2019 RANKING & REVIEWS

PAID & FREE INVESTMENT PORTFOLIO MANAGEMENT SOFTWARE

![]()

![]()

![]()

The Top 6 Best Investment Software in 2019 | Paid & Free Portfolio Trackers & Management Software Applications

Whether you are an individual looking for paid or free personal financial portfolio management, a professional money manager, a trader, a financial advisor, a portfolio manager, a hedge fund manager, or a broker, staying on top of investment portfolio management keeps you one step ahead of the rest of the field.

With the many different investment management software and investment tracking software options available on the market today, how do you decide which investment portfolio management software is best for your individual needs or for your clients’ needs?

![]()

![]()

![]()

Based on a lot of emails and questions that we have received from our readers, AdvisoryHQ’s editorial team decided to conduct extensive research to identify the top portfolio trackers and investment management tools that are best matched for you.

Below are 2019’s best-ranked asset management solutions, including one award-winning portfolio tracker software which is free for you to use.

Best Portfolio Management Software

Top 6 Best Investment Portfolio Management Software | Brief Comparison & Ranking

Click any of the investment analysis and portfolio tracker names below to go directly to the detailed review section for that software:

Top Portfolio Management Software | Free or Paid? | Best for |

| Personal Capital Wealth Management Software * Top Rated | Free | Individual Investors, High-Net-Worth Individuals, U.S. Consumers, Money Managers ► See Review ◄ |

| Stator Portfolio Manager Software | Paid | Traders, Hedge Funds, Brokerages |

| iBalance™ | Paid | Professional Money Managers |

| Fund Manager Portfolio Management Software | Paid | Traders, Investment Advisors, and Investors |

| Investment Account Manager | Paid | Professional Money Managers |

| FrontPM | Paid | Private Equity Firms and Direct Investment Managers |

Table: Top 6 Best Portfolio Management Software

Detailed Review – Top Ranking Best Investment Portfolio Management Software

To help you better decide which of these investment analysis and portfolio management software is best, AdvisoryHQ has broken down the basics for each one.

Ideal for everyone from individuals, investors, portfolio management firms, wealth advisors, financial advisors, hedge funds, brokers, investment managers, and private equity firms, the best portfolio management software and investment tracking software is right here for your perusal.

When you initially started out, managing a relatively small stock, bonds, or fixed asset investment portfolio was a fairly easy task. In place of an advanced investing portfolio management software, a simple Excel spreadsheet might have sufficed for conducting investment portfolio management and securities tracking.

However, as your portfolio investments increase in scale, basic portfolio management software and simple portfolio tracker spreadsheets will no longer meet your investment analysis and portfolio management needs.

That’s why highly sophisticated investment management software tools have become such a huge boon to the wealth management and investing industry. The best portfolio and investment management software will allow you to keep track of multiple portfolios, as well as a wide range of IRAs, 401(k) accounts, investment portfolio accounts, brokerage trading accounts, stocks, bonds, fixed assets, derivatives, high yielding savings accounts, international assets, structured instruments, and many more.

Below, please find a detailed review of each software on our list of best portfolio management software. We have highlighted some key factors that allowed these investment management software tools to score so high in our selection ranking.

Personal Capital Wealth Management | Review

If you understand nothing else about Personal Capital’s investment management and portfolio tracking software, understand this: this software is revolutionizing wealth management.

Founded in 2009 by Bill Harris (previous CEO of PayPal and also Intuit), Personal Capital is an all-in-one personal finance, money management, portfolio management, and robo-advisory platform.

360-View of Your Financial Analysis and Portfolio Tracking

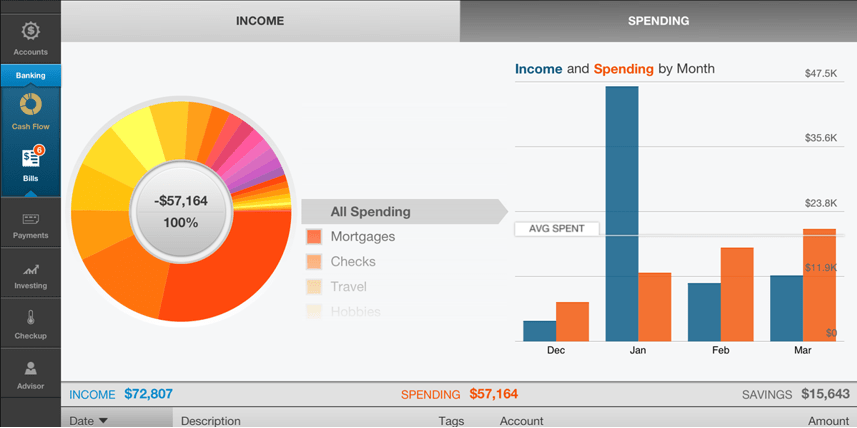

One of the highly acclaimed features of Personal Capital’s wealth management software is that it allows you to get a 360 view of your investments, as well as your day to day financial transactions in real time.

You can see money going into your accounts and money going out, expenses that are coming due in the near future, your combined portfolio assets, and many more. It’s like having your own highly advanced portfolio algorithm machine.

Wealth Management: A 360-View

Best of all…you can use Personal Capital’s portfolio management software to track your wealth and portfolio for free.

► Sign Up Here: Personal Capital Free Wealth Management Software ◄

Key Factors That Enabled This Software to Rank as One of the Best Portfolio Management Software

For more details on how Personal Capital came to be on AdvisoryHQ’s list of the top investment and portfolio management software, see our detailed breakdown of this investment management software below.

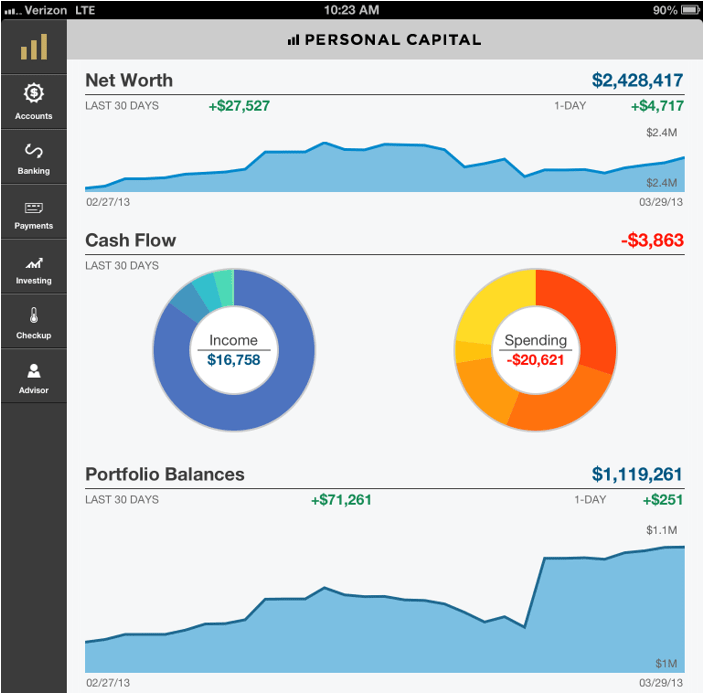

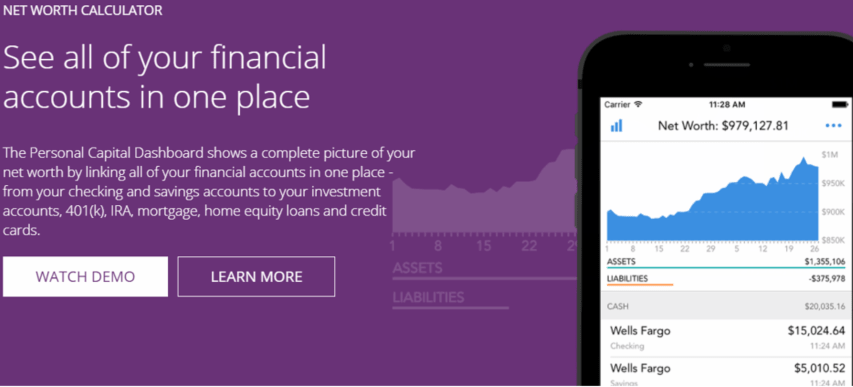

Complete View of Your Entire Net Worth in Real-Time

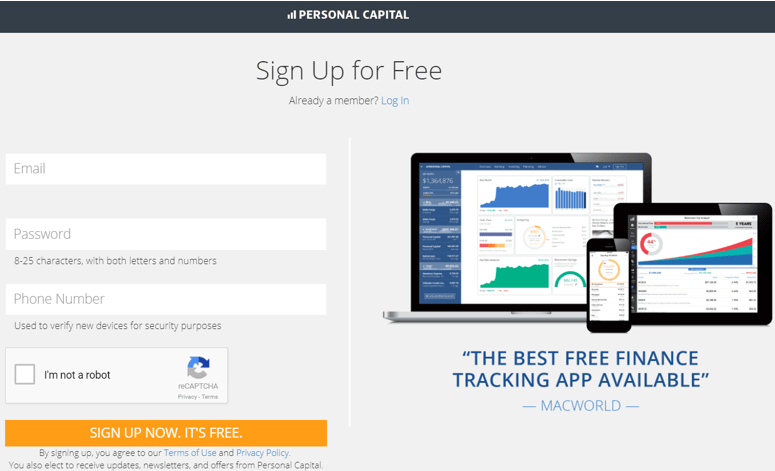

Having multiple investments and income streams is a good thing, but keeping track is a major pain point for most investors and high-net-worth individuals. The Personal Capital dashboard offers you easy and quick access to a consolidated view of all your accounts in one place, including checking, savings, CDs, mutual funds, credit cards, 401(k)s, mutual funds, and other securities.

Right now, do you know exactly how much you are worth? Most people don’t. With Personal Capital’s wealth management system, you get a real-time view of your net worth any time you log into your account and click on your dashboard.

Your Personal Capital Dashboard

![]()

![]()

![]()

On your Personal Capital investment and finance dashboard, you can easily see your top investment gainers and losers as well as investment returns, portfolio allocations, balances, and estimated investment fees. Each time you log into the dashboard–on desktop or mobile–you’ll see a complete view of your net worth, as well as your holdings.

Over time, the portfolio management software will help you see if your net worth is trending positively, and you can then take steps to make adjustments in your spending and savings habits.

Top Rated Free Investment Management Software for all Investors

Although Personal Capital is rated this year’s top free investment management software for individual investors, portfolio and asset managers also use Personal Capital to manage their own personal investments and portfolios, as well as for tracking their daily financial budgeting and transactions.

This is possible based on the software application’s holistic “portfolio management and personal finance” capabilities, which involves budgeting, financial planning, portfolio analysis, expenses tracking, and many features that are used to manage both your daily personal financial situation, as well as your investment portfolios.

Get Personal Capital’s Wealth Management System Today – It’s FREE

Are You on Track Financially? This Portfolio Management System Lets You Know

As mentioned above, Personal Capital’s portfolio management platform gives you everything that you need to gauge, monitor, and optimize your investment portfolio holdings as well as all of your other finances (accounts, credit, home equity, etc.).

This is possible because this top investment tracking software allows you to link all of your external financial (banks, credit cards, and other) accounts, and get immediate access to a comprehensive and holistic view of your financial life.

This is very important because you can easily see if you’re in good shape for retirement based on real time information and data from your linked accounts. You are able to effectively assess the impact of normal life events and changes, both those that are planned and those that are unplanned – such as college for the kids/grandkids, relocation, a new job, a baby, marriage, divorce, or illness.

You can successfully evaluate your spending and saving habits and make changes to them before it’s too late.

Understanding how to manage your own portfolio leaves a lot of consumers stumbling and wondering what they should do next. This is where top-performing and highly advanced best portfolio management software and investment tools come into play.

Highly Advanced Analytic Portfolio Management System

Another really great capability of Personal Capital is its Investment Checkup interface, which allows you to easily see how well all of your investments are performing – and how you could do even better.

With this portfolio management software, you can easily do a benchmark analysis to compare your portfolio allocations to an ideal market-target allocation designed to minimize risk and maximize returns to meet your investing and portfolio management goals.

This is done via the algorithmic smart portfolio management strategy and Dynamic Tactical Weighting approach, which incorporates Modern Portfolio Theory and equal sector/size weighting.

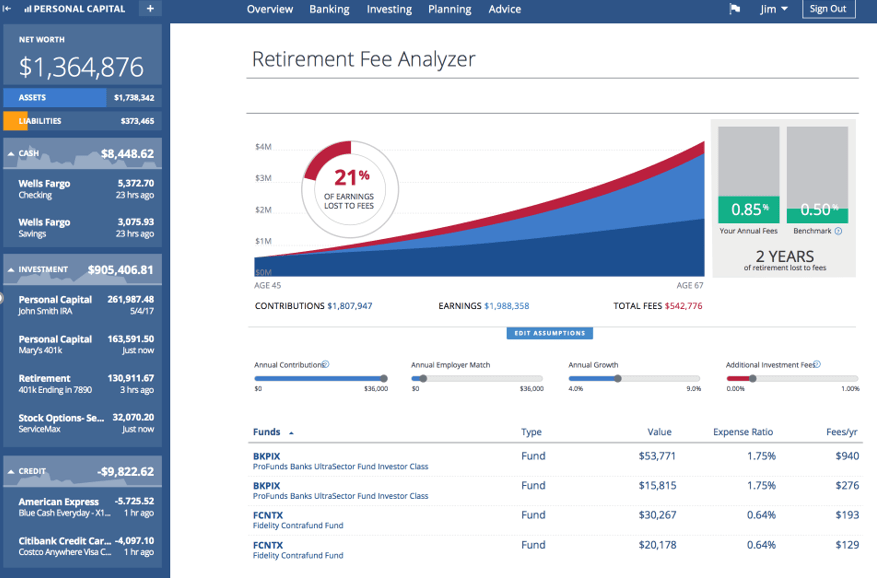

Personal Capital Allows You to See What Hidden Investment Fees Are Costing You.

Although Personal Capital provides a free money management software, they do charge a small fee if you need to use their services to invest or if you want one of the firm’s financial advisors and investment managers to manage your assets. However, their fees are much less than the 1% average financial advisor fee that traditional portfolio managers and brokers are charging today (See below section on pricing).

Do you realize that as an investor, you could be losing thousands of dollars in hidden fees in your mutual fund, investing, and retirement accounts? Mutual funds and investment brokers sometimes recommend investments that pay them the highest levels of commissions. They also impose additional fees, including account opening fees, maintenance fees, and investing fees.

Over time, these fees add up and can dramatically reduce your lifetime savings.

Personal Capital’s portfolio management software breaks down the cost by funds, ETFs, and other categories so that you can easily focus on your analysis and determine whether you need to make any changes.

Using Personal Capital’s Retirement Fee Analyzer tool, you can see those areas where you can cut out commissions, transactional, and annual fees with one all-in management fee.

Financial Planning Services

If you are not a financial investment professional, the idea of utilizing a highly advanced investment tracking software can seem intimidating.

That isn’t the case with Personal Capital’s wealth management tool, which is part of what makes it one of the best investment management software for regular individuals who are dabbling in their own investment schemes. The unique brand of Personal Capital features financial portfolio management combined with advanced technology to offer objective investment analysis for clients.

After filling out your own personal information, this portfolio management software can deliver customized investment strategies to help you reach your goals, whether that means saving for retirement or just investing your funds for a rainy day.

►Free Wealth Management Software, Get Yours Today!◄

Unlike some investment management software, Personal Capital goes beyond just financial portfolio management. You’ll find a number of portfolio management tools to help you manage your investment accounts and save for retirement (no matter how close that might be).

Personal Capital Pricing

This investment tracking software is FREE to use to track and manage your wealth and your portfolios. However, if you choose to use a Personal Capital financial advisor to manage your money, there is a small investment management fee, detailed below.

You’ll be charged by a percentage of the funds invested through Personal Capital.

Their investment portfolio management style focuses on affordable options for strategically achieving your goals. Compared to personal financial advisors who may charge exorbitant rates by the hour, Personal Capital features low fees that the regular person would deem affordable without any hidden costs.

Money Invested | Fee Schedule |

First $1 million | 0.89% |

First $3 million | 0.79% |

Next $2 million | 0.69% |

Next $5 million | 0.59% |

Over $10 million | 0.49% |

If you were to need access to the funds within your account quickly, the good news is that their portfolio management software tends to deal in highly liquid securities.

It means that it should be simple for you to withdraw funds from your accounts within a one to three business day settlement period through their investment software.

Personal Capital Investment Management: Free Financial Software

► Sign Up Here: Personal Capital Free Wealth Management Software ◄

Stator Portfolio Management Software Review

Stator Portfolio Management Software was created by Anfield Capital out of Australia just twelve years ago in 2004. They are currently responsible for managing over $150 million AUD over the span of twenty countries around the world.

Their portfolio management software is used by traders, investors, and brokerage firms globally. Stator has been featured in Your Trading Edge magazine, Financial Review Smart Investor, and Wrightbooks, among others.

Key Factors That Enabled Stator to Rank as One of the Best Portfolio Management Software

See below to learn how Stator Portfolio Management Software became one of the best portfolio management software choices on the market today.

Program

The versatility of the portfolio management software from Stator is definitely what ranks it as one of the best portfolio management software programs on the market today. Used by traders and investors globally, Stator Advanced Finance Management is a top investment software option for individual investors, traders, hedge funds, and brokerage firms.

In order to cater to such a large spectrum of clients, Stator Portfolio Management Software has created four separate versions of their investment management software: Lite, Standard, Pro, and Platinum.

For the individual investor, Lite will likely be sufficient because this investment software manages just one estate in a single currency.

The other portfolio management software options allow for unlimited estates with estate searches and portfolios, various sub-portfolios, and assets. You will be able to run basic reports, backup your data, and have access to online tutorials.

As you move into the Pro and Platinum investment and portfolio management software, you gain more access to things like multiple currencies, foreign exchange trades, ETOs, futures, and more advanced analytics and reports.

With Platinum, you are gaining the ability to use it for enterprise installation and subscription email support, among other items that are better suited for large-scale investment firms.

Pricing

Of course, those four separate categories of portfolio management software can come with some drastically different price tags.

Because they are based out of Australia, their prices are listed in AUD instead of USD, but it still gives you a great comparison for the price variations among the different types of portfolio management software.

You can see the basic prices for their investment software listed in the chart below:

Stator Portfolio Management System | Price (in AUD) |

Lite | $75 |

Standard | $195 |

Pro | $395 |

The Platinum version of the Stator investment tracking software is priced on a per-job basis depending on whether you need a single or a site license. Pricing for this portfolio management software is only available through direct contact with the company.

►Free Wealth Management Software, Get Yours Today!◄

FrontPM Review

FrontPM, powered by the larger company known as eFront, is well-known in the industry for providing solutions to financial portfolio management for private equity firms, real estate investment, banking, and insurance companies.

They value innovation, integrity, excellence, accountability, and teamwork, setting sophisticated standards for Environment, Social and Governance practices (ESG) within the industry.

Serving over 800 clients globally, they are the top solutions provider for fund administration, servicing a total of 48 countries.

Key Factors That Enabled This Software to Rank as One of the Best Portfolio Management Software

If you would like to find out more information on why we ranked FrontPM as one of the best portfolio management software and investment management software choices, see the below sections.

Financial Portfolio Management

Designed for private equity firms and direct investment managers, FrontPM aims to provide solutions to many of the issues seen within this sector that are key when it comes to investment management software.

This portfolio management software accomplishes an array of key tasks, including:

- Compiles accurate data and investment analysis to protect you in the event of an audit

- Allows you to spend more time analyzing performance instead of crafting spreadsheets

- Makes information easily accessible

- Is integrated with Excel

- Lowers exposure to loss of key personnel

Beyond that, their investment software also allows you to make a template-based portfolio on a web-based portal utilizing user-defined rules, generate flexible calculations for standard performance indicators, and centralize data (both current and historical).

Excel Compatibility

One of the primary benefits of FrontPM is its compatibility with Excel, which they use to format and send you performance indicators on generated reports.

Instead of using Excel to perform your own calculations after copying and pasting the data into each sheet individually, FrontPM’s investment management software allows you to build your reports directly into Excel, as well as import data from your own Excel spreadsheets back into the program.

This allows you to track and audit reports more efficiently than portfolio management software that does not integrate Excel compatibility.

Hosting

Another of the primary advantages of the investment portfolio management software from FrontPM is the option of hosting through the cloud or through your company.

Private equity firms and direct investment managers can opt to use FrontPM’s investment software through their own computers and servers.

Alternatively, they can also opt to use portfolio management software through the cloud in order to give them more flexibility and greater access to resources through a variety of locations.

Of course, you can also use this investment portfolio management software in combination with the other eFront components, such as Front Invest for GPs and Front GP.

By integrating FrontPM with these other portfolio management software and front-to-back office solutions, you gain access to even more features that can help you to better manage portfolios for your clients.

►Free Wealth Management Software, Get Yours Today!◄

Fund Manager Portfolio Management Software Review

Fund Manager Portfolio Management Software is unique in the scope and size of the company behind its incredible portfolio management software.

Created in 1993 with more than two decades worth of experience, Beiley Software (the company behind Fund Manager) is comprised of a team of just three individuals located in Arizona.

Their privately-held corporation has created a robust system that features different levels and options, making it the best portfolio management software for individuals, investment advisors, and traders.

Key Factors That Enabled This Software to Rank as One of the Best Portfolio Management Software

Find out more of the compelling reasons that Fund Manager Portfolio Management Software is listed on our ranking of the best portfolio management software and investment management software available on the market today.

Features

If you’ve been on the fence about selecting a portfolio management software, Fund Manager Portfolio Management Software has something for everyone: average individuals, professional money managers, and advisors.

The primary difference between the three investment software programs lies in the maximum number of investments you are allowed in each portfolio (see the chart below).

Investment Software Option | Maximum Investments | Price |

Individual | 500 | $99 |

Professional | 5,000 | $295 |

Advisor | 50,000 | $1,495 |

See Also: Free Portfolio & Investment Management Software (Get Yours Today)

Beyond that, all three of the investment and portfolio management software solutions feature a large selection of basic features to help yield the greatest returns:

- Capital gains calculations

- Exporting data to tax software

- Price alerts

- Yield calculations

- Multiple currency support

- Rebalancing holdings

If you were interested in the investment analysis and portfolio management aspect of a portfolio management software, the professional or advisor feature may be better suited for you.

Both of these investment software options will give you access to more advanced statistics with stop loss alerts, moving average alerts, wash sale support, a correlation matrix report, and more.

Only the advisor portfolio management software grants access to client management features.

You can customize this section of the investment portfolio management to send emailed graphs and reports directly to your clients, to give them access to support, to add your own logo to reports, and to accomplish bulk reconciliation.

In addition, the portfolio management software will provide institutional broker-dealer interfaces, have access to advanced report filters and displays, report disclaimers, and perform batch printing.

Pricing

You gain significantly more investment management software tools when you upgrade to either the professional or advisor version of the Fund Manager Portfolio Management Software. However, those extra features do come with a hefty price increase.

By far, the individual user investment software is the most affordable version at just $99. From there, professional money managers may be pleased to see that it costs just $295, but the advisor version of the portfolio management software jumps significantly to $1,495.

This may be more expensive than some of the portfolio management software available, but it offers an array of detailed features to help with investment analysis and portfolio management, as well as including client support into your work.

It may be worth the investment to have one of the best portfolio management software options working with you and your company.

Related: Personal Capital App Review | What You Should Know About Personal Capital

iBalance™ Review

iBalance™ from softTarget was founded back in 2000 with the goal of creating an investment portfolio management software for individuals who work within the industry.

They built and continue to improve on their investment and portfolio management software through a team of engineers and financial experts who specialize in investments.

Values are mentioned frequently throughout their investment tracking software website, touting their “excellence, innovation, integrity, and continuity.”

Key Factors That Enabled This Software to Rank as One of the Best Portfolio Management Software

Want to know what iBalance™ from softTarget features landed it on our list of the best portfolio management software? See below for a handful of the compelling investment management software features that brought it here.

Technique

Portfolio management software should be designed to allow you to make changes to your portfolio and to make new investments quickly and easily. iBalance™ strives to do just that, promising full investment policy support for your clients.

From allocation to constraints and client preferences, the investment portfolio management software creates a world of customizable portfolios with the client at the center.

Furthermore, because of its detailed information on policy, this investment management software also takes legislation and compliance into account when making trades.

The end goal of this investment software is to maximize returns for clients once taxes are accounted for.

With all of the features that are heavy on policy and legal standpoints, iBalance™ has been shown to be one of the best portfolio management software choices for professional money managers, including wealth managers, institutional managers, group retirement plan administrators, and compliance officers.

See Also: Free Portfolio & Investment Management Software (Get Yours Today)

Portfolio Management System

For professional money managers, iBalance™ is especially ideal because of the investment tracking software they put in place to make your life easier.

Most money managers have a particular investment style and strategy that they attempt to implement with their clients. iBalance™ takes these preferences into account to model and implement these strategies across your clients’ portfolios.

In addition to making trades quickly and easily, you can set up rule-balanced portfolio rebalancing, handle what-if scenarios for clients, and manage complex tax-efficiency issues.

Their compliance dashboard gives you access to a rules library, compliance certificates, and an audit trail, should you ever need any of that information.

The investment software also features a multi-asset and a multi-currency option that allows you even greater flexibility with your clients.

The number of investment management software features available through their portfolio management software is what mainly attracts professional money managers of all varieties to their platform.

While the portfolio management software may be very client-focused — in terms of the degree to which you can customize for a specific account’s personal preferences, risk tolerance, need for rebalancing, and more — but the end goal of the entire financial portfolio management system is to allow money managers to do just that with ease.

Investment Account Manager Review

Investment Account Manager 3 creates a robust and award-winning investment and portfolio management software that has been around for individual investors and professional money managers since 1985.

With its lengthy history, it’s no wonder that it has accumulated awards and accolades such as Softpedia’s 100% Clean, AAII Comparison perfect scores for performance, score documentation, and ease of use, and a 4.7 out of 5-star rating on Amazon.

Key Factors That Enabled This Software to Rank as One of the Best Portfolio Management Software

See below for a few of the key features that placed Investment Account Manager onto AdvisoryHQ’s ranking of the best portfolio management software.

Tools

Investment Account Manager, often referred to as IAM, is well-known for its unified account management, featuring multiple IRAs and multiple taxable accounts alongside their financial portfolio management features.

These features include risk tolerance, portfolio goals, advice, investor resources, and financial portfolio management.

From a professional standpoint, this portfolio management software is great because you can track an unlimited number of portfolios, even those of varying types (including trust funds, children’s accounts, and more).

To see how your personal portfolios or your clients’ holdings are faring, you have access to over fifty different reports to measure their gains and losses, tax filing, capital gain distributions, commissions, and more.

As you get started with Investment Account Manager’s portfolio management software, you can access their tutorials to learn how to make better use of their investment tracking software.

By including use of QuoteMedia with the individual version of the investment management software, you will gain access to a data feed that can update portfolios with accurate data and descriptions at the end of each month.

While you can opt to do this manually with the lower versions of the portfolio management software, it saves time to order a version with QuoteMedia included. QuoteMedia is included with the IAM Professional version.

Safety

Investment Account Manager’s investment tracking software heavily emphasizes one feature above all others: safety.

This should put both individual investors and professional money managers at ease with the emphasis they place on keeping your sensitive and personal financial information secure.

As a company, they do not have access to your data, nor do they download it onto their own servers. Your information remains directly on your computer and is as secure as you set your personal or business computer up to be.

Pricing

Your investment portfolio management software with Investment Account Manager gives you plenty of options as a professional money manager.

You can opt for any one of three different types of portfolio management software, complete with at least one year of support. After your support runs out, you can continue to purchase more in annual increments at a significantly discounted rate.

For more information on the various pricing structures for their portfolio management software, see the chart below:

Portfolio Management Software | Price |

Investment Account Manager 3 | $89 |

Investment Account Manager 3 with QuoteMedia | $129 |

Investment Account Manager 3 Professional | $395 |

What Is Portfolio Management?

Knowing the best portfolio management software on the market today won’t do you much good if you don’t first understand the importance behind financial portfolio management and investment tracking software.

What is portfolio management, and why is portfolio management software important?

Investment analysis and portfolio management are very simple in theory: they are the art of examining your current spread of investments to determine how effective the ratio and policies are in achieving your specific goals. It balances your personal risk level against the performance of various stocks, bonds, funds, and other types of investments in order to effectively allocate the money you are interested in investing.

With any luck, good investment analysis and portfolio management can help you to reach your financial goals with ease.

Understanding how to manage your own portfolio leaves a lot of consumers stumbling and wondering what they should do next. This is where portfolio management software and investment software come into play. With a portfolio management system and the various portfolio management tools available from investment tracking software, you can make wiser decisions regarding the spread of your investments and the risks you are willing to assume alongside them.

Investment tracking software will help you monitor the profits and losses your investments are garnering.

Furthermore, a good investment portfolio management software may even make suggestions for how to better invest your money based on profiles for the financial information you create.

So, what is portfolio management? It really boils down to taking a careful look at your investment strategy in order to make it more successful.

With the help of the best portfolio management software on the market, you can be well on your way to your own financial portfolio management.

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated firms, products, and services.

Conclusion: Best Portfolio Management Software

Whether you are an individual investor, a professional money manager, or a private equity firm, having the best portfolio management software available can significantly increase the returns on your investments.

Through smart analytics and reports, investment software allows you to view and respond to the data faster on your clients’ holdings or even your own holdings using investment and portfolio management.

After reading through our article, you can now confidently answer the questions, “What is portfolio management?” and “How do you decide which portfolio management software is best for you?”

Our ranking of the best portfolio management software should be a great starting point for evaluating what your own needs are and comparing them to the top portfolio management software in the market.

Image Sources:

- BigStock.com

- Personalcapital.com

- Pixabay.com

- Personal Capital

- Income and Spending By Month

- Best Free Finance Tracking App

- See all your financial accounts in one place

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.