owners, and non-profits, Harris Financial Advisors offers integrated and comprehensive wealth management services that are designed solely around its clients’ needs.

With multiple financial resources and a drive to empower its clients to take charge of their financial future, Harris Financial Advisors earns a 5-star rating as one of the best Los Angeles financial planners to consider partnering with in 2020-2021.

Related: Reviews of Top Wealth Management Firms in Houston, TX

HCR Wealth Advisors Review

With a reputation for objectivity and empathy, HCR Wealth Advisors brings a unique perspective to the financial planning industry. This top financial planning firm in Los Angeles was founded in 1988 and provides independent and comprehensive services.

HCR does not specifically state whether the firm is fee-only or fee-based on its website. However, its ADV notes that individuals working for the firm may receive commissions. This points to a fee-based structure, at least for some representatives.

Given that, it’s important to note that the firm offers financial guidance as a fiduciary, which means its expert advisors operate in the best interests of their clients at all times.

This top Los Angeles financial planner works with high-net-worth families, athletes, business owners, divorcees, and retirees.

Key Factors That Enabled HCR Wealth Advisors to Rank as One of the Top Financial Advisors in Los Angeles

Guidance Through All Life’s Transitions

HCR’s team of top-rated Los Angeles financial advisors understand that life is full of surprises. These can come in the form of life transitions as well as unpredictable turns in the financial markets. The aim of the firm’s expert advisors is to help clients be ready to face and overcome all of life’s challenges with a sound financial strategy.

The firm’s strategy is to look at your investments, retirement plans, and financial targets to give you a plan that evolves along with your life. They’ll offer a plan that is built to handle transitions such as:

- Marriage

- Divorce

- Inheritance

- Retirement

- Loss of a loved one

- Selling a business

- Starting a business

- Sudden and significant influx of assets

The Clarity Formula™

While everyone walks their own unique path in life, there are certain financial considerations that remain a constant.

The innovative Los Angeles financial advisors at HCR Wealth Advisors help bring all those financial considerations together in The Clarity Formula™. This formula is designed to encompass all the steps that clients will encounter on their journey to financial success.

The steps laid out by this Los Angeles wealth management firm, include:

- Financial Planning (retirement planning, budgeting, net worth analysis, etc.)

- Investment Management (portfolio management, market research, etc.)

- Estate Planning (trust review, legacy planning, etc.)

- Risk Management (insurance review, personal coverage review, etc.)

- Tax Strategies (year-end tax loss harvesting, retirement plan optimization, etc.)

- Cash Management (cash flow analysis, debt structuring, etc.)

- Philanthropy (charitable giving, donor-advised funds, etc.)

- Value-Added Services (thought leadership, business consulting, etc.)

Top-Rated Wealth Management Los Angeles

Rating Summary

HCR Wealth Advisors offers a holistic and comprehensive approach to wealth management and financial planning. Its transparent process includes just about everything that anyone looking for the best financial advisor in Los Angeles would need.

With a focus on resilient financial planning that takes all life factors into consideration, HCR Wealth Advisors is awarded a 5-star rating and is one of the top Los Angeles financial advisors to consider in 2020-2021.

See Also: Top Financial Advisors in New Jersey

Miracle Mile Advisors Review

Offering sophisticated and comprehensive financial management, Miracle Mile Advisors is a top-rated Los Angeles wealth management firm founded by ex-Wall Street advisors who wanted to create something better.

Miracle Mile is a fee-only wealth management firm in Los Angeles that also operates as a fiduciary. The firm specializes in working with high-net-worth families, individuals, and businesses, and has two offices – one in Los Angeles and one in Newport Beach.

Key Factors That Enabled Miracle Mile Advisors to Rank as One of the Top Financial Advisors in Los Angeles

Elegantly Simple Portfolio Management

Miracle Mile Advisors has innovated several investing processes to increase the value of client investments while mitigating risk. This Los Angeles wealth management firm’s approach includes bringing simplicity to a normally complex process.

The portfolio management process that clients can expect from the Los Angeles financial advisors at Miracle Mile includes:

- Macro Overview: Extensive macro-economic research, forecast return expectations across global markets, creation of confidence intervals

- Asset Allocation: Creation of specific allocations based upon the macro-economic outlook, portfolio optimization for client risk tolerance, opportunistically allocated portfolios

- Portfolio Design: Identify ideal underlying investments, use proprietary characteristics to implement selections, monitor investment exposures

- Tax Optimization: Select tax-efficient investments, implement ongoing tax-loss harvesting, analyze portfolio metrics

- Implementation & Monitoring: Take a phased implementation approach, monitor key macro-economic indicators, daily holdings monitoring, rebalance as needed

2020-2021’s Top-Rated Financial Planners in Los Angeles, CA

Customized Planning Services

The team at Miracle Mile Advisors tailors their plans to each client because they feel that no two plans should be exactly alike. While the basic foundations of good wealth management may remain the same, the firm’s advisors believe that how they’re applied should reflect the specific lifestyle and financial goals of each person.

This top-rated Los Angeles wealth management firm helps clients anticipate and solidify their financial plan to include resiliency for any of life’s major events such as:

- Retirement

- Births

- Injury or illness

- Education

- Marriage

- Divorce

Rating Summary

Financial peace of mind is at the heart of the guidance that Miracle Mile Advisors provides its clients. The firm has also consistently garnered industry recognition from publications such as Forbes and Barron’s.

One unique feature that sets this firm apart from other investment firms in Los Angeles is the roll-over photos included on its team listing. The photos show a unique side of each staff member, helping clients get a more personal glimpse into the professionals they’ll be working with.

With a diligent investment process that looks at all potential factors and a client-centric attitude, Miracle Mile Advisors scores a 5-star rating as one of the best financial advisors in Los Angeles to consider partnering with in 2020-2021.

Don’t Miss: Reviews of Best Financial Advisors in Phoenix & Scottsdale, AZ

Navigoe Review

A truly full-service financial planning firm, Navigoe was started to offer a more client-centric form of wealth management than what was being offered back in the early 1990’s. The firm is based in Redondo Beach, CA, and serves clients throughout the LA area as well as in other states.

This fee-only Los Angeles wealth management firm is also a fiduciary. The firm works with a variety of clients, including those nearing or in retirement, working professionals, those going through life transitions, and business owners.

Key Factors That Enabled Navigoe to Rank as One of the Top Financial Advisors in Los Angeles

Personalized, Client-Centric Process

Choosing the right financial advisor in Los Angeles can be a process. Navigoe advisors believe it’s vital that each client and their financial advisor are on the same page, so they always begin with 3-5 meetings to gain an in-depth understanding of each client’s financial goals and needs.

This top-rated financial advisor in Los Angeles has an education-based process designed to help each client understand all financial decisions and how they may impact their future.

‘Navigo’ means to sail, navigate, and travel by sea in Latin, so you’ll see a nautical theme throughout the firm’s site. Its client-centric introductory process includes:

- Introductory Meeting to Meet the Crew

- Discovery Meeting to Prepare for the Voyage

- Charting the Course

- Getting Ready to Set Sail

Fee-Only Pricing & Fiduciary Commitment

Navigoe represents the highest standards of ethics and best practices among Los Angeles financial planning firms. Its fee-only pricing structure instills trust that clients will receive completely objective advice, free from any conflicts of interest due to commissions or referral income.

As a fiduciary, the Los Angeles financial advisors at Navigoe are legally obligated to put their clients’ best interests ahead of all else. This offers a foundation of trust and transparency between advisors and their clients.

Navigoe maintains an active membership with professional organizations such as:

- National Association of Personal Financial Advisors (NAPFA)

- Financial Planning Association (FPA)

- Fee-Only Network

2020-2021 Ranking: Best Financial Advisors in Los Angeles

Rating Summary

Navigoe’s advisors believe in working closely with their clients to help them achieve their financial dreams. Rather than just setting clients afloat in the right direction, they come on board with you as your navigator. Relationship building and personalized service are both hallmarks of these Los Angeles financial advisors.

With a completely unique style and client-dedicated approach to financial management, Navigoe earns a 5-star rating as one of the best Los Angeles financial planners to consider working with in 2020-2021.

Westmount Asset Management, LLC Review

Founded in 1990, Westmount Asset Management, LLC is a leading independent investment firm serving high-net-worth families, pensions and nonprofits throughout Southern California.

For over 30 years, Westmount has positioned itself as an innovative advisory firm that eschews conventional tactics for a more flexible, personalized experience. Many of the principles adopted by the firm at its founding have since evolved into industry standards. Westmount’s website, for example, mentions that it was one of the first firms to adopt the fiduciary advisor model “that eliminated commissions – and conflicts of interest.”

Westmount is a fee-only advisor, though we always recommend confirming fee structure with a firm before contracting their services.

Key Factors That Enabled Westmount Asset Management, LLC to Rank as One of the Top Wealth Management Firms in Los Angeles

Approach to Investing

Westmount’s advisory team uses a highly personalized methodology to understand each client’s financial situation and goals. Westmount then uses that information to develop a customized portfolio and asset allocation that aligns tightly with those goals.

Westmount outlines its investment approach by describing the five fundamental tenants its advisors follow:

- They never stop looking for high-quality investment opportunities that will add value to their clients’ portfolios.

- They adhere to conventional wisdom, but not rigidly.

- They have deep expertise in alternative strategies that can potentially complement more traditional holdings like stocks and bonds.

- They (mostly) invest for the long-term but remain flexible in order to take advantage of short-term opportunities that may enhance returns or reduce risk in client portfolios.

- They recognize investors are increasingly demanding access to investments that can deliver both financial returns and positive social change.

Context Driven Approach to Financial Planning

The best investment advice has context, according to this top-rated financial planning firm in Los Angeles. This context entails understanding all the facets of a client’s life as well as the investment marketplace.

The “dig deep” philosophy of this wealth management firm in Los Angeles allows its advisors to completely understand each client’s needs, wants and dreams so they can design the perfect financial strategy for their future. For that reason, Westmount offers a full suite of financial planning services at no additional charge for its clients.

Westmount’s financial planning process:

- Uses sophisticated modeling software to create a financial roadmap that helps visualize future financial scenarios.

- Helps answer important questions about Social Security and Medicare options, retirement trajectories, funding future education for children or grandchildren, and more.

- Offers clarity and organization around the client’s entire wealth picture, including their investments, charitable intentions, and multigenerational planning concerns.

- Involves the client’s other financial experts to provide a holistic financial experience and seamless execution of the plan.

For those investors who like to feel heard by their Los Angeles financial planners, Westmount will be a perfect fit. The firm’s advisors put a premium on getting to know their clients’ lives so they can offer a personalized financial roadmap to get them where they need to go.

With a diligent process for wealth management and financial planning and a pioneering spirit, Westmount Asset Management earns a 5-star rating as one of the best financial advisors in Los Angeles to consider working with in 2020-2021.

Popular Article: Ranking and Reviews of Best Financial Advisors in San Diego

Your Wealth Effect Review

Your Wealth Effect is a top-rated financial advisor in Los Angeles that has grown over the last decade to manage $1 billion in client assets. The firm’s advisors put an emphasis on client communications, which helps everyone make better, more informed decisions.

This Los Angeles asset management firm is part of the Wells Fargo Advisors Financial Network. It focuses on retirement planning and has three main specialties: 401(k)s, 401(k) participants, and people approaching retirement.

Your Wealth Effect offers its clients an option to choose between fee-based or traditional commission transaction arrangements depending on their preference. As always, we recommend confirming the fee structure with any advisor in advance of working with them.

Key Factors That Enabled Your Wealth Effect to Rank as One of the Top Wealth Management Firms in Los Angeles

Experienced & Credentialed Team

Your Wealth Effect has a team of 12 experienced financial advisors, many of them with industry certifications. Certifications give clients peace of mind that advisors are keeping up with what’s happening in the financial industry and have gone through certain standards of training.

Credentials held by this team of top Los Angeles wealth managers include:

- Certified Financial Planner™ (CFP®)

- CDFA® (Certified Divorce Financial Analyst)

- CIMA (Certified Investment Management Analyst)

- CRPC (Chartered Retirement Planning Counselor)

Financial advisors that receive industry certifications, such as CFP®, have gone through extensive training and experience requirements. They also have to commit to upholding ethical standards that require that they always put their clients’ interests first.

Helpful Articles & Charts

If you’re looking for some insight into how wealth management firms in Los Angeles interpret market conditions, Your Wealth Effect will be an especially interesting option for you. For example, the firm shares travel charts on its site, explaining that they are often a great way to measure business and consumer confidence.

The advisors at this top Los Angeles financial planning firm put a focus on client communication and financial literacy. You’ll find on the firm’s website helpful articles related to a variety of financial management topics, as well as letters to clients.

Best Wealth Management Firms in Los Angeles

Rating Summary

Investors that are interested in retirement planning will find Your Wealth Effect to be a good option. Their experienced team specializes in retirement planning and investments focused on funding a successful retirement. The practice has also received numerous industry as well as community service awards.

We should point out that the firm has not shared much information about its specific services, information that we typically find on wealth management firm websites. Instead, you will find an invitation to contact the firm regarding a variety of needs, such as retirement planning, investment guidance, education savings, estate planning, and more.

With a focus on clear customer communications and a dynamic and experienced team, Your Wealth Effect is awarded a 5-star rating as a top financial advisor in Los Angeles to consider working with in 2020-2021.

L&S Advisors Review

Offering a “smarter, safer” approach to investing, L&S Advisors is a top-rated Los Angeles wealth management firm founded in 1979. The firm is based upon a thoughtful style of management that includes a high degree of integrity and transparency.

This Los Angeles financial planner is an independent, fee-only, Registered Investment Advisor (RIA). They focus mainly on asset and wealth management services (including custom portfolios), rather than a range of varied financial planning services.

Key Factors That Enabled L&S Advisors to Rank as One of the Top Financial Advisors in Los Angeles

An Investor’s Advantage

Those investors looking for a sophisticated and dynamic portfolio will find L&S Advisors to be a top choice due to its laser focus on this area of financial management.

As a client of L&S Advisors, you can take advantage of a carefully curated approach designed to maximize your return and mitigate any unnecessary risk.

No matter your personal preference, this financial advisor in Los Angeles can offer a plan to fit your needs.

The firm offers several strategies and multi-strategy blends to fit a variety of investment focuses. Each of the following areas includes their own strategic subset:

- L&S Guardian Equity Strategies: For growth through concentrated tactical participation and a strong focus on capital preservation.

- L&S Explorer Equity Strategies: For growth through broad market diversification.

- L&S Sprinter Equity Strategies: For growth through consistent market participation.

- L&S Fixed Income Strategies: Primary focus on yield.

- Customized Strategies: Customized portfolios to meet client-specific investment goals.

Wealth Management Los Angeles | Top 2020-2021 Ranking

L&S Risk Pulse™

Risk management is the number one priority for L&S, and as such, it takes a front seat in each and every investment strategy, portfolio, and client relationship. L&S Risk Pulse™ is the firm’s proprietary, real-time evaluation of overall market risk.

This tool offers a deep quantitative and qualitative analysis that weighs market risks and helps this Los Angeles wealth manager safeguard client portfolios and minimize downside exposure.

Rating Summary

While L&S Advisors may have a more limited range of financial services than other top financial advisors in Los Angeles, what they do, they are experts at. Each of their portfolio managers has an impressive 30+ years of experience, giving investors confidence in their recommendations.

However, potential clients should be aware that L&S Advisors is solely an investment manager, so those seeking other services, such as tax planning or retirement planning, may not find them to be a perfect fit.

With expertise in risk-managed and resilient portfolios, L&S Advisors is a top choice for those looking for investment management. We’ve given them 3-stars, simply due to the more limited range of offerings as compared to other Los Angeles wealth management firms.

Related: Rankings of Best Financial Advisors & Wealth Management Firms in Philadelphia

Free Wealth & Finance Software - Get Yours Now ►

Conclusion—Top 12 Best Financial Advisors & Wealth Management Firms in Los Angeles, CA

Financial advisors in Los Angeles can be as varied as their clients, which gives you a better chance of finding one that is a perfect fit for both your personal style and financial needs.

Determining factors to use when choosing a top-rated financial advisor in Los Angeles include things like clientele specialty, investible asset minimums, and range of services offered.

Fee structure and costs are also other important comparison points between the Los Angeles wealth management firms you consider. If you’re unsure of whether a firm is fee-based or fee-only, ask the advisors directly to confirm.

Many LA wealth management and financial planning firms offer complimentary consultations. This is a great way to get to know the advisors at a firm better and get an idea of whether the firm is a good match for you.

To ensure a productive initial meeting with a potential Los Angeles wealth manager, make a list of all your investable assets, financial goals for the future, and any specific upcoming life events, such as buying a new home or education planning.

The firms on our list of top-rated financial advisors in Los Angeles represent a wide variety of specialties, and we believe they can match nearly anyone’s needs. These firms are all excellent options to consider for financial guidance in 2020-2021 and beyond.

Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the rate table(s) displayed on this page.

Image sources:

- https://abacuswealth.com/advisors/

- https://www.acapam.com/about/

- https://www.adviceperiod.com/our-approach/structure/

- https://pixabay.com/photos/pool-swimming-rooftop-hotel-720697/

- https://www.epwealth.com/services/financial-planning/

- https://harrisfinancial.net/

- https://www.hcrwealth.com/experience/

- https://www.miraclemileadvisors.com/

- https://www.navigoe.com/about/

- https://unsplash.com/photos/LZr7ZcMVDs4

- https://www.lsadvisors.com/services/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.