RANKING & REVIEWS

BEST UK ROBO ADVISERS

Finding the Best UK Robo Adviser: Best British Robo Advisory Firms in the UK

With the influx of UK robo advisers hitting the scene to capitalize on direct investment and portfolio management service, it can be difficult to know which robo advisor in the UK fits your needs the best.

No one wants to invest their retirement or rainy-day savings with an automated investment firm that cannot yield returns on their investment.

Most of the British robo advisory companies are just now bursting onto the scene or have only a few years’ worth of experience under their belts, so how do you know which of them will be the best UK robo adviser moving forward?

The United States has long seen the advantage of online investment companies (See: Top 6 Best Robo Advisors in America), and the UK is finally catching on to the concept.

Some robo advisers in the UK are promising fees that are drastically lower than those charged by traditional UK financial advisers and UK wealth management services.

Other British robo advisers in the UK are simply touting the fact that online investing is a hands-off way for do-it-yourself investors to get the highest returns on their investments with the least amount of research and effort.

Award Emblem: Top 6 Best UK Robo Advisers

In an attempt to help UK consumers better understand the sudden influx of robo advisers in the UK, AdvisoryHQ has conducted a detailed review of various UK robo investment companies, resulting in the below UK robo investing reviews.

We reviewed the services that each automated UK wealth management platform promises to offer clients, as well as the pricing and other key factors to help you make an educated decision.

By the end, you’ll know which one is the best UK robo adviser for your personal investments. Find out which British robo advisers made our list of the top UK robo advisors below.

Top 6 Best UK Robo Advisers (& 1 to Avoid) | Brief Comparison & Ranking

Top UK Robo Advisors | Highlighted Features | Ratings |

| Moneyfarm | Results-driven investing process | 5 |

| Moola | Multi-faceted investing philosophy | 5 |

| Nutmeg | Transparency in rate of return for each portfolio | 5 |

| Scalable Capital | Specialize in globally-diversified portfolios with larger investments | 5 |

| Wealthify | Accessible & affordable investing for millennials | 5 |

| Wealth Horizon | Provides long-term advisement & investment management | 3 |

| True Potential Investor | History of negative reviews & poor investment advice | 1 |

Table: Top 6 Best UK Robo Advisers (& 1 to Avoid) | Above list is sorted by rating

Why Select a British Robo Adviser (UK)?

As popularity increases for the top UK robo advisors, it’s only natural to wonder what the benefits could be in opting for one of these direct portfolio management services.

Robo investing is a form of algorithmic trading devised from a Nobel Prize-winning formula. With the best UK robo advisers, you have the opportunity to view the allocation of your assets and then make custom tweaks and changes as you see necessary.

However, the British robo advisers in the UK will create the basic framework for your investment strategy.

Best UK Robo Advisers

In just a few minutes, you can create a personal profile with one of the top UK robo advisers. This helps the system to generate your risk tolerance and weigh it alongside your financial goals and saving needs.

A long-term retirement savings account can withstand a greater degree of risk than an investment account designed to cover the down payment of your home within the next three years.

The top UK robo advisors should take your goals and your risk tolerance into account before creating an investment plan.

Once the robo adviser has created the investment strategy for you, you don’t have to lift a finger.

The best UK robo advisers will automatically rebalance your portfolio and guide you along. Several of the UK robo advisers will not even allow you to make changes unless they review your entire account.

However, the biggest difference between a traditional wealth management approach and the use of a UK robo adviser is the fees associated with the service provided.

A traditional approach with a personal financial planner or wealth manager typically runs around 1.7 to 2.2 percent of your investment.

With a robo adviser UK, you can expect to pay less than 1 percent in fees, depending on which of the top UK robo advisors you decide to use.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best and Largest British Robo Advisers

Below, please find a detailed review of each robo adviser on our list of top UK robo advisors. We have highlighted some of the factors that allowed these UK robo investing firms to score so high in our selection ranking.

Click below for previous years’ rankings:

- 2016 Ranking: Top 6 Best Robo Advisors in the UK

- 2017 Ranking: Top 7 Best Robo Advisors in the UK

Moneyfarm Review

Founded in 2011, Moneyfarm is committed to making it possible for every investor to have low-stress, low-cost wealth management.

For those living in the UK or Italy, Moneyfarm is one of the top UK robo advisers to consider partnering with.

They offer affordable investments, diverse portfolios, and best of all, automated UK robo investing, so you don’t have to worry about how your money is being cared for.

Key Factors That Enabled Moneyfarm to Rank as One of the Best UK Robo Advisers

How does Moneyfarm stack up against other top UK robo advisors? We’ll uncover what UK robo investing reviews have to say in the next sections.

Moneyfarm Review: Strategy

Like many of the top UK robo advisors, Moneyfarm employs a dynamic, comprehensive investing strategy. This includes three main components:

- Diversification: A range of asset classes, geographies, and currencies are selected to maximize growth

- Management Costs: A strong focus is put to minimizing costs to improve investor returns

- Looking Ahead: Current and future market fluctuations are closely monitored to enhance portfolio performance

All investments are monitored 24/7 by the Investment Committee, ensuring that portfolios stay on track and providing stress-free wealth management for investors.

Moneyfarm Review: Pricing

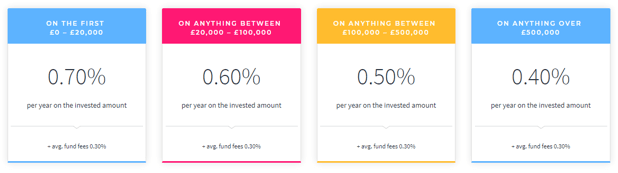

Our Moneyfarm review found that this UK robo advisor employs straightforward, affordable pricing structure within all its investment offerings.

No matter what amount you choose to invest, there will always be an underlying fund cost. This typically averages out to 0.30%.

When it comes to management fees, however, Moneyfarm strives to keep portfolios accessible and affordable. Here is a brief look at their management fee pricing structure:

- £0- £20,000 has an annual fee of 0.70 percent

- £20,000.01- £100,000 has an annual fee of 0.60 percent

- £100,000.01- £500,000 has an annual fee of 0.50 percent

- Over £500,000 has an annual fee of 0.40 percent

Not only can investors save on management fees, but they can still take advantage of Moneyfarm’s expert portfolio management and personal guidance through phone appointments, email, or social media.

Moneyfarm Review

Rating Summary

Although robo investing is primarily hands-off, that doesn’t mean that the process can’t be personalized.

As one of the top UK robo advisors, Moneyfarm makes sure that each investor gets a customized portfolio to match their financial needs, goals, and preferences.

With a personalized sign-up process, affordable rates, and a focus on effective strategizing, investors can rest assured that their recommended portfolio—and its management—is in good hands, earning Moneyfarm an overall 5-star rating.

See Also: Wealthfront Review – What Is Wealthfront? Is Wealthfront Safe?

Moola Review

With a results-driven mission to instill investors with confidence and success, Moola has risen to become a top UK robo advisor.

Their values include making UK wealth management affordable, accessible, easy to understand, enjoyable, and most importantly, effective, making Moola one of the best UK robo advisors to consider partnering with this year.

Key Factors That Enabled Moola to Rank as One of the Best UK Robo Advisers

How does Moola stack up against other top UK robo advisors? We’ll uncover what UK robo investing reviews have to say in the next sections.

Moola Review: Investment Approach

As one of the top UK robo advisers, Moola employs a dynamic approach that not only makes expert investment strategies accessible, but also efficient. Their investment approach can be broken down into five branches, detailed below.

Precision Investing

This UK robo adviser recognizes the importance of making every pound count, which is why they employ fractional trading.

With Precision investing, small amounts from dividends or monthly contributions can be precisely split across a range of assets, increasing the overall value of each portfolio.

Global Exposure

Each portfolio is structured to benefit from global growth, combining multiple investments from China to Germany.

Balanced Assets

To manage risk and return, Moola creates portfolios that include multiple assets (like gold, bonds, and shares).

Currency Management

Globally diverse portfolios will naturally be exposed to different currencies, a factor which few UK robo advisers acknowledge.

As a top robo advisor in the UK, Moola carefully uses currency hedging to ensure that potential risks from global currencies are effectively managed.

Tactical Rebalancing

Moola monitors all portfolios to measure market performance and environmental changes, rebalancing when needed to keep performance on track.

Moola Review: Fee Structure

Fee structures for robo advisers in the UK can be complicated, but Moola strives to make fees both simple and transparent.

Regardless of account balance, investors will have an annual fee of 0.75 percent. There will also be an ETF fee, which ranges between 0.19-0.25 percent annually, putting Moola right on par with competing UK robo advisers.

To estimate what your monthly and yearly fees would be according to investment size, Moola provides a handy bar graph, making it easy for low and high net worth investors to evaluate their options.

Rating Summary

For new and experienced investors alike, Moola offers a dynamic approach and results-driven portfolios, earning them a 5-star rating as one of the best robo advisors in the UK.

However, it’s worth mentioning that high net worth individuals investing larger sums of money could potentially get much lower fees by choosing a robo advisor in the UK with a sliding fee structure.

With that said, Moola still offers an uncomplicated, straightforward pricing structure and a multi-faceted investing philosophy, which may make higher fees worthwhile for some high net worth investors.

Don’t Miss: WiseBanyan vs. Betterment – Rankings & Review

Nutmeg Review

One of the very first UK robo advisers to hit the direct-to-consumer discretionary service scene, Nutmeg has been leading the way in online investments in the United Kingdom since 2011.

For the past few years, their position as one of the best British robo advisers has gone largely unchallenged, continuing to maintain the top spot as the largest UK robo adviser.

Created out of the disappointment with the traditional wealth management industry, Nutmeg aims to deliver the client-facing value it felt the investment world was lacking: transparency, peace of mind, and easy accessibility.

Key Factors That Enabled Nutmeg to Rank as One of the Best UK Robo Advisers

Interested in how Nutmeg uses those values as a top UK robo adviser? Find out more about the services they provide in our Nutmeg investment review, found below.

Nutmeg Review: Strategy

Like most dominant UK robo advisers in the wealth management industry, Nutmeg focuses on long-term investments that spread your assets across numerous industries.

To do this in a cost-effective manner, portfolios are comprised of ETFs, due to their accuracy and low cost to trade, supporting diversification and keeping annual fees as low as possible for investors.

Portfolios are assembled based on your personal risk tolerance, represented by a number on a scale from one to ten. One offers portfolios with the least amount of risk, while a rating of ten signifies a very aggressive portfolio with the most risk.

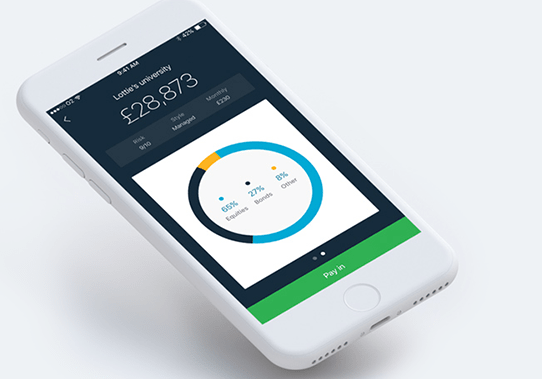

Nutmeg Investment Review

Nutmeg Review: Fully Managed vs Fixed Allocation Portfolios

Our Nutmeg investment review found that Nutmeg’s UK robo advisers come with two separate investment styles and pricing scales. See the below sections for a detailed comparison of these two investment offerings.

Fully Managed Portfolios

Fully Managed Portfolios can be seen as Nutmeg’s take on hybrid UK robo adviser services—portfolios are digitally accessible, but they are built, monitored, and adjusted by a human team of experts.

Fees are 0.75 percent for accounts up to £100k, dropping down to 0.35 percent for any additional investments. The average underlying fund cost is 0.19 percent.

Our Nutmeg investment review found that these UK robo adviser services are best for investors that prefer having a team of dedicated professionals constantly monitoring their investments, actively finding opportunities to reduce risk and improve returns.

Fixed Allocation Portfolios

Conversely, Fixed Allocation Portfolios are intelligent portfolios that have been created by experts, but are not managed by a physical team. Instead, these portfolios have fully automated rebalancing and dividend reinvestment.

For investments up to £100k, annual management fees will be 0.45 percent, dropping down to 0.25 percent for any additional investments. Average underlying fund costs typically come in around 0.17 percent.

Our Nutmeg investment review found that these UK robo adviser services are made for investors that are comfortable with a fully automated service without human intervention.

With significantly lower prices, these services are also great for investors that want the highest level of diversification at a much more affordable cost.

No matter which type of portfolio you choose, if you plan to get started with Nutmeg’s UK robo adviser, be prepared to invest a minimum of £500 in the very beginning.

Rating Summary

As one of the best UK robo advisors, Nutmeg demonstrates a strong commitment to transparency, fully describing each element of the investment process, pricing, and historical returns.

While investors with less than £100k in a fully managed portfolio will find that this UK robo adviser has slightly higher fees, investments over the £100k investment mark will have significantly lower fees than competing UK robo advisers.

Part of what makes Nutmeg a top UK robo adviser comes from the ability to choose between two different investing styles—human portfolio management, and fully automated portfolio management.

Having access to two different investing styles is a great way for investors to choose the best portfolio management for them, making Nutmeg one of the best UK robo advisors to consider partnering with this year.

Related: What is Ally Invest? | Review | Ally Invest Reviews of Fees, Services, & Investment Products

Scalable Capital Review

For those who have at least £10k to invest, Scalable Capital is a rising UK robo adviser that caters to individuals looking to make sizeable contributions to a wealth management account.

Their mission statement includes creating an environment for a wide group of investors to access investment services that were previously only available for the extremely wealthy.

Key Factors That Enabled Scalable Capital to Rank as One of the Best UK Robo Advisers

How does Scalable Capital stack up when it comes to the promises they make as one of the top UK robo advisors? We’ll uncover what the UK robo investing reviews have to say in the next sections.

Scalable Capital Review: Services

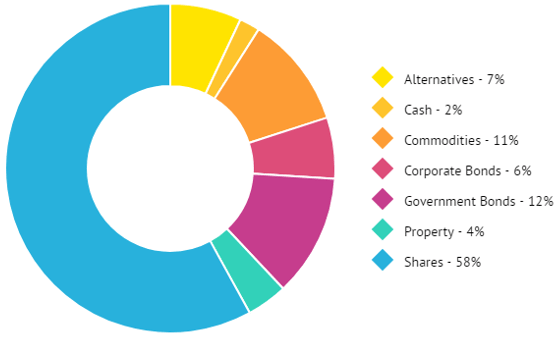

Like most of the robo advisers in the UK, Scalable Capital creates a selection of portfolios based on your risk tolerance. They specialize in globally-diversified, ETF-based portfolios that create wealth over the long term.

Their technology allows them to continuously monitor your portfolio’s performance and make changes to the asset allocation as necessary.

As a top UK robo adviser, they believe that computer algorithms can much better predict long-term success, particularly when considering the theory that emotion is a main factor in the underperformance of investment accounts.

If your financial goals change, you may alter your personal information to consider revising your investment strategy, but to protect the expert growth of your investments, this UK robo adviser will not allow you to directly edit your portfolio.

Because Scalable Capital is an online UK wealth management service, they do not provide financial advice. However, if investors have questions about their portfolio or how it works, their customer service team is ready and waiting.

Best UK Robo Advisers

Scalable Capital Review: Pricing

Unlike many of the other robo advisers in the UK, Scalable Capital does not have a sliding scale for fees based on your account balance.

Instead, they charge an even 0.75 percent across the board for your assets under management.

In order to maintain transparency, Scalable Capital also points out that their UK robo advisers also charge an expense ratio for the ETFs purchased for the portfolios. This typically runs around 0.19 percent.

Overall, your total fees come to approximately 1 percent when all is said and done.

Scalable Capital claims to provide an investment service that was previously inaccessible to all but the wealthiest individuals, but you should still plan on needing at least £10,000 to start an investment account with them.

Keep in mind that if your account balance hovers around the £10,000 minimum and you wish to withdraw funds, you will be required to withdraw the full amount.

Rating Summary

Scalable Capital may have one of the highest minimum investments, but it is also one of the best robo advisers in the UK for transparent pricing and innovative investment software.

With that in mind, it’s important to consider whether investors will truly get their money’s worth when investing with Scalable Capital.

Although the flat rate of 0.75 percent does provide clarity and transparency, it’s worth mentioning that high net worth investors can easily get between 0.50-0.35 percent for the same services by choosing a UK robo advisor with a sliding fee structure.

Still, for investors that have at least £10k to invest, Scalable Capital offers valuable services and an expert approach, earning the firm a 5-star rating overall.

Popular Article: Is Ellevest the Best Robo Advisor for Woman Investors? | Review | Ellevest Review of Investment Fees, Services, & Methodology

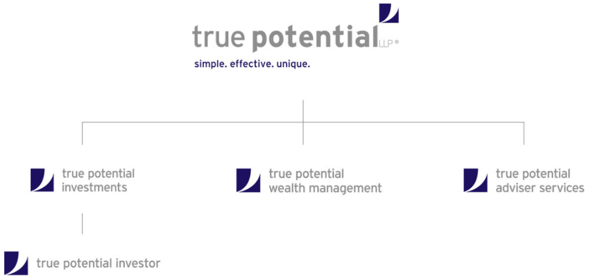

True Potential Investor Review

True Potential Investor aims to revolutionize the way people invest, providing technology that is simple, effective, and unique.

Although True Potential Investor has managed over £3 billion to date, our UK robo advisor review uncovered a few crucial reasons why investors may want to choose another UK robo advisor instead.

See below for an in-depth overview of why True Potential Investor earned a 1 rating, and what the company can do to improve their ranking.

Rating Summary

High Portfolio Management Fees

Part of finding the best robo advisers in the UK comes from finding valuable services at affordable prices. True Potential Investor has the highest fees out of all UK robo advisers in our review, detailed in the table below.

Fee Type | Fee Amount | Purpose |

| Platform | 0.40% | Administration, access, safekeeping of investments, custodian services, customer support |

| Portfolio | 0.83% | Investment in a True Potential Portfolio, access to world-class fund managers, oversight of Investment Committee |

While a total of 1.23 percent in fees is certainly more affordable than using a traditional portfolio manager, these fees are significantly higher than what competing UK robo advisers are offering.

Additionally, upon withdrawing investments from the platform, True Potential Investor will also charge a £50 administration fee, adding to the potential cost of investing.

The combination of higher annual fees and withdrawal fees could become significantly problematic for clients with limited funds to invest—and with so many alternative, more affordable options, it’s unclear as to how these higher fees could be worthwhile.

Negative Reviews

Nearly half of True Potential Investor reviewers on TrustPilot express dissatisfaction with their experience, ranging from unanswered emails to a confusing interface.

Many detail issues reaching and interacting with customer service, with some reviewers even describing their experience as “extremely unprofessional.”

Still more common are complaints over an excessive amount of “spam” or promotional emails, with a few reviewers even receiving multiple phone calls to verify whether these emails were received.

Perhaps indicative of repeated issues with critical reviews, True Potential Investor has created a page specifically to help investors file complaints about their service, titled “Make A Complaint.”

While this is certainly a great sign of transparency—and a step in the right direction—repeated negative reviews and a separate page for complaints should make potential investors wary of partnering with this UK robo advisor.

Legal Issues from Parent Company

True Potential Investor is part of a larger family of UK wealth management and financial service branches, all operating underneath the True Potential brand.

Before partnering with True Potential Investor, consumers may want to consider these recent missteps from other branches of the True Potential family:

- In 2016, True Potential Wealth Management was ordered to reimburse a client after unjustifiably advising that his pensions be transferred to their platform, incurring higher charges and commissions.

- In 2017, an ‘inaccurate’ and ‘unsolicited’ email sent by a sales director misinformed clients about its defined benefit pension transfer service, “fail[ing] to mention that clients would be put into a restricted investment proposition and [their own] Sipp.”

While the Investor service is not directly connected to Wealth Management, it certainly does not appear as though True Potential is operating in a way that instills client trust.

This type of negative press coverage could point to underlying issues with the company culture, principles, or procedures, which should always be taken into considering before trusting UK robo advisors with your investments.

Robo Advisor in the UK

Read More: Is Fidelity Go the Best Robo-Advisor for You? | Review | Everything You Need to Know About Fidelity Robo-Advisor Services

Free Wealth & Finance Software - Get Yours Now ►

Wealth Horizon Review

Focusing on becoming one of the top UK robo advisers, Wealth Horizon adopts a unique perspective on the humble beginnings of their company.

According to this UK robo adviser, they saw a need that wasn’t being adequately filled among other UK robo advisers and decided to fill the gaps with lower prices and more personalized services.

Thus, Wealth Horizon launched a platform that allows you to have affordable financial advice for a personalized solution to your investment needs.

Key Factors That Enabled Wealth Horizon to Rank as One of the Best UK Robo Advisers

If you’re interested in learning more about what makes Wealth Horizon possibly the best UK robo adviser, check out our compelling reasons for ranking them on our list of the top UK robo advisors.

Wealth Horizon Review: Personalized Services

As one of the top British robo advisers, Wealth Horizon provides easy access to real financial advice from human financial advisors.

They promise a solution in less than thirty minutes after a series of questions designed to help identify your goals and how much risk your portfolio should include.

At any point during the process, this top robo advisor in the UK allows investors to call into their customer service line, ask financial questions, or alter your risk level if your financial situation or goals change.

This is a great solution for someone who loves the flexibility of online investments through a top UK robo adviser, but who also enjoys having a real person explain investment strategies and follow up with them.

Wealth Horizon Review: Pricing

As one of the top robo advisers in the UK, Wealth Horizon charges 0.25 percent on investments, 0.50 percent for ongoing advice, 0.25 percent in platform fees, and an 0.18 percent underlying fund charge.

Altogether, you are looking at an ongoing rate of around 0.93 percent.

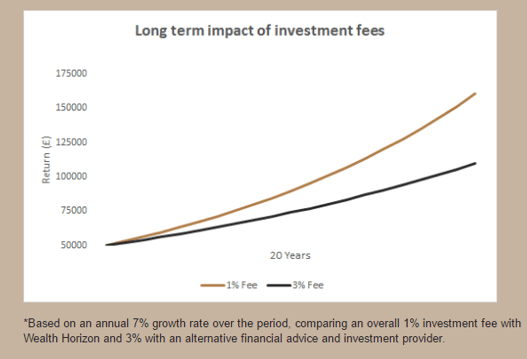

At the high end of the spectrum for traditional services, they estimate you could be spending between 2-3 percent instead. This graph indicates the additional wealth you could accrue with Wealth Horizon’s lower fees.

UK Wealth Management

Rating Summary

For new investors, Wealth Horizon is a great fit. Not only does this UK robo advisor make the process simple and accessible, but it also makes long-term investments and advice affordable with annual fees at 0.93 percent.

Ultimately, however, Wealth Horizon receives a 3-star rating due to a few needed updates on their website.

The wording regarding their pricing structure can be confusing, particularly when it comes to the “initial investing charge.”

Despite being labeled as an initial charge, a footnote explains that the 0.25 percent fee applies to both the initial investment and subsequent investments, which could potentially be misleading for new investors.

Additionally, while evaluating Wealth Horizon as a top robo advisor in the UK, our review also found that the company does not have any information on their team or founders, which impacts their perceived level of transparency.

Clarifying the fee structure and adding information about team experience, qualifications, and roles could easily boost Wealth Horizon to a full 5-star rating.

Related: Betterment Fees vs. Wealthfront Fees vs. Personal Capital Fees | Costs of the Best Robo Advisors

Wealthify Review

With a sleek website that holds plenty of appeal for young investors, Wealthify promises a simple investment plan with no “complicated jargon” or “daunting fees.”

UK robo investing reviews consider Wealthify’s typical clients to include millennial savers and new investors who bring smaller balances to the table.

Key Factors That Enabled Wealthify to Rank as One of the Best UK Robo Advisors

See below for the details on what allows AdvisoryHQ to rank Wealthify as a leading robo advisor in the UK.

Wealthify Review: Services

As one of the best UK robo advisor options, Wealthify allows investors to choose how much they are willing to risk. Select from their risk categories to determine what suits your personality best: Cautious, Tentative, Confident, Ambitious, or Adventurous.

Depending on how much risk you would like your portfolio to have, this leading UK robo adviser will come up with a custom investment plan, allowing algorithms to create a complete investment plan.

Best UK Robo Advisors

The exact asset mixture to help you reach your financial goals depends on the length of your investments and the risk tolerance that you initially select.

You do not get to select the stocks or change the allocation of your assets unless you intend to alter your risk tolerance or your personal goals.

Wealthify monitors your account on a daily basis. If there is turbulence in one sector of the market, they may take your investments and redistribute them to include less risky assets, protecting your initial investment.

Wealthify Review: Pricing

UK robo advisor reviews of Wealthify love to point out the low minimum balance necessary to get started.

Unlike other UK robo advisers, you don’t need thousands of dollars to start investing—with Wealthify, you can open an account with just £1 and build from there.

There is no account minimum, and no additional fees or charges for smaller accounts, making Wealthify the perfect option for younger or low net worth investors.

Like all of the top UK robo advisors, they believe in transparent fees, so you know exactly what you are going to be spending upfront.

They charge a single annual fee based on a sliding scale relating to your account balance. It will never be more than 0.70 percent, and could be as low as 0.50 percent, depending on your total balance.

Of course, fund managers will also charge an average fee of 0.19 percent, creating a total average cost of 0.89 percent annually.

Wealthify is also a UK robo adviser that doesn’t believe in keeping your money tied up. You can withdraw your funds whenever you need to or want to without any additional charges.

Rating Summary

With low fees and high value, it’s no wonder that UK robo advisor reviews on Wealthify are so positive.

Not only does Wealthify have one of the lowest annual fees, but investors benefit from a ton of valuable services, including ongoing monitoring and adjustments, live chat and email support, customized investment plans, and more.

Investors also benefit from the lack of a minimum investment requirement, making it possible for anyone to start building a portfolio, regardless of total net worth.

Wealthify also boasts an incredibly user-friendly, engaging, and advanced platform, making them one of the best UK robo advisors for younger investors to partner with.

Don’t Miss: Top Online Financial Advisors (Human Advisor, Robo-Advisor, and Hybrid)

Conclusion: Finding the Best UK Robo Advisor for You

Before committing to a UK robo adviser, it’s important to examine your unique financial situation.

While some may be more interested in using large sums of money for long-term wealth building for retirement, others may need a top UK robo advisor that can help them to just get started.

No matter what your personal financial situation may be, these top UK robo advisors are a great place to start.

How do you decide which robo advisor in the UK is the best fit for you, even after reading the detailed UK robo advisor reviews? You might want to consider asking yourself a few of these questions:

- How much money do I want to invest with a robo advisor UK upfront or on a monthly basis?

- How much risk am I willing to tolerate with a UK robo adviser?

- How much can I afford to spend in fees with a top UK robo advisor?

- What are my financial goals that a robo advisor in the UK could assist me with?

- Do I need or want personal assistance from a financial advisor, or solely the help of a UK robo adviser platform?

When you can accurately answer these questions, the answer to which is the best UK robo advisor for you will become significantly clearer.

Take a close look at UK robo investing reviews to ensure that you are selecting a company that matches your investment needs perfectly.

Popular Article: Best Email Marketing Campaigns | Ranking | Most Effective Email Marketing Strategies

Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the rate table(s) displayed on this page.

Image sources:

- https://www.bigstockphoto.com/image-82252127/stock-photo-analyzing-investment-charts-with-laptop

- https://www.moneyfarm.com/uk/pricing/

- https://www.nutmeg.com/fully-managed-portfolios#managed-performance

- https://uk.scalable.capital/mobile-app

- http://www.wealthhorizon.com/our-fees/

- https://www.tpllp.com/story/

- https://www.wealthify.com/why-invest

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.